Parsons Corporation (NYSE: PSN) today announced financial results

for the fourth quarter and fiscal year ended December 31, 2024.

CEO Commentary“2024 was another exceptional

year for Parsons. We achieved record results for total revenue,

adjusted EBITDA, adjusted EBITDA margin, operating cash flow,

contract win rates, and contract awards. We are delivering

consistent results as we reported double-digit organic revenue

growth every quarter for the last two years,” said Carey Smith,

chair, president, and chief executive officer. "We also achieved

organic revenue growth of more than 20% and adjusted EBITDA growth

of more than 30% for the second consecutive year, demonstrating our

commitment to efficiently managing the business and drive margin

expansion.

Our balanced portfolio and our team’s strong execution in our

six large and growing end-markets is enabling us to take advantage

of unprecedented global infrastructure spending and a purpose-built

federal portfolio ready to counter near peer threats. As a Company

serving both commercial and government customers, we understand the

imperative to move with speed and agility to expeditiously solve

our customers’ most pressing and complex challenges. Looking

forward, I am very excited about our prospects and ability to

continue to deliver mid- single-digit or better organic revenue

growth. We have the right portfolio, in the right markets, and the

right team to continue to drive shareholder value.”

Fourth Quarter 2024 Results

Year-over-Year Comparisons (Q4 2024 vs. Q4

2023)

Total revenue for the fourth quarter of 2024 increased by $240

million, or 16%, to $1.7 billion. This increase was driven by

organic growth of 14% and contributions from acquisitions. Organic

growth was primarily driven by strong growth in the company's

critical infrastructure protection and cyber markets. Operating

income increased 29% to $100 million primarily due to organic

growth including the ramp-up of recent contract wins and growth on

existing contracts. Net income increased 21% to $54 million. GAAP

diluted earnings per share (EPS) attributable to Parsons was $0.49

in the fourth quarter of 2024, compared to $0.39 in the prior year

period.

Adjusted EBITDA including noncontrolling interests for the

fourth quarter of 2024 was $147 million, a 14% increase over the

prior year period. The adjusted EBITDA increase was driven

primarily by the ramp-up of recent contract wins and growth on

existing contracts, with effective cost control. Adjusted EBITDA

margin was 8.5% in the fourth quarter of 2024, compared to 8.6% in

the fourth quarter of 2023. Adjusted EBITDA growth for the quarter

was negatively impacted by $29 million of adjustments on two

programs. A normalized margin excluding these adjustments would

have been 10.0% in the fourth quarter of 2024. Adjusted EPS was

$0.78 in the fourth quarter of 2024, compared to $0.69 in the

fourth quarter of 2023.

Fiscal Year 2024 Results

Fiscal Year Comparison (fiscal year 2024 vs. fiscal year

2023)

Total revenue for the the year ended December 31, 2024 increased

by $1.3 billion, or 24%, to $6.8 billion. This increase was driven

by organic growth of 22% and contributions from acquisitions.

Organic growth was driven by the ramp-up of recent contract wins

and growth on existing contracts. Operating income increased 48% to

$428 million million primarily due to increased volume on new and

existing contracts, while continuing to closely monitor and manage

costs. Net income increased to $235 million. Diluted earnings per

share (EPS) attributable to Parsons was $2.12, compared to $1.42 in

the prior year period.

Adjusted EBITDA including noncontrolling interests for the the

year ended December 31, 2024 was $605 million, a 30% increase over

the prior year period. Adjusted EBITDA margin was 9.0% for the the

year ended December 31, 2024, compared to 8.5% in the prior year

period. Adjusted diluted EPS was $3.26 for the the year ended

December 31, 2024, compared to $2.43 for the year ended December

31, 2023. The year-over-year adjusted EBITDA and adjusted EPS

increases were driven by growth on accretive contracts,

contributions from acquisitions, and continuing to effectively

manage costs.

Segment Results

Federal Solutions Segment

Federal Solutions Quarter-over-Quarter Comparisons (Q4

2024 vs. Q4 2023)

| |

Three Months Ended |

|

|

Growth |

|

| |

December 31, 2024 |

|

|

December 31, 2023 |

|

|

Dollars/Percent |

|

|

Percent |

|

|

Revenue |

$ |

1,003,323 |

|

|

$ |

843,244 |

|

|

$ |

160,079 |

|

|

|

19 |

% |

| Adjusted EBITDA |

$ |

99,960 |

|

|

$ |

82,485 |

|

|

$ |

17,475 |

|

|

|

21 |

% |

| Adjusted EBITDA margin |

|

10.0 |

% |

|

|

9.8 |

% |

|

|

0.2 |

% |

|

|

2 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fourth quarter 2024 Federal Solutions revenue increased by $160

million, or 19%, to $1.0 billion. This increase was driven by

organic growth of 17% and the contribution from the company's

BlackSignal acquisition. Organic growth was driven primarily by the

ramp-up of recent contract wins and growth on existing

contracts.

Federal Solutions adjusted EBITDA including noncontrolling

interests increased by $17 million, or 21%, to $100 million.

Adjusted EBITDA margin increased 20 basis points to 10.0%. These

increases were driven primarily by higher volume and improved mix,

with effective indirect cost controls.

Federal Solutions Fiscal Year Comparison (fiscal year

2024 vs. fiscal year 2023)

| |

The Year Ended |

|

|

Growth |

|

| |

December 31, 2024 |

|

|

December 31, 2023 |

|

|

Dollars/Percent |

|

|

Percent |

|

|

Revenue |

$ |

4,007,114 |

|

|

$ |

3,020,701 |

|

|

$ |

986,413 |

|

|

|

33 |

% |

| Adjusted EBITDA |

$ |

415,498 |

|

|

$ |

289,571 |

|

|

$ |

125,927 |

|

|

|

43 |

% |

| Adjusted EBITDA margin |

|

10.4 |

% |

|

|

9.6 |

% |

|

|

0.8 |

% |

|

|

8 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Federal Solutions revenue for the year ended December 31, 2024

increased $986 million, or 33%, to $4.0 billion. This increase was

driven by organic growth of 30% and contributions from the

company's SealingTech and BlackSignal acquisitions. Organic growth

was driven by the strong growth in the company's critical

infrastructure protection and cyber markets.

Federal Solutions adjusted EBITDA including noncontrolling

interests for the year ended December 31, 2024 increased by $126

million, or 43%, to $415 million. Adjusted EBITDA margin increased

80 basis points from 9.6% to 10.4%. These increases were driven

primarily by increased volume on accretive contracts, and

contributions from high-margin acquisitions.

