Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

27 Janvier 2025 - 4:53PM

Edgar (US Regulatory)

Portfolio

of

Investments

November

30,

2024

NXC

(Unaudited)

PRINCIPAL

DESCRIPTION

RATE

MATURITY

VALUE

LONG-TERM

INVESTMENTS

-

96.2% (99.3%

of

Total

Investments)

X

86,210,881

MUNICIPAL

BONDS

-

96.2% (99.3%

of

Total

Investments)

X

–

CONSUMER

STAPLES

-

0.2%

(0.2%

of

Total

Investments)

$

20,000

California

County

Tobacco

Securitization

Agency,

Tobacco

Settlement

Asset-Backed

Bonds,

Los

Angeles

County

Securitization

Corporation,

Series

2020A

4

.000

%

06/01/49

$

18,992

1,265,000

Golden

State

Tobacco

Securitization

Corporation,

California,

Tobacco

Settlement

Asset-Backed

Bonds,

Capital

Appreciation

Series

2021B-2

0

.000

06/01/66

142,022

TOTAL

CONSUMER

STAPLES

161,014

EDUCATION

AND

CIVIC

ORGANIZATIONS

-

0.5%

(0.5%

of

Total

Investments)

60,000

(a)

California

School

Finance

Authority,

School

Facility

Revenue

Bonds,

Alliance

for

College-Ready

Public

Schools

Project,

Series

2016A

5

.000

07/01/46

60,241

385,000

(a)

California

School

Finance

Authority,

School

Facility

Revenue

Bonds,

Alliance

for

College-Ready

Public

Schools

Project,

Series

2016C

5

.000

07/01/46

389,147

TOTAL

EDUCATION

AND

CIVIC

ORGANIZATIONS

449,388

HEALTH

CARE

-

12.7%

(13.1%

of

Total

Investments)

2,590,000

California

Health

Facilities

Financing

Authority,

California,

Revenue

Bonds,

Sutter

Health,

Refunding

Series

2016B

5

.000

11/15/46

2,651,135

1,000,000

California

Health

Facilities

Financing

Authority,

Revenue

Bonds,

Adventist

Health

System/West,

Refunding

Series

2016A

4

.000

03/01/39

997,371

1,240,000

California

Health

Facilities

Financing

Authority,

Revenue

Bonds,

City

of

Hope

National

Medical

Center,

Series

2019

4

.000

11/15/45

1,234,691

965,000

California

Health

Facilities

Financing

Authority,

Revenue

Bonds,

CommonSpirit

Health,

Series

2020A

4

.000

04/01/49

956,829

125,000

California

Health

Facilities

Financing

Authority,

Revenue

Bonds,

CommonSpirit

Health,

Series

2024A

5

.250

12/01/49

139,497

1,365,000

California

Health

Facilities

Financing

Authority,

Revenue

Bonds,

Kaiser

Permanente

System,

Series

2017A-2

4

.000

11/01/44

1,367,250

70,000

California

Health

Facilities

Financing

Authority,

Revenue

Bonds,

Providence

Health

&

Services,

Refunding

Series

2014A

5

.000

10/01/38

70,132

255,000

California

Health

Facilities

Financing

Authority,

Revenue

Bonds,

Providence

Health

&

Services,

Series

2014B

5

.000

10/01/44

255,058

1,040,000

California

Infrastructure

and

Economic

Development

Bank,

Revenue

Bonds,

Adventist

Health

Energy

Projects,

Series

2024A

5

.250

07/01/54

1,118,406

450,000

California

Municipal

Finance

Authority,

Revenue

Bonds,

Community

Health

System,

Series

2021A

-

AGM

Insured

4

.000

02/01/51

452,327

35,000

California

Municipal

Finance

Authority,

Revenue

Bonds,

Eisenhower

Medical

Center,

Refunding

Series

2017A

5

.000

07/01/47

35,486

130,000

California

Municipal

Finance

Authority,

Revenue

Bonds,

NorthBay

Healthcare

Group,

Series

2017A

5

.250

11/01/41

131,372

150,000

California

Municipal

Financing

Authority,

Certificates

of

Participation,

Palomar

Health,

Series

2022A

-

AGM

Insured

5

.250

11/01/52

160,633

350,000

California

Statewide

Communities

Development

Authority,

California,

Revenue

Bonds,

Loma

Linda

University

Medical

Center,

Series

2014A

5

.250

12/01/34

350,223

1,365,000

(a)

