Filed Pursuant to Rule 433

Registration No. 333-271955

Dated: July 8, 2024

PRICING TERM SHEET

U.S.$750,000,000

Senior Preferred Callable Floating Rate Notes due 2028 (the “SP 2028 Floating Rate Notes”)

| Issuer: |

Banco Santander, S.A. |

| Series Number: |

SP-229 |

| Issuer Ratings*: |

A2 (Positive) / A+ (Stable) / A- (Stable) by Moody’s/S&P/Fitch |

| Expected Notes Ratings*: |

A2 / A+ / A (Moody’s / S&P / Fitch) |

| Status: |

Senior Preferred |

| Principal Amount: |

U.S.$750,000,000 |

| Form of Issuance: |

SEC Registered |

| Pricing Date: |

July 8, 2024 |

| Settlement Date**: |

July 15, 2024 (T+5) |

| Maturity Date: |

July 15, 2028 |

| Optional Redemption Date: |

July 15, 2027 |

| Type of Interest Rate: |

Floating Rate |

| Base Rate: |

Compounded SOFR, which is a compounded average of daily SOFR (the Secured Overnight Financing Rate) as determined by the Calculation Agent in respect of any Interest Period, in accordance with the formula specified in the preliminary prospectus supplement. |

| Floating Interest Rate: |

Base Rate plus the spread of 112 basis points per annum, subject to a minimum interest rate of 0% payable quarterly in arrears for each quarterly Interest Period from, and including, the Settlement Date to, but excluding, the Maturity Date. |

| Interest Payment Dates: |

Each January 15, April 15, July 15 and October 15, commencing on October 15, 2024 up to and including the Maturity Date or any date of earlier redemption. |

| Price to Public: |

100.000% of the Principal Amount |

| Redemption Price: |

100.000% |

| Underwriting Discount / Commission: |

0.250% |

| Proceeds to Issuer (after deducting Underwriting Discount / Commission): |

99.750% (U.S.$748,125,000). This amount is before deducting other expenses incurred in connection with this offering. The Underwriters will not reimburse the Issuer for any such expenses. |

| Day Count Fraction: |

Actual/360 (Modified, following, adjusted) |

| Optional Early Redemption (Call): |

Applicable as specified in the prospectus supplement |

| Early Redemption for Clean-up Call: |

Applicable as specified in the prospectus supplement |

| Early Redemption for TLAC/MREL Disqualification Event: |

Not Applicable |

| Early Redemption for Taxation Reasons: |

Applicable as specified in the prospectus supplement |

| Substitution and Variation: |

Applicable as specified in the prospectus supplement |

| Business Days: |

New York City, London and T2 |

| Minimum Denominations / Multiples: |

Minimum denominations of U.S.$200,000 and multiples of U.S.$200,000 in excess thereof |

| Listing: |

New York Stock Exchange |

| Trustee and Principal Paying Agent and Calculation Agent: |

The Bank of New York Mellon, London Branch |

| Governing Law: |

New York law, except that the authorization and execution by Banco Santander, S.A. of the Base Indenture, the Third Supplemental Indenture and the SP 2028 Floating Rate Notes and certain provisions of the SP 2028 Floating Rate Notes, the Base Indenture and the Third Supplemental Indenture related to the status of the SP 2028 Floating Rate Notes shall be governed and construed in accordance with Spanish Law. |

| Agreement to and Acknowledgement of Statutory Bail-in: |

By its acquisition of any SP 2028 Floating Rate Notes, each holder (including each holder of a beneficial interest in the SP 2028 Floating Rate) acknowledges, accepts, consents and agrees to be bound by the terms of the SP 2028 Floating Rate related to the exercise of the Spanish Bail-In Power. |

| Waiver of set-off: |

Applicable as specified in the prospectus supplement. |

| Risk Factors: |

Investors should read the information under the heading “Risk Factors” in the preliminary prospectus supplement dated July 8, 2024. |

| U.S. Federal Income Tax Considerations: |

For a discussion of the material U.S. federal income tax considerations for the ownership and disposition of the SP 2028 Floating Rate Notes by U.S. investors, see “Taxation—U.S. Federal Income Tax Considerations” in the preliminary prospectus supplement. That discussion does not describe all of the tax consequences that may be relevant in the light of a U.S. investor’s particular circumstances. |

| Selling Restrictions: |

Canada, EEA, United Kingdom, Hong Kong, Italy, Japan, People’s Republic of China (excluding Hong Kong, Macau and Taiwan), Republic of Korea, Taiwan, Singapore, Switzerland and Australia. No publicity or marketing nor public offering which requires the registration of a prospectus in Spain. The SP 2028 Floating Rate Notes are not intended to be offered, sold or otherwise made available to and should not be offered, sold or otherwise made available to any retail investor in the EEA and in the United Kingdom, as per the preliminary prospectus supplement. |

| Conflict of Interest: |

Santander US Capital Markets LLC is a subsidiary of Banco Santander, S.A. Therefore, Santander US Capital Markets LLC is deemed to have a “conflict of interest” under FINRA Rule 5121 and, accordingly, the offering of the SP 2028 Floating Rate Notes will comply with the applicable requirements of FINRA Rule 5121. |

| CUSIP / ISIN: |

05964H BE4 / US05964HBE45 |

| Sole Global Coordinator: |

Santander US Capital Markets LLC |

| Joint Bookrunners: |

Barclays Capital Inc.

BofA Securities, Inc.

Goldman Sachs Bank Europe SE

Jefferies LLC

Morgan Stanley & Co. LLC

Santander US Capital Markets LLC

Scotia Capital (USA) Inc.

Wells Fargo Securities, LLC |

| Co-Leads: |

Cabrera Capital Markets LLC

Caixa - Banco de Investimento, S.A.

CIBC World Markets Corp.

Loop Capital Markets LLC

Rabo Securities USA, Inc. |

*Any ratings obtained will reflect only the views

of the respective rating agency and should not be considered a recommendation to buy, sell or hold the SP 2028 Floating Rate Notes. The

ratings assigned by the rating agencies are subject to revision or withdrawal at any time by such rating agencies in their sole discretion.

Each rating should be evaluated independently of any other rating.

