Santander Goes National in the United States with Openbank, Bringing High Yield Savings Opportunities to More Americans

10 Décembre 2024 - 7:51PM

Business Wire

- Openbank by Santander offers a high yield savings account

featuring an attractive Annual Percentage Yield (APY) of 5.00% and

frictionless account opening that takes less than four

minutes.

- Eligible U.S. customers can take advantage of Openbank’s safe

and secure digital banking experience, built on Santander’s

proprietary technology.

- Openbank was built upon Santander’s legacy of strength and

stability, as a global financial powerhouse with 171 million

customers.

Santander Bank has officially launched Openbank, a new digital

banking platform, whose initial offering brings high yield savings

opportunities to more Americans. Openbank’s high yield savings

account features an attractive Annual Percentage Yield (APY) of

5.00%*, no fees, low minimum deposits, and an exceptional customer

experience with frictionless account opening that takes less than

four minutes.

With the launch of Openbank, Santander expands its addressable

market in the U.S., complementing its existing branch network to

serve customers nationally and grow deposits to be a lower-cost

funding source for the company’s consumer lending, including its

at-scale Auto business.

“Openbank brings to life our strategy to build a digital bank

with branches to accelerate growth and provide easy access to high

yield savings accounts for U.S. customers nationwide,” said Tim

Wennes, CEO of Santander US. “The early results for Openbank have

been strong, and we expect our new customers will find Openbank to

be a seamless and easy digital experience, backed by one of the

world’s largest financial services companies with 171 million

customers around the globe.”

Santander US’s research shows that 6 in 10 middle-income

Americans have not taken action to benefit from higher yields

available. Consumers have been reluctant to act on higher interest

rates because of commonly held misperceptions, such as that opening

an account is overly burdensome, time-consuming, and not worth it.

Openbank’s High Yield Savings account’s attractive APY is among the

best savings opportunities available on the market, and the account

has been rated 4.5 stars out of 5 on Bankrate.com.**

Openbank provides eligible U.S. customers with a digital banking

experience built upon Santander’s legacy of strength and stability,

as a global financial powerhouse. This launch marks the first time

Santander integrates its entire core, proprietary technology into

one stack, offering customers a seamless and secure online banking

experience.

“High yield savings accounts are only the beginning, as we

introduce Openbank to customers across the U.S. outside our

historic footprint in the Northeast,” said Swati Bhatia, Head of

Retail Banking & Transformation of Santander Bank. “At

Santander, consumer banking is in our DNA. Operating a digital

consumer bank within a global consumer bank allows us to innovate

faster like a fintech and introduce new products in a matter of

months, not years.”

Additional products will be introduced in time to ensure that

Openbank by Santander is meeting the ongoing needs of its

customers.

As part of the Openbank by Santander launch, Santander Bank

created an in-person and mobile launch event called “Play to Save.”

The innovative experience included two games focused on saving and

making smart money moves. For the in-person experience, consumers

were able to play using a large game controller placed in front of

a projected gaming screen in Austin and Miami.

Openbank by Santander deposits, through Santander Bank, are FDIC

insured up to $250,000 per depositor, per ownership category and

the platform employs biometric security protocols to add an extra

layer of security, so customers can bank digitally with

confidence.

For more information about Openbank by Santander, including

eligibility and how to open an account, please visit

openbank.us.

About Santander Bank,

N.A.

Santander Bank, N.A. is one of the country’s leading retail and

commercial banks, with $102 billion in assets. With its corporate

offices in Boston, the Bank’s more than 5,100 employees and more

than 1.8 million customers are principally located in

Massachusetts, New Hampshire, Connecticut, Rhode Island, New York,

New Jersey, Pennsylvania and Delaware. The Bank is a wholly-owned

subsidiary of Madrid-based Banco Santander, S.A. (NYSE: SAN),

recognized as one of the world’s most admired companies by Fortune

Magazine in 2024, with approximately 171 million customers in the

U.S., Europe, and Latin America. It is overseen by Santander

Holdings USA, Inc., Banco Santander’s intermediate holding company

in the U.S. For more information on Santander Bank, please visit

www.santanderbank.com.

Openbank in the United States is a division of Santander

Bank, N.A., which is a Member of FDIC and a wholly owned subsidiary

of Banco Santander, S.A. © 2024 Santander Bank, N.A. All rights

reserved. Santander, Santander Bank, Openbank, the Flame Logo are

trademarks of Banco Santander, S.A. or its subsidiaries in the

United States or other countries. All other trademarks are the

property of their respective owners. For more information on

Openbank in the United States, please visit www.openbank.us.

*Interest Rates and Annual Percentage Yields (APYs) are accurate

as of 12:01 am Eastern Time on December 10, 2024. The products and

rates we offer may vary between locations, are available in select

markets only, and are subject to change without notice.

Availability for this product will be based on the residential zip

code entered when account is opened within online application

process. This is a variable-rate account and the rate applicable to

your balance tier may change at any time without notice. Fees may

reduce earnings. A minimum deposit of $500 is required to open a

Openbank High Yield Savings account. Personal accounts only.

**Rating from Bankrate.com as of December 10, 2024.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241210832946/en/

Media Contact Andrew Simonelli

andrew.simonelli@santander.us

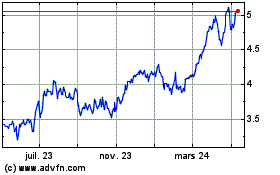

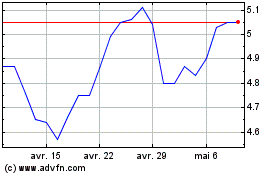

Banco Santander (NYSE:SAN)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

Banco Santander (NYSE:SAN)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025