Form DEFA14A - Additional definitive proxy soliciting materials and Rule 14(a)(12) material

06 Mai 2024 - 10:21PM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE SECURITIES EXCHANGE ACT OF 1934

(AMENDMENT No. 1)

Filed by the Registrant ☒ Filed by a party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary proxy statement

☐ Confidential, for use of the Commission only (as permitted by Rule 14a-6(e)(2))

☐ Definitive proxy statement

☒ Definitive additional materials

☐ Soliciting material pursuant to Rule 14a-11(c) or Rule 14a-12

ProAssurance Corporation

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ No fee required

☐ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11

The filing fee of $ was calculated on the basis of the information that follows:

(1)Title of each class of securities to which transaction applies:

(2)Aggregate number of securities to which transaction applies:

(3)Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): (4)Proposed maximum Aggregate value of transaction: ☐ Fee paid previously with preliminary materials.

☐ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

(1)Amount Previously Paid:

(2)Form, Schedule or Registration Statement No.:

EXPLANATORY NOTE

On April 12, 2024, ProAssurance Corporation (“ProAssurance,” “we,” “us,” “our,” and the “Company”) filed with the Securities and Exchange Commission its definitive proxy statement (the “Proxy Statement”) for the Company’s 2024 Annual Meeting of Stockholders to be held 9:00 am, Central Daylight Time on May 22, 2024 (the “Annual Meeting”). The purpose of this proxy supplement (“Supplement”) is to correct certain inadvertent errors included in the Proxy Statement, as described below. The Company urges you to read the Proxy Statement and this Supplement in their entirety. Except as specifically supplemented or amended by the information contained herein, all information set forth in the Proxy Statement remains unchanged.

Outstanding Shares

In the Proxy Statement, the Company inadvertently reported the incorrect number of shares of common stock, par value $0.01 per share, of the Company (the “Common Stock”) outstanding as of the close of business on March 25, 2024, the record date for the Annual Meeting (the “Record Date”), to be 63,260,704 shares. The correct number of shares of Common Stock outstanding was 63,178,556 shares. The Proxy Statement also inadvertently reported the incorrect number of treasury shares that cannot be voted at the meeting to be 9,192,209 shares as of the close of business on the Record Date. The correct number of treasury shares was 12,606,968 shares.

DIRECTOR COMPENSATION

(During Last Completed Fiscal Year)

| | | | | | | | | | | | | | | | | | | | |

| Name | Fees

Earned

or Paid

in Cash | Stock

Awards

($) | NonEquity

Incentive

Plan

Compensation

($) | Change in

Pension

Value and

Nonqualified

Deferred

Compensation

Earnings | All Other

Compensation

($) | Total

($) |

Kedrick D. Adkins Jr | 108,333 | — | — | — | — | 108,333 | |

Bruce D. Angiolillo | 180,000 | — | — | — | — | 180,000 | |

Fabiola Cobarrubias | 100,208 | — | — | — | — | 100,208 | |

Samuel A. Di Piazza | 92,500 | — | — | — | — | 92,500 | |

Maye Head Frei | 92,250 | — | — | — | — | 92,250 | |

M. James Gorrie | 86,667 | — | — | — | — | 86,667 | |

Ziad R. Haydar | 80,000 | — | — | — | — | 80,000 | |

Frank A. Spinosa | 86,667 | — | — | — | — | 86,667 | |

Scott C. Syphax | 86,667 | — | — | — | — | 86,667 | |

Katisha T. Vance | 90,000 | — | — | — | — | 90,000 | |

Thomas A. S. Wilson, Jr. | 86,667 | — | — | — | — | 86,667 | |

| | | | | | |

BENEFICIAL OWNERSHIP OF OUR COMMON STOCK

Ownership by Our Directors and Executive Officers

The following table sets forth, as of March 25, 2024, information regarding the ownership of Common Stock by:

•our executive officers named in the Summary Compensation Table under “Executive Compensation,” which we refer to as the “Named Executive Officers;”

•our directors and director nominees; and

•all of our directors and executive officers as a group.

| | | | | | | | | | | | | | |

| Stockholders | | Amount & Nature of Beneficial Ownership(1) | | Percent

of Class |

| Directors | |

Kedrick D. Adkins Jr. | | 14,901 | | * |

Bruce D. Angiolillo | | 17,563 | | * |

Fabiola Cobarrubias | | 7,095 | | * |

Samuel A. Di Piazza, Jr. | | 26,892 | | * |

Maye Head Frei | | 13,209 | | * |

M. James Gorrie | | 29,009 | | * |

Ziad R. Haydar | | 22,423 | | * |

Edward L. Rand, Jr.(2) | | 169,422 | | * |

Frank A. Spinosa | | 24,232 | | * |

Scott C. Syphax | | 7,095 | | * |

Katisha T. Vance | | 16,070 | | * |

Thomas A. S. Wilson, Jr. | | 27,009 | | * |

Director Nominees | | | | |

| Richard J. Bielen | | — | | * |

| Staci M. Pierce | | — | | * |

Other Named Executive Officers | | | | |

Dana S. Hendricks | | 23,956 | | * |

Jeffrey P. Lisenby | | 76,621 | | * |

| | | | |

Kevin M. Shook | | 31,732 | | * |

Robert D. Francis | | 9,623 | | * |

All Directors, Director Nominees and Executive Officers as a Group (18 Persons) | | 516,852 | | 1.02% |

| | | | |

* Less than 1%. | | | | |

(1) Except as otherwise indicated, the persons named in the above table have sole voting power and investment power with respect to all shares of Common Stock shown as beneficially owned by them. The information as to the beneficial ownership of Common Stock has been furnished by the respective persons listed in the above table. The information excludes restricted stock units and performance shares granted to executive officers that are unvested. No executive officer holds unexercised stock options.

(2) Shares are held in a joint brokerage account for Mr. Rand and his spouse.

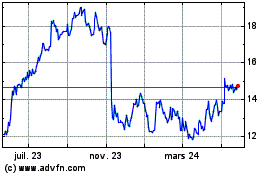

ProAssurance (NYSE:PRA)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

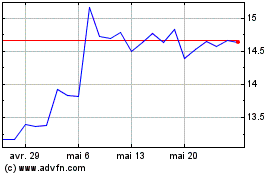

ProAssurance (NYSE:PRA)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024