**It is expected that delivery of the SP 2028 Floating

Rate Notes will be made against payment therefore on or about July 15, 2024, which is the fifth day following the date hereof (such settlement

cycle being referred to as “T+5”). Under Rule 15c6-1 under the Securities Exchange Act of 1934, as amended, trades in the

secondary market are generally required to settle in one business day, unless the parties to any such trade expressly agree otherwise.

Accordingly, purchasers who wish to trade the SP 2028 Floating Rate Notes prior to the business day preceding the settlement date will

be required, by virtue of the fact that the SP 2028 Floating Rate Notes initially settle in T+5, to specify an alternative settlement

cycle at the time of any such trade to prevent failed settlement and should consult their own advisors.

The issuer has filed a registration statement (including

a base prospectus and a related preliminary prospectus supplement) with the U.S. Securities and Exchange Commission (SEC) for this offering.

Before you invest, you should read the preliminary prospectus supplement, the base prospectus in that registration statement, and other

documents the issuer has filed with the SEC for more complete information about the issuer and this offering. You may get these documents

for free by searching the SEC online database (EDGAR®) at www.sec.gov.

Alternatively, you may obtain a copy of the base

prospectus and the preliminary prospectus supplement from Barclays Capital Inc. by calling toll free 1-888-603-5847, BofA Securities,

Inc. by calling toll free 1-800-294-1322, Goldman Sachs Bank Europe SE by calling toll free 1-866-471-2526, Jefferies LLC by calling toll

free 1-877-877-0696, Morgan Stanley & Co. LLC by calling toll free 1-212-761-6691, Santander US Capital Markets LLC by calling toll

free 1-855-403-3636, Scotia Capital (USA) Inc. by calling toll free 1-800-372-3930 and Wells Fargo Securities, LLC by calling toll free

1-800-645-3751.

Capitalized terms used but not defined in this

term sheet have the meanings set forth in the base prospectus as supplemented by the preliminary prospectus supplement.

The distribution of this term sheet and the

offering of the securities to which this term sheet relates may be restricted by law in certain jurisdictions and therefore persons into

whose possession this term sheet comes should inform themselves about and observe any such restrictions. Any failure to comply with these

restrictions could result in a violation of the laws of any such jurisdiction.

EU PRIIPs Regulation / PROHIBITION OF SALES

TO EEA RETAIL INVESTORS: The SP 2028 Floating Rate Notes are not intended to be offered, sold or otherwise made available to

and should not be offered, sold or otherwise made available to any retail investor in the European Economic Area (“EEA”).

For these purposes, a retail investor means a person who is one (or more) of: (i) a retail client, as defined in point (11) of Article

4(1) of MiFID II; (ii) a customer within the meaning of Directive (EU) 2016/97 (as amended, (the “IDD”), where that

customer would not qualify as a professional client as defined in point (10) of Article 4(1) of MiFID II ; or (iii) not a qualified investor

as defined in the Prospectus Regulation. Consequently, no key information document required by Regulation (EU) No. 1286/2014 (the “EU

PRIIPs Regulation”) for offering or selling the SP 2028 Floating Rate Notes or otherwise making them available to retail investors

in the EEA has been prepared and therefore offering or selling the SP 2028 Floating Rate Notes or otherwise making them available to any

retail investor in the EEA may be unlawful under the EU PRIIPs Regulation.

UK PRIIPs Regulation / PROHIBITION OF SALES

TO UK RETAIL INVESTORS: The SP 2028 Floating Rate Notes are not intended to be offered, sold or otherwise made available to

and should not be offered, sold or otherwise made available to any retail investor in the United Kingdom (“UK”). For

these purposes, a retail investor means a person who is one (or more) of: (i) a retail client, as defined in point (8) of Article 2 of

Regulation (EU) No. 2017/565 as it forms part of UK domestic law by virtue of the European Union (Withdrawal) Act 2018 (“EUWA”);

or (ii) a customer within the meaning of the provisions of the FSMA and any rules or regulations made under the FSMA to implement IDD,

where that customer would not qualify as a professional client, as defined in point (8) of Article 2(1) of Regulation (EU) No. 600/2014

as it forms part of UK domestic law by virtue of the EUWA. Consequently, no key information document required by Regulation (EU) No. 1286/2014

as it forms part of UK domestic law by virtue of the EUWA (the “UK PRIIPs Regulation”) for offering or selling the

SP 2028 Floating Rate Notes or otherwise making them available to retail investors in the UK has been prepared and therefore offering

or selling the SP 2028 Floating Rate Notes or otherwise making them available to any retail investor in the UK may be unlawful under the

UK PRIIPs Regulation.

MIFID II PRODUCT GOVERNANCE/PROFESSIONAL INVESTORS

AND ECPS ONLY TARGET MARKET – Solely for the purposes of each manufacturer's product approval process, the target market assessment

in respect of the SP 2028 Floating Rate Notes has led to the conclusion that: (i) the target market for the SP 2028 Floating Rate Notes

is eligible counterparties and professional clients only, each as defined in MiFID II; and (ii) all channels for distribution of the SP

2028 Floating Rate Notes to eligible counterparties and professional clients are appropriate. The target market assessment indicates that

the SP 2028 Floating Rate Notes are incompatible with the needs, characteristics and objectives of clients which are retail clients (as

defined in MiFID II). Any person subsequently offering, selling, or recommending the SP 2028 Floating Rate Notes (a “distributor”)

should take into consideration the manufacturers' target market assessment; however, a distributor subject to MiFID II is responsible

for undertaking its own target market assessment in respect of the SP 2028 Floating Rate Notes (by either adopting or refining the manufacturers’

target market assessment) and determining appropriate distribution channels.

UK MIFIR PRODUCT GOVERNANCE/PROFESSIONAL INVESTORS

AND ECPS ONLY TARGET MARKET – Solely for the purposes of each manufacturer's product approval process, the target market assessment

in respect of the SP 2028 Floating Rate Notes has led to the conclusion that: (i) the target market for the SP 2028 Floating Rate Notes

is eligible counterparties, as defined in the FCA Handbook Conduct of Business Sourcebook (“COBS”), and professional

clients only, as defined in Regulation (EU) No. 600/2014 as it forms part of UK domestic law by virtue of the EUWA (“UK MiFIR”);

and (ii) all channels for distribution of the SP 2028 Floating Rate Notes to eligible counterparties and professional clients are appropriate.

