false

0001551901

0001551901

2023-11-21

2023-11-21

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): November 22, 2023

(November 21, 2023)

Stellus Capital Investment Corporation

(Exact Name of Registrant as Specified in Charter)

| Maryland |

|

814-00971 |

|

46-0937320 |

|

(State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

| |

|

4400

Post Oak Parkway, Suite

2200

Houston,

Texas |

|

77027 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s Telephone Number, Including

Area Code: (713) 292-5400

Not applicable

(Former Name or Former Address, if Changed Since

Last Report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

| |

¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| |

|

|

| |

¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Securities registered pursuant to Section 12(b) of the Act: |

| |

|

Title of each class |

Trading

Symbol(s) |

Name of each exchange on which registered |

| Common Stock, par value $0.001 per share |

SCM |

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 1.01 Entry into a Material Definitive Agreement.

On November 21, 2023,

Stellus Capital Investment Corporation (the “Company”) entered into the Fourth Amendment to Amended and Restated Senior

Secured Revolving Credit Agreement (the “Fourth Amendment Agreement”) by and among the Company, as the borrower, Zions

Bancorporation, N.A. dba Amegy Bank (“Amegy Bank”), as the administrative agent, and the lenders that are party thereto

from time to time (collectively, the “Lenders”). The Fourth Amendment Agreement further amends the Amended and Restated

Senior Secured Revolving Credit Agreement dated September 18, 2020 (as amended by the First Amendment and Commitment Increase to

Amended and Restated Senior Secured Revolving Credit Agreement, dated December 22, 2021, the Second Amendment to Amended and

Restated Senior Secured Revolving Credit Agreement dated February 28, 2022, and the Third Amendment and Commitment Increase to

Amended and Restated Senior Secured Revolving Credit Agreement, dated May 13, 2022, the “Existing Credit Facility”) by

and among the Company, Amegy Bank, as the administrative agent, and the Lenders that are party thereto from time to time. The Fourth Amendment Agreement, among other things, (i) decreases the maximum commitment under the Existing Credit Facility from $265,000,000

to $260,000,000, (ii) increases the maximum accordion limit from $315,000,000 to $350,000,000, (iii) authorizes the replacement of CDOR

with a CORRA benchmark rate to be agreed for advances in Canadian Dollars, (iv) extends the Commitment Termination Date to November 21,

2027 and Final Maturity Date to November 21, 2028, and (v) reduces the Company's interest coverage ratio requirement from 2.00:1.00 to

1.75:1.00.

Capitalized terms under this

Item 1.01, unless otherwise defined herein, have the meaning ascribed to them under the Existing Credit Facility. The description above

is only a summary of the material provisions of the Fourth Amendment Agreement and is qualified in its entirety by reference to a copy

of the Fourth Amendment Agreement, which is filed as Exhibit 10.1 to this current report on Form 8-K and incorporated by reference herein.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation

under an Off-Balance Sheet Arrangement of Registrant.

The information contained in Item 1.01 to this

current report on Form 8-K is by this reference incorporated in this Item 2.03.

Item 9.01 Financial Statements

and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: November 22, 2023 |

STELLUS CAPITAL INVESTMENT CORPORATION |

| |

|

|

| |

|

|

| |

By: |

/s/ W. Todd Huskinson |

| |

|

W. Todd Huskinson |

| |

|

Chief Financial Officer |

Exhibit 10.1

FOURTH AMENDMENT TO

AMENDED AND RESTATED SENIOR SECURED REVOLVING

CREDIT AGREEMENT

THIS FOURTH AMENDMENT TO AMENDED

AND RESTATED SENIOR SECURED REVOLVING CREDIT AGREEMENT dated as of November 21, 2023 (this “Amendment”),

is among STELLUS CAPITAL INVESTMENT CORPORATION, a Maryland corporation (the “Borrower”), the LENDERS party

hereto, and ZIONS BANCORPORATION, N.A. dba AMEGY BANK, as Administrative Agent. Capitalized terms used herein and not otherwise defined

shall have the meanings given to such terms in Article I of this Amendment.

