0001166258falseN-CSRSNet asset value and market value are published in Barron’s on Saturday, The Wall Street Journal on Monday and The New York Times on Monday and Saturday. Net asset value and market value are published daily on the Fund’s website at www.amundi.com/us. 0001166258 2024-04-01 2024-09-30 0001166258 2023-10-01 2024-03-31 0001166258 2024-09-30 0001166258 2024-03-31 0001166258 2023-03-31 0001166258 2022-03-31 0001166258 2021-03-31 0001166258 2020-03-31 xbrli:shares iso4217:USD xbrli:pure iso4217:USD xbrli:shares

SECURITIES AND EXCHANGE COMMISSION

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number

811-21043

Pioneer High Income Fund, Inc.

(Exact name of registrant as specified in charter)

60 State Street, Boston, MA 02109

(Address of principal executive offices) (ZIP code)

Christopher J. Kelley, Amundi Asset Management, Inc.,

60 State Street, Boston, MA 02109

(Name and address of agent for service)

Registrant’s telephone number, including area code: (617)

742-7825

Date of fiscal year end: March 31, 2025

Date of reporting period: April 1, 2024 through September 30, 2024

Form

N-CSR

is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule

30e-1

under the Investment Company Act of 1940 (17 CFR

270.30e-1). The

Commission may use the information provided on Form

N-CSR

in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form

N-CSR,

and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form

N-CSR

unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. ss. 3507.

ITEM 1. REPORT TO STOCKHOLDERS.

Pioneer High Income Fund, Inc.

Semiannual Report | September 30, 2024

visit us: www.amundi.com/us

| |

2 |

| |

9 |

| |

10 |

| |

11 |

| |

12 |

| |

37 |

| |

43 |

| |

65 |

| |

68 |

| |

73 |

Pioneer High Income Fund, Inc. |

Semiannual Report

|

9/30/24

1

Portfolio Management Discussion | 9/30/24

In the following interview, Andrew Feltus discusses the factors that affected the performance of Pioneer High Income Fund, Inc. during the six-month period ended September 30, 2024. Mr. Feltus, a Managing Director and Co-Director of High Yield, and a portfolio manager at Amundi Asset Management US, Inc. (Amundi US), is responsible for the daily management of the Fund, along with Matthew Shulkin, a senior vice president and a portfolio manager at Amundi US, and Kenneth Monaghan, a Managing Director and Co-Director of High Yield, and a portfolio manager at Amundi US.

Q |

How did the Fund perform during the six-month period ended September 30, 2024? |

A |

Pioneer High Income Fund, Inc. returned 7.97% at net asset value (NAV) and 9.02% at market price during the six-month period ended September 30, 2024. During the same six-month period, the Fund’s benchmark, the ICE Bank of America US High Yield Index (the ICE BofA Index), returned 5.66% at NAV. The ICE BofA Index is an unmanaged measure of the performance of high-yield securities. Unlike the Fund, the ICE BofA Index does not use leverage. While the use of leverage increases investment opportunity, it also increases investment risk. |

| |

During the same six-month period, the average return at NAV of the 39 closed end funds in Morningstar’s High Yield Bond Closed End Funds category (which may or may not be leveraged) was 7.66%, while the same closed end fund Morningstar category’s average return at market price was 9.07%. The shares of the Fund were selling at a 5.33% discount to NAV on September 30, 2024. Comparatively, the Fund’s shares were selling at a discount to NAV of 6.24% on March 31, 2024. On September 30, 2024, the standardized 30-day SEC yield of the Fund’s shares was 7.32%*. |

Q |

Which of the Fund’s investment strategies contributed positively to the Fund’s benchmark-relative performance during the six-month period ended September 30, 2024? |

A |

The Fund carries leveraged exposure to the high yield corporate bond market, which proved additive to benchmark-relative |

| * |

The 30-day SEC yield is a standardized formula that is based on the hypothetical annualized earning power (investment income only) of the Fund’s portfolio securities during the period indicated. |

2

Pioneer High Income Fund, Inc. |

Semiannual Report

|

9/30/24

| |

returns during the six-month period, driven by the market’s positive performance during the period. With respect to ratings categories, the Fund’s tilt toward lower quality issues within the high yield corporate bond market benefited benchmark-relative results during the six-month period, as non-rated issues outperformed the higher-rated “BB” issues in which the Fund was underweight. In sector terms, the Fund’s underweight allocations to the retail, capital goods and automotive sectors, as well as an overweight to the insurance sector, contributed positively to the Fund’s benchmark-relative returns during the six-month period. Finally, the Fund’s benchmark-relative returns benefited from out-of-benchmark allocations to insurance-linked securities, as returns experienced by the Fund’s holdings within the category exceeded those of the broader high yield corporate bond market during the six-month period. |

| |

Top performing individual securities included TMS International, which provides industrial steel mill services, and Trinity Industrial, within the machinery subsector, as both had strong earnings reported during the period. |

Q |

Which investment strategies detracted from the Fund’s benchmark-relative performance results during the six-month period ended September 30, 2024? |

A |

The main factor that held back the performance of the Fund was that the duration of the Funds portfolio was shorter than that of the benchmark. As US Treasury yields and spreads fell, this held back the performance of the Fund. The Fund typically maintains a shorter duration relative to the benchmark in an effort to reduce volatility in the Funds portfolio, as the leverage that the Fund employs increases the volatility of the Funds portfolio. |

| |

Overweight exposure to the energy sector, and underweight exposure to the telecommunications and media sectors, were the largest detractors from benchmark-relative performance during the six-month period. The individual securities that detracted most from the benchmark-relative performance during the period were within the consumer goods, healthcare and basic industry sectors. |

| |

A top detractor from the Fund’s performance on an individual security basis was Spectrum Brands, which is categorized as |

Pioneer High Income Fund, Inc. |

Semiannual Report

|

9/30/24

3

| |

personal & household products subsector within the consumer goods sector. It was anticipated that the company would utilize cash proceeds to buy back existing debt, but this did not materialize. |

Q |

Did the Fund’s distributions** to stockholders change during the six-month period ended September 30, 2024? |

A |

The Fund’s monthly distribution rate remained at $0.0550 per share over the course of the six-month period. |

Q |

How did the level of leverage in the Fund change during the six-month period ended September 30, 2024? |

A |

The Fund employs leverage through a credit agreement. As of September 30, 2024, 30.4% of the Fund’s total managed assets were financed by leverage, or borrowed funds, compared with 31.2% of the Fund’s total managed assets financed by leverage at the start of the six-month period on April 1, 2024. The change in the percentage of the Fund’s total managed assets financed by leverage during the six-month period was the result of an increase in the value of the Fund’s total managed assets relative to the absolute amount of funds borrowed. The interest rate on the Fund’s leverage decreased by 1 basis points from March 31, 2024 to September 30, 2024. |

Q |

Did the Fund have any exposure to derivatives during the six- month period ended September 30, 2024? |

A |

Yes, we invested the Fund’s portfolio in forward foreign currency exchange contracts (currency forwards) and other currency related derivatives during the period, which had a positive effect on benchmark-relative performance. These investments were made to hedge positions bought in non-dollar securities. In addition, the Fund’s small position in credit default swaps contributed modestly to relative returns. |

Q |

What is your investment outlook, and how is the Fund positioned heading into the second half of its fiscal year? |

A |

The US economy has experienced stronger growth than anticipated this year, but is gradually decelerating. The once- |

** |

Dividends/Distributions are not guaranteed. |

4

Pioneer High Income Fund, Inc. |

Semiannual Report

|

9/30/24

| |

overheated labor market has cooled, with companies reducing their hiring rates, yet layoffs have remained relatively low thus far. To trigger a recession in the US, an increase in layoffs is likely necessary. Although the Federal Reserve’s shift towards a less restrictive policy and emphasis on employment downside risks lessen the threat of recession, a hard economic landing is still possible. The re-emergence of a more dovish Powell has also decreased downside risk for corporate bonds. Currently, high yield spreads are relatively and historically narrow, suggesting that investors have already accounted for limited economic risk. Currently, high yield spreads are relatively and historically narrow, suggesting that investors have already accounted for limited economic risk. While yields remain attractive relative to inflation, the market has factored in a very aggressive trajectory for Fed rate cuts over the next year. We expect defaults to decline as we do not see a significant sector or driver that would increase defaults to levels seen in past periods of volatility such as the 2008 financial crisis. |

| |

September 2024 opened with the economic tea leaves reflecting a continued cooling in US labor demand, with two separate data releases pointing to a further contraction in job openings and monthly job creation falling to a level below labor force growth. As the month progressed, investor attention shifted to the September 18th Federal Open Market Committee (FOMC) meeting. A Fed Funds rate cut, the first rate action since July 2023, was widely anticipated with expectations divided between an initial rate reduction of 25 and 50 basis points. Ultimately, the FOMC proceeded with a 50-basis point cut. Treasury yields rose post the FOMC announcement as the Fed had implemented a “hawkish 50” by kicking off an easing cycle without showing alarm or committing to similar magnitude rate cuts in the future. Chair Powell highlighted that the historically outsized initial rate cut was largely driven by a decrease in PCE inflation to 2.2%, which is close to the Fed’s 2.0% target, rather than by major concerns regarding growth. He also noted that the timing and extent of future rate cuts would be contingent on economic data, particularly employment figures, and he refrained from endorsing market predictions of another 50-basis point cut at one of the remaining meetings of the year. |

Pioneer High Income Fund, Inc. |

Semiannual Report

|

9/30/24

5

| |

We do not believe that the high yield market will perform as poorly as it has historically performed in a recession. Credit quality is currently higher than it has been historically, featuring more BB-rated (higher quality) credits and a reduced number of CCC-rated (lower quality) credits. Secondly, issuance has been focused on refinancing debt, rather than adding debt for acquisitions or other purposes. |

| |

The very tight levels of spreads is a concern. Yields remain attractive, but spreads are in the tightest decile historically. They are pricing in defaults falling back to non-recessionary levels (2-3%) versus the average levels we are currently experiencing. We do not expect a significant decrease in the number of defaults until profits recover across the economy. We have sought to reduce risk in the Fund’s portfolio relative to recent periods, and sought to maintain a high level of yield. This will allow us to add risk to the Fund’s portfolio if the market sells off to levels that price in some margin of error. |

| |

The main focus of the Fund continues to be income and the higher level of interest rates has helped. Our cost of leverage has declined slightly as the Fed has begun the process of easing. This should allow some flexibility, although it might be accompanied by a more difficult environment for high yield bonds. While the market has been “risk on” in the last year, we believe security selection will be more important going forward, and we’ve seen distressed securities struggle lately. Our team of analysts will focus on identifying mispriced securities to help the Fund perform. |

6

Pioneer High Income Fund, Inc. |

Semiannual Report

|

9/30/24

Please refer to the Schedule of Investments on pages 12 - 36 for a full listing of Fund securities.