Critical Infrastructure Segment

Critical Infrastructure Quarter-over-Quarter Comparisons

(Q4 2024 vs. Q4 2023)

| |

Three Months Ended |

|

|

Growth |

|

| |

December 31, 2024 |

|

|

December 31, 2023 |

|

|

Dollars/Percent |

|

|

Percent |

|

|

Revenue |

$ |

730,994 |

|

|

$ |

650,982 |

|

|

$ |

80,012 |

|

|

|

12 |

% |

| Adjusted EBITDA |

$ |

46,659 |

|

|

$ |

45,658 |

|

|

$ |

1,001 |

|

|

|

2 |

% |

| Adjusted EBITDA margin |

|

6.4 |

% |

|

|

7.0 |

% |

|

|

-0.6 |

% |

|

|

-9 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fourth quarter 2024 Critical Infrastructure revenue increased by

$80 million, or 12%, to $731 million. This increase was driven by

organic growth of 9% and the inorganic revenue contributions from

the company's BCC and I.S. Engineers acquisitions. Organic growth

was driven by higher volume as a result of new awards in both the

company's Middle East and North America infrastructure markets.

Critical Infrastructure adjusted EBITDA including noncontrolling

interests increased by $1 million, or 2%, to $47 million from the

fourth quarter of 2023. Adjusted EBITDA margin decreased to 60

basis points to 6.4%. The adjusted EBITDA margin decrease was

impacted by the $29 million of adjustments previously discussed,

partially offset by profits from accretive organic growth on both

new and existing contracts.

Critical Infrastructure Fiscal Year Comparison (fiscal

year 2024 vs. fiscal year 2023)

| |

The Year Ended |

|

|

Growth |

|

| |

December 31, 2024 |

|

|

December 31, 2023 |

|

|

Dollars/Percent |

|

|

Percent |

|

|

Revenue |

$ |

2,743,462 |

|

|

$ |

2,422,048 |

|

|

$ |

321,414 |

|

|

|

13 |

% |

| Adjusted EBITDA |

$ |

189,455 |

|

|

$ |

175,102 |

|

|

$ |

14,353 |

|

|

|

8 |

% |

| Adjusted EBITDA margin |

|

6.9 |

% |

|

|

7.2 |

% |

|

|

-0.3 |

% |

|

|

-4 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Critical Infrastructure revenue for the year ended December 31,

2024 increased by $321 million or 13%, to $2.7 billion almost all

of which was organic. Organic growth was driven by expansion in

both the Middle East and North America.

Critical Infrastructure adjusted EBITDA including noncontrolling

interests for the year ended December 31, 2024 increased by $14

million, or 8%, to $189 million. The adjusted EBITDA increase was

driven primarily by organic growth and operating leverage. Adjusted

EBITDA margin decreased 30 basis points to 6.9%. The lower margin

for the year was the result of adjustments on the two programs

previously discussed. Excluding these impacts, Critical

Infrastructure margins were 10.1% for the full year.

Fourth Quarter and Fiscal Year 2024 Key Performance

Indicators

- Fourth quarter 2024: net bookings

increased 34% to $1.7 billion. Book-to-bill ratio: 1.0x.

- Fiscal year 2024: net bookings

increased 17% to $7.0 billion. Book-to-bill ratio: 1.0x.

- Total backlog: $8.9 billion, up 4% from

Q4 2023.

- Cash flow from operating activities:

Fourth quarter 2024: $127 million compared to $190 million in the

fourth quarter of 2023. For the twelve months ended December 31,

2024, cash flow from operating activities increased 28% to $524

million, compared to $408 million in the prior year period.

Significant Contract Wins

Parsons continues to win new business across both segments and

all six end markets. During the fourth quarter of 2024, the company

won six single-award contracts worth more than $100 million each,

bringing Parsons total to 15 contract wins worth more than $100

million for the full year, matching the company's record in 2023.

After the fourth quarter of 2024 ended, the company won two

additional contracts worth more than $100 million each.

- Awarded two new, three-year contracts

in Saudi Arabia totaling over $275 million. The company booked the

first option period on both awards in the fourth quarter of

2024.

- Booked a portion of an option year

contract with a confidential customer for $242 million.

- Awarded a new lead design contract for

the Newark AirTrain Replacement Program – Guideway and Stations

project. The company is a subcontractor on the $1.2 billion

project. As the lead designer, Parsons will be responsible for

designing 2.5 miles of elevated guideway, along with three new

stations.

- Awarded an option period totaling $122

million by the Department of State, of which the company booked $84

million. On this contract, Parsons installs integrated security

systems for 270 US overseas diplomatic missions. This work also

includes Counter-Unmanned Aircraft Systems, biometrics, emergency

alarms, mass notification systems, and alarm annunciation

systems.

- Awarded an option year totaling $104

million on the company’s General Services Administration C5ISR,

exercise, operations, and information services contract. On this

program, Parsons designs, develops, trains and deploys scalable

machine learning solutions to extract actionable intelligence from

vast amounts of data and delivers it to Intelligence analysts and

warfighters.

- Awarded a two-year, follow-on

cybersecurity contract valued at $96 million, of which the company

booked $78 million. On this contract, Parsons provides a wide range

of services focused on identifying, mitigating, and reducing cyber

risks to ensure mission resilience and operational readiness.

- After the fourth quarter of 2024 ended,

the company was also awarded a follow-on program and construction

management contract in Dubai valued at over $200 million. This win

highlights the strength of Parsons' entire Middle East portfolio

and the acceleration in its UAE business.

- After the fourth quarter of 2024 ended,

the company was awarded an additional $125 million ceiling value

modification that was added to Parsons cyber threat hunt forward

program which came through the company's Sealing Tech

acquisition.

Additional Corporate Highlights

During the quarter, the company announced and closed a strategic

acquisition and was named one of America’s most trusted companies

by Forbes. These awards complement other recognitions the company

received during 2024 including being named as one of the World’s

Most Ethical Companies by Ethisphere for the 15th consecutive year

and recognized as one of the best employers for new grads by

Forbes.