W

I T N E S S E T H:

WHEREAS, the Borrower, the

Lenders and the Administrative Agent are parties to that certain Amended and Restated Senior Secured Revolving Credit Agreement, dated

as of September 18, 2020 (as amended by that First Amendment and Commitment Increase to Amended and Restated Senior Secured Revolving

Credit Agreement dated December 22, 2021, that Second Amendment to Amended and Restated Senior Secured Revolving Credit Agreement

dated February 28, 2022, that Third Amendment and Commitment Increase to Amended and Restated Senior Secured Revolving Credit Agreement

dated May 13, 2022, and as further amended, supplemented, and restated or otherwise modified, the “Credit Agreement”);

WHEREAS, the Borrower requests

certain amendments to the Credit Agreement, including (i) a change in the total Commitments, (ii) an extension of the Commitment

Termination Date and Final Maturity Date, and (iii) the authorization to replace CDOR with the CORRA benchmark, in each case as more

fully set forth herein; and

WHEREAS, the Lenders are willing,

on the terms and subject to the conditions hereinafter set forth, to agree to the amendments set forth below and the other terms hereof.

NOW, THEREFORE, the parties

hereto hereby covenant and agree as follows:

ARTICLE I

DEFINITIONS

Section 1.1 Certain

Definitions. The following terms when used in this Amendment shall have the following meanings (such meanings to be equally applicable

to the singular and plural forms thereof):

“Amendment”

is defined in the preamble.

“Borrower”

is defined in the preamble.

“Credit Agreement”

is defined in the first recital.

“Fourth Amendment Effective

Date” is defined in Article III.

Section 1.2 Other

Definitions. Capitalized terms used in this Amendment but not defined herein, shall have the meanings given such terms in the Credit

Agreement.

ARTICLE II

AMENDMENTS TO CREDIT AGREEMENT

Section 2.1 Amendments

to Credit Agreement.

(a) Section 1.01

(Definitions) of the Credit Agreement is amended to (i) delete the defined term “Unsecured Notes Due 2022” in its entirety,

and (ii) add the following new defined terms in their appropriate alphabetical order:

“Fourth Amendment”

means that certain Fourth Amendment to Amended and Restated Senior Secured Revolving Credit Agreement dated November 21, 2023, among

the Borrower, the Lenders, and the Administrative Agent.

“Fourth Amendment

Effective Date” means November 21, 2023.

“Unsecured Notes”

means the Borrower’s 4.875% Notes due 2026, issued pursuant to that certain Indenture dated May 5, 2014, between the Borrower,

as issuer, and U.S. Bank National Association, as trustee, as supplemented from time to time.

(b) Section 1.01

(Definitions) of the Credit Agreement is amended to delete the definitions of “Commitment Termination Date”, “Federal

Funds Effective Rate”, “Final Maturity Date”, and “Scheduled Payment Date” in their entirety and to replace

them with the following:

“Commitment Termination

Date” means November 21, 2027, as such date may be extended upon the consent of each affected Lender and the payment

by Borrower of a then-market commitment fee.

“Federal Funds

Effective Rate” means, for any day, the weighted average (rounded upwards, if necessary, to the next 1/100 of 1%) of the

rates on overnight Federal funds transactions with members of the Federal Reserve System arranged by Federal funds brokers, as published

on the next succeeding Business Day by the Federal Reserve Bank of New York, or, if such rate is not so published for any day that is

a Business Day, the average (rounded upwards, if necessary, to the next 1/100 of 1%) of the quotations for such day for such transactions

received by the Administrative Agent from three Federal funds brokers of recognized standing selected by it; provided that if the

Federal Funds Effective Rate as so determined shall ever be less than the Floor, then the Federal Funds Effective Rate shall be deemed

to be the Floor.