All investments are subject to risk, including the possible loss of principal. In the past several years, financial markets have experienced increased volatility and heightened uncertainty. The market prices of securities may go up or down, sometimes rapidly or unpredictably, due to general market conditions, such as real or perceived adverse economic, political, or regulatory conditions, recessions, inflation, changes in interest or currency rates, lack of liquidity in the bond markets, the spread of infectious illness or other public health issues, armed conflict including Russia’s military invasion of Ukraine, sanctions against Russia, other nations or individuals or companies and possible countermeasures, market disruptions caused by tariffs, trade disputes or other government actions, or adverse investor sentiment. These conditions may continue, recur, worsen or spread.

Investments in high-yield or lower-rated securities are subject to greater-than-average risk.

The Fund may invest in securities of issuers that are in default or that are in bankruptcy.

The Fund invests in insurance-linked securities. The return of principal and the payment of interest and/or dividends on insurance linked securities are contingent on the non-occurrence of a pre-defined “trigger” event, such as a hurricane or an earthquake of a specific magnitude.

Investing in foreign and/or emerging markets securities involves risks relating to interest rates, currency exchange rates, economic, social, and political conditions, which could increase volatility. These risks are magnified in emerging markets.

When interest rates rise, the prices of fixed-income securities held by the Fund will generally fall. Conversely, when interest rates fall the prices of fixed-income securities held by the Fund will generally rise. A general rise in interest rates could adversely affect the price and liquidity of fixed-income securities.

Investments in the Fund are subject to possible loss due to the financial failure of the issuers of the underlying securities and their inability to meet their debt obligations.

The Fund may invest up to 50% of its total assets in illiquid securities. Illiquid securities may be difficult to dispose of at a price reflective of their value at the times when the Fund believes it is desirable to do so, and the market price of illiquid securities is generally more volatile than that of more liquid securities.

Pioneer High Income Fund, Inc. |

Semiannual Report

|

9/30/24

7

Illiquid securities are also more difficult to value and investment of the Fund’s assets in illiquid securities may restrict the Fund’s ability to take advantage of market opportunities.

The Fund employs leverage through a credit agreement. Leverage creates significant risks, including the risk that the Fund’s incremental income or capital appreciation for investments purchased with the proceeds of leverage will not be sufficient to cover the cost of leverage, which may adversely affect the return for stockholders.

The Fund is required to meet certain regulatory and other asset coverage requirements in connection with its use of leverage. In order to maintain required asset coverage levels, the Fund may be required to reduce the amount of leverage employed by the Fund, alter the composition of its investment portfolio or take other actions at what might be inopportune times in the market. Such actions could reduce the net earnings or returns to stockholders over time, which is likely to result in a decrease in the market value of the Fund’s shares.

These risks may increase share price volatility.

Any information in this stockholder report regarding market or economic trends or the factors influencing the Fund’s historical or future performance are statements of opinion as of the date of this report. Past performance is no guarantee of future results.

8

Pioneer High Income Fund, Inc. |

Semiannual Report

|

9/30/24

Portfolio Summary | 9/30/24

Portfolio Diversification

(As a percentage of total investments)*

| (As a percentage of total investments)* |

| 1. |

Hercules LLC, 6.50%, 6/30/29 |

1.22% |

| 2. |

Prime Security Services Borrower LLC/Prime Finance, Inc., 6.25%, 1/15/28 (144A) |

1.19 |

| 3. |

Hanover Insurance Group, Inc., 7.625%, 10/15/25 |

1.11 |

| 4. |

Liberty Mutual Group, Inc., 10.75% (3 Month Term SOFR + 738 bps), 6/15/58 (144A) |

1.06 |

| 5. |

Kennedy-Wilson, Inc., 5.00%, 3/1/31 |

1.03 |

| 6. |

McGraw-Hill Education, Inc., 8.00%, 8/1/29 (144A) |

1.01 |

| 7. |

Limak Cimento Sanayi ve Ticaret AS, 9.75%, 7/25/29 (144A) |

1.00 |

| 8. |

Provident Funding Associates LP/PFG Finance Corp., 6.375%, 6/15/25 (144A) |

0.98 |

| 9. |

Prime Healthcare Services, Inc., 9.375%, 9/1/29 (144A) |

0.94 |

| 10. |

Grupo Aeromexico SAB de CV, 8.50%, 3/17/27 (144A) |

0.94 |

* Excludes short-term investments and all derivative contracts except for options purchased. The Fund is actively managed, and current holdings may be different. The holdings listed should not be considered recommendations to buy or sell any securities.

†

Amount rounds to less than 0.1%.

Pioneer High Income Fund, Inc. |

Semiannual Report

|

9/30/24

9

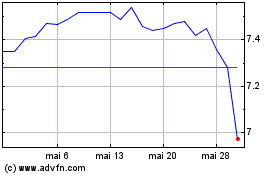

Prices and Distributions | 9/30/24

| |

9/30/24 |

3/31/24 |

| Market Value |

$8.00 |

$7.66 |

| Discount |

(5.33)% |

(6.24)% |

Net Asset Value per Share^

| |

9/30/24 |

3/31/24 |

| Net Asset Value |

$8.45 |

$8.17 |

Distributions per Share*: 4/1/24 - 9/30/24

| |

Net Investment

Income |

Short-Term

Capital Gains |

Long-Term

Capital Gains |

| 4/1/24 – 9/30/24 |

$0.3300 |

$— |

$— |

| |

9/30/24 |

3/31/24 |

| 30-Day SEC Yield |

7.01% |

7.32% |

The data shown above represents past performance, which is no guarantee of future results.

^ Net asset value and market value are published in Barron’s on Saturday, The Wall Street Journal on Monday and The New York Times on Monday and Saturday. Net asset value and market value are published daily on the Fund’s website at

www.amundi.com/us

.

* The amount of distributions made to stockholders during the period was in excess of the net investment income earned by the Fund during the period.

10

Pioneer High Income Fund, Inc. |

Semiannual Report

|

9/30/24

Performance Update | 9/30/24

The mountain chart on the right shows the change in market value, including reinvestment of dividends and distributions, of a $10,000 investment made in common shares of Pioneer High Income Fund, Inc. during the periods shown, compared to that of the ICE BofA U.S. High Yield Index.

Average Annual Total Return

(As of September 30, 2024) |

Period |

Net

Asset

Value

(NAV) |

Market

Price |

ICE BofA

U.S. High

Yield

Index |

| 10 Years |

5.11% |

2.12% |

4.95% |

| 5 Years |

6.36 |

6.90 |

4.55 |

| 1 Year |

20.62 |

30.20 |

15.66 |

Value of $10,000 Investment

Call 1-800-710-0935 or visit www.amundi.com/us for the most recent month-end performance results. Current performance may be lower or higher than the performance data quoted.

Performance data shown represents past performance. Past performance is no guarantee of future results. Investment return and market price will fluctuate, and your shares may trade below NAV, due to such factors as interest rate changes and the perceived credit quality of borrowers.

Total investment return does not reflect broker sales charges or commissions. All performance is for common shares of the Fund.

Shares of closed-end funds, unlike open-end funds, are not continuously offered. There is a one-time public offering and, once issued, shares of closed-end funds are bought and sold in the open market through a stock exchange and frequently trade at prices lower than their NAV. NAV per common share is total assets less total liabilities, which include preferred shares or borrowings, as applicable, divided by the number of common shares outstanding.

When NAV is lower than market price, dividends are assumed to be reinvested at the greater of NAV or 95% of the market price. When NAV is higher, dividends are assumed to be reinvested at prices obtained through open-market purchases under the Fund’s dividend reinvestment plan.

The performance table and graph do not reflect the deduction of fees and taxes that a stockholder would pay on Fund distributions or the sale of Fund shares. Had these fees and taxes been reflected, performance would have been lower.

The ICE Bank of America U.S. High Yield Index is an unmanaged, commonly accepted measure of the performance of high yield securities. Index returns are calculated monthly, assume reinvestment of dividends and, unlike Fund returns, do not reflect any fees, expenses or sales charges.

The Index does not employ leverage. It is not possible to invest directly in the Index.