The target market assessment indicates that the SP 2028 Floating Rate Notes are incompatible with the needs, characteristic and objectives

of clients which are retail clients (as defined in Regulation (EU) No 2017/565 as it forms part of the domestic law of the UK by virtue

of the EUWA). Any person subsequently offering, selling or recommending the SP 2028 Floating Rate Notes (a “distributor”)

should take into consideration the manufacturers' target market assessment; however, a distributor subject to the FCA Handbook Product

Intervention and Product Governance Sourcebook (the “UK MiFIR Product Governance Rules”) is responsible for undertaking

its own target market assessment in respect of the SP 2028 Floating Rate Notes (by either adopting or refining the manufacturers' target

market assessment) and determining appropriate distribution channels.

This term sheet is not an offer of securities

or investments for sale nor a solicitation of an offer to buy securities or investments in any jurisdiction where such offer or solicitation

would be unlawful. No action has been taken that would permit an offering of the SP 2028 Floating Rate Notes or possession or distribution

of this term sheet in any jurisdiction where action for that purpose is required. Persons into whose possession this term sheet comes

are required to inform themselves about and to observe any such restrictions.

PRICING TERM SHEET

U.S.$1,500,000,000 5.365% Senior

Preferred Callable Fixed-to-Fixed Rate Notes due 2028 (the “SP 2028 Fixed-to-Fixed Rate Notes”)

| Issuer: |

Banco Santander, S.A. |

| Series Number: |

SP-230 |

| Issuer Ratings*: |

A2 (Positive) / A+ (Stable) / A- (Stable) by Moody’s/S&P/Fitch |

| Expected Notes Ratings*: |

A2 / A+ / A (Moody’s / S&P / Fitch) |

| Status: |

Senior Preferred |

| Principal Amount: |

U.S.$1,500,000,000 |

| Form of Issuance: |

SEC Registered |

| Pricing Date: |

July 8, 2024 |

| Settlement Date**: |

July 15, 2024 (T+5) |

| Maturity Date: |

July 15, 2028 |

| Optional Redemption Date: |

July 15, 2027 |

| Benchmark Treasury: |

4.625 % UST due June 15, 2027 |

| Benchmark Treasury Yield: |

4.415% |

| Spread to Benchmark Treasury: |

T+95 bps |

| Re-offer Yield: |

5.365% |

| Coupon: |

5.365% per annum, from and including July 15, 2024 to, but excluding,

the Reset Date (as defined below).

If not redeemed at the Optional Redemption Date, U.S. Treasury Rate

(as defined below) plus 0.950% per annum, from and including, the Reset Date to, but excluding, July 15, 2028.

|

| Price to Public: |

100.000% of the Principal Amount |

| Redemption Price: |

100.000% |

| Underwriting Discount / Commission: |

0.250% |

| Proceeds to Issuer (after deducting Underwriting Discount / Commission): |

99.750% (U.S.$1,496,250,000). This amount is before deducting other expenses incurred in connection with this offering. The Underwriters will not reimburse the Issuer for any such expenses. |

| Initial Fixed Rate: |

From, and including, July 15, 2024 to, but excluding, the Reset Date at the rate of 5.365% per annum, payable semi-annually in arrears. |

| Reset Fixed Rate: |

From, and including, the Reset Date to, but excluding, July 15, 2028

(the “Reset Period”) at a fixed rate equal to the U.S. Treasury Rate (as defined below) as of the Reset Determination Date

(as defined below), plus 0.950% per annum, payable semi-annually in arrears.

U.S. Treasury Rate: means, in relation to the Reset Date and the Reset

Period commencing on the Reset Date, the rate per annum equal to: (1) the average of the yields on actively traded U.S. Treasury securities

adjusted to constant maturity, for one-year maturities, for the five (5) Business Days immediately prior to the Reset Determination Date,

published in the most recent H.15, for the maturity of one year; or (2) if such release (or any successor release) is not published during

the week immediately prior to the Reset Determination Date or does not contain such yields, the rate per annum equal to the semi-annual

equivalent yield to maturity of the Comparable Treasury Issue, calculated using a price for the Comparable Treasury Issue (expressed as

a percentage of its principal amount) equal to the Comparable Treasury Price for the Reset Date.

The U.S. Treasury Rate shall be determined by the Calculation Agent.

If the U.S. Treasury Rate cannot be determined, for whatever reason,

as described under (1) or (2) above, “U.S. Treasury Rate” means the rate in percentage per annum as notified by the Calculation

Agent to Banco Santander equal to the yield on U.S. Treasury securities having a maturity of one year as set forth in the most recent

H.15 (or any successor release, as determined by Banco Santander and notified to the Calculation Agent) at 5:00 p.m. (New York City time)

on the Reset Determination Date, as applicable.

“Calculation Agent” means the Trustee or such other person

authorized by Banco Santander as the party responsible for calculating the rate(s) of interest and interest amount(s) and/or such other

amount(s) from time to time in relation to the SP 2028 Fixed-to-Fixed Rate Notes.

“Comparable Treasury Issue” means, with respect to the Reset

Period, the U.S. Treasury security or securities selected by Banco Santander (and notified to the Calculation Agent) with a maturity date

on or about the last day of the Reset Period, and that would be utilized at the time of

|

| |

selection and in accordance with customary financial practice, in pricing

new issues of corporate debt securities denominated in U.S. dollars and having a maturity of one year.

“Comparable Treasury Price” means, with respect to the Reset

Date, (i) the arithmetic average of the Reference Treasury Dealer Quotations for the Reset Date (calculated on the Reset Determination

Date preceding the Reset Date), after excluding the highest and lowest such Reference Treasury Dealer Quotations, or (ii) if fewer than

five such Reference Treasury Dealer Quotations are received, the arithmetic average of all such quotations, or (iii) if fewer than two

such Reference Treasury Dealer Quotations are received, then such Reference Treasury Dealer Quotation as quoted in writing to Banco Santander

and the Calculation Agent by a Reference Treasury Dealer.

“H.15” means the daily statistical release designated as

such and published by the Board of Governors of the United States Federal Reserve System under the caption “Treasury constant maturities,”

or any successor or replacement publication, as determined by Banco Santander (and notified to the Calculation Agent) that establishes

yield on actively traded U.S. Treasury securities adjusted to constant maturity, and “most recent H.15” means in respect of

the Reset Period, the H.15 which includes a yield to maturity for U.S. Treasury securities with a maturity of one year published closest

in time but prior to the Reset Determination Date.