California

Statewide

Communities

Development

Authority,

California,

Revenue

Bonds,

Loma

Linda

University

Medical

Center,

Series

2016A

5

.250

12/01/56

1,379,467

70,000

California

Statewide

Community

Development

Authority,

Health

Revenue

Bonds,

Enloe

Medical

Center,

Refunding

Series

2022A

-

AGM

Insured

5

.250

08/15/52

75,806

TOTAL

HEALTH

CARE

11,375,683

Portfolio

of

Investments

November

30,

2024

(continued)

NXC

PRINCIPAL

DESCRIPTION

RATE

MATURITY

VALUE

HOUSING/MULTIFAMILY

-

8.6%

(8.9%

of

Total

Investments)

$

545,000

(a)

California

Community

Housing

Agency,

California,

Essential

Housing

Revenue

Bonds,

Creekwood,

Series

2021A

4

.000

%

02/01/56

$

370,810

590,000

(a)

California

Community

Housing

Agency,

California,

Essential

Housing

Revenue

Bonds,

Glendale

Properties,

Junior

Series

2021A-2

4

.000

08/01/47

475,553

870,000

(a)

California

Community

Housing

Agency,

California,

Essential

Housing

Revenue

Bonds,

Serenity

at

Larkspur

Apartments,

Series

2020A

5

.000

02/01/50

659,397

568,455

California

Housing

Finance

Agency,

Municipal

Certificate

Revenue

Bonds,

Class

A

Series

2019-2

4

.000

03/20/33

574,930

509,781

California

Housing

Finance

Agency,

Municipal

Certificate

Revenue

Bonds,

Class

A

Series

2021-1

3

.500

11/20/35

499,436

87,178

California

Housing

Finance

Agency,

Municipal

Certificate

Revenue

Bonds,

Class

A

Series2019-1

4

.250

01/15/35

90,235

509,192

California

Housing

Finance

Agency,

Municipal

Certificate

Revenue

Bonds,

Class

A

Social

Certificates

Series

2023-1

4

.375

09/20/36

532,091

660,000

(a)

CMFA

Special

Finance

Agency

I,

California,

Essential

Housing

Revenue

Bonds,

The

Mix

at

Center

City,

Series

2021A-2

4

.000

04/01/56

520,247

225,000

(a)

CMFA

Special

Finance

Agency,

California,

Essential

Housing

Revenue

Bonds,

Enclave

Apartments,

Senior

Series

2022A-1

4

.000

08/01/58

181,983

320,000

(a)

CSCDA

Community

Improvement

Authority,

California,

Essential

Housing

Revenue

Bonds,

777

Place-Pomona,

Senior

Lien

Series

2021A-2

3

.250

05/01/57

226,208

425,000

(a)

CSCDA

Community

Improvement

Authority,

California,

Essential

Housing

Revenue

Bonds,

Acacia

on

Santa

Rosa

Creek,

Senior

Lien

Series

2021A

4

.000

10/01/56

378,676

560,000

(a)

CSCDA

Community

Improvement

Authority,

California,

Essential

Housing

Revenue

Bonds,

Altana

Glendale,

Series

2021A-2

4

.000

10/01/56

461,367

750,000

(a)

CSCDA

Community

Improvement

Authority,

California,

Essential

Housing

Revenue

Bonds,

Center

City

Anaheim,

Series

2020A

5

.000

01/01/54

670,953

540,000

(a)

CSCDA

Community

Improvement

Authority,

California,

Essential

Housing

Revenue

Bonds,

Moda

at

Monrovia

Station,

Social

Series

2021A-2

4

.000

10/01/56

427,017

265,000

(a)