“Final Maturity

Date” means November 21, 2028.

“Scheduled Payment

Date” means the 15th day of each calendar month beginning December 15, 2027, and continuing on the 15th

day of each calendar month thereafter through and including the Final Maturity Date.

(c) The

last sentence of the definition of “Commitments” in Section 1.01 of the Credit Agreement is deleted in

its entirety and replaced with the following sentence: “The aggregate amount of all Dollar Lenders’ Commitments as of the

Fourth Amendment Effective Date is $260,000,000.”

(d) The

definitions of “Permitted Refinancing” and “Unsecured Longer-Term Indebtedness” in Section 1.01

of the Credit Agreement are each amended to delete the defined term “Unsecured Notes Due 2022” where it appears and to replace

it with the new defined term “Unsecured Notes”.

(e) Clauses

(A) and (B) of Section 2.08(e)(i) (Increase of the Commitments) of the Credit

Agreement are deleted in their entirety and replaced with the following clauses:

“(A) the

minimum amount of the Commitment of any Assuming Lender, and the minimum amount of the increase of the Commitment of any Increasing Lender,

as part of such Commitment Increase shall be $15,000,000 or a larger multiple of $5,000,000 in excess thereof (or such lesser amount as

the Administrative Agent may reasonably agree);

(B) immediately

after giving effect to such Commitment Increase, the total Commitments of all of the Lenders hereunder shall not exceed $350,000,000;”

(f) Clause

(a) of Section 5.13 (Calculation of Borrowing Base) is amended to replace “20%” with “12%”

whereby such clause (a) shall read in its entirety as follows:

“(a) the

Advance Rate applicable to that portion of the aggregate Value of the Portfolio Investments of all issuers in a consolidated group of

corporations or other entities (collectively, a “Consolidated Group”) exceeding 12% of Shareholders’

Equity of the Borrower (which, for purposes of this calculation shall exclude the aggregate amount of investments in, and advances to,

Financing Subsidiaries) shall be 0%;”

(g) Section 5.14

(Refinancing of Unsecured Notes Due 2022) of the Credit Agreement is deleted in its entirety and replaced with the following:

“Section 5.14 Refinancing

of Unsecured Notes. By no later than September 30, 2025, the Borrower shall cause at least the entire outstanding principal

balance of the Unsecured Notes to be extended and refinanced under the terms of a Permitted Refinancing that complies with this Agreement

(including, but not limited to, Section 6.01(b)).”

(h) Section 6.07(a) (Minimum

Shareholders’ Equity) of the Credit Agreement is deleted in its entirety and replaced with the following:

“(a) Minimum

Shareholders’ Equity. The Borrower will not permit Shareholders’ Equity at the last day of any fiscal quarter of the Borrower

to be less than $173,255,660 plus 25% of the net proceeds of the sale of Equity Interests by the Borrower and its Subsidiaries

after June 30, 2023 (other than proceeds of sales of Equity Interests by and among the Borrower and its Subsidiaries).”

(i) Section 6.07(d) (Interest

Coverage Ratio) of the Credit Agreement is deleted in its entirety and replaced with the following:

“(d) Interest

Coverage Ratio. The Borrower will not permit the Interest Coverage Ratio to be less than 1.75 : 1.00 as of the last day of Borrower’s

fiscal quarter ending December 31, 2023, and the last day of each fiscal quarter thereafter.”

(j) Section 6.01(b) (Indebtedness),

Section 6.11 (Modifications of Unsecured Notes Due 2022 and Unsecured Longer-Term Indebtedness Documents), and Section 6.12

(Payments of Unsecured Notes Due 2022, SBA Debentures, and Unsecured Longer-Term Indebtedness) of the Credit Agreement are amended

to delete the defined term “Unsecured Notes Due 2022” and replace it in each place with the new defined term “Unsecured

Notes”.