- During the fourth quarter, the company

announced and closed its acquisition of BCC Engineering in an

all-cash transaction valued at $230 million. BCC is a full-service

engineering firm that provides planning, design, and management

services for transportation, civil, and structural engineering

projects in Florida, Georgia, Texas, South Carolina and Puerto

Rico. This acquisition strengthens Parsons’ position as an

infrastructure leader while expanding the company’s reach in the

Southeastern United States, an area where the Infrastructure

Investment and Jobs Act provided approximately $100 billion in

Federal Highway Administration formula dollars for fiscal years

2022-2026.

- After the fourth quarter ended, Parsons

announced and closed its acquisition of TRS Group, an environmental

solutions firm that specializes in remediation technology, in an

all-cash transaction valued at $36 million. TRS is an industry

leader in PFAS, thermal, and holistic environmental remediation,

having cleaned hazardous and toxic substances from soil,

groundwater, and fire suppression systems for global clients. This

acquisition enhances Parsons' environmental remediation

capabilities in both operating segments and serves as a force

multiplier for the company's industry-leading PFAS remediation

solutions.

- Recognized as “Contractor of the Year”

at the 22nd Annual Greater Washington Government Contractor Awards,

where the company won the “Contractor of the Year, greater than

$300 million” category. The annual event, presented by the Northern

Virginia Chamber of Commerce and the Professional Services Council,

is the premier event honoring the leadership, innovation, and

commitment to excellence of the people and businesses of the

government contracting community.

- Named the 8th Most Trusted Company in

America 2025 according to Forbes’ listing of the Most Trusted

Companies in America. Forbes’ list combines data on a wide range of

factors across four categories: employee trust, customer trust,

investor trust, and media sentiment.

- Parsons Kicking Horse Canyon Phase 4

project was awarded the prestigious 2024 Best Project Award in the

Road/Highway category by Engineering News-Record. The project’s

design incorporated state-of-the-art technologies and used

innovative methods such as accelerated bridge construction and

viaducts to navigate difficult conditions, ensuring minimal

disruption and efficient progress despite identified challenges.

This award recognizes the project’s outstanding engineering,

innovative design, and exceptional teamwork.

Fiscal Year 2025 Guidance

The table below summarizes the company's fiscal year 2025

guidance.

|

|

Fiscal Year2025 Guidance |

| Revenue |

$7.0 billion - $7.5

billion |

| Adjusted EBITDA including

non-controlling interest |

$640 million - $710

million |

| Cash

Flow from Operating Activities |

$420

million - $480 million |

| |

|

Net income guidance is not presented as the company believes

volatility associated with interest, taxes, depreciation,

amortization and other matters affecting net income, including but

not limited to one-time and nonrecurring events and the impact of

M&A, will preclude the company from providing, with reasonable

certainty, net income guidance for fiscal year 2025.

Reiterating Long-term Growth Targets

The table below summarizes the company's long-term growth

targets.

|

|

Long-term Growth Targets |

Highlights |

|

Organic Revenue Growth |

Mid- single-digit or better organic growth |

Growth is off a revenue base that is $1.3 billion higher than

fiscal year 2023 |

| Total Revenue Growth |

Mid- single-digit or better organic growth + M&A |

Growth is off a revenue base that

is $1.3 billion higher than fiscal year 2023 |

| Adjusted EBITDA Margin

Expansion |

Average 20 - 30 basis pointsper year |

Continual margin improvement

opportunity. Adjusted EBITDA expansion also off a higher revenue

base |

| Free Cash Flow Conversion |

>100% |

Robust free cash flow generation

to fund future organic and inorganic investment opportunities |

|

Capital deployment priorities: M&A and share repurchases to

increase shareholder value |

Conference Call Information

Parsons will host a conference call today, February 19, 2025, at

8:00 a.m. ET to discuss the financial results for its fourth

quarter and fiscal year 2024.

Access to a webcast of the live conference call can be obtained

through the Investor Relations section of the company's website

(https://investors.parsons.com). Those parties interested in

participating via telephone may register on the Investor Relations

website or by clicking here.

A replay will be available on the company's website

approximately two hours after the conference call and continuing

for one year.

About Parsons Corporation

Parsons (NYSE: PSN) is a leading disruptive technology provider

in the national security and global infrastructure markets, with

capabilities across cyber and intelligence, space and missile

defense, transportation, environmental remediation, urban

development, and critical infrastructure protection. Please visit

Parsons.com and follow us on LinkedIn and Facebook to learn how

we’re making an impact.

Forward-Looking Statements

This Earnings Release and materials included therewith contains

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995, Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. Forward-looking

statements are based on our current expectations, beliefs, and

assumptions, and are not guarantees of future performance.

Forward-looking statements are inherently subject to uncertainties,

risks, changes in circumstances, trends and factors that are

difficult to predict, many of which are outside of our control.

Accordingly, actual performance, results and events may vary

materially from those indicated in the forward-looking statements,

and you should not rely on the forward-looking statements as

predictions of future performance, results or events. Numerous

factors could cause actual future performance, results and events

to differ materially from those indicated in the forward-looking

statements, including, among others: the impact of COVID-19; any

issue that compromises our relationships with the U.S. federal

government or its agencies or other state, local or foreign

governments or agencies; any issues that damage our professional

reputation; changes in governmental priorities that shift

expenditures away from agencies or programs that we support; our

dependence on long-term government contracts, which are subject to

the government’s budgetary approval process; the size of

addressable markets and the amount of government spending on

private contractors; failure by us or our employees to obtain and

maintain necessary security clearances or certifications; failure

to comply with numerous laws and regulations; changes in government

procurement, contract or other practices or the adoption by

governments of new laws, rules, regulations and programs in a

manner adverse to us; the termination or nonrenewal of our

government contracts, particularly our contracts with the U.S.

government; our ability to compete effectively in the competitive

bidding process and delays, contract terminations or cancellations

caused by competitors’ protests of major contract awards received

by us; our ability to generate revenue under certain of our

contracts; any inability to attract, train or retain employees with

the requisite skills, experience and security clearances; the loss

of members of senior management or failure to develop new leaders;

misconduct or other improper activities from our employees or

subcontractors; our ability to realize the full value of our

backlog and the timing of our receipt of revenue under contracts

included in backlog; changes in the mix of our contracts and our

ability to accurately estimate or otherwise recover expenses, time

and resources for our contracts; changes in estimates used in

recognizing revenue; internal system or service failures and

security breaches; and inherent uncertainties and potential adverse

developments in legal proceedings including litigation, audits,

reviews and investigations, which may result in material adverse

judgments, settlements or other unfavorable outcomes. These factors

are not exhaustive and additional factors could adversely affect

our business and financial performance. For a discussion of

additional factors that could materially adversely affect our

business and financial performance, see the factors including under

the caption “Risk Factors” in our Annual Report with the Securities

and Exchange Commission pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934 for the fiscal year ended December

31, 2024, on Form 10-K, filed on February 19, 2025, and our other

filings with the Securities and Exchange Commission.