CSCDA

Community

Improvement

Authority,

California,

Essential

Housing

Revenue

Bonds,

Monterrey

Station

Apartments,

Senior

Lien

Series

2021A-1

3

.125

07/01/56

185,534

115,000

(a)

CSCDA

Community

Improvement

Authority,

California,

Essential

Housing

Revenue

Bonds,

Oceanaire-Long

Beach,

Social

Series

2021A-2

4

.000

09/01/56

91,109

245,000

(a)

CSCDA

Community

Improvement

Authority,

California,

Essential

Housing

Revenue

Bonds,

Parallel-Anaheim

Series

2021A

4

.000

08/01/56

223,874

50,000

(a)

CSCDA

Community

Improvement

Authority,

California,

Essential

Housing

Revenue

Bonds,

Pasadena

Portfolio

Social

Bond,

Mezzanine

Senior

Series

2021B

4

.000

12/01/56

38,094

100,000

CSCDA

Community

Improvement

Authority,

California,

Essential

Housing

Revenue

Bonds,

Pasadena

Portfolio

Social

Bond,

Series

2021A-2

3

.000

12/01/56

70,593

185,000

(a)

CSCDA

Community

Improvement

Authority,

California,

Essential

Housing

Revenue

Bonds,

Union

South

Bay,

Series

2021A-2

4

.000

07/01/56

153,202

160,000

(a)

CSCDA

Community

Improvement

Authority,

California,

Essential

Housing

Revenue

Bonds,

Westgate

Phase

1-Pasadena

Apartments,

Senior

Lien

Series

2021A-1

3

.000

06/01/47

113,636

585,000

(a)

CSCDA

Community

Improvement

Authority,

California,

Essential

Housing

Revenue

Bonds,

Westgate

Phase

1-Pasadena

Apartments,

Senior

Lien

Series

2021A-2

3

.125

06/01/57

358,464

600,000

CSCDA

Community

Improvement

Authority,

California,

Essential

Housing

Revenue

Bonds,

Wood

Creek

Apartments,

Senior

Lien

Series

2021A-1

3

.000

12/01/49

425,776

TOTAL

HOUSING/MULTIFAMILY

7,729,185

PRINCIPAL

DESCRIPTION

RATE

MATURITY

VALUE

TAX

OBLIGATION/GENERAL

-

27.3%

(28.2%

of

Total

Investments)

$

620,000

Butte-Glenn

Community

College

District,

Butte

and

Glenn

Counties,

California,

General

Obligation

Bonds,

Election

2016

Series

2017A

5

.250

%

08/01/46

$

647,408

1,000,000

California

State,

General

Obligation

Bonds,

Various

Purpose

Refunding

Series

2015

5

.000

08/01/34

1,007,061

1,000,000

Chaffey

Joint

Union

High

School

District,

San

Bernardino

County,

California,

General

Obligation

Bonds,

Election

2012

Series

2017C

5

.250

08/01/47

1,037,316

6,205,000

Desert

Community

College

District,

Riverside

County,

California,

General

Obligation

Bonds,

Election

of

2016

Series

2024

4

.000

08/01/51

6,263,327

1,000,000

Marin

Healthcare

District,

Marin

County,

California,

General

Obligation

Bonds,

2013

Election,

Series

2015A

4

.000

08/01/45

1,000,773

2,790,000

Natomas

Unified

School

District,

Sacramento

County,

California,

General

Obligation

Bonds,

Election

of

2018,

Series

2020A

-

AGM

Insured

4

.000

08/01/49

2,796,352

7,575,000

Palomar

Pomerado

Health,

California,

General

Obligation

Bonds,

Convertible

Capital

Appreciation,

Election

2004

Series

2010A

0

.000

08/01/34

4,731,093

65,000

Puerto

Rico,

General

Obligation

Bonds,

Restructured

Series

2022A-1

4

.000

07/01/41

62,629

1,000,000

San

Benito

High

School

District,

San

Benito

and

Santa

Clara

Counties,

California,

General

Obligation

Bonds,

2016

Election

Series

2017

5

.250

08/01/46

1,044,985

8,075,000

San

Bernardino

Community

College

District,

California,

General

Obligation

Bonds,

Election

of

2008

Series

2009B

0

.000

08/01/44

3,655,149

2,000,000

(b)