“Reference Treasury Dealer” means each of up to five banks

selected by Banco Santander, or the affiliates of such banks, which are (i) primary U.S. Treasury securities dealers, and their respective

successors, or (ii) market makers in pricing corporate bond issues denominated in U.S. dollars.

“Reference Treasury Dealer Quotations” means with respect

to each Reference Treasury Dealer and the Reset Date, the arithmetic average, as determined by the Calculation Agent, of the bid and offered

prices for the applicable Comparable Treasury Issue, expressed in each case as a percentage of its principal amount, at 11:00 a.m. (New

York City time), on the Reset Determination Date.

|

| Interest Payment Dates: |

Each January 15 and July 15, commencing on January 15, 2025 up to and including the Maturity Date or any date of earlier redemption. |

| Day Count Fraction: |

30/360 (following, unadjusted) |

| Optional Early Redemption (Call): |

Applicable as specified in the prospectus supplement |

| Early Redemption for TLAC/MREL Disqualification Event: |

Not Applicable |

| Early Redemption for Clean-Up Call: |

Applicable as specified in the prospectus supplement |

| Early Redemption for Taxation Reasons: |

Applicable as specified in the prospectus supplement |

| Substitution and Variation: |

Applicable as specified in the prospectus supplement |

| Business Days: |

New York City, London, and T2 |

| Reset Determination Date: |

The second Business Day immediately preceding the Reset Date |

| Reset Date: |

July 15, 2027 |

| Minimum Denominations / Multiples: |

Minimum denominations of U.S.$200,000 and multiples of U.S.$200,000 in excess thereof |

| Listing: |

New York Stock Exchange |

| Trustee and Principal Paying Agent and Calculation Agent: |

The Bank of New York Mellon, London Branch |

| Governing Law: |

New York law, except that the authorization and execution by Banco Santander, S.A. of the Base Indenture, the Third Supplemental Indenture and the SP 2028 Fixed-to-Fixed Rate Notes and certain provisions of the SP 2028 Fixed-to-Fixed Rate Notes, the Base Indenture and the Third Supplemental Indenture related to the status of the SP 2028 Fixed-to-Fixed Rate Notes shall be governed and construed in accordance with Spanish Law. |

| Agreement to and Acknowledgement of Statutory Bail-in: |

By its acquisition of any SP 2028 Fixed-to-Fixed Rate Notes, each holder (including each holder of a beneficial interest in the SP 2028 Fixed-to-Fixed Rate Notes) acknowledges, accepts, consents and agrees to be bound by the terms of the SP 2028 Fixed-to-Fixed Rate Notes related to the exercise of the Spanish Bail-In Power. |

| Waiver of set-off: |

Applicable as specified in the prospectus supplement. |

| Risk Factors: |

Investors should read the information under the heading “Risk

Factors” in the preliminary prospectus supplement dated July 8, 2024. Additionally, the following discussion supplements the information

under the heading “Risk Factors” in the preliminary prospectus supplement:

The interest rate on the SP 2028 Fixed-to-Fixed Rate Notes will reset

on the Reset Date.

|

| |

The interest rate on the SP 2028 Fixed-to-Fixed Rate Notes will initially

be 5.365% per annum in respect of the period from (and including) the date of issuance to (but excluding) the Reset Date. On the Reset

Date, the interest rate will be reset such that the applicable per annum interest rate on the SP 2028 Fixed-to-Fixed Rate Notes in respect

of the period from (and including) the Reset Date to (but excluding) the SP 2028 Fixed-to-Fixed Rate Notes Maturity Date will be a fixed

rate equal to the applicable U.S. Treasury Rate as of the Reset Determination Date plus 0.950%. As a result, the interest rate following

the Reset Date may be less than the initial interest rate, which would affect the amount of any interest payments under the SP 2028 Fixed-to-Fixed

Rate Notes and, by extension, could affect their market value.

The historical U.S. Treasury Rates are not an indication of future

U.S. Treasury Rates.

The historical U.S. Treasury Rates are not an indication of future U.S.

Treasury Rates. The interest rate on the SP 2028 Fixed-to-Fixed Rate Notes from and including the Reset Date to, but excluding, the SP

2028 Fixed-to-Fixed Rate Notes Maturity Date will be reset to a fixed per annum rate to be determined based on the applicable U.S. Treasury

Rate on the Reset Determination Date. In the past, U.S. Treasury Rates have experienced significant fluctuations. You should note that

historical levels, fluctuations and trends of U.S. Treasury Rates are not necessarily indicative of future levels. Any historical upward

or downward trend in U.S. Treasury Rates is not an indication that U.S. Treasury Rates are more or less likely to increase or decrease

at any time, and you should not take the historical U.S. Treasury Rates as an indication of future rates. You bear the financial risks

of fluctuations in the U.S. Treasury Rates and their effect on the interest on, and the market value of, the SP 2028 Fixed-to-Fixed Rate

Notes.

|

| U.S. Federal Income Tax Considerations: |

For a discussion of the material U.S. federal income tax considerations

for the ownership and disposition of the SP 2028 Fixed-to-Fixed Rate Notes by U.S. investors, see “Taxation—U.S. Federal Income

Tax Considerations” in the preliminary prospectus supplement, as supplemented by the discussion below. These discussions do not

describe all of the tax consequences that may be relevant in the light of a U.S. investor’s particular circumstances.

Additional Tax Disclosure

The following discussion supplements the discussion in the

|

| |

accompanying preliminary prospectus supplement under “Taxation—U.S.

Federal Income Tax Considerations” and the discussion in the prospectus under the caption “Taxation—U.S. Federal

Income Tax Considerations—Taxation of Debt Securities” solely as it relates to the SP 2028 Fixed-to-Fixed Rate Notes offered

hereby.