Pioneer High Income Fund, Inc. |

Semiannual Report

|

9/30/24

11

Schedule of Investments | 9/30/24

|

|

|

|

|

|

Value |

| |

UNAFFILIATED ISSUERS — 142.8%^ |

|

| |

Senior Secured Floating Rate Loan Interests — 2.0% of Net Assets*(a) |

|

| |

Auto Parts & Equipment — 0.5% |

|

| 1,375,628 |

First Brands Group LLC, First Lien 2021 Term Loan, 10.514% (Term SOFR + 500 bps), 3/30/27 |

$ 1,364,117 |

| |

Total Auto Parts & Equipment |

|

|

|

| |

Casino Hotels — 0.6% |

|

| 1,492,268 |

Century Casinos, Inc., Term B Facility Loan, 11.301% (Term SOFR + 600 bps), 4/2/29 |

$ 1,428,847 |

| |

Total Casino Hotels |

|

|

|

| |

Computer Services — 0.1% |

|

| 380,000(b) |

Amazon Holdco, Inc., Seven-Year Term Loan, 7/30/31 |

$ 379,287 |

| |

Total Computer Services |

|

|

|

| |

Cruise Lines — 0.3% |

|

| 840,000 |

LC Ahab US Bidco LLC, Initial Term Loan, 8.345% (Term SOFR + 350 bps), 5/1/31 |

$ 844,725 |

| |

Total Cruise Lines |

|

|

|

| |

Electric-Generation — 0.3% |

|

| 675,000(b) |

Alpha Generation LLC, Term Loan B, 9/19/31 |

$ 675,844 |

| |

Total Electric-Generation |

|

|

|

| |

Medical-Drugs — 0.2% |

|

| 390,000 |

Endo Finance Holdings, Inc., Initial Term Loan, 9.783% (Term SOFR + 450 bps), 4/23/31 |

$ 390,122 |

| |

Total Medical-Drugs |

|

|

|

| |

Total Senior Secured Floating Rate Loan Interests

(Cost $5,078,633) |

|

|

|

Shares |

|

|

|

|

|

|

| |

Common Stocks — 0.5% of Net Assets |

|

| |

|

|

| 22 |

LyondellBasell Industries NV, Class A |

$ 2,110 |

| |

Total Chemicals |

|

|

|

The accompanying notes are an integral part of these financial statements.

12

Pioneer High Income Fund, Inc. |

Semiannual Report

|

9/30/24

Shares |

|

|

|

|

|

Value |

| |

Communications Equipment — 0.0% † |

|

| 2,630 + |

Digicel International Finance Ltd. |

$ 6,575 |

| |

Total Communications Equipment |

|

|

|

| |

Diversified Telecommunication Services — 0.0% † |

|

| 251,944 + |

Atento S.A. |

$ 7 |

| |

Total Diversified Telecommunication Services |

|

|

|

| |

Oil, Gas & Consumable Fuels — 0.0% † |

|

| 21(c) |

Amplify Energy Corp. |

$ 137 |

| 8,027 |

Petroquest Energy, Inc. |

1,405 |

| |

Total Oil, Gas & Consumable Fuels |

|

|

|

| |

Passenger Airlines — 0.5% |

|

| 57,203 |

Grupo Aeromexico SAB de CV |

$ 1,283,122 |

| |

Total Passenger Airlines |

|

|

|

| |

|

|

| 2,975(c) |

Endo, Inc. |

$ 75,804 |

| |

Total Pharmaceuticals |

|

|

|

| |

Total Common Stocks

(Cost $1,479,274) |

|

|

|

|

|

|

|

|

|

|

| |

Asset Backed Securities — 0.6% of

Net Assets |

|

| 1,443,149 |

Santander Bank Auto Credit-Linked Notes, Series 2023-B, Class F, 12.24%, 12/15/33 (144A) |

$ 1,494,135 |

| |

Total Asset Backed Securities

(Cost $1,443,149) |

|

|

|

| |

Collateralized Mortgage Obligations—2.3% of Net Assets |

|

| 710,000(a) |

Connecticut Avenue Securities Trust, Series 2021-R01, Class 1B2, 11.28% (SOFR30A + 600 bps), 10/25/41 (144A) |

$ 747,491 |

| 430,000(a) |

Federal Home Loan Mortgage Corp. STACR REMIC Trust, Series 2021-DNA7, Class B2, 13.08% (SOFR30A + 780 bps), 11/25/41 (144A) |

465,883 |

| 450,000(a) |

Federal Home Loan Mortgage Corp. STACR REMIC Trust, Series 2021-HQA3, Class B2, 11.53% (SOFR30A + 625 bps), 9/25/41 (144A) |

471,266 |

The accompanying notes are an integral part of these financial statements.

Pioneer High Income Fund, Inc. |

Semiannual Report

|

9/30/24

13

Schedule of Investments | 9/30/24

|

|

|

|

|

|

Value |

| |

Collateralized Mortgage Obligations— (continued) |

|

| 610,000(a) |

Federal Home Loan Mortgage Corp. STACR REMIC Trust, Series 2022-DNA2, Class B2, 13.78% (SOFR30A + 850 bps), 2/25/42 (144A) |

$ 670,998 |

| 1,370,000(a) |

Federal Home Loan Mortgage Corp. STACR Trust, Series 2019-DNA3, Class B2, 13.545% (SOFR30A + 826 bps), 7/25/49 (144A) |

1,568,650 |

| 120,000(a) |

Federal National Mortgage Association Connecticut Avenue Securities, Series 2021-R02, Class 2B2, 11.48% (SOFR30A + 620 bps), 11/25/41 (144A) |

126,191 |

| 1,350,000(a) |

STACR Trust, Series 2018-HRP2, Class B2, 15.895% (SOFR30A + 1,061 bps), 2/25/47 (144A) |

1,638,625 |

| |

Total Collateralized Mortgage Obligations

(Cost $5,231,268) |

|

|

|

| |

Commercial Mortgage-Backed Securities—2.5% of Net Assets |

|

| 1,415,000(a) |

Capital Funding Mortgage Trust, Series 2021-19, Class B, 20.41% (1 Month Term SOFR + 1,521 bps), 10/27/24 (144A) |

$ 1,406,411 |

| 890,204(d) |

FREMF Mortgage Trust, Series 2019-KJ24, Class B, 7.60%, 10/25/27 (144A) |

837,941 |

| 1,499,131(a) |

FREMF Mortgage Trust, Series 2019-KS12, Class C, 12.361% (SOFR30A + 701 bps), 8/25/29 |

1,438,456 |

| 222,712(a) |

FREMF Mortgage Trust, Series 2020-KF74, Class C, 11.711% (SOFR30A + 636 bps), 1/25/27 (144A) |

205,284 |

| 317,897(a) |

FREMF Mortgage Trust, Series 2020-KF83, Class C, 14.461% (SOFR30A + 911 bps), 7/25/30 (144A) |

300,442 |

| 2,500,000 |

Wells Fargo Commercial Mortgage Trust, Series 2015-C28, Class E, 3.00%, 5/15/48 (144A) |

1,970,550 |

| |

Total Commercial Mortgage-Backed Securities

(Cost $6,329,737) |

|

|

|

The accompanying notes are an integral part of these financial statements.

14

Pioneer High Income Fund, Inc. |

Semiannual Report

|

9/30/24

|

|

|

|

|

|

Value |

| |

Convertible Corporate Bonds — 2.7% of Net Assets |

|

| |

|

|

| IDR 1,422,679,000 |

PT Bakrie & Brothers Tbk, 12/31/24 |

$ 7,142 |

| |

Total Banks |

|

|

|

| |

Chemicals — 1.7% |

|

| 4,000,000(e) |

Hercules LLC, 6.50%, 6/30/29 |

$ 4,248,381 |

| |

Total Chemicals |

|

|

|

| |

Commercial Services — 0.5% |

|

| 1,130,000 |

Global Payments, Inc., 1.50%, 3/1/31 (144A) |

$ 1,079,150 |

| |

Total Commercial Services |

|

|

|

| |

Entertainment — 0.5% |

|

| 1,455,000(f) |

DraftKings Holdings, Inc., 3/15/28 |

$ 1,259,302 |

| |

Total Entertainment |

|

|

|

| |

Total Convertible Corporate Bonds

(Cost $5,634,248) |

|

|

|

| |

Corporate Bonds — 123.3% of Net

Assets |

|

| |

Advertising — 3.3% |

|

| 2,090,000 |

Clear Channel Outdoor Holdings, Inc., 7.50%, 6/1/29 (144A) |

$ 1,800,030 |

| 1,470,000 |

Neptune Bidco US, Inc., 9.29%, 4/15/29 (144A) |

1,439,938 |

| 2,010,000 |

Stagwell Global LLC, 5.625%, 8/15/29 (144A) |

1,943,305 |

| 3,000,000 |

Summer BC Bidco B LLC, 5.50%, 10/31/26 (144A) |

2,964,214 |

| |

Total Advertising |

|

|

|

| |

Aerospace & Defense — 1.5% |

|

| 2,150,000 |

Bombardier, Inc., 6.00%, 2/15/28 (144A) |

$ 2,164,214 |

| 246,000 |

Bombardier, Inc., 7.125%, 6/15/26 (144A) |

249,774 |

| 740,000 |

Spirit AeroSystems, Inc., 9.375%, 11/30/29 (144A) |

802,790 |

| 592,000 |

Triumph Group, Inc., 9.00%, 3/15/28 (144A) |

619,715 |

| |

Total Aerospace & Defense |

|

|

|

| |

Airlines — 4.8% |

|

| 1,938,887(g) |

ABRA Global Finance, 11.50% (5.50% PIK or 6.00% Cash), 3/2/28 (144A) |

$ 2,070,422 |

| 355,000 |

Delta Air Lines, Inc., 7.375%, 1/15/26 |

365,212 |

The accompanying notes are an integral part of these financial statements.