All forward-looking statements are based on currently available

information and speak only as of the date on which they are made.

We assume no obligation to update any forward-looking statements

made in this presentation that becomes untrue because of subsequent

events, new information or otherwise, except to the extent we are

required to do so in connection with our ongoing requirements under

federal securities laws.

|

Media: |

Investor Relations: |

| Bryce McDevitt |

Dave Spille |

| Parsons Corporation |

Parsons Corporation |

| (703) 851-4425 |

(703) 775-6191 |

|

Bryce.McDevitt@Parsons.com |

Dave.Spille@Parsons.us |

| |

|

PARSONS CORPORATIONCONSOLIDATED

STATEMENTS OF OPERATIONS(In thousands, except per share

data)(Quarterly Data Unaudited)

|

|

Three Months Ended |

|

|

Twelve Months Ended |

|

|

|

December 31, 2024 |

|

|

December 31, 2023 |

|

|

December 31, 2024 |

|

|

December 31, 2023 |

|

|

Revenue |

$ |

1,734,317 |

|

|

$ |

1,494,226 |

|

|

$ |

6,750,576 |

|

|

$ |

5,442,749 |

|

| Direct

cost of contracts |

|

1,364,565 |

|

|

|

1,127,022 |

|

|

|

5,344,154 |

|

|

|

4,236,735 |

|

| Equity

in (losses) earnings of unconsolidated joint ventures |

|

(5,336 |

) |

|

|

(52,248 |

) |

|

|

(23,361 |

) |

|

|

(47,751 |

) |

| Selling,

general and administrative expenses |

|

264,604 |

|

|

|

237,512 |

|

|

|

954,995 |

|

|

|

869,905 |

|

| Operating income |

|

99,812 |

|

|

|

77,444 |

|

|

|

428,066 |

|

|

|

288,358 |

|

| Interest

income |

|

2,219 |

|

|

|

600 |

|

|

|

11,428 |

|

|

|

2,191 |

|

| Interest

expense |

|

(12,542 |

) |

|

|

(9,128 |

) |

|

|

(51,582 |

) |

|

|

(31,497 |

) |

|

Convertible debt repurchase loss |

|

- |

|

|

|

- |

|

|

|

(18,355 |

) |

|

|

- |

|

| Other

income (expense), net |

|

(1,396 |

) |

|

|

3,335 |

|

|

|

(1,906 |

) |

|

|

5,001 |

|

| Total other income

(expense) |

|

(11,719 |

) |

|

|

(5,193 |

) |

|

|

(60,415 |

) |

|

|

(24,305 |

) |

| Income before income tax

expense |

|

88,093 |

|

|

|

72,251 |

|

|

|

367,651 |

|

|

|

264,053 |

|

| Income

tax expense |

|

(18,729 |

) |

|

|

(14,194 |

) |

|

|

(76,986 |

) |

|

|

(56,138 |

) |

| Net income including

noncontrolling interests |

|

69,364 |

|

|

|

58,057 |

|

|

|

290,665 |

|

|

|

207,915 |

|

| Net

income attributable to noncontrolling interests |

|

(15,184 |

) |

|

|

(13,149 |

) |

|

|

(55,612 |

) |

|

|

(46,766 |

) |

| Net income attributable to

Parsons Corporation |

$ |

54,180 |

|

|

$ |

44,908 |

|

|

$ |

235,053 |

|

|

$ |

161,149 |

|

| Earnings per share: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

$ |

0.51 |

|

|

$ |

0.43 |

|

|

$ |

2.21 |

|

|

$ |

1.53 |

|

|

Diluted |

$ |

0.49 |

|

|

$ |

0.39 |

|

|

$ |

2.12 |

|

|

$ |

1.42 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average number shares used to compute basic and

diluted EPS(In thousands) (Quarterly Data Unaudited)

| |

Three Months Ended |

|

|

Twelve Months Ended |

|

| |

December 31, 2024 |

|

|

December 31, 2023 |

|

|

December 31, 2024 |

|

|

December 31, 2023 |

|

|

Basic weighted average number of shares outstanding |

|

106,465 |

|

|

|

105,285 |

|

|

|

106,274 |

|

|

|

104,992 |

|

| Dilutive

effect of stock-based awards |

|

1,890 |

|

|

|

1,395 |

|

|

|

1,778 |

|

|

|

1,173 |

|

| Dilutive

effect of warrants |

|

903 |

|

|

|

- |

|

|

|

494 |

|

|

|

- |

|

| Dilutive

effect of convertible senior notes due 2025 |

|

2,564 |

|

|

|

8,917 |

|

|

|

3,628 |

|

|

|

8,917 |

|

| Diluted

weighted average number of shares outstanding |

|

111,822 |

|

|

|

115,597 |

|

|

|

112,174 |

|

|

|

115,082 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income available to shareholders used to compute

diluted EPS as a result of adopting the if-converted method in

connection with the Convertible Senior Notes (In

thousands) (Quarterly Data Unaudited)

| |

Three Months Ended |

|

|

Twelve Months Ended |

|

| |

December 31, 2024 |

|

|

December 31, 2023 |

|

|

December 31, 2024 |

|

|

December 31, 2023 |

|

|

Net income attributable to Parsons Corporation |

$ |

54,180 |

|

|

$ |

44,908 |

|

|

|

235,053 |

|

|

|

161,149 |

|

|

Convertible senior notes if-converted method interest

adjustment |

|

58 |

|

|

|

626 |

|

|

|

2,932 |

|

|

|

2,291 |

|

| Diluted

net income attributable to Parsons Corporation |

$ |

54,238 |

|

|

$ |

45,534 |

|

|

|

237,985 |

|

|

|

163,440 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PARSONS CORPORATIONCONSOLIDATED BALANCE

SHEETS(In thousands, except share information)