Characterization of the Notes

Although the matter is not free from doubt,

the SP 2028 Fixed-to-Fixed Rate Notes should be treated as “variable rate debt instruments” that provide for stated

interest at a single fixed rate followed by a qualified floating rate (“QFR”) for U.S. federal income tax purposes. Under

the Treasury Regulations applicable to variable rate debt instruments, in order to determine the amount of original issue discount (“OID”),

if any, in respect of the SP 2028 Fixed-to-Fixed Rate Notes, an equivalent fixed rate debt instrument must be constructed. The

equivalent fixed rate debt instrument is constructed in the following manner: (i) first, the initial fixed rate is converted to a

QFR that would preserve the fair market value of the SP 2028 Fixed-to-Fixed Rate Notes, and (ii) second, each QFR (including

the QFR determined under clause (i) above) is converted to a fixed rate substitute (which generally will be the value of that QFR

as of the issue date of the SP 2028 Fixed-to-Fixed Rate Notes). Under the applicable Treasury Regulations, the SP 2028 Fixed-to-Fixed Rate

Notes generally will be treated as providing for “qualified stated interest” at a rate equal to the lowest rate of interest

in effect at any time under the equivalent fixed rate debt instrument, and any interest under the equivalent fixed rate debt instrument

in excess of that rate generally would be treated as part of the stated redemption price at maturity and, therefore, as possibly giving

rise to OID. Based on the application of these rules to the SP 2028 Fixed-to-Fixed Rate Notes and the pricing terms of the SP

2028 Fixed-to-Fixed Rate Notes, we do not expect the SP 2028 Fixed-to-Fixed Rate Notes to be treated as issued with

OID.

If, contrary to our expectation, the SP 2028 Fixed-to-Fixed Rate Notes

are issued with OID, the rules described in “Taxation—U.S. Federal Income Tax Considerations—Taxation of Debt Securities—Original

Issue Discount” in the accompanying prospectus would apply to such Notes.

|

| Selling Restrictions: |

Canada, EEA, United Kingdom, Hong Kong, Italy, Japan, People’s Republic of China (excluding Hong Kong, Macau and Taiwan), Republic of Korea, Taiwan, Singapore, Switzerland and Australia. No publicity or marketing nor public offering which requires the registration of a prospectus in Spain. The SP 2028 Fixed-to-Fixed Rate Notes are not intended to be offered, sold or otherwise made available to and should |

| |

not be offered, sold or otherwise made available to any retail investor in the EEA and in the United Kingdom, as per the preliminary prospectus supplement. |

| Conflict of Interest: |

Santander US Capital Markets LLC is a subsidiary of Banco Santander, S.A. Therefore, Santander US Capital Markets LLC is deemed to have a “conflict of interest” under FINRA Rule 5121 and, accordingly, the offering of the SP 2028 Fixed-to-Fixed Rate Notes will comply with the applicable requirements of FINRA Rule 5121. |

| CUSIP / ISIN: |

05964H BF1 / US05964HBF10 |

| Sole Global Coordinator: |

Santander US Capital Markets LLC |

| Joint Bookrunners: |

Barclays Capital Inc.

BofA Securities, Inc.

Goldman Sachs Bank Europe SE

Jefferies LLC

Morgan Stanley & Co. LLC

Santander US Capital Markets LLC

Scotia Capital (USA) Inc.

Wells Fargo Securities, LLC |

| Co-Leads: |

Cabrera Capital Markets LLC

Caixa - Banco de Investimento, S.A.

CIBC World Markets Corp.

Loop Capital Markets LLC

Rabo Securities USA, Inc. |

*Any ratings obtained will reflect only the views

of the respective rating agency and should not be considered a recommendation to buy, sell or hold the SP 2028 Fixed-to-Fixed Rate Notes.

The ratings assigned by the rating agencies are subject to revision or withdrawal at any time by such rating agencies in their sole discretion.

Each rating should be evaluated independently of any other rating.

**It is expected that delivery of the SP 2028 Fixed-to-Fixed

Rate Notes will be made against payment therefore on or about July 15, 2024, which is the fifth day following the date hereof (such settlement

cycle being referred to as “T+5”). Under Rule 15c6-1 under the Securities Exchange Act of 1934, as amended, trades in the

secondary market are generally required to settle in one business day, unless the parties to any such trade expressly agree otherwise.

Accordingly, purchasers who wish to trade the SP 2028 Fixed-to-Fixed Rate Notes prior to the business day preceding the settlement date

will be required, by virtue of the fact that the SP 2028 Fixed-to-Fixed Rate Notes initially settle in T+5, to specify an alternative

settlement cycle at the time of any such trade to prevent failed settlement and should consult their own advisors.

The issuer has filed a registration statement (including

a base prospectus and a related preliminary prospectus supplement) with the U.S. Securities and Exchange Commission (SEC) for this offering.

Before you invest, you should read the preliminary prospectus supplement, the base prospectus in that registration statement, and other

documents the issuer has filed with the SEC for more complete information about the issuer and this offering. You may get these documents

for free by searching the SEC online database (EDGAR®) at www.sec.gov.

Alternatively, you may obtain a copy of the base

prospectus and the preliminary prospectus supplement from Barclays Capital Inc. by calling toll free 1-888-603-5847, BofA Securities,

Inc. by calling toll free 1-800-294-1322, Goldman Sachs Bank Europe SE by calling toll free 1-866-471-2526, Jefferies LLC by calling toll

free 1-877-877-0696, Morgan Stanley & Co. LLC by calling toll free 1-212-761-6691,

Santander US Capital Markets LLC by calling toll

free 1-855-403-3636, Scotia Capital (USA) Inc. by calling toll free 1-800-372-3930 and Wells Fargo Securities, LLC by calling toll free

1-800-645-3751.

Capitalized terms used but not defined in this

term sheet have the meanings set forth in the base prospectus as supplemented by the preliminary prospectus supplement.

The distribution of this term sheet and the

offering of the securities to which this term sheet relates may be restricted by law in certain jurisdictions and therefore persons into

whose possession this term sheet comes should inform themselves about and observe any such restrictions. Any failure to comply with these

restrictions could result in a violation of the laws of any such jurisdiction.

EU PRIIPs Regulation / PROHIBITION OF SALES

TO EEA RETAIL INVESTORS: The SP 2028 Fixed-to-Fixed Rate Notes are not intended to be offered, sold or otherwise made available

to and should not be offered, sold or otherwise made available to any retail investor in the European Economic Area (“EEA”).