Pioneer High Income Fund, Inc. |

Semiannual Report

|

9/30/24

15

Schedule of Investments | 9/30/24

|

|

|

|

|

|

Value |

| |

Airlines — (continued) |

|

| 3,001,186(a) |

Gol Finance S.A., 15.344% (1 Month Term SOFR + 1,050 bps), 1/29/25 (144A) |

$ 3,181,257 |

| 3,255,000 |

Grupo Aeromexico SAB de CV, 8.50%, 3/17/27 (144A) |

3,289,220 |

| 330,000 |

Latam Airlines Group S.A., 13.375%, 10/15/29 (144A) |

383,913 |

| 759,000 |

Mileage Plus Holdings LLC/Mileage Plus Intellectual Property Assets, Ltd., 6.50%, 6/20/27 (144A) |

768,437 |

| EUR 1,600,000 |

Transportes Aereos Portugueses S.A., 5.625%, 12/2/24 (144A) |

1,779,259 |

| |

Total Airlines |

|

|

|

| |

Auto Manufacturers — 0.4% |

|

| 1,035,000 |

JB Poindexter & Co., Inc., 8.75%, 12/15/31 (144A) |

$ 1,094,268 |

| |

Total Auto Manufacturers |

|

|

|

| |

Auto Parts & Equipment — 0.6% |

|

| 1,285,000 |

Adient Global Holdings, Ltd., 8.25%, 4/15/31 (144A) |

$ 1,363,385 |

| |

Total Auto Parts & Equipment |

|

|

|

| |

Banks — 3.7% |

|

| 600,000(d)(h) |

Bank of America Corp., 6.50% (3 Month Term SOFR + 444 bps) |

$ 599,858 |

| EUR 2,400,000 (d)(h) |

CaixaBank S.A., 3.625% (5 Year EUR Swap + 386 bps) |

2,377,515 |

| 1,175,000 |

Freedom Mortgage Corp., 12.25%, 10/1/30 (144A) |

1,315,947 |

| 675,000(d)(h) |

Intesa Sanpaolo S.p.A., 7.70% (5 Year USD Swap Rate + 546 bps) (144A) |

674,177 |

| 1,975,000 |

KeyBank N.A., 4.90%, 8/8/32 |

1,922,533 |

| 410,000(d) |

Toronto-Dominion Bank, 7.25% (5 Year CMT Index + 298 bps), 7/31/84 |

427,159 |

| 1,240,000(d) |

Toronto-Dominion Bank, 8.125% (5 Year CMT Index + 408 bps), 10/31/82 |

1,330,287 |

| 545,000(d)(h) |

UBS Group AG, 9.25% (5 Year CMT Index + 476 bps) (144A) |

642,737 |

| |

Total Banks |

|

|

|

The accompanying notes are an integral part of these financial statements.

16

Pioneer High Income Fund, Inc. |

Semiannual Report

|

9/30/24

|

|

|

|

|

|

Value |

| |

Biotechnology — 0.3% |

|

| EUR 745,000 |

Cidron Aida Finco S.a.r.l., 5.00%, 4/1/28 (144A) |

$ 805,537 |

| |

Total Biotechnology |

|

|

|

| |

Building Materials — 3.5% |

|

| 1,991,000 |

AmeriTex HoldCo Intermediate LLC, 10.25%, 10/15/28 (144A) |

$ 2,082,751 |

| 2,211,000 |

Cornerstone Building Brands, Inc., 6.125%, 1/15/29 (144A) |

1,956,408 |

| 1,140,000 |

Knife River Corp., 7.75%, 5/1/31 (144A) |

1,212,076 |

| 3,550,000 |

Limak Cimento Sanayi ve Ticaret AS, 9.75%, 7/25/29 (144A) |

3,477,765 |

| |

Total Building Materials |

|

|

|

| |

Chemicals — 7.5% |

|

| 1,355,000 |

LSF11 A5 HoldCo LLC, 6.625%, 10/15/29 (144A) |

$ 1,317,927 |

| EUR 885,000 |

Lune Holdings S.a.r.l., 5.625%, 11/15/28 (144A) |

863,584 |

| 2,250,000 |

LYB Finance Co. BV, 8.10%, 3/15/27 (144A) |

2,418,703 |

| 2,831,000 |

Mativ Holdings, Inc., 6.875%, 10/1/26 (144A) |

2,829,726 |

| 980,000(i) |

Mativ Holdings, Inc., 8.00%, 10/1/29 (144A) |

1,000,261 |

| 470,000 |

Olin Corp., 9.50%, 6/1/25 (144A) |

478,225 |

| EUR 1,355,000 |

Olympus Water US Holding Corp., 9.625%, 11/15/28 (144A) |

1,618,178 |

| 2,320,000 |

Olympus Water US Holding Corp., 9.75%, 11/15/28 (144A) |

2,476,041 |

| 2,500,000 |

SCIL IV LLC/SCIL USA Holdings LLC, 5.375%, 11/1/26 (144A) |

2,468,952 |

| EUR 1,005,000 |

SCIL IV LLC/SCIL USA Holdings LLC, 9.50%, 7/15/28 (144A) |

1,207,402 |

| 2,000,000 |

Tronox, Inc., 4.625%, 3/15/29 (144A) |

1,868,254 |

| |

Total Chemicals |

|

|

|

| |

Coal — 1.2% |

|

| 2,795,000 |

Alliance Resource Operating Partners LP/Alliance Resource Finance Corp., 8.625%, 6/15/29 (144A) |

$ 2,970,084 |

| |

Total Coal |

|

|

|

| |

Commercial Services — 7.0% |

|

| 20,000 |

Allied Universal Holdco LLC, 7.875%, 2/15/31 (144A) |

$ 20,430 |

The accompanying notes are an integral part of these financial statements.

Pioneer High Income Fund, Inc. |

Semiannual Report

|

9/30/24

17

Schedule of Investments | 9/30/24

|

|

|

|

|

|

Value |

| |

Commercial Services — (continued) |

|

| 1,645,000 |

Allied Universal Holdco LLC/Allied Universal Finance Corp., 6.00%, 6/1/29 (144A) |

$ 1,470,061 |

| 1,905,000 |

Allied Universal Holdco LLC/Allied Universal Finance Corp., 9.75%, 7/15/27 (144A) |

1,909,098 |

| 1,165,000 |

Avis Budget Car Rental LLC/Avis Budget Finance, Inc., 8.25%, 1/15/30 (144A) |

1,191,726 |

| 1,652,000 |

Champions Financing, Inc., 8.75%, 2/15/29 (144A) |

1,682,651 |

| 2,116,000 |

Garda World Security Corp., 6.00%, 6/1/29 (144A) |

2,030,669 |

| 2,059,000 |

Garda World Security Corp., 9.50%, 11/1/27 (144A) |

2,061,705 |

| 319,000 |

Herc Holdings, Inc., 5.50%, 7/15/27 (144A) |

318,608 |

| 915,000 |

NESCO Holdings II, Inc., 5.50%, 4/15/29 (144A) |

843,426 |

| 4,155,000 |

Prime Security Services Borrower LLC/Prime Finance, Inc., 6.25%, 1/15/28 (144A) |

4,156,118 |

| 1,093,000 |

Sotheby's, 7.375%, 10/15/27 (144A) |

1,051,952 |

| 690,000 |

Williams Scotsman, Inc., 6.625%, 6/15/29 (144A) |

710,416 |

| |

Total Commercial Services |

|

|

|

| |

Computers — 0.3% |

|

| 365,000 |

Amentum Escrow Corp., 7.25%, 8/1/32 (144A) |

$ 380,926 |

| 415,000 |

Fortress Intermediate 3, Inc., 7.50%, 6/1/31 (144A) |

437,836 |

| |

Total Computers |

|

|

|

| |

Distribution/Wholesale — 0.9% |

|

| 705,000 |

Velocity Vehicle Group LLC, 8.00%, 6/1/29 (144A) |

$ 734,050 |

| 1,325,000 |

Windsor Holdings III LLC, 8.50%, 6/15/30 (144A) |

1,417,324 |

| |

Total Distribution/Wholesale |

|

|

|

| |

Diversified Financial Services — 12.8% |

|

| 3,500,000(d)(h) |

Air Lease Corp., 4.125% (5 Year CMT Index + 315 bps) |

$ 3,284,678 |

| 1,725,000(d) |

Ally Financial, Inc., 6.184% (SOFR + 229 bps), 7/26/35 |

1,765,439 |

| 811,000 |

Bread Financial Holdings, Inc., 7.00%, 1/15/26 (144A) |

807,081 |

| 140,000(j) |

Credito Real SAB de CV SOFOM ER, 8.00%, 1/21/28 (144A) |

13,796 |

The accompanying notes are an integral part of these financial statements.

18

Pioneer High Income Fund, Inc. |

Semiannual Report

|

9/30/24

|

|

|

|

|

|

Value |

| |

Diversified Financial Services — (continued) |

|

| 1,500,000(j) |

Credito Real SAB de CV SOFOM ER, 9.50%, 2/7/26 (144A) |

$ 152,775 |

| 1,095,000 |

Freedom Mortgage Holdings LLC, 9.125%, 5/15/31 (144A) |

1,125,778 |

| 1,140,000 |

Freedom Mortgage Holdings LLC, 9.25%, 2/1/29 (144A) |

1,184,968 |

| EUR 480,000 |

Garfunkelux Holdco 3 S.A., 6.75%, 11/1/25 (144A) |

359,859 |

| GBP 820,000 |

Garfunkelux Holdco 3 S.A., 7.75%, 11/1/25 (144A) |

731,780 |

| 350,000 |

GGAM Finance, Ltd., 7.75%, 5/15/26 (144A) |

357,888 |

| 1,805,000 |

GGAM Finance, Ltd., 8.00%, 6/15/28 (144A) |

1,934,702 |

| 3,045,000 |

Global Aircraft Leasing Co., Ltd., 8.75%, 9/1/27 (144A) |

3,089,926 |

| 2,900,000 |

Jefferies Finance LLC/JFIN Co.-Issuer Corp., 5.00%, 8/15/28 (144A) |

2,757,351 |

| 845,000 |

Nationstar Mortgage Holdings, Inc., 6.00%, 1/15/27 (144A) |

845,097 |

| 1,210,000 |

OneMain Finance Corp., 7.875%, 3/15/30 |

1,264,918 |

| 2,320,000 |

OneMain Finance Corp., 9.00%, 1/15/29 |

2,458,428 |

| 755,000 |

PHH Mortgage Corp., 7.875%, 3/15/26 (144A) |

758,846 |

| 3,415,000 |

Provident Funding Associates LP/PFG Finance Corp., 6.375%, 6/15/25 (144A) |

3,413,787 |

| 2,405,000 |

Provident Funding Associates LP/PFG Finance Corp., 9.75%, 9/15/29 (144A) |

2,450,246 |

| 1,051,000 |

United Wholesale Mortgage LLC, 5.50%, 4/15/29 (144A) |

1,023,675 |

| 1,860,000 |

United Wholesale Mortgage LLC, 5.75%, 6/15/27 (144A) |

1,847,903 |

| |

Total Diversified Financial Services |

|

|

|

| |

Electric — 1.5% |

|

| 360,000 |

Alpha Generation LLC, 6.75%, 10/15/32 (144A) |

$ 365,075 |

| 412,000 |

Cemig Geracao e Transmissao S.A., 9.25%, 12/5/24 (144A) |

411,803 |

| 1,145,000 |

Lightning Power LLC, 7.25%, 8/15/32 (144A) |

1,204,010 |

| 676,000 |

NRG Energy, Inc., 6.625%, 1/15/27 |

676,969 |

The accompanying notes are an integral part of these financial statements.