|

|

|

December 31, 2024 |

|

|

December 31, 2023 |

|

| |

|

|

|

|

|

|

|

Assets |

|

|

|

|

|

|

| Current

assets: |

|

|

|

|

|

|

|

Cash and cash equivalents (including $202,121 and $128,761 Cash of

consolidated joint ventures) |

|

$ |

453,548 |

|

|

$ |

272,943 |

|

|

Accounts receivable, net (including $294,700 and $274,846 Accounts

receivable of consolidated joint ventures, net) |

|

|

1,100,396 |

|

|

|

915,638 |

|

|

Contract assets (including $7,906 and $11,096 Contract assets of

consolidated joint ventures) |

|

|

741,504 |

|

|

|

757,515 |

|

|

Prepaid expenses and other current assets (including $14,723 and

$11,929 Prepaid expenses and other current assets of consolidated

joint ventures) |

|

|

166,952 |

|

|

|

191,430 |

|

|

Total current assets |

|

|

2,462,400 |

|

|

|

2,137,526 |

|

|

|

|

|

|

|

|

|

|

Property and equipment, net (including $2,971 and $3,274 Property

and equipment of consolidated joint ventures, net) |

|

|

111,575 |

|

|

|

98,957 |

|

|

Right of use assets, operating leases (including $5,726 and $9,885

Right of use assets, operating leases of consolidated joint

ventures) |

|

|

153,048 |

|

|

|

159,211 |

|

|

Goodwill |

|

|

2,082,680 |

|

|

|

1,792,665 |

|

|

Investments in and advances to unconsolidated joint ventures |

|

|

138,759 |

|

|

|

128,204 |

|

|

Intangible assets, net |

|

|

349,937 |

|

|

|

275,566 |

|

|

Deferred tax assets |

|

|

133,450 |

|

|

|

140,162 |

|

|

Other noncurrent assets |

|

|

56,113 |

|

|

|

71,770 |

|

|

Total assets |

|

$ |

5,487,962 |

|

|

$ |

4,804,061 |

|

|

|

|

|

|

|

|

|

|

Liabilities and Shareholders' Equity |

|

|

|

|

|

|

| Current

liabilities: |

|

|

|

|

|

|

|

Accounts payable (including $28,214 and $49,234 Accounts payable of

consolidated joint ventures) |

|

$ |

207,589 |

|

|

$ |

242,821 |

|

|

Accrued expenses and other current liabilities (including $198,797

and $145,040 Accrued expenses and other current liabilities of

consolidated joint ventures) |

|

|

894,425 |

|

|

|

801,423 |

|

|

Contract liabilities (including $66,144 and $61,234 Contract

liabilities of consolidated joint ventures) |

|

|

289,799 |

|

|

|

301,107 |

|

|

Short-term lease liabilities, operating leases (including $3,522

and $4,753 Short-term lease liabilities, operating leases of

consolidated joint ventures) |

|

|

52,725 |

|

|

|

58,556 |

|

|

Income taxes payable |

|

|

7,701 |

|

|

|

6,977 |

|

|

Short-term debt |

|

|

463,405 |

|

|

|

- |

|

|

Total current liabilities |

|

|

1,915,644 |

|

|

|

1,410,884 |

|

|

|

|

|

|

|

|

|

|

Long-term employee incentives |

|

|

31,818 |

|

|

|

22,924 |

|

|

Long-term debt |

|

|

784,096 |

|

|

|

745,963 |

|

|

Long-term lease liabilities, operating leases (including $2,203 and

$5,132 Long-term lease liabilities, operating leases of

consolidated joint ventures) |

|

|

114,386 |

|

|

|

117,505 |

|

|

Deferred tax liabilities |

|

|

11,043 |

|

|

|

9,775 |

|

|

Other long-term liabilities |

|

|

96,486 |

|

|

|

120,295 |

|

|

Total liabilities |

|

|

2,953,473 |

|

|

|

2,427,346 |

|

|

Contingencies (Note 12) |

|

|

|

|

|

|

|

Shareholders' equity: |

|

|

|

|

|

|

|

Common stock, $1 par value; authorized 1,000,000,000 shares;

