Boeing Boosts Buyback Program, Dividend

15 Décembre 2015 - 1:10AM

Dow Jones News

Boeing Co.'s board on Monday raised its cash dividend by 20% and

lifted an existing stock buyback program by $2 billion,

underscoring the cash-generating potential of raising its

commercial aircraft production rate.

The Chicago-based company spent $6.75 billion this year on share

buybacks out of the original $12 billion authorization announced

last December. The latest increase brings the approved total to $14

billion.

Boeing has prioritized investment in development and higher

production of new commercial planes, such as revamped versions of

its 737 and 777 jets, over shareholder returns and deal-making, but

will have returned around 100% of 2015 operating cash generation to

investors this year.

The increased dividend and larger buyback authorization indicate

Boeing expects what analysts have called a "super cycle" of

commercial aircraft orders to continue, as well as expressing

confidence in plans to boost production of the 787 Dreamliner.

Boeing shares came under pressure last summer from investors

concerned about the exposure of its $485 billion

commercial-airplane backlog to airlines in emerging markets.

Boeing had lagged behind the buyback programs of some peers in

the U.S. aerospace and defense sector before ramping up in 2013,

and the latest top-up indicates it could accelerate activity as

executives continue to describe the stock as undervalued.

The company said it expected to resume buyback activity in

January, with the balance of repurchases under the expanded program

likely to take place in the next two to three years. The quarterly

dividend was raised to $1.09 a share, continuing a run of five

years of higher payouts.

U.S. industrial firms have continued to pour cash into buybacks

despite the surge in merger and acquisition activity this year, and

aerospace and defense companies have been particularly active in

recent years, in part because of tailwinds from pension regulations

that have reduced their funding commitments.

Pentagon leaders have been critical of the level of buyback

activity among defense companies—military sales account for a third

of Boeing revenues—arguing companies should direct more funding to

internal research and development. Companies have retorted that the

Defense Department needs to be more explicit about where extra

funding should go, and improve incentives to encourage

investment.

Northrop Grumman Corp. and Lockheed Martin Corp. have led the

surge in buyback activity, with the former retiring a quarter of

its shares over the past three years and in September securing

authorization to buy back another $4 billion in stock.

Boeing shares closed down 1.1% at $143.05 Monday, recovering

some of its early losses, and were recently up 1.2% at $144.76 in

aftermarket trade.

Write to Doug Cameron at doug.cameron@wsj.com

(END) Dow Jones Newswires

December 14, 2015 18:55 ET (23:55 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

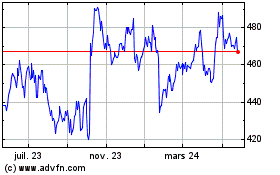

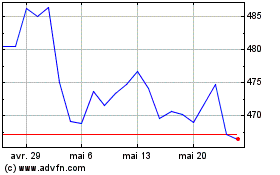

Northrop Grumman (NYSE:NOC)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Northrop Grumman (NYSE:NOC)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024