Phillips 66 announces agreement to sell interest in Gulf Coast Express

16 Décembre 2024 - 1:15PM

Business Wire

Phillips 66 (NYSE: PSX) announced today that it has entered into

a definitive agreement to sell DCP GCX Pipeline LLC, which owns a

25% non-operated equity interest in Gulf Coast Express Pipeline

LLC, to an affiliate of ArcLight Capital Partners, LLC for pre-tax

total cash proceeds of $865 million, subject to purchase price

adjustments.

“With this transaction, we have exceeded our $3 billion asset

divestiture target established in our strategic priorities. We

intend to continue to optimize the portfolio and rationalize

non-core assets going forward,” said Mark Lashier, chairman and CEO

of Phillips 66. “The evolution of our portfolio underscores our

position as a leading integrated downstream energy provider,

enhancing shareholder value and positioning the company for the

future.”

Gulf Coast Express Pipeline is an approximately 500-mile

pipeline system that transports about 2 billion cubic feet per day

of natural gas from the Permian Basin to the Agua Dulce, Texas

area. Following the transaction, Gulf Coast Express Pipeline LLC

will be jointly owned by subsidiaries of Kinder Morgan, Inc. (NYSE:

KMI) and affiliates of ArcLight Capital Partners, LLC.

The sales price represents an implied Enterprise Value/EBITDA

multiple of 10.6x based on expected 2025 EBITDA. Proceeds from the

sale will support the strategic priorities of Phillips 66,

including returns to shareholders and debt reduction.

The sale is expected to close in January 2025.

About Phillips 66

Phillips 66 (NYSE: PSX) is a leading integrated downstream

energy provider that manufactures, transports and markets products

that drive the global economy. The company’s portfolio includes

Midstream, Chemicals, Refining, Marketing and Specialties, and

Renewable Fuels businesses. Headquartered in Houston, Phillips 66

has employees around the globe who are committed to safely and

reliably providing energy and improving lives while pursuing a

lower-carbon future. For more information, visit phillips66.com or

follow @Phillips66Co on LinkedIn.

Cautionary Statement for the Purposes of the “Safe Harbor”

Provisions of the Private Securities Litigation Reform Act of

1995 —This news release contains forward-looking statements

within the meaning of the federal securities laws with respect to

the sale of Phillips 66’s equity interests in DCP GCX Pipeline LLC

and the use of proceeds from such sale. Words such as

“anticipated,” “estimated,” “expected,” “planned,” “scheduled,”

“targeted,” “believe,” “continue,” “intend,” “will,” “would,”

“objective,” “goal,” “project,” “efforts,” “strategies” and similar

expressions that convey the prospective nature of events or

outcomes generally indicate forward-looking statements. However,

the absence of these words does not mean that a statement is not

forward-looking. Forward-looking statements included in this news

release are based on management’s expectations, estimates and

projections as of the date they are made. These statements are not

guarantees of future events or performance, and you should not

unduly rely on them as they involve certain risks, uncertainties

and assumptions that are difficult to predict. Therefore, actual

outcomes and results may differ materially from what is expressed

or forecast in such forward-looking statements. Factors that could

cause actual results or events to differ materially from those

described in the forward-looking statements include: changes in

governmental policies or laws that relate to the company’s

operations, including regulations that seek to limit or restrict

refining, marketing and midstream operations or regulate profits,

pricing, or taxation of the company’s products or feedstocks, or

other regulations that restrict feedstock imports or product

exports; the company’s ability to timely obtain or maintain permits

necessary for projects; fluctuations in NGL, crude oil, refined

petroleum, renewable fuels and natural gas prices, and refining,

marketing and petrochemical margins; the effects of any widespread

public health crisis and its negative impact on commercial activity

and demand for refined petroleum or renewable fuels products;

changes to worldwide government policies relating to renewable

fuels and greenhouse gas emissions that adversely affect programs

including the renewable fuel standards program, low carbon fuel

standards and tax credits for renewable fuels; potential liability

from pending or future litigation; liability for remedial actions,

including removal and reclamation obligations under existing or

future environmental regulations; unexpected changes in costs for

constructing, modifying or operating the company’s facilities; the

company’s ability to successfully complete, or any material delay

in the completion of, any asset disposition, acquisition, shutdown

or conversion that we have announced or may pursue, including

receipt of any necessary regulatory approvals or permits related

thereto; unexpected difficulties in manufacturing, refining or

transporting the company’s products; the level and success of

drilling and production volumes around the company’s midstream

assets; risks and uncertainties with respect to the actions of

actual or potential competitive suppliers and transporters of

refined petroleum products, renewable fuels or specialty products;

lack of, or disruptions in, adequate and reliable transportation

for the company’s products; failure to complete construction of

capital projects on time or within budget; the company’s ability to

comply with governmental regulations or make capital expenditures

to maintain compliance with laws; limited access to capital or

significantly higher cost of capital related to illiquidity or

uncertainty in the domestic or international financial markets,

which may also impact the company’s ability to repurchase shares

and declare and pay dividends; potential disruption of the

company’s operations due to accidents, weather events, including as

a result of climate change, acts of terrorism or cyberattacks;

general domestic and international economic and political

developments, including armed hostilities (such as the

Russia-Ukraine war), expropriation of assets, and other diplomatic

developments; international monetary conditions and exchange

controls; changes in estimates or projections used to assess fair

value of intangible assets, goodwill and property and equipment

and/or strategic decisions with respect to the company’s asset

portfolio that cause impairment charges; investments required, or

reduced demand for products, as a result of environmental rules and

regulations; changes in tax, environmental and other laws and

regulations (including alternative energy mandates); political and

societal concerns about climate change that could result in changes

to the company’s business or increase expenditures, including

litigation-related expenses; the operation, financing and

distribution decisions of equity affiliates we do not control; and

other economic, business, competitive and/or regulatory factors

affecting the company’s businesses generally as set forth in

Phillips 66’s filings with the Securities and Exchange Commission.

Phillips 66 is under no obligation (and expressly disclaims any

such obligation) to update or alter its forward-looking statements,

whether as a result of new information, future events or

otherwise.

Use of Non-GAAP Financial Information — This news release

includes the term “EBITDA,” which, as used in this release, is a

forward-looking non-GAAP financial measure. EBITDA is defined as

estimated net income plus estimated net interest expense, income

taxes, depreciation and amortization. Net income is the most

directly comparable GAAP financial measure. EBITDA estimates depend

on future levels of revenues and expenses, which are not reasonably

estimable at this time. Accordingly, we cannot provide a

reconciliation between projected 2025 EBITDA to net income without

unreasonable effort.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241215722732/en/

Jeff Dietert (investors) 832-765-2297 jeff.dietert@p66.com

Owen Simpson (investors) 832-765-2297 owen.simpson@p66.com

Thaddeus Herrick (media) 855-841-2368

thaddeus.f.herrick@p66.com

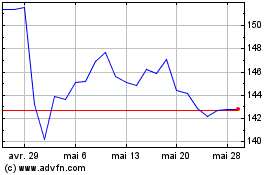

Phillips 66 (NYSE:PSX)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Phillips 66 (NYSE:PSX)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025