West

Hills

Community

College

District,

California,

General

Obligation

Bonds,

School

Facilities

Improvement

District

3,

2008

Election

Series

2011

-

AGM

Insured

0

.000

08/01/38

2,234,395

TOTAL

TAX

OBLIGATION/GENERAL

24,480,488

TAX

OBLIGATION/LIMITED

-

10.6%

(11.0%

of

Total

Investments)

925,000

Bell

Community

Redevelopment

Agency,

California,

Tax

Allocation

Bonds,

Bell

Project

Area,

Series

2003

-

RAAI

Insured

5

.625

10/01/33

927,043

20,000

Brentwood

Infrastructure

Financing

Authority,

California,

Infrastructure

Revenue

Bonds,

Refunding

Subordinated

Series

2014B

5

.000

09/02/36

20,010

15,000

Golden

State

Tobacco

Securitization

Corporation,

California,

Tobacco

Settlement

Asset-Backed

Revenue

Bonds,

Series

2022A-1

5

.000

06/01/51

15,823

1,000,000

Los

Angeles

County

Metropolitan

Transportation

Authority,

California,

Measure

R

Sales

Tax

Revenue

Bonds,

Senior

Series

2016A

5

.000

06/01/39

1,028,116

3,000,000

Los

Angeles

County

Metropolitan

Transportation

Authority,

California,

Proposition

C

Sales

Tax

Revenue

Bonds,

Green

Senior

Lien

Series

2019A

5

.000

07/01/44

3,189,597

1,000,000

Norco

Redevelopment

Agency,

California,

Tax

Allocation

Bonds,

Project

Area

1,

Series

2009

7

.000

03/01/34

1,003,208

1,118,000

Puerto

Rico

Sales

Tax

Financing

Corporation,

Sales

Tax

Revenue

Bonds,

Restructured

2018A-1

5

.000

07/01/58

1,123,047

550,000

Puerto

Rico

Sales

Tax

Financing

Corporation,

Sales

Tax

Revenue

Bonds,

Taxable

Restructured

Cofina

Project

Series

2019A-2

4

.784

07/01/58

551,129

180,000

River

Islands

Public

Financing

Authority,

California,

Special

Tax

Bonds,

Community

Facilities

District

2003-1

Improvement

Area

1,

Refunding

Series

2022A-1

-

AGM

Insured

5

.250

09/01/52

195,468

60,000

San

Francisco

City

and

County

Redevelopment

Agency

Successor

Agency,

California,

Special

Tax

Bonds,

Community

Facilities

District

7,

Hunters

Point

Shipyard

Phase

One

Improvements,

Refunding

Series

2014

5

.000

08/01/39

60,096

15,000

Signal

Hill

Redevelopment

Agency,

California,

Project

1

Tax

Allocation

Bonds,

Series

2011

7

.000

10/01/26

15,044

1,285,000

Stockton

Public

Financing

Authority,

California,

Revenue

Bonds,

Arch

Road

East

Community

Facility

District

99-02,

Series

2018A

5

.000

09/01/28

1,339,236

60,000

Transbay

Joint

Powers

Authority,

California,

Tax

Allocation

Bonds,

Senior

Green

Series

2020A

5

.000

10/01/45

61,775

TOTAL

TAX

OBLIGATION/LIMITED

9,529,592

Portfolio

of

Investments

November

30,

2024

(continued)

NXC

PRINCIPAL

DESCRIPTION

RATE

MATURITY

VALUE

TRANSPORTATION

-

12.8%

(13.2%

of

Total

Investments)

$

60,000

California

Municipal

Finance

Authority,

Special

Facility

Revenue

Bonds,

United

Airlines,

Inc.

