PGIM DC Solutions, the retirement solutions provider of PGIM,

announces the results of its Defined Contribution (DC) Landscape

Survey, illuminating varying perspectives and trends across

retirement plan decision-maker communities.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20250212321837/en/

Michael Miller, Managing Director and

Head of PGIM DC Solutions (Photo: Business Wire)

PGIM’s research, conducted in partnership with Greenwald

Associates, is based on a survey of 302 retirement plan

decision-makers.

“Employers and plan sponsors have shown a clear interest in

providing better retirement outcomes for employees,” said Michael

Miller, managing director and head of PGIM DC Solutions. “As the

industry evolves, enhanced income solutions, plan design, advice,

education and communication will all play pivotal roles in

improving the retirement experience for American workers.”

The survey results have been organized into a four-part series,

with analysis and commentary led by David Blanchett, head of

retirement research at PGIM DC Solutions.

Key focus areas and findings include:

- Personalized solutions can improve retirement outcomes.

Survey results indicate significant interest in personalized

solutions, with 88% of plan sponsors surveyed believing

personalized advice and guidance will improve retirement outcomes.

Interest in managed accounts, especially when used as the default

investment, increases significantly at lower price points. For

example, 63% of plans are interested at 10 or less basis points,

which is significantly less than price points today which tend to

equal or exceed 25 basis points.

- Quality investments make a meaningful impact. Overall

satisfaction with plan investments is relatively high in areas such

as asset class diversification (93%), performance (91%) and cost

(85%). DC plan decision-makers were also relatively satisfied with

target-date funds (TDFs) and have relatively high conviction in

certain exposures, including active fixed income, high-yield bonds

and alternative assets such as real estate and commodities.

However, concerns exist with respect to the glide path, volatility

and lawsuit vulnerability.

- Tools and education will be key to retirement success.

Survey results reveal 81% of respondents agree a key component to

achieving retirement success entails retirees having access to

tools and education to help navigate investing, spending and Social

Security decisions. However, only 48% of plans offer tools to help

retirees determine prudent spending levels and only 20% of plans

offer Social Security claiming tools.

- There is room to improve retirement outcomes for plan

participants. While it is clear plan sponsors believe DC plans

offer competitive advantages and help retain top talent, 64% of

respondents believe plans need to be more innovative. Plan

communications are the most widely noted area for potential plan

enhancements, with 85% of respondents having noted customized

communications can lead to better retirement outcomes. Artificial

intelligence (AI) could be leveraged to simplify personalized

communications, though relatively few plans note using AI

today.

“DC plans continue to improve to help participants get not just

to, but through retirement,” noted Blanchett. “While the industry

progress is promising, our survey results suggest more can be done

to optimize retirement for DC participants, though cost limitations

persist.”

More detailed findings from the survey and accompanying

four-part series and analysis can be found here.

ABOUT THE SURVEY

The research was conducted in partnership with Greenwald

Associates. Online surveys were completed by 302 retirement plan

decision-makers in September and October of 2024. Respondents

included decision-makers for DC plans with at least $10 million in

plan assets. Larger plans were oversampled, with 152 respondents

being decision-makers in plans with at least $100 million in

assets. Findings were weighted by plan asset size, using data from

a BrightScope/ICI 2021 report.

ABOUT PGIM DC SOLUTIONS

As the retirement solutions provider of PGIM, PGIM DC Solutions

seeks to deliver innovative defined contribution solutions founded

on market-leading research and capabilities. Our highly experienced

team partners with clients on customized solutions to solve for

retirement income. As of Sept. 30, 2024, PGIM had $177 billion in

DC assets under management and PGIM DC Solutions’ AUM was $1.3

billion.1

ABOUT PGIM

PGIM is the global asset management business of Prudential

Financial, Inc. (NYSE: PRU). In 42 offices across 19 countries, our

more than 1,400 investment professionals serve both retail and

institutional clients around the world.

As a leading global asset manager with $1.4 trillion in assets

under management,2 PGIM is built on a foundation of strength,

stability, and disciplined risk management. Our multi-affiliate

model allows us to deliver specialized expertise across key asset

classes with a focused investment approach. This gives our clients

a diversified suite of investment strategies and solutions with

global depth and scale across public and private asset classes,

including fixed income, equities, real estate, private credit, and

other alternatives. For more information, visit pgim.com.