146,656,225 and 146,341,363 shares issued; 52,657,447 and

45,960,122 public shares outstanding; 54,117,904 and 59,879,857

ESOP shares outstanding |

|

|

146,655 |

|

|

|

146,341 |

|

|

Treasury stock, 39,880,875 shares at cost |

|

|

(815,282 |

) |

|

|

(827,311 |

) |

|

Additional paid-in capital |

|

|

2,684,829 |

|

|

|

2,779,365 |

|

|

Retained earnings |

|

|

426,781 |

|

|

|

203,724 |

|

|

Accumulated other comprehensive loss |

|

|

(26,594 |

) |

|

|

(14,908 |

) |

|

Total Parsons Corporation shareholders' equity |

|

|

2,416,389 |

|

|

|

2,287,211 |

|

|

Noncontrolling interests |

|

|

118,100 |

|

|

|

89,504 |

|

|

Total shareholders' equity |

|

|

2,534,489 |

|

|

|

2,376,715 |

|

|

Total liabilities and shareholders' equity |

|

|

5,487,962 |

|

|

|

4,804,061 |

|

|

|

|

|

|

|

|

|

|

|

PARSONS CORPORATIONCONSOLIDATED

STATEMENTS OF CASH FLOWS

| |

|

For the Twelve Months Ended |

|

| (in

thousands) |

|

December 31, 2024 |

|

|

December 31, 2023 |

|

|

Cash flows from operating activities: |

|

|

|

|

|

|

|

Net income including noncontrolling interests |

|

$ |

290,665 |

|

|

$ |

207,915 |

|

|

Adjustments to reconcile net (loss) income to net cash used in

operating activities |

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

99,251 |

|

|

|

119,973 |

|

|

Amortization of debt issue costs |

|

|

7,799 |

|

|

|

2,842 |

|

|

Loss (gain) on disposal of property and equipment |

|

|

948 |

|

|

|

206 |

|

|

Convertible debt repurchase loss |

|

|

18,355 |

|

|

|

- |

|

|

Provision for doubtful accounts |

|

|

- |

|

|

|

32 |

|

|

Deferred taxes |

|

|

6,101 |

|

|

|

(8,914 |

) |

|

Foreign currency transaction gains and losses |

|

|

6,919 |

|

|

|

(330 |

) |

|

Equity in losses (earnings) of unconsolidated joint ventures |

|

|

23,361 |

|

|

|

47,751 |

|

|

Return on investments in unconsolidated joint ventures |

|

|

40,162 |

|

|

|

48,970 |

|

|

Stock-based compensation |

|

|

56,082 |

|

|

|

34,365 |

|

|

Contributions of treasury stock |

|

|

59,778 |

|

|

|

58,172 |

|

|

Changes in assets and liabilities, net of acquisitions and

consolidated joint ventures: |

|

|

|

|

|

|

|

Accounts receivable |

|

|

(163,139 |

) |

|

|

(176,181 |

) |

|

Contract assets |

|

|

31,881 |

|

|

|

(119,898 |

) |

|

Prepaid expenses and other assets |

|

|

35,830 |

|

|

|

(95,415 |

) |

|

Accounts payable |

|

|

(42,686 |

) |

|

|

24,497 |

|

|

Accrued expenses and other current liabilities |

|

|

79,984 |

|

|

|

163,440 |

|

|

Contract liabilities |

|

|

(11,325 |

) |

|

|

84,439 |

|

|

Income taxes |

|

|

(341 |

) |

|

|

2,886 |

|

|

Other long-term liabilities |

|

|

(16,019 |

) |

|

|

12,949 |

|

|

Net cash provided by operating activities |

|

|

523,606 |

|

|

|

407,699 |

|

|

Cash flows from investing activities: |

|

|

|

|

|

|

|

Capital expenditures |

|

|

(49,213 |

) |

|

|

(40,396 |

) |

|

Proceeds from sale of property and equipment |

|

|

179 |

|

|

|

546 |

|

|

Payments for acquisitions, net of cash acquired |

|

|

(428,710 |

) |

|

|

(221,937 |

) |

|

Investments in unconsolidated joint ventures |

|

|

(133,921 |

) |

|

|

(119,582 |

) |

|

Return of investments in unconsolidated joint ventures |

|

|

54,950 |

|

|

|

5,018 |

|

|

Proceeds from sales of investments in unconsolidated joint

ventures |

|

|

- |

|

|

|

381 |

|

|

Net cash used in investing activities |

|

|

(556,715 |

) |

|

|

(375,970 |

) |

|

Cash flows from financing activities: |

|

|

|

|

|

|

|

Proceeds from borrowings under credit agreement |

|

|

153,200 |

|

|

|

620,900 |

|

|

Repayments of borrowings under credit agreement |

|

|

(153,200 |

) |

|

|

(620,900 |

) |

|

Proceeds from issuance of convertible notes due 2029 |

|

|

800,000 |

|

|

|

- |

|

|

Repurchases of convertible notes due 2025 |

|

|

(497,613 |

) |

|

|

- |

|

|

Payments for debt issuance costs |

|

|

(19,185 |

) |

|

|

- |

|

|

Contributions by noncontrolling interests |

|

|

2,174 |

|

|

|

2,867 |

|

|

Distributions to noncontrolling interests |

|

|

(29,199 |

) |

|

|

(12,496 |

) |

|

Repurchases of common stock |

|

|

(25,000 |

) |

|

|

(11,000 |

) |

|

Taxes paid on vested stock |

|

|

(22,560 |

) |

|

|

(7,301 |

) |

|

Capped call transactions |

|

|

(88,400 |

) |

|

|

- |

|

|

Bond hedge termination |

|

|

195,549 |

|

|

|

- |

|

|

Redemption of warrants |

|

|

(104,952 |

) |

|

|

- |

|

|

Proceeds from issuance of common stock |

|

|

7,935 |

|

|

|

6,059 |

|

|

Net cash provided by (used in) financing activities |

|

|

218,749 |

|

|

|

(21,871 |

) |

|

Effect of exchange rate changes |

|

|

(5,035 |

) |

|

|

546 |

|

|

Net increase (decrease) in cash, cash equivalents, and restricted

cash |

|

|

180,605 |

|

|

|

10,404 |

|

|

Cash, cash equivalents and restricted cash: |

|

|

|

|

|

|

|

Beginning of year |

|

|

272,943 |

|

|

|

262,539 |

|

|

End of period |

|

$ |

453,548 |

|

|

$ |

272,943 |

|

|

|

|

|

|

|

|

|

|

|

Contract Awards (in thousands)

| |

|

Three Months Ended |

|

|

Twelve Months Ended |

|

|

|

|

December 31, 2024 |

|

|

December 31, 2023 |

|

|

December 31, 2024 |

|

|

December 31, 2023 |

|

|

Federal Solutions |

|

$ |

780,048 |

|

|

$ |

616,750 |

|

|

$ |

3,880,290 |

|

|

$ |

3,259,052 |

|

| Critical

Infrastructure |

|

|

892,115 |

|

|

|

631,710 |

|

|

|

3,158,982 |

|

|

|

2,737,728 |

|

| Total

Awards |

|

$ |

1,672,163 |

|

|

$ |

1,248,460 |

|

|

$ |

7,039,272 |

|

|

$ |

5,996,780 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Backlog (in thousands)

| |

|

December 31, 2024 |

|

|

December 31, 2023 |

|

| Federal Solutions: |

|

|

|

|

|

|

|

Funded |

|

$ |

1,712,627 |

|

|

$ |

1,454,581 |

|

|

Unfunded |

|

|

2,961,356 |

|

|

|

3,490,781 |

|

| Total Federal Solutions |

|

|

4,673,983 |

|

|

|

4,945,362 |

|

| Critical Infrastructure: |

|

|

|

|

|

|

|

Funded |

|

|

4,167,611 |

|

|

|

3,578,902 |

|

|

Unfunded |

|

|

52,321 |

|

|

|

68,007 |

|

| Total Critical

Infrastructure |

|

|

4,219,932 |

|

|

|

3,646,909 |

|

| Total Backlog |

|

$ |

8,893,915 |

|

|

$ |

8,592,271 |

|

| |

|

|

|

|

|

|

|

|

Book-To-Bill

Ratio1:

| |

|

Three Months Ended |

|

|

Twelve Months Ended |

|

| |

|

December 31, 2024 |

|

|

December 31, 2023 |

|

|

December 31, 2024 |

|

|

December 31, 2023 |

|

|

Federal Solutions |

|

|

0.8 |

|

|

|

0.7 |

|

|

|

1.0 |

|

|

|

1.1 |

|

| Critical

Infrastructure |

|

|

1.2 |

|

|

|

1.0 |

|

|

|

1.2 |

|

|

|

1.1 |

|

|

Overall |

|

|

1.0 |

|

|

|

0.8 |

|

|

|

1.0 |

|

|

|

1.1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP Financial InformationThe tables under