Los

Angeles

International

Airport

Project,

Series

2019,

(AMT)

4

.000

%

07/15/29

$

59,844

800,000

Long

Beach,

California,

Harbor

Revenue

Bonds,

Series

2015D

5

.000

05/15/42

805,791

1,860,000

Los

Angeles

Department

of

Airports,

California,

Revenue

Bonds,

Los

Angeles

International

Airport,

Refunding

&

Subordinate

Series

2022C,

(AMT)

4

.000

05/15/40

1,860,641

1,525,000

Los

Angeles

Department

of

Airports,

California,

Revenue

Bonds,

Los

Angeles

International

Airport,

Subordinate

Lien

Series

2022A,

(AMT)

5

.000

05/15/45

1,620,326

3,250,000

Riverside

County

Transportation

Commission,

California,

Toll

Revenue

Senior

Lien

Bonds,

RCTC

91

Express

Lanes,

Refunding

Series

2021B-1

4

.000

06/01/39

3,326,658

305,000

San

Diego

County

Regional

Airport

Authority,

California,

Airport

Revenue

Bonds,

International

Senior

Series

2023B,

(AMT)

5

.000

07/01/53

322,233

1,000,000

San

Diego

County

Regional

Airport

Authority,

California,

Airport

Revenue

Bonds,

Subordinate

Series

2021B,

(AMT)

5

.000

07/01/46

1,049,321

1,400,000

San

Francisco

Airport

Commission,

California,

Revenue

Bonds,

San

Francisco

International

Airport,

Refunding

Second

Series

2023C,

(AMT)

5

.500

05/01/40

1,585,668

90,000

San

Joaquin

Hills

Transportation

Corridor

Agency,

Orange

County,

California,

Refunding

Senior

Lien

Toll

Road

Revenue

Bonds,

Series

2021A

4

.000

01/15/50

90,370

750,000

San

Joaquin

Hills

Transportation

Corridor

Agency,

Orange

County,

California,

Toll

Road

Revenue

Bonds,

Refunding

Junior

Lien

Series

2014B

5

.250

01/15/44

751,133

TOTAL

TRANSPORTATION

11,471,985

U.S.

GUARANTEED

-

6.8%

(7.0%

of

Total

Investments)

(c)

410,000

California

Health

Facilities

Financing

Authority,

California,

Revenue

Bonds,

Sutter

Health,

Refunding

Series

2016B,

(Pre-

refunded

11/15/26)

5

.000

11/15/46

428,868

2,500,000

California

Health

Facilities

Financing

Authority,

California,

Revenue

Bonds,

Sutter

Health,

Series

2016A,

(Pre-refunded

11/15/25)

5

.000

11/15/41

2,553,491

35,000

California

Health

Facilities

Financing

Authority,

Revenue

Bonds,

CommonSpirit

Health,

Series

2020A,

(Pre-refunded

4/01/30)

4

.000

04/01/49

37,490

1,650,000

Golden

State

Tobacco

Securitization

Corporation,

California,

Enhanced

Tobacco

Settlement

Asset-Backed

Revenue

Bonds,

Refunding

Series

2015A,

(Pre-refunded

6/01/25)

5

.000

06/01/40

1,668,073

1,350,000

Golden

State

Tobacco

Securitization

Corporation,

California,

Enhanced

Tobacco

Settlement

Asset-Backed

Revenue

Bonds,

Refunding

Series

2015A,

(Pre-refunded

6/01/25)

5

.000

06/01/40

1,364,787

TOTAL

U.S.

GUARANTEED

6,052,709

UTILITIES

-

16.7%

(17.2%

of

Total

Investments)

840,000

California

Community

Choice

Financing

Authority,

Clean

Energy

Project

Revenue

Bonds,

Green

Series

2024A,

(Mandatory

Put

4/01/32)

5

.000

05/01/54

912,064

375,000

(a)

California

Pollution

Control

Financing

Authority,

Water

Furnishing

Revenue

Bonds,

Poseidon

Resources

Channelside

LP

Desalination

Project,

Series

2012,

(AMT)

5

.000

07/01/37

375,184

1,160,000

(a)

California

Pollution

Control

Financing

Authority,

Water

Furnishing

Revenue

Bonds,

Poseidon

Resources

Channelside

LP

Desalination

Project,

Series

2012,

(AMT)