Pioneer High Income Fund, Inc. |

Semiannual Report

|

9/30/24

19

Schedule of Investments | 9/30/24

|

|

|

|

|

|

Value |

| |

Electric — (continued) |

|

| 1,045,000 |

Talen Energy Supply LLC, 8.625%, 6/1/30 (144A) |

$ 1,138,864 |

| 6,000 |

Vistra Operations Co. LLC, 5.625%, 2/15/27 (144A) |

5,991 |

| |

Total Electric |

|

|

|

| |

Electrical Components & Equipments — 1.3% |

|

| 2,600,000 |

Energizer Holdings, Inc., 6.50%, 12/31/27 (144A) |

$ 2,641,465 |

| 520,000 |

WESCO Distribution, Inc., 7.25%, 6/15/28 (144A) |

532,475 |

| |

Total Electrical Components & Equipments |

|

|

|

| |

Electronics — 0.9% |

|

| 1,330,000 |

EquipmentShare.com, Inc., 8.00%, 3/15/33 (144A) |

$ 1,361,501 |

| 735,000 |

EquipmentShare.com, Inc., 8.625%, 5/15/32 (144A) |

771,087 |

| |

Total Electronics |

|

|

|

| |

Entertainment — 2.5% |

|

| 395,000 |

International Game Technology Plc, 6.25%, 1/15/27 (144A) |

$ 403,198 |

| 1,910,000 |

Light & Wonder International, Inc., 7.00%, 5/15/28 (144A) |

1,926,724 |

| 1,910,000 |

Light & Wonder International, Inc., 7.25%, 11/15/29 (144A) |

1,976,132 |

| EUR 730,000 |

Lottomatica S.p.A./Roma, 7.125%, 6/1/28 (144A) |

855,268 |

| 930,000 |

Mohegan Tribal Gaming Authority, 8.00%, 2/1/26 (144A) |

919,747 |

| |

Total Entertainment |

|

|

|

| |

Food — 0.7% |

|

| 531,000 |

Albertsons Cos., Inc./Safeway, Inc./New Albertsons LP/Albertsons LLC, 7.50%, 3/15/26 (144A) |

$ 535,582 |

| 1,215,000 |

Fiesta Purchaser, Inc., 9.625%, 9/15/32 (144A) |

1,257,692 |

| |

Total Food |

|

|

|

| |

Healthcare-Products — 0.8% |

|

| 1,960,000 |

Sotera Health Holdings LLC, 7.375%, 6/1/31 (144A) |

$ 2,035,478 |

| |

Total Healthcare-Products |

|

|

|

The accompanying notes are an integral part of these financial statements.

20

Pioneer High Income Fund, Inc. |

Semiannual Report

|

9/30/24

|

|

|

|

|

|

Value |

| |

Healthcare-Services — 3.4% |

|

| 1,014,000 |

Auna S.A., 10.00%, 12/15/29 (144A) |

$ 1,069,818 |

| 580,000 |

CHS/Community Health Systems, Inc., 5.625%, 3/15/27 (144A) |

570,760 |

| 265,000 |

CHS/Community Health Systems, Inc., 6.00%, 1/15/29 (144A) |

257,259 |

| 385,000 |

LifePoint Health, Inc., 5.375%, 1/15/29 (144A) |

363,784 |

| 3,200,000 |

Prime Healthcare Services, Inc., 9.375%, 9/1/29 (144A) |

3,300,747 |

| 2,775,000 |

US Acute Care Solutions LLC, 9.75%, 5/15/29 (144A) |

2,874,231 |

| |

Total Healthcare-Services |

|

|

|

| |

Home Builders — 1.5% |

|

| 1,155,000 |

Beazer Homes USA, Inc., 7.25%, 10/15/29 |

$ 1,185,837 |

| 2,285,000 |

LGI Homes, Inc., 8.75%, 12/15/28 (144A) |

2,447,043 |

| |

Total Home Builders |

|

|

|

| |

Household Products/Wares — 0.7% |

|

| 2,050,000 |

Spectrum Brands, Inc., 3.875%, 3/15/31 (144A) |

$ 1,794,761 |

| |

Total Household Products/Wares |

|

|

|

| |

Insurance — 5.0% |

|

| 3,800,000 |

Hanover Insurance Group, Inc., 7.625%, 10/15/25 |

$ 3,879,771 |

| 3,075,000(d) |

Liberty Mutual Group, Inc., 10.75% (3 Month Term SOFR + 738 bps), 6/15/58 (144A) |

3,711,381 |

| 2,677,000 |

Liberty Mutual Insurance Co., 7.697%, 10/15/97 (144A) |

3,178,313 |

| 1,100,000 |

MetLife, Inc., 10.75%, 8/1/39 |

1,571,956 |

| |

Total Insurance |

|

|

|

| |

Internet — 1.6% |

|

| 3,005,000 |

Acuris Finance US, Inc./Acuris Finance S.a.r.l., 9.00%, 8/1/29 (144A) |

$ 3,020,025 |

| 205,000 |

Expedia Group, Inc., 6.25%, 5/1/25 (144A) |

205,525 |

| 700,000 |

ION Trading Technologies S.a.r.l., 9.50%, 5/30/29 (144A) |

716,568 |

| |

Total Internet |

|

|

|

| |

Iron & Steel — 2.3% |

|

| 1,855,000 |

Carpenter Technology Corp., 7.625%, 3/15/30 |

$ 1,942,320 |

The accompanying notes are an integral part of these financial statements.

Pioneer High Income Fund, Inc. |

Semiannual Report

|

9/30/24

21

Schedule of Investments | 9/30/24

|

|

|

|

|

|

Value |

| |

Iron & Steel — (continued) |

|

| 1,721,000 |

Cleveland-Cliffs, Inc., 7.00%, 3/15/32 (144A) |

$ 1,739,915 |

| 2,235,000 |

TMS International Corp., 6.25%, 4/15/29 (144A) |

2,128,302 |

| |

Total Iron & Steel |

|

|

|

| |

Leisure Time — 4.2% |

|

| 215,000 |

Carnival Corp., 7.625%, 3/1/26 (144A) |

$ 216,990 |

| 235,000 |

Carnival Holdings Bermuda, Ltd., 10.375%, 5/1/28 (144A) |

253,581 |

| EUR 731,000 |

Carnival Plc, 1.00%, 10/28/29 |

706,360 |

| 1,000,000 |

Cruise Yacht Upper HoldCo, Ltd., 11.875%, 7/5/28 |

1,027,500 |

| 1,295,000 |

NCL Corp., Ltd., 5.875%, 3/15/26 (144A) |

1,295,080 |

| 2,435,000 |

NCL Corp., Ltd., 7.75%, 2/15/29 (144A) |

2,609,353 |

| 965,000 |

NCL Corp., Ltd., 8.125%, 1/15/29 (144A) |

1,031,777 |

| 360,000 |

NCL Finance, Ltd., 6.125%, 3/15/28 (144A) |

367,200 |

| 2,790,000 |

Viking Cruises, Ltd., 6.25%, 5/15/25 (144A) |

2,785,916 |

| |

Total Leisure Time |

|

|

|

| |

Lodging — 3.3% |

|

| 375,000 |

Choice Hotels International, Inc., 5.85%, 8/1/34 |

$ 386,721 |

| 2,095,000 |

Genting New York LLC/GENNY Capital, Inc., 7.25%, 10/1/29 (144A) |

2,119,786 |

| 1,715,000 |

Hilton Grand Vacations Borrower Escrow LLC/Hilton Grand Vacations Borrower Esc, 6.625%, 1/15/32 (144A) |

1,736,017 |

| 1,715,000 |

Melco Resorts Finance, Ltd., 7.625%, 4/17/32 (144A) |

1,767,875 |

| 1,505,000 |

MGM Resorts International, 6.50%, 4/15/32 |

1,533,648 |

| 725,000 |

Travel + Leisure Co., 6.625%, 7/31/26 (144A) |

738,692 |

| |

Total Lodging |

|

|

|

| |

Media — 4.5% |

|

| 2,500,000 |

CCO Holdings LLC/CCO Holdings Capital Corp., 4.75%, 2/1/32 (144A) |

$ 2,203,195 |

| 2,200,000 |

CSC Holdings LLC, 4.625%, 12/1/30 (144A) |

1,116,485 |

| 1,925,000 |

CSC Holdings LLC, 5.00%, 11/15/31 (144A) |

951,299 |

| 835,000 |

CSC Holdings LLC, 11.75%, 1/31/29 (144A) |

807,104 |

| 1,057,000 |

Gray Television, Inc., 7.00%, 5/15/27 (144A) |

1,038,928 |

The accompanying notes are an integral part of these financial statements.

