SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of November, 2024

Commission File Number 1-14732

COMPANHIA SIDERÚRGICA NACIONAL

(Exact name of registrant as specified in its charter)

National Steel Company

(Translation of Registrant's name into English)

Av. Brigadeiro Faria Lima 3400, 20º andar

São Paulo, SP, Brazil

04538-132

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports

under cover Form 20-F or Form 40-F. Form 20-F ___X___ Form 40-F _______

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No ___X____

COMPANHIA

SIDERÚRGICA NACIONAL

Companhia Aberta

CNPJ/MF

33.042.730/0001-04

NIRE nº 35-3.0039609.0

MATERIAL

FACT

COMPANHIA SIDERÚRGICA

NACIONAL (“Company”) announces that the Board of Directors approved its 16th issuance of simple debentures,

not convertible into shares, of the unsecured type, in up to two series, in the total amount of R$ 500,000,000.00 (five hundred million

reais), with a nominal unit value of R$1,000.00, on the date of issuance (“Debentures” e “Issuance”,

respectively).

The Issuance will be the subject

of a public offering, under the rite of automatic registration, in accordance with Law No. 6,385, of December 7, 1976, as amended, Resolution

of the Brazilian Securities Exchange Commission (“CVM”) No. 160, of July 13, 2022, as amended, and other applicable legal

and regulatory provisions, under the firm placement guarantee regime, intended for the investing public in general (“Offer”).

The Debentures will meet the requirements of article 2 of Law No. 12,431, of June 24, 2011, as amended, so that their holders will be

entitled to tax benefits in accordance with the law.

Within the scope of the Offer,

the procedure for collecting investment intentions will be adopted, organized by the Coordinators, in accordance with the terms to be

set out in the deed of issuance of the Debentures (“Deed of Issuance”) and in the distribution contract to be signed between

the Company and the Coordinators with receipt of reservations, in compliance with the provisions of article 61, paragraph 2, of CVM Resolution

160, to (i) define the final remuneration rate; (ii) define the number of series, observing the allocation system; (iii) define the number

of Debentures to be allocated in each series, observing the maximum quantity of Debentures in the Second Series and the maximum volume

of Debentures in the Second Series; and (iv) verify the existence of demand for the placement of all series of Debentures, and, if such

demand is verified, define on the Issuance in up to 2 (two) series (“Bookbuilding Procedure”).

The First Series Debentures will

have a maturity period of 10 (ten) years, counting from the date of issuance. Remunerative interest will be accrued on the updated nominal

unit value of the First Series Debentures corresponding to a certain percentage per year, to be defined in accordance with the Bookbuilding

Procedure, and which will be the highest rate between (a) the internal rate of return of the Security Public Treasury IPCA+ with Semiannual

Interest (new denomination of National Treasury Notes – Series B) (“NTN-B”), due on May 15, 2033, calculated

in accordance with the indicative quote published by ANBIMA on its website (http://www.anbima.com.br) on the date of completion of the

Bookbuilding Procedure, exponentially increased by an annual surcharge (spread) of 0.49% (forty-nine hundredths percent) per year, base

252 (two hundred and fifty-two) Business Days, and (b) 6.90% (six whole and ninety hundredths percent) per year, based on 252 (two hundred

and fifty-two) Business Days.

The Second Series Debentures will have

a maturity period of 15 (fifteen) years, counting from the date of issuance. Remunerative interest will be accrued on the updated nominal

unit value of the Second Series Debentures corresponding to a certain percentage per year, to be defined in accordance with the Bookbuilding

Procedure, and which will be the highest rate between (a) the internal rate of return of the NTN -B, maturing on May 15, 2035, calculated

in accordance with the indicative price published by ANBIMA on its website (http://www.anbima.com.br) on the date of the Bookbuilding

Procedure, plus exponentially with an annual surcharge (spread) of 0.69% (sixty-nine hundredths percent) per year, based on 252 (two

hundred and fifty-two) Business Days, and (b) 7.00% (seven percent) per year, based on 252 (two hundred and fifty-two) Business Days.

Pursuant to article 2, paragraph 1,

of Law 12,431, Decree 11,964 and Resolution of the National Monetary Council No. 5,034, of July 21, 2022, the net resources raised by

the Company through the Debentures will be used exclusively for the future payment and/or reimbursement of expenses, expenses, grants

and/or debts related to the implementation of the infrastructure investment project in the energy sector, specifically in generation from

renewable sources, as long as they occurred within a period equal to or less than 24 ( twenty-four) months from the closing date of the

Offer.

The general conditions of the Issuance

are indicated in the minutes of the Company's Board of Directors Meeting, which is available on the Company's investor relations page

and on the CVM website on the world wide web.

This Material Fact is disclosed by the

Company exclusively in compliance with applicable legislation and regulations, in a manner that is exclusively informative in nature and

should not be interpreted or considered, for all legal purposes, as a sales or offering material for the Debentures.

São Paulo, November

05, 2024.

COMPANHIA SIDERÚRGICA NACIONAL

Antonio Marco Campos Rabello

Executive Director of Finance and Investor

Relations

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: November 6, 2024

|

COMPANHIA SIDERÚRGICA NACIONAL |

|

|

|

By: |

/S/ Benjamin Steinbruch

|

| |

Benjamin Steinbruch

Chief Executive Officer

|

|

|

|

|

|

By: |

/S/ Antonio Marco Campos Rabello

|

| |

Antonio Marco Campos Rabello

Chief Financial and Investor Relations Officer

|

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements. These statements are statements that are not historical facts, and are based on management's current view and estimates of future economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes", "estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected events, trends or results will actually occur. The statements are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual results to differ materially from current expectations.

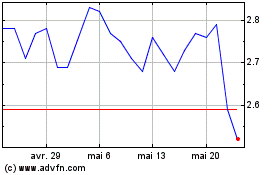

Companhia Siderurgica Na... (NYSE:SID)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

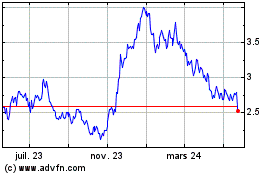

Companhia Siderurgica Na... (NYSE:SID)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024