5

.000

11/21/45

1,160,149

645,000

Long

Beach

Bond

Finance

Authority,

California,

Natural

Gas

Purchase

Revenue

Bonds,

Series

2007A

5

.500

11/15/37

757,277

2,000,000

Los

Angeles

Department

of

Water

and

Power,

California,

Power

System

Revenue

Bonds,

Series

2020B

5

.000

07/01/40

2,210,107

3,000,000

Los

Angeles

Department

of

Water

and

Power,

California,

Waterworks

Revenue

Bonds,

Series

2017A

5

.000

07/01/44

3,096,099

2,900,000

Los

Angeles

Department

of

Water

and

Power,

California,

Waterworks

Revenue

Bonds,

Series

2017A

4

.000

07/01/47

2,911,235

1,000,000

Los

Angeles

Department

of

Water

and

Power,

California,

Waterworks

Revenue

Bonds,

Series

2018B

5

.000

07/01/38

1,069,572

Part

F

of

Form

N-PORT

was

prepared

in

accordance

with

U.S.

generally

accepted

accounting

principles

(“U.S.

GAAP”)

and

in

conformity

with

the

applicable

rules

and

regulations

of

the

U.S.

Securities

and

Exchange

Commission

(“SEC”)

related

to

interim

filings.

Part

F

of

Form

N-PORT

does

not

include

all

information

and

footnotes

required

by

U.S.

GAAP

for

complete

financial

statements.

Certain

footnote

disclosures

normally

included

in

financial

statements

prepared

in

accordance

with

U.S.

GAAP

have

been

condensed

or

omitted

from

this

report

pursuant

to

the

rules

of

the

SEC.

For

a

full

set

of

the

Fund’s

notes

to

financial

statements,

please

refer

to

the

Fund’s

most

recently

filed

annual

or

semi-annual

report.

Fair

Value

Measurements

The

Fund’s

investments

in

securities

are

recorded

at

their

estimated

fair

value

utilizing

valuation

methods

approved

by

the

Board

of

Directors/

Trustees.

Fair

value

is

defined

as

the

price

that

would

be

received

upon

selling

an

investment

or

transferring

a

liability

in

an

orderly

transaction

to

an

independent

buyer

in

the

principal

or

most

advantageous

market

for

the

investment.

U.S.

GAAP

establishes

the

three-tier

hierarchy

which

is

used

to

maximize

the

use

of

observable

market

data

and

minimize

the

use

of

unobservable

inputs

and

to

establish

classification

of

fair

value

measurements

for

disclosure

purposes.

Observable

inputs

reflect

the

assumptions

market

participants

would

use

in

pricing

the

asset

or

liability.

Observable

inputs

are

based

on

market

data

obtained

from

sources

independent

of

the

reporting

entity.

Unobservable

inputs

reflect

management’s

assumptions

about

the

assumptions

market

participants

would

use

in

pricing

the

asset

or

liability.

Unobservable

inputs

are

based

on

the

best

information

available

in

the

circumstances.

The

following

is

a

summary

of

the

three-tiered

hierarchy

of

valuation

input

levels.

Level

1

–

Inputs

are

unadjusted

and

prices

are

determined

using

quoted

prices

in

active

markets

for

identical

securities.

Level

2

–

Prices

are

determined

using

other

significant

observable

inputs

(including

quoted

prices

for

similar

securities,

interest

rates,

credit

spreads,

etc.).

Level

3

–

Prices

are

determined

using

significant

unobservable

inputs

(including

management’s

assumptions

in

determining

the

fair

value

of

investments).

