Form 425 - Prospectuses and communications, business combinations

10 Mars 2025 - 9:12PM

Edgar (US Regulatory)

Filed by ServiceNow, Inc.

Commission File No. 001-35580

Pursuant to Rule 425 under the Securities Act of 1933, as amended

Subject Company: ServiceNow, Inc.

On March 10, 2025, ServiceNow, Inc. published the following on X:

On March 10, 2025, ServiceNow, Inc. published the following on Facebook:

On March 10, 2025, ServiceNow, Inc. published the following on LinkedIn:

On March 10, 2025, Amit Zavery, President, Chief Product Officer and Chief Operating Officer of ServiceNow, Inc., published the following on LinkedIn:

On March 10, 2025, Gina Mastantuono, President and Chief Financial Officer of ServiceNow, Inc., published the following on LinkedIn:

On March 10, 2025, Paul Smith, President, Global Customer and Field Operations of ServiceNow, Inc., published the following on LinkedIn:

* * *

Cautionary Statement Regarding Forward Looking Statements

This communication contains “forward‑looking statements” about the expectations, beliefs, plans, intentions, and strategies relating to ServiceNow’s proposed acquisition of Moveworks. Such forward‑looking statements include, among others, statements regarding future product capabilities and offerings and expected benefits to ServiceNow and its customers arising from and in relation to the proposed acquisition and the timing of closing of the proposed acquisition. Forward‑looking statements are subject to known and unknown risks and uncertainties and are based on potentially inaccurate assumptions that could cause actual results to differ materially from those expected or implied by the forward‑looking statements. If any such risks or uncertainties materialize or if any of the assumptions prove incorrect, our results could differ materially from the results expressed or implied by the forward‑looking statements we make. We undertake no obligation, and do not intend, to update the forward‑looking statements. Factors that may cause actual results to differ materially from those in any forward‑looking statements include, without limitation, challenges with completion of the proposed acquisition as anticipated, including obtaining regulatory approvals and other conditions to the completion of the proposed acquisition; the effect of the announcement or pendency of the proposed acquisition on Moveworks’ business, operating results, and relationships with customers, suppliers, competitors and others; risks that the proposed acquisition may disrupt Moveworks’ current plans and business operations; the occurrence of any event, change or other circumstances that could give rise to the termination of the definitive agreement; the outcome of any legal proceedings related to the proposed acquisition; restrictions during the pendency of the proposed acquisition that may impact Moveworks’ ability to pursue certain business opportunities or strategic transactions; challenges or delays in assimilating or integrating Moveworks’ technology into our platform; challenges retaining employees of Moveworks after the proposed acquisition closes; unanticipated obligations or liabilities related to Moveworks’ legacy business; potential adverse tax consequences and the potential effects on the accounting of the proposed acquisition; and disruption to our business and diversion of our management’s attention and other resources. Further information on factors that could affect our financial and other results is included in the filings we make with the U.S. Securities and Exchange Commission (the “SEC”) from time to time.

Important Information and Where to Find It

This communication relates to a proposed transaction between ServiceNow and Moveworks. ServiceNow will file a registration statement on Form S-4 with the SEC, pursuant to which the offer and sale of common stock of ServiceNow in the proposed transaction will be registered. ServiceNow also will file other documents regarding the proposed transaction with the SEC. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT AND ALL OTHER RELEVANT DOCUMENTS FILED OR THAT WILL BE FILED WITH THE SEC IN CONNECTION WITH THE PROPOSED TRANSACTION, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION.

Investors and security holders will be able to obtain free copies of the registration statement, and all other relevant documents filed or that will be filed with the SEC by ServiceNow through the website maintained by the SEC at www.sec.gov. The documents filed by ServiceNow with the SEC also may be obtained free of charge at ServiceNow’s website at www.servicenow.com/company/investor-relations/sec-filings.html.

No Offer or Solicitation

This communication is for informational purposes only and is not intended to and shall not constitute an offer to buy or sell or the solicitation of an offer to buy or sell any securities, or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made, except by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended.

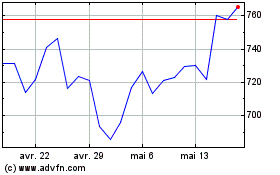

ServiceNow (NYSE:NOW)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

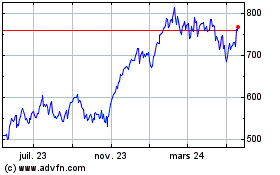

ServiceNow (NYSE:NOW)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025