SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

For the month of June, 2024

Commission File Number: 001-12518

Banco Santander, S.A.

(Exact name of registrant as specified in its

charter)

Ciudad Grupo Santander

28660 Boadilla del Monte (Madrid) Spain

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F:

Banco Santander, S.A.

TABLE OF CONTENTS

|

Item |

|

| |

|

| 1 |

Report of Other Relevant Information dated June 18, 2024 |

Item

1

Banco Santander, S.A. (the “Bank”

or “Banco Santander”), in compliance with the securities market legislation, hereby communicates the following:

OTHER RELEVANT INFORMATION

Banco Santander share capital reduces

by 2.09% following completion of buy-back programme

Reference is made to our notice

of inside information of 19 February 2024 (official registry number 2114) (the “Buy-back Commencement Communication”),

relating to the buyback programme of own shares approved by the board of directors of Banco Santander (the “Buy-back Programme”

or the “Programme”). The Bank informs that, after the last acquisitions mentioned below, the maximum investment provided

for in the Buy-back Programme (i.e. EUR 1,459 million) has been reached, having acquired a total of 331,305,000 own shares, representing

approximately 2.09% of the Bank’s share capital. The acquisition of shares under the Buy-back Programme has been communicated on

a regular basis, pursuant to the provisions of Articles 2.2 and 2.3 of the Commission Delegated Regulation (EU) No. 2016/1052. As a consequence

of the above, the Buy-back Programme has been terminated in accordance with the terms set out when it was announced.

As disclosed in the Buy-back Commencement

Communication, the purpose of the Programme was to reduce the Bank’s share capital by redeeming the shares acquired thereunder,

which was authorised by the European Central Bank on 7 February 2024 (the “Capital Reduction”). The implementation

of the Capital Reduction, which was approved at the Bank’s ordinary general shareholders’ meeting held on 22 March 2024 on

second call under item 5 B of the agenda, is expected to take place at the meeting of the board of directors of the Bank to be held on

25 June 2024.

As a result of the Capital Reduction,

Banco Santander’s share capital will be reduced by EUR 165,652,500 through the cancellation of the aforementioned 331,305,000 own

shares, each with a nominal value of EUR 0.50. Consequently, the Bank’s share capital will be set at EUR 7,747,136,786, represented

by 15,494,273,572 shares, all of them of the same class and series.

The purpose of the Capital Reduction

is the cancellation of the own shares acquired under the Buy-back Programme, contributing to the remuneration of the Bank’s shareholders

by increasing the profit per share, which is inherent to the decrease in the number of shares. The Capital Reduction will not entail the

return of contributions to shareholders since the Bank is the owner of the shares to be cancelled.

It is expected that a reserve for

amortised capital be created with a charge to the share premium reserve for an amount equal to the nominal value of the cancelled shares

(i.e. EUR 165,652,500), which may only be used under the same conditions as those required for the reduction of the share capital, pursuant

to the provisions of Article 335 c) of the Spanish Companies Law. Consequently, in accordance with the provisions of such Article, the

Bank’s creditors will not be afforded the right of objection referred to in Article 334 of the same Law.

For purposes of the provisions

of Article 411 of the Spanish Companies Law and in accordance with Additional Provision One of Law 10/2014 of 26 June on the organisation,

supervision and solvency of credit institutions, it is hereby stated for the record that, as the Bank is a credit institution and the

other requirements set forth in the aforementioned Additional Provision are met, the consent of the bondholder syndicates for the outstanding

debenture and bond issues is not required for the implementation of the reduction.

The announcements of the Capital

Reduction will be published in the Official Gazette of the Spanish Commercial Registry and on the Bank’s corporate website (www.santander.com)

in the coming days.

Thereafter, the public deed regarding

the corporate resolutions on the Capital Reduction and amendment of the Bank’s By-laws will be granted and subsequently registered

with the Commercial Registry of Santander. In addition, the delisting of the 331,305,000 cancelled shares from the Spanish and foreign

stock exchanges or stock markets on which the Bank’s shares are listed, and the cancellation of the book-entry records of the cancelled

shares before the competent bodies will both be requested.