For these purposes, a retail investor means a person who is one (or more) of: (i) a retail client, as defined in point (11) of Article

4(1) of MiFID II; (ii) a customer within the meaning of Directive (EU) 2016/97 (as amended, (the “IDD”), where that

customer would not qualify as a professional client as defined in point (10) of Article 4(1) of MiFID II ; or (iii) not a qualified investor

as defined in the Prospectus Regulation. Consequently, no key information document required by Regulation (EU) No. 1286/2014 (the “EU

PRIIPs Regulation”) for offering or selling the SP 2028 Fixed-to-Fixed Rate Notes or otherwise making them available to retail

investors in the EEA has been prepared and therefore offering or selling the SP 2028 Fixed-to-Fixed Rate Notes or otherwise making them

available to any retail investor in the EEA may be unlawful under the EU PRIIPs Regulation.

UK PRIIPs Regulation / PROHIBITION OF SALES

TO UK RETAIL INVESTORS: The SP 2028 Fixed-to-Fixed Rate Notes are not intended to be offered, sold or otherwise made available

to and should not be offered, sold or otherwise made available to any retail investor in the United Kingdom (“UK”).

For these purposes, a retail investor means a person who is one (or more) of: (i) a retail client, as defined in point (8) of Article

2 of Regulation (EU) No. 2017/565 as it forms part of UK domestic law by virtue of the European Union (Withdrawal) Act 2018 (“EUWA”);

or (ii) a customer within the meaning of the provisions of the FSMA and any rules or regulations made under the FSMA to implement IDD,

where that customer would not qualify as a professional client, as defined in point (8) of Article 2(1) of Regulation (EU) No. 600/2014

as it forms part of UK domestic law by virtue of the EUWA. Consequently, no key information document required by Regulation (EU) No. 1286/2014

as it forms part of UK domestic law by virtue of the EUWA (the “UK PRIIPs Regulation”) for offering or selling the

SP 2028 Fixed-to-Fixed Rate Notes or otherwise making them available to retail investors in the UK has been prepared and therefore offering

or selling the SP 2028 Fixed-to-Fixed Rate Notes or otherwise making them available to any retail investor in the UK may be unlawful under

the UK PRIIPs Regulation.

MIFID II PRODUCT GOVERNANCE/PROFESSIONAL INVESTORS

AND ECPS ONLY TARGET MARKET – Solely for the purposes of each manufacturer's product approval process, the target market assessment

in respect of the SP 2028 Fixed-to-Fixed Rate Notes has led to the conclusion that: (i) the target market for the SP 2028 Fixed-to-Fixed

Rate Notes is eligible counterparties and professional clients only, each as defined in MiFID II; and (ii) all channels for distribution

of the SP 2028 Fixed-to-Fixed Rate Notes to eligible counterparties and professional clients are appropriate. The target market assessment

indicates that the SP 2028 Fixed-to-Fixed Rate Notes are incompatible with the needs, characteristics and objectives of clients which

are retail clients (as defined in MiFID II). Any person subsequently offering, selling, or recommending the SP 2028 Fixed-to-Fixed Rate

Notes (a “distributor”) should take into consideration the manufacturers' target market assessment; however, a distributor

subject to MiFID II is responsible for undertaking its own target market assessment in respect of the SP 2028 Fixed-to-Fixed Rate Notes

(by either adopting or refining the manufacturers’ target market assessment) and determining appropriate distribution channels.

UK MIFIR PRODUCT GOVERNANCE/PROFESSIONAL INVESTORS

AND ECPS ONLY TARGET MARKET – Solely for the purposes of each manufacturer's product approval process, the target market assessment

in respect of the SP 2028 Fixed-to-Fixed Rate Notes has led to the conclusion that: (i) the target market for the SP 2028 Fixed-to-Fixed

Rate Notes is eligible counterparties, as defined in the FCA Handbook Conduct of Business Sourcebook (“COBS”), and

professional clients only, as defined in Regulation (EU) No. 600/2014 as it forms part of UK domestic law by virtue of the EUWA (“UK

MiFIR”); and (ii) all channels for distribution of the SP 2028 Fixed-to-Fixed Rate Notes to eligible counterparties and professional

clients are appropriate. The target market assessment indicates that the SP 2028 Fixed-to-Fixed Rate Notes are incompatible with the needs,

characteristic and objectives of clients which are retail clients (as defined in Regulation (EU) No 2017/565 as it forms part of the domestic

law of the UK by virtue of the EUWA). Any person subsequently offering, selling or recommending the SP 2028 Fixed-to-Fixed Rate Notes

(a “distributor”) should take into consideration the manufacturers' target market assessment; however, a distributor subject

to the FCA Handbook Product Intervention and Product Governance Sourcebook (the “UK MiFIR Product Governance Rules”)

is responsible for undertaking its own target market assessment in respect of the SP 2028 Fixed-to-Fixed Rate Notes (by either adopting

or refining the manufacturers' target market assessment) and determining appropriate distribution channels.

This term sheet is not an offer of securities

or investments for sale nor a solicitation of an offer to buy securities or investments in any jurisdiction where such offer or solicitation

would be unlawful. No action has been taken that would permit an offering of the SP 2028

Fixed-to-Fixed Rate Notes or possession or distribution

of this term sheet in any jurisdiction where action for that purpose is required. Persons into whose possession this term sheet comes

are required to inform themselves about and to observe any such restrictions.

PRICING TERM SHEET

U.S.$1,500,000,000 5.439% Senior

Preferred Fixed Rate Notes due 2031 (the “SP 2031 Fixed Rate Notes”)

| Issuer: |

Banco Santander, S.A. |

| Series Number: |

SP-232 |

| Issuer Ratings*: |

A2 (Positive) / A+ (Stable) / A- (Stable) by Moody’s/S&P/Fitch |

| Expected Notes Ratings*: |

A2 / A+ / A (Moody’s / S&P / Fitch) |

| Status: |

Senior Preferred |

| Principal Amount: |

U.S.$1,500,000,000 |

| Form of Issuance: |

SEC Registered |

| Pricing Date: |

July 8, 2024 |

| Settlement Date**: |

July 15, 2024 (T+5) |

| Maturity Date: |

July 15, 2031 |

| Benchmark Treasury: |

4.250% UST due June 30, 2031 |

| Benchmark Treasury Yield: |

4.239% |

| Spread to Benchmark Treasury: |

T+120 bps |

| Re-offer Yield: |

5.439% |

| Coupon: |

5.439% per annum, payable semi-annually in arrears. |

| Price to Public: |

100.000% of the Principal Amount |

| Underwriting Discount / Commission: |

0.350% |

| Proceeds to Issuer (after deducting Underwriting Discount / Commission): |

99.650% (U.S.$1,494,750,000). This amount is before deducting other expenses incurred in connection with this offering. Additionally, the Underwriters have agreed to reimburse the Issuer for $165,000 of such expenses. |

