Stifel Announces Acquisition of Bryan, Garnier & Co.

06 Janvier 2025 - 2:00PM

Stifel Financial Corp. (NYSE: SF) today announced it has signed a

definitive agreement to acquire Bryan, Garnier & Co. (“Bryan

Garnier”), a leading independent full-service investment bank

focused on European technology and healthcare companies. Terms of

the transaction were not disclosed.

Founded in 1996, Bryan Garnier’s product suite

includes mergers & acquisitions advisory, private and public

growth financing solutions and institutional sales & execution.

With a team of approximately 200 professionals, including 33

Managing Directors, Bryan Garnier is headquartered in Paris and has

offices in London, Amsterdam, Munich, Oslo, Stockholm, and New

York.

“As a leading European middle market investment

bank in the healthcare and technology verticals, Bryan Garnier

represents an ideal partner,” said Ronald J. Kruszewski, Stifel

Chairman and CEO. “Its culture and long-term history of providing

clients with high quality advice in two of our largest investment

banking growth verticals is highly complementary with Stifel’s

business. This combination is a logical next step in the evolution

of Stifel’s global advisory business.”

“By integrating Stifel’s capabilities across

advisory, private and public markets, and equity and debt

solutions, Stifel and Bryan Garnier are offering unparalleled

opportunities for clients, employees, and the European market as a

whole,” said Olivier Garnier, co-founder and Managing Partner of

Bryan Garnier.

Over the years, Stifel has grown both

organically and through acquisition, and is on pace to generate

more than $4.8 billion in net revenue in 2024.* With nearly 10,000

professionals located across approximately 400 offices across the

United States, Europe, the Middle East, and Asia, Stifel is a

leading M&A advisor and a premier capital markets firm. Stifel

was named “US Mid-Market Equity House of the Year” by International

Financing Review (IFR), recognizing outstanding capital markets

achievements in 2023.

Keefe, Bruyette & Woods, A Stifel Company,

acted as exclusive financial advisor and Bryan Cave Leighton

Paisner LLP acted as legal advisor to Stifel in the transaction.

Houlihan Lokey acted as exclusive financial advisor and White &

Case LLP acted as legal advisor to Bryan Garnier.

*Based on YTD annualized net revenue through 9/30/24

Stifel Company Information

Stifel Financial Corp. (NYSE: SF) is a financial services holding

company headquartered in St. Louis, Missouri, that conducts its

banking, securities, and financial services business through

several wholly owned subsidiaries. Stifel’s broker-dealer clients

are served in the United States through Stifel, Nicolaus &

Company, Incorporated, including its Eaton Partners and Miller

Buckfire business divisions; Keefe, Bruyette & Woods, Inc.; and

Stifel Independent Advisors, LLC; in Canada through Stifel Nicolaus

Canada Inc.; and in the United Kingdom and Europe through Stifel

Nicolaus Europe Limited. The Company’s broker-dealer affiliates

provide securities brokerage, investment banking, trading,

investment advisory, and related financial services to individual

investors, professional money managers, businesses, and

municipalities. Stifel Bank and Stifel Bank & Trust offer a

full range of consumer and commercial lending solutions. Stifel

Trust Company, N.A. and Stifel Trust Company Delaware, N.A. offer

trust and related services. To learn more about Stifel, please

visit the Company’s website at www.stifel.com. For global

disclosures, please visit

https://www.stifel.com/investor-relations/press-releases.

About Bryan, Garnier &

CoBryan, Garnier & Co is a European growth investment

bank that helps healthcare and technology companies become global

champions. By combining extensive sector expertise with an

entrepreneurial mindset, Bryan Garnier provides companies and their

investors with independent growth strategic advice, and privileged

access to buyers and capital in Europe, the US and Asia. As a

full-service investment bank, the firm offering includes private

and public growth financing solutions, mergers and acquisitions

(M&A) advisory, research insights, and institutional sales

& execution. Founded in 1996, Bryan Garnier & Co is an

independent partnership with around 200 employees located in major

financial centers in Europe and the US.

Cautionary Note Regarding

Forward-Looking StatementsThe information contained in

this press release contains certain statements that may be deemed

to be “forward-looking statements” within the meaning of Section

27A of the Securities Act of 1933 and Section 21E of the Securities

Exchange Act of 1934. All statements in this report not dealing

with historical results are forward-looking and are based on

various assumptions. The forward-looking statements in this report

are subject to risks and uncertainties that could cause actual

results to differ materially from those expressed in or implied by

the statements. Material factors and assumptions could cause

actual results to differ materially from current

expectations. The Company does not undertake to update

forward-looking statements to reflect circumstances or events that

occur after the date the forward-looking statements are made. The

Company disclaims any intent or obligation to update these

forward-looking statements.

Media Contact: Neil Shapiro, +1 (212)

271-3447shapiron@stifel.com

Investor Relations Contact:Joel Jeffrey, +1

(212) 271-3610investorrelations@stifel.com

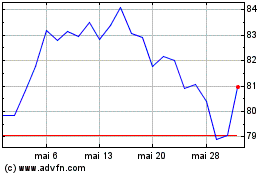

Stifel Financial (NYSE:SF)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Stifel Financial (NYSE:SF)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025