(k) The

last sentence of Section 9.02(b) (Amendments to this Agreement) is deleted in its entirety and replaced with the

following:

“Notwithstanding

the foregoing, (i) amendments and modifications to Annex A may be approved and executed in accordance with Section 2.01(b) hereof,

and (ii) amendments and supplements to this Agreement and the other Loan Documents for the purpose of replacing the CDOR Rate and

Adjusted CDOR Rate may be made in accordance with the terms of the Fourth Amendment.”

(l) Schedule 1.01(b) (Commitments)

is amended and restated in its entirety in the form of Schedule 1.01(b) to this Amendment. On the Fourth Amendment

Effective Date, adjustments of Borrowings will be made that will result in, after giving effect to all such deemed prepayments and borrowings,

such Loans and participations in Letters of Credit, Swingline Loans and Multicurrency Loans being held by the Lenders ratably in accordance

with their Commitments, after giving effect to the Commitments set forth on Schedule 1.01(b) attached hereto. Each

Lender party hereto hereby waives any breakage fees or other amounts to which such Lender may otherwise be entitled under Section 2.15

of the Credit Agreement, which may result from the prepayment of any Loan of that Lender on the Fourth Amendment Effective Date as a result

of the foregoing adjustments.

Section 2.2 Amendments

to Replace CDOR.

(a) At

any time following the Fourth Amendment Effective Date, the Lenders covenant and agree that Administrative Agent, Multicurrency Lender,

and the Borrower are authorized to enter into amendments or supplements to the Credit Agreement and the other Loan Documents for the purpose

of replacing the CDOR Rate and Adjusted CDOR Rate with a CORRA benchmark rate for Multicurrency Loans denominated in CAD and making technical,

administrative or operational changes (including but not limited to timing and frequency of determining rates and making payments of interest,

and timing of Borrowing Requests) pursuant to a written agreement which is approved and executed by the Administrative Agent, Multicurrency

Lender and the Borrower (whether one or more amendments, the “CORRA Amendment”). “CORRA”

means the Canadian Overnight Repo Rate Average as administered and published by the CORRA Administrator. “CORRA Administrator”

means the Bank of Canada (or any successor administrator of the Canadian Overnight Repo Rate Average).

(b) Each

Lender consents and agrees that the definitive CORRA Amendment may expressly provide that:

(i) the

CORRA benchmark rate may be a forward-looking term rate (administered by CanDeal Benchmark Administration Services Inc., TSX, Inc.

or a successor administrator of the forward-looking term rate selected by the Administrative Agent in its reasonable discretion) and/or

a daily compounded rate and may also include options to borrow Multicurrency Loans denominated in CAD as Canadian prime rate loans;

(ii) the

Administrative Agent is authorized to make technical, administrative or operational changes from time to time to use, administer, adopt

or implement the CORRA benchmark with respect to Multicurrency Loans denominated in CAD without any further action or consent of any other

party to this Agreement or any other Loan Document;

(iii) Multicurrency

Loans in CAD made by the Multicurrency Lender shall remain subject to participation by each Lender as provided in Section 2.01 of

the Credit Agreement; and

(iv) when

executed by the Administrative Agent, the CORRA Amendment will be conclusive and binding on each Lender and each Lender authorizes the

Administrative Agent to enter into the CORRA Amendment on such Lender’s behalf and on such terms as are acceptable to the Administrative

Agent.