| Interest Payment Dates: |

Each January 15 and July 15, commencing on January 15, 2025 up to and including the Maturity Date or any date of earlier redemption. |

| Day Count Fraction: |

30/360 (following, unadjusted) |

| Optional Early Redemption (Call): |

Not Applicable |

| Early Redemption for TLAC/MREL Disqualification Event: |

Not Applicable |

| Early Redemption for Clean-up Call: |

Applicable as specified in the prospectus supplement |

| Early Redemption for Taxation Reasons: |

Applicable as specified in the prospectus supplement |

| Substitution and Variation: |

Applicable as specified in the prospectus supplement |

| Business Days: |

New York City, London, and T2 |

| Minimum Denominations / Multiples: |

Minimum denominations of U.S.$200,000 and multiples of U.S.$200,000 in excess thereof |

| Listing: |

New York Stock Exchange |

| Trustee and Principal Paying Agent and Calculation Agent: |

The Bank of New York Mellon, London Branch |

| Governing Law: |

New York law, except that the authorization and execution by Banco Santander, S.A. of the Base Indenture, the Third Supplemental Indenture and the SP 2031 Fixed Rate Notes and certain provisions of the SP 2031 Fixed Rate Notes, the Base Indenture and the Third Supplemental Indenture related to the status of the SP 2031 Fixed Rate Notes shall be governed and construed in accordance with Spanish Law. |

| Agreement to and Acknowledgement of Statutory Bail-in: |

By its acquisition of any SP 2031 Fixed Rate Notes, each holder (including each holder of a beneficial interest in the SP 2031 Fixed Rate Notes) acknowledges, accepts, consents and agrees to be bound by the terms of the SP 2031 Fixed Rate Notes related to the exercise of the Spanish Bail-In Power. |

| Waiver of set-off: |

Applicable as specified in the prospectus supplement. |

| Risk Factors: |

Investors should read the information under the heading “Risk Factors” in the preliminary prospectus supplement dated July 8, 2024. |

| U.S. Federal Income Tax Considerations: |

For a discussion of the material U.S. federal income tax considerations for the ownership and disposition of the SP 2031 Fixed Rate Notes by U.S. investors, see “Taxation—U.S. Federal Income Tax Considerations” in the preliminary prospectus supplement. That discussion does not describe all of the tax consequences that may be relevant in the light of a U.S. investor’s particular circumstances. |

| Selling Restrictions: |

Canada, EEA, United Kingdom, Hong Kong, Italy, Japan, People’s Republic of China (excluding Hong Kong, Macau and Taiwan), Republic of Korea, Taiwan, Singapore, Switzerland and Australia. No publicity or |

| |

marketing nor public offering which requires the registration of a prospectus in Spain. The SP 2031 Fixed Rate Notes are not intended to be offered, sold or otherwise made available to and should not be offered, sold or otherwise made available to any retail investor in the EEA and in the United Kingdom, as per the preliminary prospectus supplement. |

| Conflict of Interest: |

Santander US Capital Markets LLC is a subsidiary of Banco Santander, S.A. Therefore, Santander US Capital Markets LLC is deemed to have a “conflict of interest” under FINRA Rule 5121 and, accordingly, the offering of the SP 2031 Fixed Rate Notes will comply with the applicable requirements of FINRA Rule 5121. |

| CUSIP / ISIN: |

05964H BG9 / US05964HBG92 |

| Sole Global Coordinator: |

Santander US Capital Markets LLC |

| Joint Bookrunners: |

Barclays Capital Inc.

BofA Securities, Inc.

Goldman Sachs Bank Europe SE

Jefferies LLC

Morgan Stanley & Co. LLC

Santander US Capital Markets LLC

Scotia Capital (USA) Inc.

Wells Fargo Securities, LLC |

| Co-Leads: |

Cabrera Capital Markets LLC

Caixa - Banco de Investimento, S.A.

CIBC World Markets Corp.

Loop Capital Markets LLC

Rabo Securities USA, Inc. |

*Any ratings obtained will reflect only the views

of the respective rating agency and should not be considered a recommendation to buy, sell or hold the SP 2031 Fixed Rate Notes. The ratings

assigned by the rating agencies are subject to revision or withdrawal at any time by such rating agencies in their sole discretion. Each

rating should be evaluated independently of any other rating.

**It is expected that delivery of the SP 2031 Fixed

Rate Notes will be made against payment therefore on or about July 15, 2024, which is the fifth day following the date hereof (such settlement

cycle being referred to as “T+5”). Under Rule 15c6-1 under the Securities Exchange Act of 1934, as amended, trades in the

secondary market are generally required to settle in one business day, unless the parties to any such trade expressly agree otherwise.

Accordingly, purchasers who wish to trade the SP 2031 Fixed Rate Notes prior to the business day preceding the settlement date will be

required, by virtue of the fact that the SP 2031 Fixed Rate Notes initially settle in T+5, to specify an alternative settlement cycle

at the time of any such trade to prevent failed settlement and should consult their own advisors.

The issuer has filed a registration statement (including

a base prospectus and a related preliminary prospectus supplement) with the U.S. Securities and Exchange Commission (SEC) for this offering.

Before you invest, you should read the preliminary prospectus supplement, the base prospectus in that registration statement, and other

documents the issuer has filed with the SEC for more complete information about the issuer and this offering. You may get these documents

for free by searching the SEC online database (EDGAR®) at www.sec.gov.

Alternatively, you may obtain a copy of the base

prospectus and the preliminary prospectus supplement from Barclays Capital Inc. by calling toll free 1-888-603-5847, BofA Securities,

Inc. by calling toll free 1-800-294-1322, Goldman Sachs Bank Europe SE by calling toll free 1-866-471-2526, Jefferies LLC by calling toll

free 1-877-877-0696, Morgan Stanley & Co. LLC by calling toll free 1-212-761-6691, Santander US Capital Markets LLC by calling toll

free 1-855-403-3636, Scotia Capital (USA) Inc. by calling toll free 1-800-372-3930 and Wells Fargo Securities, LLC by calling toll free

1-800-645-3751.