The

following

table

summarizes

the

market

value

of

the

Fund's

investments

as

of

the

end

of

the

reporting

period,

based

on

the

inputs

used

to

value

them:

PRINCIPAL

DESCRIPTION

RATE

MATURITY

VALUE

UTILITIES

(continued)

$

250,000

(a)

Puerto

Rico

Aqueduct

and

Sewerage

Authority,

Revenue

Bonds,

Refunding

Senior

Lien

Series

2020A

5

.000

%

07/01/47

$

257,869

2,050,000

Sacramento

County

Sanitation

Districts

Financing

Authority,

California,

Revenue

Bonds,

Sacramento

Regional

County

Sanitation

District,

Series

2020A

5

.000

12/01/50

2,211,281

TOTAL

UTILITIES

14,960,837

TOTAL

MUNICIPAL

BONDS

(Cost

$83,741,036)

86,210,881

TOTAL

LONG-TERM

INVESTMENTS

(Cost

$83,741,036)

86,210,881

PRINCIPAL

DESCRIPTION

RATE

MATURITY

VALUE

SHORT-TERM

INVESTMENTS

-

0.7%

(0.7%

of

Total

Investments)

X

600,000

MUNICIPAL

BONDS

-

0.7% (0.7%

of

Total

Investments)

X

–

HEALTH

CARE

-

0.7%

(0.7%

of

Total

Investments)

$

600,000

(d)

California

Health

Facilities

Financing

Authority,

California,

Revenue

Bonds,

Scripps

Health,

Weekly

Mode

Series

2024C-1

1

.750

11/15/63

$

600,000

TOTAL

HEALTH

CARE

600,000

TOTAL

MUNICIPAL

BONDS

(Cost

$600,000)

600,000

TOTAL

SHORT-TERM

INVESTMENTS

(Cost

$600,000)

600,000

TOTAL

INVESTMENTS

-

96.9%

(Cost

$84,341,036)

86,810,881

OTHER

ASSETS

&

LIABILITIES,

NET

-

3.1%

2,793,537

NET

ASSETS

APPLICABLE

TO

COMMON

SHARES

-

100%

$

89,604,418

Level

1

Level

2

Level

3

Total

Long-Term

Investments:

Municipal

Bonds

$

–

$

86,210,881

$

–

$

86,210,881

Short-Term

Investments:

Municipal

Bonds

–

600,000

–

600,000

Total

$

–

$

86,810,881

$

–

$

86,810,881

Portfolio

of

Investments

November

30,

2024

(continued)

NXC

All

percentages

shown

in

the

Portfolio

of

Investments

are

based

on

net

assets

applicable

to

common

shares

unless

otherwise

noted.

(a)

Security

is

exempt

from

registration

under

Rule

144A

of

the

Securities

Act

of

1933,

as

amended.

These

securities

are

deemed

liquid

and

may

be

resold

in

transactions

exempt

from

registration,

which

are

normally

those

transactions

with

qualified

institutional

buyers.

As

of

the

end

of

the

reporting

period,

the

aggregate

value

of

these

securities

is

$9,158,181

or

10.5%

of

Total

Investments.

(b)

Step-up

coupon

bond,

a

bond

with

a

coupon

that

increases

("steps

up"),

usually

at

regular

intervals,

while

the

bond

is

outstanding.

The

rate

shown

is

the

coupon

as

of

the

end

of

the

reporting

period.

(c)

Backed

by

an

escrow

or

trust

containing

sufficient

U.S.

Government

or

U.S.

Government

agency

securities,

which

ensure

the

timely

payment

of

principal

and

interest.

(d)

Investment

has

a

maturity

of

greater

than

one

year,

but

has

variable

rate

and/or

demand

features

which

qualify

it

as

a

short-term

investment.

The

rate

disclosed,

as

well

as

the

reference

rate

and

spread,

where

applicable,

is

that

in

effect

as

of

the

end

of

the

reporting

period.

This

rate

changes

periodically

based

on

market

conditions

or

a

specified

market

index.

AMT

Alternative

Minimum

Tax

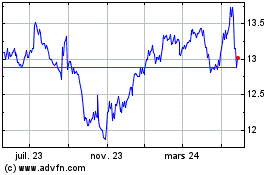

Nuveen California Select... (NYSE:NXC)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

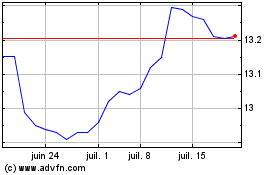

Nuveen California Select... (NYSE:NXC)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025