ARTICLE III

CONDITIONS TO EFFECTIVENESS

Section 3.1 Effective

Date. This Amendment shall become effective on the date (the “Fourth Amendment Effective Date”) when the

Administrative Agent shall have received:

(a) counterparts

of this Amendment duly executed and delivered on behalf of the Borrower, each Lender, and the Administrative Agent, together with the

Subsidiary Guarantors’ Consent and Agreement executed by each Subsidiary Guarantor;

(b) a

Revolving Credit Note executed by Borrower in the maximum principal amount of each Lender’s Commitment, as requested by any Lender;

(c) an

Officer’s Certificate of Borrower, certifying as to incumbency of officers, specimen signatures, organizational documents, and resolutions

adopted by the Board of Directors of Borrower authorizing this Amendment, in form and substance satisfactory to Administrative Agent;

(d) satisfactory

results of UCC lien search reports of Borrower and each Subsidiary Guarantor from each applicable jurisdiction;

(e) a

certificate of existence/good standing for Borrower and each Subsidiary Guarantor from its jurisdiction of formation;

(f) a

legal opinion of counsel to Borrower with respect to this Amendment in form and substance acceptable to the Administrative Agent; and

(g) payment

by the Borrower of all fees payable pursuant to the Fourth Amendment Fee Letter dated as of the date hereof between the Borrower and Amegy

Bank.

ARTICLE IV

MISCELLANEOUS

Section 4.1 Representations.

The Borrower hereby represents and warrants that (i) this Amendment constitutes a legal, valid and binding obligation of it, enforceable

against it in accordance with its terms, (ii) upon the effectiveness of this Amendment, no Event of Default shall exist and (iii) its

representations and warranties as set forth in the Loan Documents, as applicable, are true and correct in all material respects (except

those representations and warranties qualified by materiality or by reference to a material adverse effect, which are true and correct

in all respects) on and as of the date hereof as though made on and as of the date hereof (unless such representations and warranties

specifically refer to a specific date, in which case, they shall be complete and correct in all material respects (or, with respect to

such representations or warranties qualified by materiality or by reference to a material adverse effect, complete and correct in all

respects) on and as of such specific date).

Section 4.2 Cross-References.

References in this Amendment to any Article or Section are, unless otherwise specified, to such Article or Section of

this Amendment.

Section 4.3 Loan

Document Pursuant to Credit Agreement. This Amendment is a Loan Document executed pursuant to the Credit Agreement and shall (unless

otherwise expressly indicated therein) be construed, administered and applied in accordance with all of the terms and provisions of the

Credit Agreement, as amended hereby, including Article IX thereof.

Section 4.4 Successors

and Assigns. The provisions of this Amendment shall be binding upon and inure to the benefit of the parties hereto and their respective

successors and assigns.

Section 4.5 Counterparts.

This Amendment may be executed in counterparts (and by different parties hereto on different counterparts), each of which shall constitute

an original, but all of which when taken together shall constitute a single contract. Delivery of an executed counterpart of a signature

page of this Amendment by telecopy electronically (e.g. pdf) shall be effective as delivery of a manually executed counterpart of

this Amendment.

Section 4.6 Governing

Law. This Amendment shall be governed by and construed in accordance with the laws of the State of New York.

Section 4.7 Full

Force and Effect. On and after the Fourth Amendment Effective Date, each reference in any Loan Document to the Credit Agreement, “thereunder”,

“thereof” or words of like import referring to the Credit Agreement shall mean and be a reference to the Credit Agreement

as amended by this Amendment. Except as specifically amended by this Amendment, the Credit Agreement and the other Loan Documents shall

remain in full force and effect (with the same priority, as applicable) and are hereby ratified and confirmed and this Amendment shall

not be considered a novation. The execution, delivery and performance of this Amendment shall not constitute a waiver of any provision

of, or operate as a waiver of any right, power or remedy of the Administrative Agent or any Lender or any other party under, the Credit

Agreement or any of the other Loan Documents.

[Signatures on Following Pages.]