"Parsons Corporation Inc. Reconciliation of Non-GAAP Measures"

present Adjusted Net Income attributable to Parsons Corporation,

Adjusted Earnings per Share, Earnings before Interest, Taxes,

Depreciation, and Amortization (“EBITDA”), Adjusted EBITDA, EBITDA

Margin, and Adjusted EBITDA Margin, reconciled to their most

directly comparable GAAP measure. These financial measures are

calculated and presented on the basis of methodologies other than

in accordance with U.S. generally accepted accounting principles

("Non-GAAP Measures"). Parsons has provided these Non-GAAP Measures

to adjust for, among other things, the impact of amortization

expenses related to our acquisitions, costs associated with a loss

or gain on the disposal or sale of property, plant and equipment,

restructuring and related expenses, costs associated with mergers

and acquisitions, software implementation costs, legal and

settlement costs, and other costs considered non-operational in

nature. These items have been Adjusted because they are not

considered core to the company’s business or otherwise not

considered operational or because these charges are non-cash or

non-recurring. The company presents these Non-GAAP Measures because

management believes that they are meaningful to understanding

Parsons’s performance during the periods presented and the

company’s ongoing business. Non-GAAP Measures are not prepared in

accordance with GAAP and therefore are not necessarily comparable

to similarly titled metrics or the financial results of other

companies. These Non-GAAP Measures should be considered a

supplement to, not a substitute for, or superior to, the

corresponding financial measures calculated in accordance with

GAAP.

1 Book-to-Bill ratio is calculated as total contract awards

divided by total revenue for the period.

PARSONS CORPORATIONNon-GAAP Financial

InformationReconciliation of Net Income to

Adjusted EBITDA(in thousands)

| |

|

Three Months Ended |

|

|

Twelve Months Ended |

|

| |

|

December 31, 2024 |

|

|

December 31, 2023 |

|

|

December 31, 2024 |

|

|

December 31, 2023 |

|

|

Net income attributable to Parsons Corporation |

|

$ |

54,180 |

|

|

$ |

44,908 |

|

|

$ |

235,053 |

|

|

$ |

161,149 |

|

|

Interest expense, net |

|

|

10,323 |

|

|

|

8,528 |

|

|

|

40,154 |

|

|

|

29,306 |

|

|

Income tax expense |

|

|

18,729 |

|

|

|

14,194 |

|

|

|

76,986 |

|

|

|

56,138 |

|

|

Depreciation and amortization (a) |

|

|

25,738 |

|

|

|

32,771 |

|

|

|

99,251 |

|

|

|

119,973 |

|

|

Net income attributable to noncontrolling interests |

|

|

15,184 |

|

|

|

13,149 |

|

|

|

55,612 |

|

|

|

46,766 |

|

|

Equity-based compensation |

|

|

16,938 |

|

|

|

11,059 |

|

|

|

61,492 |

|

|

|

36,151 |

|

|

Convertible debt repurchase loss |

|

|

- |

|

|

|

- |

|

|

|

18,355 |

|

|

|

- |

|

|

Transaction-related costs (b) |

|

|

8,180 |

|

|

|

2,985 |

|

|

|

17,138 |

|

|

|

12,013 |

|

|

Restructuring (c) |

|

|

- |

|

|

|

698 |

|

|

|

- |

|

|

|

1,244 |

|

|

Other (d) |

|

|

(2,653 |

) |

|

|

(149 |

) |

|

|

912 |

|

|

|

1,933 |

|

|

Adjusted EBITDA |

|

$ |

146,619 |

|

|

$ |

128,143 |

|

|

$ |

604,953 |

|

|

$ |

464,673 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(a) Depreciation and amortization for the three and twelve

months ended December 31, 2024, is $18.9 million and $77.5 million,

respectively, in the Federal Solutions Segment and $6.9 million and

$21.7 million, respectively, in the Critical Infrastructure

Segment. Depreciation and amortization for the three and twelve

months ended December 31, 2023, is $27.8 million and $101.2

million, respectively, in the Federal Solutions Segment and $4.9

million and $18.7 million, respectively, in the Critical

Infrastructure Segment.

(b) Reflects costs incurred in connection with acquisitions and

other non-recurring transaction costs, primarily fees paid for

professional services and employee retention.

(c) Reflects costs associated with and related to our corporate

restructuring initiatives.

(d) Includes a combination of gain/loss related to sale of fixed

assets, software implementation costs, and other individually

insignificant items that are non-recurring in nature.

PARSONS CORPORATIONNon-GAAP Financial

InformationComputation of Adjusted EBITDA

Attributable to Noncontrolling Interests(in thousands)

| |

|

Three months ended |

|

|

Twelve Months Ended |

|

| |

|

December 31, 2024 |

|

|

December 31, 2023 |

|

|

December 31, 2024 |

|

|

December 31, 2023 |

|

|

Federal Solutions Adjusted EBITDA attributable to Parsons

Corporation |

|

$ |

99,925 |

|

|

$ |

82,423 |

|

|

$ |

415,338 |

|

|

$ |

289,250 |

|

| Federal Solutions Adjusted

EBITDA attributable to noncontrolling interests |

|

|

35 |

|

|

|

62 |

|

|

|

160 |

|

|

|

321 |

|

| Federal Solutions Adjusted

EBITDA including noncontrolling interests |

|

$ |

99,960 |

|

|

$ |

82,485 |

|

|

$ |

415,498 |

|

|

$ |

289,571 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Critical Infrastructure

Adjusted EBITDA attributable to Parsons Corporation |

|

|

31,319 |

|

|

|

32,304 |

|

|

|

132,901 |

|

|

|

127,785 |

|

| Critical Infrastructure

Adjusted EBITDA attributable to noncontrolling interests |

|

|

15,340 |

|

|

|

13,354 |

|

|

|

56,554 |

|

|

|

47,317 |

|

| Critical Infrastructure

Adjusted EBITDA including noncontrolling interests |

|

$ |

46,659 |

|

|

$ |

45,658 |

|

|

$ |

189,455 |

|

|

$ |

175,102 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Total Adjusted EBITDA

including noncontrolling interests |

|

$ |

146,619 |

|

|

$ |

128,143 |

|

|

$ |

604,953 |

|

|

$ |

464,673 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PARSONS CORPORATIONNon-GAAP Financial

