UPDATE: Primus Back In Nan Shan Bid; Forming JV With Taiwan Secom, Goldsun

04 Janvier 2011 - 9:04AM

Dow Jones News

Primus Financial Holdings Ltd. is once again bidding for

American International Group Inc.'s (AIG) Taiwan life-insurance

unit, this time with Taiwan Secom Co. (9917.TW) and Goldsun

Development & Construction Co. (2504.TW), both of which are

controlled by a prominent local family.

Hong Kong-based Primus' latest offer for Nan Shan Life Insurance

Co. comes after Taiwan's financial regulator rejected the company's

US$2.15 billion joint bid for Nan Shan with Hong Kong-listed China

Strategic Holdings Ltd. in August, citing concerns about China

Strategic's financial strength and commitment to Nan Shan.

Primus' new consortium joins Chinatrust Financial Holding Co.

(2891.TW), Cathay Financial Holding Co. (2882.TW), Ruentex Group

and Fubon Financial Holding Co. (2881.TW) in the race for Nan Shan,

whose large customer base makes it an attractive acquisition target

to firms looking to secure a bigger share of the island's crowded

insurance market.

AIG has been looking for a buyer for Nan Shan as it tries to

shed non-core assets and repay the funds received through a U.S.

government bailout during the financial crisis.

Primus' decision to bring in local partners backed by the

prominent Lin family, whose business interests include property

development, cement production and manufacturing of home security

devices, could help tip the balance in its favor this time around.

However, neither Taiwan Secom, a home security supplier, nor

Goldsun Development, a developer, have experience in the

life-insurance or financial-related industries, which could present

a hurdle.

Taiwan Secom's director Max Chu told Dow Jones Newswires on

Tuesday the three companies are in the process of setting up a

joint venture to formally bid for Nan Shan, and have already

expressed their interest in Nan Shan to AIG.

He added Taiwan Secom and Goldsun will jointly hold a

controlling stake in the venture. Chu declined to say how much the

venture will offer for Nan Shan.

Goldsun wasn't immediately available for comment. AIG

spokeswoman Lauren Day and a spokeswoman for Primus both declined

to comment.

The other known bidders for Nan Shan have offered between

US$2.20 billion and US$3.00 billion for Nan Shan, with Chinatrust

submitting the highest bid, a Taiwanese lawmaker said last week,

citing information from his contacts at the U.S. Treasury

Department.

Whether AIG's latest bid to sell its unit succeeds depends on

Taiwan's Financial Supervisory Commission. The FSC has said its

approval of a potential sale will depend on whether a buyer has

sound financing and insurance experience, will look after

policyholders and staff and make a long-term commitment to the

company, and can meet future funding needs.

Chinatrust, Cathay and Fubon already have insurance operations,

although the latter two are better capitalized. Ruentex lacks

significant experience operating an insurance company.

Nan Shan is the biggest foreign player in the island's insurance

market in terms of market share, a local banker who isn't involved

in the deal said earlier. The market's high penetration rate of

about 14% and low profit margins have prompted some foreign

investors to exit the island, the banker added.

-By Aries Poon, Dow Jones Newswires; 886-2-25022557;

aries.poon@dowjones.com

--Fanny Liu and Nisha Gopalan contributed to the article.

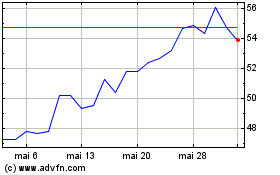

Primoris Services (NYSE:PRIM)

Graphique Historique de l'Action

De Mai 2024 à Juin 2024

Primoris Services (NYSE:PRIM)

Graphique Historique de l'Action

De Juin 2023 à Juin 2024