Capitalized terms used but not defined in this

term sheet have the meanings set forth in the base prospectus as supplemented by the preliminary prospectus supplement.

The distribution of this term sheet and the

offering of the securities to which this term sheet relates may be restricted by law in certain jurisdictions and therefore persons into

whose possession this term sheet comes should inform themselves about and observe any such restrictions. Any failure to comply with these

restrictions could result in a violation of the laws of any such jurisdiction.

EU PRIIPs Regulation / PROHIBITION OF SALES

TO EEA RETAIL INVESTORS: The SP 2031 Fixed Rate Notes are not intended to be offered, sold or otherwise made available to and

should not be offered, sold or otherwise made available to any retail investor in the European Economic Area (“EEA”).

For these purposes, a retail investor means a person who is one (or more) of: (i) a retail client, as defined in point (11) of Article

4(1) of MiFID II; (ii) a customer within the meaning of Directive (EU) 2016/97 (as amended, (the “IDD”), where that

customer would not qualify as a professional client as defined in point (10) of Article 4(1) of MiFID II ; or (iii) not a qualified investor

as defined in the Prospectus Regulation. Consequently, no key information document required by Regulation (EU) No. 1286/2014 (the “EU

PRIIPs Regulation”) for offering or selling the SP 2031 Fixed Rate Notes or otherwise making them available to retail investors

in the EEA has been prepared and therefore offering or selling the SP 2031 Fixed Rate Notes or otherwise making them available to any

retail investor in the EEA may be unlawful under the EU PRIIPs Regulation.

UK PRIIPs Regulation / PROHIBITION OF SALES

TO UK RETAIL INVESTORS: The SP 2031 Fixed Rate Notes are not intended to be offered, sold or otherwise made available to and

should not be offered, sold or otherwise made available to any retail investor in the United Kingdom (“UK”). For these

purposes, a retail investor means a person who is one (or more) of: (i) a retail client, as defined in point (8) of Article 2 of Regulation

(EU) No. 2017/565 as it forms part of UK domestic law by virtue of the European Union (Withdrawal) Act 2018 (“EUWA”);

or (ii) a customer within the meaning of the provisions of the FSMA and any rules or regulations made under the FSMA to implement IDD,

where that customer would not qualify as a professional client, as defined in point (8) of Article 2(1) of Regulation (EU) No. 600/2014

as it forms part of UK domestic law by virtue of the EUWA. Consequently, no key information document required by Regulation (EU) No. 1286/2014

as it forms part of UK domestic law by virtue of the EUWA (the “UK PRIIPs Regulation”) for offering or selling the

SP 2031 Fixed Rate Notes or otherwise making them available to retail investors in the UK has been prepared and therefore offering or

selling the SP 2031 Fixed Rate Notes or otherwise making them available to any retail investor in the UK may be unlawful under the UK

PRIIPs Regulation.

MIFID II PRODUCT GOVERNANCE/PROFESSIONAL INVESTORS

AND ECPS ONLY TARGET MARKET – Solely for the purposes of each manufacturer's product approval process, the target market assessment

in respect of the SP 2031 Fixed Rate Notes has led to the conclusion that: (i) the target market for the SP 2031 Fixed Rate Notes is eligible

counterparties and professional clients only, each as defined in MiFID II; and (ii) all channels for distribution of the SP 2031 Fixed

Rate Notes to eligible counterparties and professional clients are appropriate. The target market assessment indicates that the SP 2031

Fixed Rate Notes are incompatible with the needs, characteristics and objectives of clients which are retail clients (as defined in MiFID

II). Any person subsequently offering, selling, or recommending the SP 2031 Fixed Rate Notes (a “distributor”) should take

into consideration the manufacturers' target market assessment; however, a distributor subject to MiFID II is responsible for undertaking

its own target market assessment in respect of the SP 2031 Fixed Rate Notes (by either adopting or refining the manufacturers’ target

market assessment) and determining appropriate distribution channels.

UK MIFIR PRODUCT GOVERNANCE/PROFESSIONAL INVESTORS

AND ECPS ONLY TARGET MARKET – Solely for the purposes of each manufacturer's product approval process, the target market assessment

in respect of the SP 2031 Fixed Rate Notes has led to the conclusion that: (i) the target market for the SP 2031 Fixed Rate Notes is eligible

counterparties, as defined in the FCA Handbook Conduct of Business Sourcebook (“COBS”), and professional clients only,

as defined in Regulation (EU) No. 600/2014 as it forms part of UK domestic law by virtue of the EUWA (“UK MiFIR”);

and (ii) all channels for distribution of the SP 2031 Fixed Rate Notes to eligible counterparties and professional clients are appropriate.

The target market assessment indicates that the SP 2031 Fixed Rate Notes are incompatible with the needs, characteristic and objectives

of clients which are retail clients (as defined in Regulation (EU) No 2017/565 as it forms part of the domestic law of the UK by virtue

of the EUWA). Any person subsequently offering, selling or recommending the SP 2031 Fixed Rate Notes (a “distributor”) should

take into consideration the manufacturers' target market assessment; however, a distributor subject to the FCA Handbook Product Intervention

and Product Governance Sourcebook (the “UK MiFIR Product Governance Rules”) is responsible for undertaking its own

target market assessment in respect of the SP 2031 Fixed Rate Notes (by either adopting or refining the manufacturers' target market assessment)

and determining appropriate distribution channels.

This term sheet is not an offer of securities

or investments for sale nor a solicitation of an offer to buy securities or investments in any jurisdiction where such offer or solicitation

would be unlawful. No action has been taken that would permit an offering of the SP 2031 Fixed Rate Notes or possession or distribution

of this term sheet in any jurisdiction where action for that purpose is required. Persons into whose possession this term sheet comes

are required to inform themselves about and to observe any such restrictions.

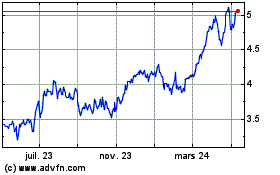

Banco Santander (NYSE:SAN)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

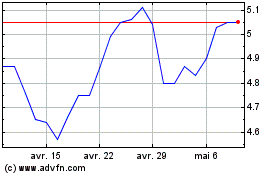

Banco Santander (NYSE:SAN)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025