1 Reported data reflect the assets under management by PGIM and

its investment adviser affiliates for defined contribution

investment purposes only.

2 As of Sept. 30, 2024.

PGIM DC Solutions LLC (“PGIM DC Solutions) is an SEC-registered

investment adviser, a Delaware limited liability company, and an

affiliate of PGIM, Inc. (“PGIM”), the principal asset management

business of Prudential Financial, Inc. (“PFI”) of the United States

of America. PFI of the United States is not affiliated in any

manner with Prudential plc, incorporated in the United Kingdom, or

with Prudential Assurance Company, a subsidiary of M&G plc,

incorporated in the United Kingdom. Registration with the SEC does

not imply a certain level of skill or training.

Receipt of these materials by anyone other than the intended

recipient does not establish a relationship between such person and

PGIM DC Solutions LLC (“PGIM DC Solutions”) or any of its

affiliates. These materials are not intended as an offer or

solicitation with respect to the purchase or sale of any security.

The information presented is not intended as investment advice and

is not a recommendation about managing or investing retirement

savings. These materials do not take into account individual

investment objectives or financial situations.

These materials represent the views, opinions and

recommendations of the author(s) regarding the economic conditions,

asset classes, securities, issuers, or financial instruments

referenced herein. Any reproduction of this document, in whole or

in part, or the disclosure of any of its contents, without PGIM’s

prior written consent, is prohibited. This document contains the

current opinions of the manager, and such opinions are subject to

change. Certain information in this document has been obtained from

sources that PGIM believes to be reliable as of the date presented;

however, PGIM cannot guarantee the accuracy of such information,

assure its completeness, or warrant such information will not be

changed. PGIM has no obligation to update any or all such

information; nor do we make any express or implied warranties or

representations as to its completeness or accuracy. Any information

presented regarding the affiliates of PGIM is presented purely to

facilitate an organizational overview and is not a solicitation on

behalf of any affiliate. These materials are not intended as an

offer or solicitation with respect to the purchase or sale of any

security or other financial instrument or any investment management

services. These materials do not constitute investment advice and

should not be used as the basis for any investment decision. Past

performance is not a guarantee or a reliable indicator of future

results.

These materials are for informational or educational purposes.

In providing these materials, PGIM is not acting as your fiduciary

and is not giving advice in a fiduciary capacity. The information

contained herein is provided on the basis of and subject to the

explanations, caveats and warnings set out in this notice and

elsewhere herein. Any discussion of risk management is intended to

describe PGIM’s efforts to monitor and manage risk but does not

imply low risk. No investment strategy or risk management technique

can guarantee returns or eliminate risk in any market environment.

These materials do not purport to provide any legal, tax or

accounting advice. These materials are not intended for

distribution to or use by any person in any jurisdiction where such

distribution would be contrary to local law or regulation. Certain

information contained in this document constitute “forward-looking

statements,” which can be identified by the use of forward-looking

terminology such as “may,” “will,” “should,” “expect,”

“anticipate,” “target,” “project,” “estimate,” “intend,” “continue”

or “believe” or the negatives thereof or other variations thereon

or comparable terminology. Due to various risks and uncertainties,

actual events or results or the actual performance of the

investments may differ materially from those reflected or

contemplated in such forward-looking statements. Any projections or

forecasts presented herein are as of the date of this presentation

and are subject to change without notice. Actual data will vary and

may not be reflected here. Projections and forecasts are subject to

high levels of uncertainty. Accordingly, any projections or

forecasts should be viewed as merely representative of a broad

range of possible outcomes. Projections or forecasts are estimated,

based on assumptions, and are subject to significant revision and

may change materially as economic and market conditions change.

PGIM has no obligation to provide updates or changes to any

projections or forecasts.

© 2025 Prudential Financial, Inc. and its related entities.

PGIM, PGIM Investments, PGIM DC Solutions and the PGIM logo are

service marks of Prudential Financial, Inc. and its related

entities, registered in many jurisdictions worldwide.

4227658

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250212321837/en/

MEDIA Leah Pappas 973-856-5709 leah.pappas@pgim.com

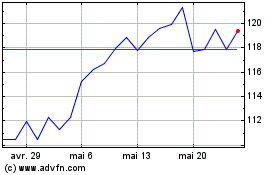

Prudential Financial (NYSE:PRU)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Prudential Financial (NYSE:PRU)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025