Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

21 Novembre 2024 - 12:01PM

Edgar (US Regulatory)

FORM 6-K

SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C.

20549

Report of Foreign

Issuer

Pursuant to Rule

13a-16 or 15d-16 of

the Securities

Exchange Act of 1934

For the month of

November, 2024

Commission File

Number: 001-12518

Banco Santander,

S.A.

(Exact name of

registrant as specified in its charter)

Ciudad Grupo

Santander

28660 Boadilla

del Monte (Madrid) Spain

(Address of principal

executive office)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F:

Banco Santander,

S.A.

TABLE OF CONTENTS

Item |

|

| |

|

| 1 |

Report of Other Relevant Information dated November 21, 2024 |

Item

1

Banco Santander, S.A. (the “Bank”

or “Banco Santander”), in compliance with the Securities Market legislation, hereby communicates the following:

OTHER RELEVANT INFORMATION

Reference is made

to our notice of inside information of 27 August 2024 (official registry number 2371) (the “Buy-back Commencement Communication”),

relating to the buyback programme of own shares (the “Buy-back Programme”) approved by the Board of Directors of Banco

Santander.

Pursuant to article 5 of Regulation (EU) no. 596/2014

on Market Abuse of 16 April 2014, and articles 2.2 and 2.3 of Commission Delegated Regulation (EU) 2016/1052, of 8 March 2016, the Bank

informs of the transactions carried out over its own shares between 14 and 20 November 2024 (both inclusive).

The cash amount of the shares purchased to 20

November 2024 as a result of the execution of the Buy-back Programme amounts to 1,230,621,507 Euros, which represents approximately

80.7% of the maximum investment amount of the Buy-back Programme. The programme was announced together with its other characteristics

through the Buy-back Commencement Communication.

| Date |

Security |

Transaction |

Trading venue |

Number of shares |

Weighted average price (€) |

| 14/11/2024 |

SAN |

Purchase |

XMAD |

3,465,036 |

4.4803 |

| 14/11/2024 |

SAN |

Purchase |

CEUX |

412,521 |

4.4472 |

| 14/11/2024 |

SAN |

Purchase |

TQEX |

43,786 |

4.4472 |

| 14/11/2024 |

SAN |

Purchase |

AQEU |

78,657 |

4.4462 |

| 15/11/2024 |

SAN |

Purchase |

XMAD |

750,000 |

4.5613 |

| 18/11/2024 |

SAN |

Purchase |

XMAD |

1,360,269 |

4.5890 |

| 18/11/2024 |

SAN |

Purchase |

CEUX |

613,502 |

4.5878 |

| 18/11/2024 |

SAN |

Purchase |

TQEX |

89,039 |

4.5880 |

| 18/11/2024 |

SAN |

Purchase |

AQEU |

337,190 |

4.5886 |

| 19/11/2024 |

SAN |

Purchase |

XMAD |

5,336,492 |

4.5151 |

| 19/11/2024 |

SAN |

Purchase |

CEUX |

1,265,231 |

4.5037 |

| 19/11/2024 |

SAN |

Purchase |

TQEX |

67,029 |

4.5132 |

| 19/11/2024 |

SAN |

Purchase |

AQEU |

581,248 |

4.5133 |

| 20/11/2024 |

SAN |

Purchase |

XMAD |

2,634,447 |

4.5339 |

| 20/11/2024 |

SAN |

Purchase |

CEUX |

589,076 |

4.5519 |

| 20/11/2024 |

SAN |

Purchase |

TQEX |

58,543 |

4.5391 |

| 20/11/2024 |

SAN |

Purchase |

AQEU |

117,934 |

4.5496 |

| |

|

|

TOTAL |

17,800,000 |

|

Issuer name: Banco Santander, S.A. - LEI

5493006QMFDDMYWIAM13

Reference of the financial instrument: ordinary

shares - Code ISIN ES0113900J37

Detailed information of the transactions carried

out within the referred period is attached as Annex I.

Boadilla del Monte (Madrid), 21 November 2024

ANNEX I

Detailed information

on each of the transactions carried out within the context of the Buy-back Programme between 14/11/2024 and 20/11/2024 (both inclusive)

(https://www.santander.com/content/dam/santander-com/es/documentos/cumplimiento/do-anexo-i-07-nov-a-13-nov-2024.pdf))

SIGNATURE

Pursuant to the

requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

| |

|

Banco Santander, S.A. |

| |

|

|

| |

|

|

| Date: |

November 21, 2024 |

|

By: |

/s/ Pedro de Mingo Kaminouchi |

| |

|

|

|

Name: |

Pedro de Mingo Kaminouchi |

| |

|

|

|

Title: |

Head of Regulatory Compliance |

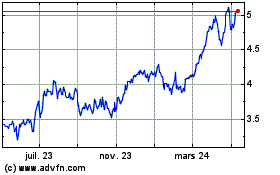

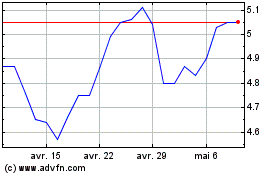

Banco Santander (NYSE:SAN)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

Banco Santander (NYSE:SAN)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025