Accumulated share capital reduction

resulting from the buyback programmes

After the completion of the Buy-back

Programme, which will entail a share capital reduction of the Bank`s share capital by approximately 2.09%, once the six buyback programmes

carried out against the 2021, 2022 and 2023 results have been completed the accumulated share capital reduction amounts to EUR 923,183,865, with the Bank having repurchased 1,846,367,730 shares since November 2021, almost 11% of its outstanding shares

as of that date.

Last transactions executed under

the Programme

Moreover, pursuant to article 5

of Regulation (EU) no. 596/2014 on Market Abuse of 16 April 2014, and articles 2.2 and 2.3 of Commission Delegated Regulation (EU) 2016/1052,

of 8 March 2016, the Bank informs, that it has carried out the following transactions over its own shares between 13 and 17 June 2024

(both inclusive):

| Date |

Security |

Transaction |

Trading venue |

Number of shares |

Weighted average price (€) |

| 13/06/2024 |

SAN |

Purchase |

XMAD |

6,200,717 |

4.4862 |

| 13/06/2024 |

SAN |

Purchase |

CEUX |

1,534,833 |

4.4412 |

| 13/06/2024 |

SAN |

Purchase |

TQEX |

265,752 |

4.4447 |

| 13/06/2024 |

SAN |

Purchase |

AQEU |

598,698 |

4.4537 |

| 14/06/2024 |

SAN |

Purchase |

XMAD |

6,149,973 |

4.3754 |

| 14/06/2024 |

SAN |

Purchase |

CEUX |

2,222,901 |

4.3538 |

| 14/06/2024 |

SAN |

Purchase |

TQEX |

291,757 |

4.3480 |

| 14/06/2024 |

SAN |

Purchase |

AQEU |

635,369 |

4.3596 |

| 17/06/2024 |

SAN |

Purchase |

XMAD |

4,703,357 |

4.3908 |

| 17/06/2024 |

SAN |

Purchase |

CEUX |

581,140 |

4.3890 |

| 17/06/2024 |

SAN |

Purchase |

TQEX |

89,415 |

4.3842 |

| 17/06/2024 |

SAN |

Purchase |

AQEU |

231,088 |

4.3846 |

| |

|

|

TOTAL |

23,505,000 |

|

Issuer name: Banco Santander, S.A. - LEI 5493006QMFDDMYWIAM13

Reference of the financial instrument: ordinary shares

- Code ISIN ES0113900J37

Detailed information of the transactions carried out within

the referred period is attached as Annex I.

Boadilla del Monte (Madrid), 18

June 2024

ANNEX I

Detailed

information on each of the transactions carried out within the context of the Buy-back Programme between 13/06/2024 and 17/06/2024 (both

inclusive).

(https://www.santander.com/content/dam/santander-com/es/documentos/cumplimiento/do-anexo-i-13-a-17-jun-2024.pdf)

IMPORTANT INFORMATION

Not a securities offer

This document and the information it

contains does not constitute an offer to sell nor the solicitation of an offer to buy any securities.

Past performance does not indicate

future outcomes

Statements about historical performance

or growth rates must not be construed as suggesting that future performance, share price or results (including earnings per share) will

necessarily be the same or higher than in a previous period. Nothing in this document should be taken as a profit and loss forecast.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

|

Banco Santander, S.A. |

| |

|

|

| |

|

|

| Date: |

June 18, 2024 |

|

By: |

/s/ Pedro de Mingo Kaminouchi |

| |

|

|

|

Name: |

Pedro de Mingo Kaminouchi |

| |

|

|

|

Title: |

Head of Regulatory Compliance |

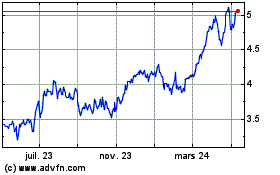

Banco Santander (NYSE:SAN)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

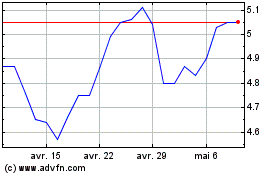

Banco Santander (NYSE:SAN)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025