InformationReconciliation of Net Income

Attributable to Parsons Corporation to Adjusted Net Income

Attributable to Parsons Corporation (in thousands, except

per share information)

| |

|

Three Months Ended |

|

|

Twelve Months Ended |

|

| |

|

December 31, 2024 |

|

|

December 31, 2023 |

|

|

December 31, 2024 |

|

|

December 31, 2023 |

|

|

Net income attributable to Parsons Corporation |

|

$ |

54,180 |

|

|

$ |

44,908 |

|

|

$ |

235,053 |

|

|

$ |

161,149 |

|

| Acquisition related intangible

asset amortization |

|

|

14,814 |

|

|

|

21,632 |

|

|

|

55,591 |

|

|

|

76,558 |

|

| Equity-based compensation |

|

|

16,938 |

|

|

|

11,059 |

|

|

|

61,492 |

|

|

|

36,151 |

|

| Convertible debt repurchase

loss |

|

|

- |

|

|

|

- |

|

|

|

18,355 |

|

|

|

- |

|

| Transaction-related costs

(a) |

|

|

8,180 |

|

|

|

2,985 |

|

|

|

17,138 |

|

|

|

12,013 |

|

| Restructuring (b) |

|

|

- |

|

|

|

698 |

|

|

|

- |

|

|

|

1,244 |

|

| Other (c) |

|

|

(2,653 |

) |

|

|

(149 |

) |

|

|

912 |

|

|

|

1,933 |

|

| Tax effect on adjustments |

|

|

(6,429 |

) |

|

|

(7,600 |

) |

|

|

(35,842 |

) |

|

|

(30,558 |

) |

| Adjusted net income

attributable to Parsons Corporation |

|

|

85,030 |

|

|

|

73,533 |

|

|

|

352,699 |

|

|

|

258,490 |

|

| Adjusted earnings per

share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted-average number of basic shares outstanding |

|

|

106,465 |

|

|

|

105,285 |

|

|

|

106,274 |

|

|

|

104,992 |

|

|

Weighted-average number of diluted shares outstanding (d) |

|

|

108,355 |

|

|

|

106,680 |

|

|

|

108,052 |

|

|

|

106,165 |

|

|

Adjusted net income attributable to Parsons Corporation per basic

share |

|

$ |

0.80 |

|

|

$ |

0.70 |

|

|

$ |

3.32 |

|

|

$ |

2.46 |

|

|

Adjusted net income attributable to Parsons Corporation per diluted

share |

|

$ |

0.78 |

|

|

$ |

0.69 |

|

|

$ |

3.26 |

|

|

$ |

2.43 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(a) Reflects costs incurred in connection with acquisitions and

other non-recurring transaction costs, primarily fees paid for

professional services and employee retention.

(b) Reflects costs associated with and related to our corporate

restructuring initiatives.

(c) Includes a combination of gain/loss related to sale of fixed

assets, software implementation costs, and other individually

insignificant items that are non-recurring in nature.

(d) Excludes dilutive effect of convertible senior notes due to

bond hedge.

PARSONS CORPORATIONCONSOLIDATED

STATEMENT OF OPERATIONSAdoption Of Accounting

Standards Update 2024-04(In thousands, except per share

data)(Unaudited)

| |

|

Quarter Ended |

|

| |

|

March 31, 2024 |

|

|

Revenue |

|

$ |

1,535,676 |

|

| Direct

cost of contracts |

|

|

1,210,827 |

|

| Equity

in losses of unconsolidated joint ventures |

|

|

(2,060 |

) |

| Selling,

general and administrative expenses |

|

|

220,945 |

|

|

Operating income |

|

|

101,844 |

|

| Interest

income |

|

|

1,152 |

|

| Interest

expense |

|

|

(12,998 |

) |

|

Convertible debt repurchase loss (1) |

|

|

(18,355 |

) |

| Other

income (expense), net |

|

|

(3,326 |

) |

| Total

other income (expense) (1) |

|

|

(33,527 |

) |

| Income

before income tax expense (1) |

|

|

68,317 |

|

| Income

tax expense (1) |

|

|

(13,324 |

) |

| Net

income including noncontrolling interests (1) |

|

|

54,993 |

|

| Net

income attributable to noncontrolling interests |

|

|

(15,243 |

) |

| Net

income attributable to Parsons Corporation (1) |

|

$ |

39,750 |

|

| Earnings per share: |

|

|

|

|

Basic |

|

$ |

0.37 |

|

|

Diluted (2) |

|

$ |

0.37 |

|

|

|

|

|

|

|

1 Presents the revised consolidated statement of operations

resulting from the adoption of Accounting Standards Update (“ASU”)

2024-04 as of January 1, 2024 on a prospective basis. As a result

of the adoption of ASU 2024-04, the Company reversed a loss on

extinguishment of debt for the partial repurchase of the

Convertible Senior Notes due 2025 and recorded the repurchase

transaction as an induced conversion. This change from

extinguishment to inducement accounting resulted in the Company

(i.) reversing the $211.0 million loss and the related $49.9

million tax benefit on extinguishment of debt, recorded in Q1 2024,

(ii.) recording a $18.4 million convertible debt repurchase loss,

(iii.) the difference between the extinguishment loss and

inducement expense of $192.6 million recorded to equity, and (iv.)

the related tax benefit of $45.6 million recorded to equity. See

"Note 2—Summary of Significant Accounting Polices—New Accounting

Pronouncements" of the Company's Form 10-K for the year ended

December 31, 2024 for a further discussion of the first quarter

2024 extinguishment accounting and subsequent change to inducement

accounting.

2 Diluted earnings per share prior to the adoption of ASU

2024-04 did not include certain adjustments as their inclusion

would have been antidilutive. Subsequent to the adoption of ASU

2024-04 these adjustments are no longer antidilutive. Dilutive

adjustments include if converted interest of $2.8 million, 1.5

million shares related to stock based awards and 6.8 million shares

related to convertible senior notes. Inclusion of these dilution

adjustments resulted in dilutive net income attributable to Parsons

Corporation of $42.5 million and total diluted shares of 114.4

million for the quarter ended March 31, 2024.

No other quarters were impacted by the adoption of ASU

2024-04.

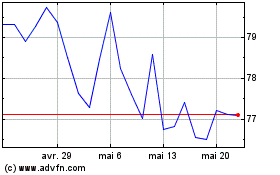

Parsons (NYSE:PSN)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Parsons (NYSE:PSN)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025