IN WITNESS WHEREOF, the parties

hereto have executed and delivered this Amendment as of the date first above written.

| BORROWER: |

STELLUS CAPITAL INVESTMENT CORPORATION |

| |

|

| |

By: |

/s/ W. Todd Huskinson |

| |

|

W. Todd Huskinson |

| |

|

Chief Financial Officer, Chief Compliance Officer, Treasurer, and Secretary |

Signature Page to Fourth Amendment– Stellus

| LENDERS: |

ZIONS BANCORPORATION, N.A. DBA AMEGY BANK,

as Administrative Agent, Swingline Lender,

Issuing Bank and as a Lender |

| |

|

| |

By: |

/s/ Mario Gagetta |

| |

|

Mario Gagetta |

| |

|

Vice President |

Signature Page to Fourth Amendment– Stellus

| |

FROST BANK, |

| |

as a Lender |

| |

|

|

| |

By: |

/s/ Jake Fitzpatrick |

| |

Name: |

Jake Fitzpatrick |

| |

Title: |

Senior Vice President |

Signature Page to Fourth Amendment– Stellus

| |

CADENCE BANK, |

| |

as a Lender |

| |

|

|

| |

By: |

/s/ Tim Ashe |

| |

Name: |

Tim Ashe |

| |

Title: |

Senior Vice President |

Signature Page to Fourth Amendment– Stellus

| |

CITY NATIONAL BANK, a national banking association, as a Lender |

| |

|

|

| |

By: |

/s/ Marc Galindo |

| |

Name: |

Marc Galindo |

| |

Title: |

Duly Authorized Signatory |

Signature Page to Fourth Amendment– Stellus

| |

STELLAR BANK, |

| |

as a Lender |

| |

|

|

| |

By: |

/s/ Jeff Caley |

| |

Name: |

Jeff Caley |

| |

Title: |

SVP - Corporate Banking |

Signature Page to Fourth Amendment– Stellus

| |

HANCOCK WHITNEY BANK, |

| |

as a Lender |

| |

|

|

| |

By: |

/s/ Ian McKie |

| |

Name: |

Ian McKie |

| |

Title: |

SVP |

Signature Page to Fourth Amendment– Stellus

| |

WOODFOREST NATIONAL BANK,

as a Lender |

| |

|

|

| |

By: |

/s/ Christine Dobbins |

| |

Name: |

Christine Dobbins |

| |

Title: |

Vice President |

Signature

Page to Fourth Amendment– Stellus

| |

TEXAS CAPITAL BANK,

as a Lender |

| |

|

|

| |

By: |

/s/ Robert Pitcock |

| |

Name: |

Robert Pitcock |

| |

Title: |

Executive Director |

Signature Page to Fourth Amendment– Stellus

| |

TRUSTMARK NATIONAL BANK,

as a Lender |

| |

|

|

| |

By: |

/s/ Jeff Deutsch |

| |

Name: |

Jeff Deutsch |

| |

Title: |

SVP |

Signature Page to Fourth Amendment– Stellus

| |

BOKF, NA dba BANK OF TEXAS,

as a Lender |

| |

|

|

| |

By: |

/s/ Fernando Sanchez |

| |

Name: |

Fernando Sanchez |

| |

Title: |

SVP |

Signature Page to Fourth Amendment– Stellus

SUBSIDIARY GUARANTORS’ CONSENT AND AGREEMENT

TO FOURTH AMENDMENT

As an inducement to Administrative

Agent and Lenders party thereto to execute, and in consideration of Administrative Agent’s and such Lenders’ execution of,

the Fourth Amendment dated as of November 21, 2023 (the “Amendment”) (capitalized terms used herein and

not otherwise defined shall have the meanings given to such terms in Article I of the Amendment), among Stellus Capital

Investment Corporation, a Maryland corporation, the Lenders party thereto, and Zions Bancorporation, N.A. dba Amegy Bank, as Administrative

Agent, each of the undersigned Subsidiary Guarantors hereby consents to the Amendment, and agrees that the Amendment shall in no way release,

diminish, impair, reduce or otherwise adversely affect the obligations and liabilities of the undersigned under any Guarantee and Security