22

Pioneer High Income Fund, Inc. |

Semiannual Report

|

9/30/24

|

|

|

|

|

|

Value |

| |

Media — (continued) |

|

| 1,545,000 |

Gray Television, Inc., 10.50%, 7/15/29 (144A) |

$ 1,613,695 |

| 3,530,000 |

McGraw-Hill Education, Inc., 8.00%, 8/1/29 (144A) |

3,542,662 |

| |

Total Media |

|

|

|

| |

Metal Fabricate/Hardware — 0.5% |

|

| 1,185,000 |

Park-Ohio Industries, Inc., 6.625%, 4/15/27 |

$ 1,162,586 |

| |

Total Metal Fabricate/Hardware |

|

|

|

| |

Mining — 3.7% |

|

| 2,340,000 |

Coeur Mining, Inc., 5.125%, 2/15/29 (144A) |

$ 2,272,336 |

| 705,000 |

First Quantum Minerals, Ltd., 6.875%, 10/15/27 (144A) |

697,027 |

| 2,840,000 |

First Quantum Minerals, Ltd., 8.625%, 6/1/31 (144A) |

2,845,685 |

| 415,000 |

First Quantum Minerals, Ltd., 9.375%, 3/1/29 (144A) |

439,877 |

| 692,000 |

Hudbay Minerals, Inc., 6.125%, 4/1/29 (144A) |

701,927 |

| 2,010,000 |

Taseko Mines, Ltd., 8.25%, 5/1/30 (144A) |

2,109,448 |

| |

Total Mining |

|

|

|

| |

Miscellaneous Manufacturing — 0.7% |

|

| 1,670,000 |

Trinity Industries, Inc., 7.75%, 7/15/28 (144A) |

$ 1,752,814 |

| |

Total Miscellaneous Manufacturing |

|

|

|

| |

Oil & Gas — 14.2% |

|

| 685,000 |

3R Lux S.a.r.l., 9.75%, 2/5/31 (144A) |

$ 721,792 |

| 1,755,000(i) |

Aethon United BR LP/Aethon United Finance Corp., 7.50%, 10/1/29 (144A) |

1,778,253 |

| 2,430,000 |

Aethon United BR LP/Aethon United Finance Corp., 8.25%, 2/15/26 (144A) |

2,458,713 |

| 1,105,000 |

Ascent Resources Utica Holdings LLC/ARU Finance Corp., 5.875%, 6/30/29 (144A) |

1,091,627 |

| 1,890,000 |

Baytex Energy Corp., 7.375%, 3/15/32 (144A) |

1,883,109 |

| 2,140,000 |

Baytex Energy Corp., 8.50%, 4/30/30 (144A) |

2,217,930 |

| 727,378 |

Borr IHC, Ltd./Borr Finance LLC, 10.00%, 11/15/28 (144A) |

754,655 |

| 541,529 |

Borr IHC, Ltd./Borr Finance LLC, 10.375%, 11/15/30 (144A) |

572,126 |

| 180,000 |

Cenovus Energy, Inc., 6.75%, 11/15/39 |

203,259 |

| 1,225,000 |

Civitas Resources, Inc., 8.375%, 7/1/28 (144A) |

1,273,350 |

| 830,000 |

Civitas Resources, Inc., 8.625%, 11/1/30 (144A) |

879,366 |

| 1,225,000 |

Civitas Resources, Inc., 8.75%, 7/1/31 (144A) |

1,296,709 |

The accompanying notes are an integral part of these financial statements.

Pioneer High Income Fund, Inc. |

Semiannual Report

|

9/30/24

23

Schedule of Investments | 9/30/24

|

|

|

|

|

|

Value |

| |

Oil & Gas — (continued) |

|

| 830,000 |

Hilcorp Energy I LP/Hilcorp Finance Co., 6.00%, 2/1/31 (144A) |

$ 805,694 |

| 1,815,000 |

Hilcorp Energy I LP/Hilcorp Finance Co., 6.875%, 5/15/34 (144A) |

1,808,259 |

| 1,330,000 |

Kosmos Energy, Ltd., 7.75%, 5/1/27 (144A) |

1,314,594 |

| 975,000 |

Kraken Oil & Gas Partners LLC, 7.625%, 8/15/29 (144A) |

973,689 |

| 1,010,000 |

MEG Energy Corp., 5.875%, 2/1/29 (144A) |

988,044 |

| 750,000 |

Murphy Oil Corp., 6.375%, 7/15/28 |

761,973 |

| 1,109,000 |

Nabors Industries, Ltd., 7.50%, 1/15/28 (144A) |

1,039,075 |

| 1,130,000 |

Noble Finance II LLC, 8.00%, 4/15/30 (144A) |

1,165,927 |

| 2,010,000 |

Occidental Petroleum Corp., 4.40%, 4/15/46 |

1,631,089 |

| 692,000 |

Petroleos Mexicanos, 6.70%, 2/16/32 |

620,406 |

| 579,000 |

Precision Drilling Corp., 6.875%, 1/15/29 (144A) |

577,796 |

| 2,265,000 |

Shelf Drilling Holdings, Ltd., 9.625%, 4/15/29 (144A) |

2,089,079 |

| 885,000 |

Southwestern Energy Co., 4.75%, 2/1/32 |

846,609 |

| 285,000 |

Transocean Titan Financing, Ltd., 8.375%, 2/1/28 (144A) |

293,553 |

| 1,030,000 |

Transocean, Inc., 6.80%, 3/15/38 |

840,567 |

| 665,000 |

Transocean, Inc., 8.25%, 5/15/29 (144A) |

659,233 |

| 665,000 |

Transocean, Inc., 8.50%, 5/15/31 (144A) |

660,777 |

| 2,075,000 |

Tullow Oil Plc, 10.25%, 5/15/26 (144A) |

1,883,382 |

| 905,000 |

Wildfire Intermediate Holdings LLC, 7.50%, 10/15/29 (144A) |

890,568 |

| 342,000 |

YPF S.A., 6.95%, 7/21/27 (144A) |

332,762 |

| |

Total Oil & Gas |

|

|

|

| |

Oil & Gas Services — 2.6% |

|

| 385,000 |

Archrock Partners LP/Archrock Partners Finance Corp., 6.25%, 4/1/28 (144A) |

$ 386,913 |

| 2,583,000 |

Archrock Partners LP/Archrock Partners Finance Corp., 6.875%, 4/1/27 (144A) |

2,591,095 |

| 1,445,000 |

Enerflex, Ltd., 9.00%, 10/15/27 (144A) |

1,490,671 |

| 703,000 |

USA Compression Partners LP/USA Compression Finance Corp., 6.875%, 9/1/27 |

708,943 |

| 1,290,000 |

USA Compression Partners LP/USA Compression Finance Corp., 7.125%, 3/15/29 (144A) |

1,328,638 |

| |

Total Oil & Gas Services |

|

|

|

The accompanying notes are an integral part of these financial statements.

24

Pioneer High Income Fund, Inc. |

Semiannual Report

|

9/30/24

|

|

|

|

|

|

Value |

| |

Packaging & Containers — 1.2% |

|

| EUR 1,400,000 |

Fiber Bidco S.p.A., 6.125%, 6/15/31 (144A) |

$ 1,550,618 |

| 1,355,000 |

Owens-Brockway Glass Container, Inc., 7.25%, 5/15/31 (144A) |

1,392,035 |

| |

Total Packaging & Containers |

|

|

|

| |

Pharmaceuticals — 1.7% |

|

| 265,000 |

Endo Finance Holdings, Inc., 8.50%, 4/15/31 (144A) |

$ 283,956 |

| 2,750,000 |

Owens & Minor, Inc., 6.625%, 4/1/30 (144A) |

2,669,418 |

| 579,000 + |

Par Pharmaceutical, Inc., 7.50%, 4/1/27 (144A) |

— |

| 1,095,000 |

Teva Pharmaceutical Finance Netherlands III BV, 7.875%, 9/15/29 |

1,209,725 |

| 2,600,000 + |

Tricida, Inc., 5/15/27 |

— |

| |

Total Pharmaceuticals |

|

|

|

| |

Pipelines — 7.2% |

|

| 1,672,285 |

Acu Petroleo Luxembourg S.a.r.l., 7.50%, 1/13/32 (144A) |

$ 1,678,355 |

| 910,000 |

DCP Midstream Operating LP, 5.60%, 4/1/44 |

904,931 |

| 1,060,000 |

Delek Logistics Partners LP/Delek Logistics Finance Corp., 7.125%, 6/1/28 (144A) |

1,061,186 |

| 1,524,000(a) |

Energy Transfer LP, 8.527% (3 Month Term SOFR + 328 bps), 11/1/66 |

1,445,635 |

| 1,965,000(d)(h) |

Energy Transfer LP, 7.125% (5 Year CMT Index + 531 bps) |

2,007,297 |

| 270,000 |

EnLink Midstream Partners LP, 5.45%, 6/1/47 |

255,329 |

| 717,000 |

EnLink Midstream Partners LP, 5.60%, 4/1/44 |

685,265 |

| 1,845,000 |

Genesis Energy LP/Genesis Energy Finance Corp., 7.875%, 5/15/32 |

1,878,479 |

| 770,000 |

Genesis Energy LP/Genesis Energy Finance Corp., 8.00%, 1/15/27 |

787,171 |

| 421,000 |

Global Partners LP/GLP Finance Corp., 7.00%, 8/1/27 |

423,842 |

| 1,515,000 |

Harvest Midstream I LP, 7.50%, 9/1/28 (144A) |

1,550,337 |

| 1,150,000 |

NuStar Logistics LP, 6.375%, 10/1/30 |

1,193,266 |

| 540,000(d) |

South Bow Canadian Infrastructure Holdings, Ltd., 7.50% (5 Year CMT Index + 367 bps), 3/1/55 (144A) |

567,332 |

| 1,265,000 |

Summit Midstream Holdings LLC, 8.625%, 10/31/29 (144A) |

1,323,155 |

The accompanying notes are an integral part of these financial statements.

