Santander Bank Earns “Outstanding” Community Reinvestment Act Rating by the OCC

16 Septembre 2024 - 4:33PM

Business Wire

Santander Announced New, $13.6 Billion

Community Plan in 2023 to Further its Commitment to Local

Communities

Santander Bank, N.A. (“Santander” or “the Bank”) today announced

that it has earned an overall “Outstanding” Community Reinvestment

Act (CRA) rating from the Office of the Comptroller of the Currency

(OCC) for the 2020-2022 exam period. Performance evaluations occur

every three years. Santander also received “Outstanding”

region-specific performance ratings in the major metropolitan areas

of Boston, New York, and Philadelphia – three of the Bank’s core

markets. Both represent the highest possible rating and is the

result of achieving Outstanding ratings on each of the lending,

investment and service tests.

“Achieving an Outstanding assessment for the second-consecutive

exam period is a testament to Santander’s unwavering commitment to

make a positive impact in the communities where we live and work,”

said Tim Wennes, Santander US CEO. “Santander has a track

record of working to build stronger communities, and we remain

committed to supporting our customers at every stage in life. I’m

particularly proud of our employees’ hard work to help consumers

and businesses across all economic spectrums prosper.”

The full performance evaluation is available here. In its

report, the OCC called out several areas where Santander

excelled:

- Flexibility to borrowers and customers at the onset of the

COVID-19 and through the evaluation period, including the

origination of more than 20,000 loans totaling over $1.8 billion

through the Small Business Administration’s Paycheck Protection

Program to support small businesses across the Bank’s footprint

impacted by the pandemic.

- Excellent responsiveness to community credit needs, including

continuing to be a leader in community development lending for the

purpose of maintaining, creating, or preserving affordable housing

– a critical need within the communities where the Bank

operates.

- Significant community investments and grants, including through

the Santander US Cultivate Small Business program, which helps

early-stage entrepreneurs build and sustain businesses in the food

industry, with a focus on supporting woman-, immigrant-, and

BIPOC-owned businesses in low-to-moderate income

neighborhoods.

- Ensuring products and services are readily accessible to

geographies and individuals of different income levels and offer

customers a safe, affordable and useful banking offering to access

and manage their money. This includes Santander® Safety Net, the

Bank’s industry-leading flexible overdraft policy, the introduction

of Santander® Essential Checking and continued enhancements to

Simply Right® Checking and Santander® Savings accounts.

Santander US announced in 2023 its latest Community Plan,

a three-year, $13.6 billion commitment on behalf of Santander’s

businesses across the United States that includes:

- $1.5 billion in small business lending

- $3 billion in community development lending and investments,

with more than $2.5 billion in affordable housing

- $9 billion in sustainable finance investment, with a focus on

renewable energy

- 100% increase in direct supplier diversity spending

- $100 million in charitable giving to nonprofit

organizations

- 100,000 employee volunteer hours in underserved

communities

Santander Bank, N.A. is one of the country’s leading

retail and commercial banks, with $102 billion in assets. With its

corporate offices in Boston, the Bank’s more than 5,100 employees

and more than 1.8 million customers are principally located in

Massachusetts, New Hampshire, Connecticut, Rhode Island, New York,

New Jersey, Pennsylvania and Delaware. The Bank is a wholly-owned

subsidiary of Madrid-based Banco Santander, S.A. (NYSE: SAN),

recognized as one of the world’s most admired companies by Fortune

Magazine in 2024, with 168 million customers in the U.S., Europe,

and Latin America. It is overseen by Santander Holdings USA, Inc.,

Banco Santander’s intermediate holding company in the U.S. For more

information on Santander Bank, please visit

www.santanderbank.com.

Santander Bank, N.A. is a Member FDIC and a wholly owned

subsidiary of Banco Santander, S.A. © 2024 Santander Bank, N.A. All

rights reserved. Santander, Santander Bank, the Flame Logo are

trademarks of Banco Santander, S.A. or its subsidiaries in the

United States or other countries. All other trademarks are the

property of their respective owners.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240916451654/en/

Victoria Day Victoria.day@santander.us

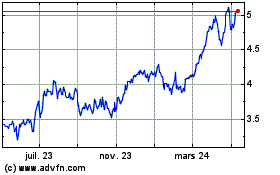

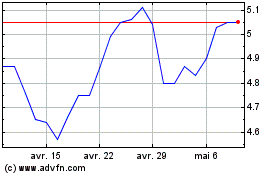

Banco Santander (NYSE:SAN)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Banco Santander (NYSE:SAN)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025