Agreement executed by the undersigned in connection with the Credit Agreement, or under any Loan Documents, agreements, documents or instruments

executed by the undersigned to create liens, security interests or charges to secure any of the Guaranteed Obligations (as defined in

the Guarantee and Security Agreement), all of which are in full force and effect. Each of the undersigned further represents and warrants

to Administrative Agent and the Lenders that, after giving effect to the Amendment, (a) the representations and warranties in each

Loan Document to which the undersigned is a party are true and correct in all material respects (or, in the case of any portion of the

representations and warranties already subject to a materiality qualifier, true and correct in all respects) on and as of the date of

the Amendment as if made on and as of the date of the Amendment (or, if any such representation or warranty is expressly stated to have

been made as of a specific date, as of such specific date), and (b) no Default or Event of Default has occurred and is continuing.

Each undersigned Subsidiary Guarantor agrees to be bound by the terms, conditions, covenants and agreements in the Amendment. This Consent

and Agreement is executed as of the date of the Amendment and shall be binding upon each of the undersigned, and their respective successors

and assigns, and shall inure to the benefit of Administrative Agent, Lenders, and their successors and assigns.

[Signatures on Following Pages.]

| SUBSIDIARY GUARANTORS: |

|

| |

|

| SCIC – ERC BLOCKER 1, INC., |

SCIC – CC BLOCKER 1, INC., |

| a Delaware corporation |

a Delaware corporation |

| |

|

| |

|

| By: |

/s/ W. Todd Huskinson |

|

By: |

/s/ W. Todd Huskinson |

| |

W. Todd Huskinson |

|

|

W. Todd Huskinson |

| |

Authorized Signatory |

|

|

Authorized Signatory |

| |

|

|

|

|

| |

|

| SCIC – SKP BLOCKER 1, INC., |

SCIC – HOLLANDER BLOCKER 1, INC., |

| a Delaware corporation |

a Delaware corporation |

| |

|

| |

|

| By: |

/s/ W. Todd Huskinson |

|

By: |

/s/ W. Todd Huskinson |

| |

W. Todd Huskinson |

|

|

W. Todd Huskinson |

| |

Authorized Signatory |

|

|

Authorized Signatory |

| |

|

|

|

|

| |

|

| SCIC – APE BLOCKER 1, INC., |

SCIC – ICD BLOCKER 1, INC., |

| a Delaware corporation |

a Delaware corporation |

| |

|

| |

|

| By: |

/s/ W. Todd Huskinson |

|

By: |

/s/ W. Todd Huskinson |

| |

W. Todd Huskinson |

|

|

W. Todd Huskinson |

| |

Authorized Signatory |

|

|

Authorized Signatory |

| |

|

|

|

|

| |

|

| SCIC – CONSOLIDATED BLOCKER, INC., |

SCIC – VENBROOK BLOCKER, INC., |

| a Delaware corporation |

a Delaware corporation |

| |

|

| |

|

| By: |

/s/ W. Todd Huskinson |

|

By: |

/s/ W. Todd Huskinson |

| |

W. Todd Huskinson |

|

|

W. Todd Huskinson |

| |

Authorized Signatory |

|

|

Authorized Signatory |

| |

|

|

|

|

| |

|

| SCIC – INVINCIBLE BLOCKER 1, INC., |

|

| a Delaware corporation |

|

| |

|

| |

|

| By: |

/s/ W. Todd Huskinson |

|

|

|

| |

W. Todd Huskinson |

|

|

|

| |

Authorized Signatory |

|

|

|

Subsidiary

Guarantors’ Consent and Agreement To

Fourth

Amendment – Stellus

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

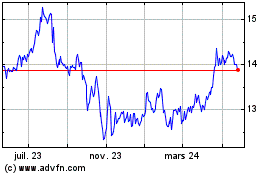

Stellus Capital Investment (NYSE:SCM)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

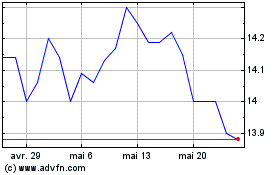

Stellus Capital Investment (NYSE:SCM)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024