Pioneer High Income Fund, Inc. |

Semiannual Report

|

9/30/24

25

Schedule of Investments | 9/30/24

|

|

|

|

|

|

Value |

| |

Pipelines — (continued) |

|

| 1,355,000 |

Venture Global LNG, Inc., 8.375%, 6/1/31 (144A) |

$ 1,430,780 |

| 505,000 |

Venture Global LNG, Inc., 9.50%, 2/1/29 (144A) |

568,885 |

| |

Total Pipelines |

|

|

|

| |

Real Estate — 1.5% |

|

| 4,000,000 |

Kennedy-Wilson, Inc., 5.00%, 3/1/31 |

$ 3,590,947 |

| |

Total Real Estate |

|

|

|

| |

REITs — 2.1% |

|

| EUR 490,000 |

Alexandrite Monnet UK Holdco Plc, 10.50%, 5/15/29 (144A) |

$ 589,826 |

| 2,275,000 |

MPT Operating Partnership LP/MPT Finance Corp., 3.50%, 3/15/31 |

1,661,391 |

| 365,000 |

Starwood Property Trust, Inc., 7.25%, 4/1/29 (144A) |

382,725 |

| 230,000 |

Uniti Group LP/Uniti Fiber Holdings, Inc./CSL Capital LLC, 6.00%, 1/15/30 (144A) |

196,172 |

| 1,555,000 |

Uniti Group LP/Uniti Group Finance, Inc./CSL Capital LLC, 10.50%, 2/15/28 (144A) |

1,659,816 |

| 755,000 |

Uniti Group LP/Uniti Group Finance, Inc./CSL Capital LLC, 10.50%, 2/15/28 (144A) |

805,892 |

| |

Total REITs |

|

|

|

| |

Retail — 1.7% |

|

| GBP 1,320,000 |

CD&R Firefly Bidco Plc, 8.625%, 4/30/29 (144A) |

$ 1,824,776 |

| 1,210,000 |

Cougar JV Subsidiary LLC, 8.00%, 5/15/32 (144A) |

1,279,289 |

| 1,125,000 |

LCM Investments Holdings II LLC, 8.25%, 8/1/31 (144A) |

1,194,548 |

| |

Total Retail |

|

|

|

| |

Telecommunications — 2.3% |

|

| 1,495,000 |

Altice France Holding S.A., 6.00%, 2/15/28 (144A) |

$ 461,691 |

| 1,169,000 |

Altice France Holding S.A., 10.50%, 5/15/27 (144A) |

403,343 |

| 270,000 |

Altice France S.A., 5.125%, 1/15/29 (144A) |

189,629 |

| 1,035,000 |

Connect Finco S.a.r.l./Connect US Finco LLC, 9.00%, 9/15/29 (144A) |

1,001,606 |

| 375,000 |

Iliad Holding SASU, 8.50%, 4/15/31 (144A) |

403,352 |

The accompanying notes are an integral part of these financial statements.

26

Pioneer High Income Fund, Inc. |

Semiannual Report

|

9/30/24

|

|

|

|

|

|

Value |

| |

Telecommunications — (continued) |

|

| 41,000 |

Sprint LLC, 7.625%, 3/1/26 |

$ 42,351 |

| 3,135,000 |

Windstream Escrow LLC/Windstream Escrow Finance Corp., 7.75%, 8/15/28 (144A) |

3,137,947 |

| |

Total Telecommunications |

|

|

|

| |

Transportation — 1.9% |

|

| 2,640,000 |

Carriage Purchaser, Inc., 7.875%, 10/15/29 (144A) |

$ 2,453,479 |

| 1,375,000 |

Danaos Corp., 8.50%, 3/1/28 (144A) |

1,415,333 |

| 820,000 |

Seaspan Corp., 5.50%, 8/1/29 (144A) |

781,012 |

| |

Total Transportation |

|

|

|

| |

Total Corporate Bonds

(Cost $299,366,939) |

|

|

|

Shares |

|

|

|

|

|

|

| |

Convertible Preferred Stock — 0.4% of Net Assets |

|

| |

Banks — 0.4% |

|

| 752(h) |

Wells Fargo & Co., 7.50% |

$ 964,214 |

| |

Total Banks |

|

|

|

| |

Total Convertible Preferred Stock

(Cost $950,539) |

|

|

|

| |

Preferred Stock — 0.0% † of Net

Assets |

|

| |

|

|

| 129,055 |

MYT Holding LLC, 10.00%, 6/6/29 |

$ 22,585 |

| |

Total Internet |

|

|

|

| |

Total Preferred Stock

(Cost $235,604) |

|

|

|

| |

Right/Warrant — 0.0% † of Net Assets |

|

| |

Trading Companies & Distributors — 0.0% † |

|

| GBP 21,700 (c) |

Avation Plc, 1/1/59 |

$ 7,978 |

| |

Total Trading Companies & Distributors |

|

|

|

| |

Total Right/Warrant

(Cost $—) |

|

|

|

The accompanying notes are an integral part of these financial statements.

Pioneer High Income Fund, Inc. |

Semiannual Report

|

9/30/24

27

Schedule of Investments | 9/30/24

|

|

|

|

|

|

Value |

| |

Insurance-Linked Securities — 6.5% of Net Assets# |

|

| |

Event Linked Bonds — 1.6% |

|

| |

Flood – U.S. — 0.3% |

|

| 250,000(a) |

FloodSmart Re, 16.376%, (3 Month U.S. Treasury Bill + 1,183 bps), 2/25/25 (144A) |

$ 255,750 |

| 250,000(a) |

FloodSmart Re, 18.602%, (3 Month U.S. Treasury Bill + 1,400 bps), 3/12/27 (144A) |

262,775 |

| 250,000(a) |

FloodSmart Re, 21.696%, (1 Month U.S. Treasury Bill + 1,715 bps), 3/11/26 (144A) |

262,850 |

| |

|

|

|

|

|

$781,375 |

|

|

| |

Multiperil – U.S. — 0.7% |

|

| 250,000(a) |

Matterhorn Re, 10.119%, (SOFR + 525 bps), 3/24/25 (144A) |

$ 253,275 |

| 250,000(a) |

Matterhorn Re, 12.619%, (SOFR + 775 bps), 3/24/25 (144A) |

254,350 |

| 250,000(a) |

Merna Re II, 11.852%, (3 Month U.S. Treasury Bill + 725 bps), 7/7/27 (144A) |

256,295 |

| 250,000(a) |

Merna Re II, 13.102%, (3 Month U.S. Treasury Bill + 850 bps), 7/7/27 (144A) |

261,704 |

| 250,000(a) |

Mystic Re, 16.546%, (3 Month U.S. Treasury Bill + 1,200 bps), 1/8/27 (144A) |

258,000 |

| 250,000(a) |

Residential Re, 16.566%, (3 Month U.S. Treasury Bill + 1,202 bps), 12/6/25 (144A) |

247,000 |

| |

|

|

|

|

|

$1,530,624 |

|

|

| |

Multiperil – U.S. & Canada — 0.2% |

|

| 250,000(a) |

Atlas Re, 17.483%, (SOFR + 1,250 bps), 6/8/27 (144A) |

$ 271,775 |

| 250,000(a) |

Easton Re, 12.046%, (3 Month U.S. Treasury Bill + 750 bps), 1/8/27 (144A) |

251,250 |

| |

|

|

|

|

|

$523,025 |

|

|

| |

Windstorm – Florida — 0.2% |

|

| 250,000(a) |

Marlon Re, 11.602%, (3 Month U.S. Treasury Bill + 700 bps), 6/7/27 (144A) |

$ 252,425 |

| 250,000(a) |

Merna Re II, 13.352%, (3 Month U.S. Treasury Bill + 875 bps), 7/7/27 (144A) |

260,858 |

| |

|

|

|

|

|

$513,283 |

|

|

| |

Windstorm – Mexico — 0.1% |

|

| 250,000(a) |

International Bank for Reconstruction & Development, 18.569%, (SOFR + 1,372 bps), 4/24/28 (144A) |

$ 261,850 |

The accompanying notes are an integral part of these financial statements.

28

Pioneer High Income Fund, Inc. |

Semiannual Report

|

9/30/24

|

|

|

|

|

|

Value |

| |

Windstorm – U.S. — 0.1% |

|

| 250,000(a) |

Bonanza Re, 12.996%, (3 Month U.S. Treasury Bill + 845 bps), 1/8/26 (144A) |

$ 259,400 |

| |

Total Event Linked Bonds |

|

|

|

|

|

|

|

|

|

|

| |

Collateralized Reinsurance — 0.6% |

|

| |

Multiperil – Massachusetts — 0.1% |

|

| 350,000(c)(k) + |

Portsalon Re 2022, 5/31/28 |

$ 320,922 |

| |

Multiperil – U.S. — 0.1% |

|

| 250,000(c)(k) + |

Mangrove Risk Solutions, 5/10/25 (144A) |

$ 234,900 |

| |

Windstorm – North Carolina — 0.1% |

|

| 250,000(c)(k) + |

Mangrove Risk Solutions, 4/30/30 |

$ 248,825 |

| |

Windstorm – U.S. — 0.2% |

|

| 250,000(c)(k) + |

Aberystwyth-PI0049, 11/30/27 |

$ 235,972 |

| 250,000(c)(k) + |

PI0048 Re 2024, 11/30/27 |

237,907 |

| |

|

|

|

|

|

$473,879 |

|

|

| |

Windstorm – U.S. Regional — 0.1% |

|

| 250,000(c)(k) + |

Oakmont Re 2024, 4/1/30 |

$ 245,758 |

| |

Total Collateralized Reinsurance |

|

|

|

| |

Reinsurance Sidecars — 4.3% |

|

| |

Multiperil – U.S. — 0.0% † |

|

| 500,000(c)(l) + |

Harambee Re 2018, 12/31/24 |

$ 2,150 |

| 600,000(l) + |

Harambee Re 2019, 12/31/24 |

— |

| |

|

|

|

|

|

$2,150 |

|

|

| |

Multiperil – Worldwide — 4.3% |

|

| 40,466(l) + |

Alturas Re 2022-2, 12/31/27 |

$ 2,582 |

| 1,500,000(c)(k) + |

Bantry Re 2024, 12/31/29 |

1,681,833 |

| 1,000,000(c)(k) + |

Berwick Re 2024-1, 12/31/29 |

1,106,873 |

| 500,000(k) + |

Eccleston Re 2023, 11/30/28 |

31,574 |

| 750,000(c)(k) + |

Gleneagles Re 2022, 12/31/27 |

225,000 |

| 1,000,000(c)(k) + |

Gullane Re 2024, 12/31/29 |

1,040,000 |

| 499,318(c)(l) + |

Lorenz Re 2019, 6/30/25 |

4,094 |

| 1,000,000(c)(k) + |

Merion Re 2022-2, 12/31/27 |

948,111 |

| 500,000(c)(k) + |

Pangaea Re 2024-1, 12/31/29 |

553,385 |

| 500,000(c)(k) + |

Pangaea Re 2024-3, 7/1/28 |

524,153 |

| 2,357(k) + |

Sector Re V, 12/1/27 (144A) |

56,306 |

The accompanying notes are an integral part of these financial statements.

