Santander Holdings USA, Inc. Announces 2024 Stress Capital Buffer

28 Juin 2024 - 10:45PM

Business Wire

The Board of Governors of the Federal Reserve System (the

“Federal Reserve”) informed Santander Holdings USA, Inc. (“SHUSA”)

on June 26, 2024, of SHUSA’s updated stress capital buffer (“SCB”)

requirement, which becomes effective on October 1, 2024. SHUSA’s

updated SCB will be 3.5% of its Common Equity Tier 1 capital (CET1)

resulting in an overall CET1 capital requirement of 8.0%.

SHUSA’s strong capitalization supports our planned capital

actions and the updated SCB is consistent with our long-term

capital efficiency objectives.

As a Category IV firm under the Federal Reserve’s tailoring

rule, SHUSA was subject to the Federal Reserve’s 2024 Supervisory

Stress Test. SHUSA remains in the top half of the firms subject to

the Supervisory Stress Test when measured by the minimum forecasted

CET1 capital ratio and the decrease from starting to minimum CET1

capital ratio. As of March 31, 2024, SHUSA maintains $5.1 Billion

of excess CET1 capital over the 8.0% capital requirement.

The increase in SHUSA’s 2024 SCB from the current 7.0%

requirement is a result of an increase in the Federal Reserve’s

projected decline in CET1 under the severely adverse scenario,

which was last updated in the 2022 cycle, and planned

dividends.

SHUSA completes its own stress tests utilizing our internally

developed bank holding company stress scenario as well as the

scenarios provided by the Federal Reserve. In our 2024 stress

testing exercise, SHUSA maintains a strong capital position under

all forecasted scenarios, including the exploratory stagflation

scenarios included this year. SHUSA’s internal stress scenario

includes lower interest rates, high unemployment and large shocks

to used car and commercial real estate prices.

Santander Holdings USA, Inc. (SHUSA) is a wholly-owned

subsidiary of Madrid-based Banco Santander, S.A. (NYSE: SAN)

(Santander), recognized as one of the world’s most admired

companies by Fortune Magazine in 2024, with approximately 166

million customers in the U.S., Europe and Latin America. As the

intermediate holding company for Santander’s U.S. businesses, SHUSA

is the parent company of financial companies with more than 11,800

employees, 4.5 million customers, and assets of over $165 billion

in the fiscal year ended 2023. These include Santander Bank, N.A.,

Santander Consumer USA Holdings Inc., Banco Santander

International, Santander Securities LLC, Santander US Capital

Markets LLC and several other subsidiaries. Santander US is

recognized as a top 10 auto lender and a top 10 multifamily bank

lender, and has a growing wealth management business. For more

information about Santander US, please visit

www.santanderus.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240628889390/en/

Media: Andrew Simonelli andrew.simonelli@santander.us

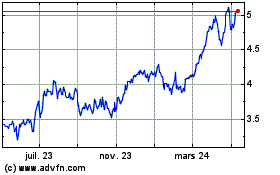

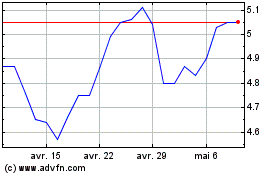

Banco Santander (NYSE:SAN)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Banco Santander (NYSE:SAN)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025