Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

30 Octobre 2024 - 5:16PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of October

2024

PEARSON plc

(Exact

name of registrant as specified in its charter)

N/A

(Translation

of registrant's name into English)

80 Strand

London, England WC2R 0RL

44-20-7010-2000

(Address

of principal executive office)

Indicate

by check mark whether the Registrant files or will file annual

reports

under

cover of Form 20-F or Form 40-F:

Form

20-F

X

Form 40-F

Indicate

by check mark whether the Registrant by furnishing the

information

contained

in this Form is also thereby furnishing the information to

the

Commission

pursuant to Rule 12g3-2(b) under the Securities Exchange Act of

1934

Yes

No X

Pearson PLC

Results of Annual General Meeting on 26 April 2024 - Update

Statement

In accordance with the UK Corporate Governance Code, Pearson plc

("Pearson" or the "Company") is providing this update following the

outcome of the Annual General Meeting ("AGM") on 28 April

2024.

The Board very much appreciated the ongoing support from our

shareholders, with all resolutions passed. However, we noted that a

significant minority voted against the 2023 Director's Remuneration

Report (30.17%) and the re-election of the Remuneration Committee

Chair (28.16%).

We welcomed the support of over two thirds of our shareholders for

these two resolutions and we were also pleased to receive support

from IVIS and Glass Lewis. We also acknowledge that both

resolutions were opposed by ISS, which we believe influenced a

significant portion of the vote against, in particular from smaller

institutional holders who may follow this recommendation for their

voting.

Whilst the company had, prior to the AGM, met with a significant

proportion of its ownership in terms of holdings and had a good

understanding of the reasons both for and against its remuneration

proposals, in light of the outcome at the 2024 AGM and given the

Company's commitment to an ongoing and transparent dialogue with

shareholders and their advisers, and in line with the requirements

under the UK Corporate Governance Code, a further engagement

exercise was initiated. This helped ensure we had captured as

much feedback about the voting outcomes as possible, and extended

the opportunity for shareholders to provide any new or further

feedback on Pearson's approach to remuneration more generally. The

results of this engagement can be summarised as

follows:

●

The Company wrote to the top 100

shareholders, comprising c.83% of the register, to offer a meeting.

This expanded our coverage from previous engagement programmes. We

have received written feedback from 11 shareholders and the

Committee Chair has participated in six meetings with shareholders

to date. We have also met with certain proxy agencies and other

representative groups. A number of shareholders responded to state

that there was no need for engagement given the extensive previous

consultations on Pearson's current remuneration

arrangements.

●

The feedback received has

reconfirmed that there remains a diverse range of views in our

shareholder base with respect to executive pay. The majority

of those that we engaged with during this exercise indicated

continued support for the approach we have

taken.

●

Some shareholders, as well as

ISS, retained concerns around the implementation of the increases

to variable incentive opportunities introduced as part of the

Remuneration Policy approved by shareholders at the 2023 AGM. In

addition, there was a perception from ISS, that implementing the

new Policy immediately after shareholder approval at the 2023 AGM,

represented a failure to adequately engage with and listen to

shareholders, in light of that vote in 2023.

●

However, the Company had

consulted widely in developing the Policy in early 2023 and had

refined the final proposals in response to the feedback received at

that time. The Policy was then implemented following approval at

the 2023 AGM on the basis that it was supported by the majority of

shareholders, including almost all major holders who engaged with

Pearson throughout the review. The Company was aware, at the time

of that implementation and, as recognised in the Directors'

Remuneration Report that year, there was a range of views among our

shareholder base, such that a significant vote against the policy

was a possibility. Notwithstanding this, the Company proceeded with

the implementation of the approved Policy because the Board

continued to believe that it was necessary for remaining

competitive in the global talent market and to drive sustainable,

profitable growth at Pearson. Critically, that view was reaffirmed

later in 2023 when it was instrumental in securing the appointment

of Omar Abbosh as the new Chief Executive. Without the new Policy,

we do not believe we would have been able to compete to hire a

leader of Omar's calibre.

●

The Board is committed to

ensuring Pearson has an executive remuneration structure that

allows us to be competitive in the global talent market and ensures

strong alignment between pay and performance. During the most

recent engagement exercise, a number of shareholders informed the

Company that they now more fully understand the talent markets

Pearson competes in (and by extension the rationale underpinning

the Remuneration Policy) as a result of this engagement, but

considered this could be explained in greater detail in the

Directors' Remuneration Report.

●

Finally, some investors had

ongoing concerns over the legacy Co-Investment Plan for the

previous Chief Executive and felt unable to vote in favour of the

Directors' Remuneration Report in part because of this. The

Co-Investment Plan has now concluded, with no further tranches to

vest and no new awards to be made (it was not retained as part of

the 2023 Policy).

●

In relation to the minority vote

against the re-election of the Remuneration Committee Chair, the

Board understands that the ISS recommendation to vote against this

resolution strongly influenced the voting outcome and was solely

related to Ms Coutu's role as Remuneration Committee Chair and in

light of ISS's views on our shareholder engagement approach on

remuneration matters. In addition, no concerns were raised by any

shareholders during this most recent engagement exercise. The Board

remains highly supportive of Ms Coutu and the exceptional

contribution she has made to the Board, including from her

leadership of the Remuneration Committee and her continued

dedication to meaningful investor dialogue.

To address the key issues highlighted above, the Company intends to

provide greater detail in the forthcoming 2024 Directors'

Remuneration Report on both its shareholder engagement activities,

including the changes made to the final 2023 Remuneration Policy

proposals to reflect investor feedback at the time, and more

information on the relevant talent markets and pay positioning for

Pearson.

Pearson

would like to thank all those who have participated in engagement

during 2023 and 2024. All feedback received is invaluable to the

Remuneration Committee. Pearson is committed to having a

constructive and positive relationship with our shareholders and

their advisors and will continue to engage as appropriate going

forward.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorized.

|

|

PEARSON

plc

|

|

|

|

|

Date: 30

October 2024

|

|

|

|

By: /s/

NATALIE WHITE

|

|

|

|

|

|

------------------------------------

|

|

|

Natalie

White

|

|

|

Deputy

Company Secretary

|

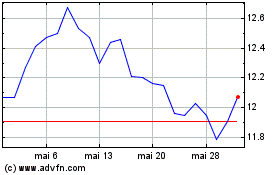

Pearson (NYSE:PSO)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

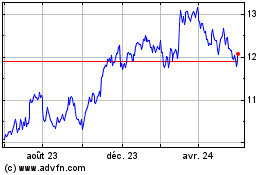

Pearson (NYSE:PSO)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024