Pioneer High Income Fund, Inc. |

Semiannual Report

|

9/30/24

29

Schedule of Investments | 9/30/24

|

|

|

|

|

|

Value |

| |

Multiperil – Worldwide — (continued) |

|

| 500,000(c)(k) + |

Sector Re V, 12/1/28 (144A) |

$ 659,906 |

| 1,000,000(c)(k) + |

Sector Re V, 12/1/28 (144A) |

1,319,811 |

| 250,000(c)(k) + |

Sussex Re 2020-1, 12/31/24 |

325 |

| 1,500,000(c)(l) + |

Thopas Re 2022, 12/31/27 |

— |

| 1,596,147(c)(l) + |

Thopas Re 2023, 12/31/28 |

— |

| 1,596,147(c)(l) + |

Thopas Re 2024, 12/31/29 |

1,974,115 |

| 500,000(c)(k) + |

Torricelli Re 2024, 6/30/30 |

540,705 |

| 244,914(c)(k) + |

Woburn Re 2019, 12/31/24 |

33,713 |

| |

|

|

|

|

|

$10,702,486 |

|

|

| |

Total Reinsurance Sidecars |

|

|

|

| |

Total Insurance-Linked Securities

(Cost $14,604,374) |

|

|

|

|

|

|

|

|

|

|

| |

Foreign Government Bond — 0.1% of

Net Assets |

|

| |

Russia — 0.1% |

|

| 382,800(j)(m) |

Russian Government International Bond, 7.500%, 3/31/30 |

$ 254,011 |

| |

Total Russia |

|

|

|

| |

Total Foreign Government Bond

(Cost $322,808) |

|

|

|

The accompanying notes are an integral part of these financial statements.

30

Pioneer High Income Fund, Inc. |

Semiannual Report

|

9/30/24

Shares |

|

|

|

|

|

Value |

| |

SHORT TERM INVESTMENTS — 1.9% of

Net Assets |

|

| |

Open-End Fund — 1.9% |

|

| 4,679,404(n) |

Dreyfus Government Cash Management,

Institutional Shares, 4.80% |

$ 4,679,404 |

| |

|

|

|

|

|

$4,679,404 |

|

|

| |

TOTAL SHORT TERM INVESTMENTS

(Cost $4,679,404) |

|

|

|

| |

TOTAL INVESTMENTS IN UNAFFILIATED ISSUERS — 142.8%

(Cost $345,355,977) |

|

| |

OTHER ASSETS AND LIABILITIES — (42.8)% |

$(106,129,737) |

| |

net assets — 100.0% |

|

| |

|

|

|

|

|

|

| bps |

Basis Points. |

| CMT |

Constant Maturity Treasury Index. |

| FREMF |

Freddie Mac Multifamily Fixed-Rate Mortgage Loans. |

| SOFR |

Secured Overnight Financing Rate. |

| SOFR30A |

Secured Overnight Financing Rate 30 Day Average. |

| (144A) |

The resale of such security is exempt from registration under Rule 144A of the Securities Act of 1933. Such securities may be resold normally to qualified institutional buyers. At September 30, 2024, the value of these securities amounted to $273,193,972, or 110.2% of net assets. |

| (a) |

Floating rate note. Coupon rate, reference index and spread shown at September 30, 2024. |

| (b) |

All or a portion of this senior loan position has not settled. Rates do not take effect until settlement date. Rates shown, if any, are for the settled portion. |

| (c) |

Non-income producing security. |

| (d) |

The interest rate is subject to change periodically. The interest rate and/or reference index and spread shown at September 30, 2024. |

| (e) |

Security is priced as a unit. |

| (f) |

Security issued with a zero coupon. Income is recognized through accretion of discount. |

| (g) |

Payment-in-kind (PIK) security which may pay interest in the form of additional principal amount. |

| (h) |

Security is perpetual in nature and has no stated maturity date. |

| (i) |

Securities purchased on a when-issued basis. Rates do not take effect until settlement date. |

| (j) |

Security is in default. |

| (k) |

Issued as participation notes. |

| (l) |

Issued as preference shares. |

The accompanying notes are an integral part of these financial statements.

Pioneer High Income Fund, Inc. |

Semiannual Report

|

9/30/24

31

Schedule of Investments | 9/30/24

| (m) |

Debt obligation initially issued at one coupon which converts to a higher coupon at a specific date. The rate shown is the rate at September 30, 2024. |

| (n) |

Rate periodically changes. Rate disclosed is the 7-day yield at September 30, 2024. |

| ^ |

Securities are pledged as collateral. |

| * |

Senior secured floating rate loan interests in which the Fund invests generally pay interest at rates that are periodically re-determined by reference to a base lending rate plus a premium. These base lending rates are generally (i) the lending rate offered by one or more major European banks, such as SOFR, (ii) the prime rate offered by one or more major United States banks, (iii) the rate of a certificate of deposit or (iv) other base lending rates used by commercial lenders. The interest rate shown is the rate accruing at September 30, 2024. |

| + |

Security is valued using significant unobservable inputs (Level 3). |

| † |

Amount rounds to less than 0.1%. |

| # |

Securities are restricted as to resale. |

Restricted Securities |

Acquisition date |

Cost |

Value |

| Aberystwyth-PI0049 |

7/1/2024 |

$218,687 |

$235,972 |

| Alturas Re 2022-2 |

4/11/2023 |

— |

2,582 |

| Atlas Re |

5/24/2024 |

250,000 |

271,775 |

| Bantry Re 2024 |

2/1/2024 |

1,482,365 |

1,681,833 |

| Berwick Re 2024-1 |

1/10/2024 |

1,000,000 |

1,106,873 |

| Bonanza Re |

1/6/2023 |

250,000 |

259,400 |

| Easton Re |

5/16/2024 |

246,724 |

251,250 |

| Eccleston Re 2023 |

7/13/2023 |

— |

31,574 |

| FloodSmart Re |

2/14/2022 |

250,000 |

255,750 |

| FloodSmart Re |

2/23/2023 |

250,000 |

262,850 |

| FloodSmart Re |

2/29/2024 |

250,000 |

262,775 |

| Gleneagles Re 2022 |

1/18/2022 |

313,226 |

225,000 |

| Gullane Re 2024 |

2/14/2024 |

969,259 |

1,040,000 |

| Harambee Re 2018 |

12/19/2017 |

10,612 |

2,150 |

| Harambee Re 2019 |

12/20/2018 |

— |

— |

| International Bank for Reconstruction & Development |

5/10/2024 |

242,280 |

261,850 |

| Lorenz Re 2019 |

6/26/2019 |

75,931 |

4,094 |

| Mangrove Risk Solutions |

6/17/2024 |

224,653 |

234,900 |

| Mangrove Risk Solutions |

7/9/2024 |

231,765 |

248,825 |

| Marlon Re |

5/24/2024 |

250,000 |

252,425 |

| Matterhorn Re |

3/10/2022 |

250,000 |

253,275 |

| Matterhorn Re |

3/10/2022 |

250,000 |

254,350 |

| Merion Re 2022-2 |

2/22/2022 |

1,000,000 |

948,111 |

| Merna Re II |

5/8/2024 |

250,000 |

256,295 |

| Merna Re II |

5/8/2024 |

250,000 |

260,858 |

| Merna Re II |

5/8/2024 |

250,000 |

261,704 |

| Mystic Re |

5/21/2024 |

249,229 |

258,000 |

The accompanying notes are an integral part of these financial statements.

32

Pioneer High Income Fund, Inc. |

Semiannual Report

|

9/30/24

Restricted Securities |

Acquisition date |

Cost |

Value |

| Oakmont Re 2024 |

5/23/2024 |

$221,839 |

$245,758 |

| Pangaea Re 2024-1 |

2/27/2024 |

500,000 |

553,385 |

| Pangaea Re 2024-3 |

7/26/2024 |

500,000 |

524,153 |

| PI0048 Re 2024 |

6/12/2024 |

210,613 |

237,907 |

| Portsalon Re 2022 |

7/15/2022 |

283,022 |

320,922 |

| Residential Re |

10/28/2021 |

250,000 |

247,000 |

| Sector Re V |

12/30/2022 |

— |

56,306 |

| Sector Re V |

12/4/2023 |

500,000 |

659,906 |

| Sector Re V |

12/29/2023 |

1,000,000 |

1,319,811 |

| Sussex Re 2020-1 |

1/23/2020 |

— |

325 |

| Thopas Re 2022 |

2/7/2022 |

— |

— |

| Thopas Re 2023 |

2/15/2023 |

— |

— |

| Thopas Re 2024 |

2/2/2024 |

1,596,147 |

1,974,115 |

| Torricelli Re 2024 |

7/17/2024 |

500,000 |

540,705 |

| Woburn Re 2019 |

1/30/2019 |

28,022 |

33,713 |

Total Restricted Securities |

|

|

$16,098,477 |

% of Net assets |

|

|

6.5% |

FORWARD FOREIGN CURRENCY EXCHANGE CONTRACTS

Currency

Purchased |

In

Exchange for |

Currency

Sold |

Deliver |

Counterparty |

Settlement

Date |

Unrealized

Appreciation

(Depreciation) |

| EUR |

297,000 |

USD |

332,955 |

Bank of America NA |

11/21/24 |

$(1,647) |

| EUR |

5,000,000 |

USD |

5,594,450 |

Brown Brothers Harriman & Co. |

12/20/24 |

(10,382) |

| USD |

1,734,779 |

EUR |

1,585,000 |

HSBC Bank USA NA |

10/25/24 |