Tender Offer Statement by Issuer (sc To-i)

08 Avril 2022 - 12:03PM

Edgar (US Regulatory)

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

SCHEDULE

TO

(Rule

14d-100)

TENDER

OFFER STATEMENT UNDER SECTION 14(d)(1) OR 13(e)(1)

OF

THE SECURITIES EXCHANGE ACT OF 1934

(Amendment

No. )

Steel

Partners Holdings L.P.

(Name

of Subject Company)

Steel

Partners Holdings L.P.

Steel Excel, Inc.

(Names

of Filing Persons - Offeror)

Common

Units, No Par Value

(Title

of Class of Securities)

85814R107

(CUSIP

Number of Class of Securities)

Jason

Wong

Chief

Financial Officer

590

Madison Avenue, 32nd Floor,

New

York, New York 10022

(212)

520-2300

(Name,

Address and Telephone Number of Person Authorized

to Receive Notices and Communications on Behalf of Filing Persons)

Copy

to:

Colin

Diamond

Andrew

J. Ericksen

White

& Case LLP

1221

Avenue of the Americas

New

York, New York 10020

(212)

819-8200

| ☐ | Check

the box if the filing relates solely to preliminary communications made before the commencement

of a tender offer. |

Check

the appropriate boxes below to designate any transactions to which the statement relates:

| ☐ | third

party tender offer subject to Rule 14d-1. |

| ☒ | issuer

tender offer subject to Rule 13e-4. |

| ☐ | going

private transaction subject to Rule 13e-3. |

| ☐ | amendment

to Schedule 13D under Rule 13d-2. |

Check

the following box if the filing is a final amendment reporting the results of a tender offer: ☐

If

applicable, check the appropriate box(es) below to designate the appropriate rule provision(s) relied upon:

| ☐ | Rule

13e-4(i) (Cross-Border Issuer Tender Offer) |

| ☐ | Rule

14d-1(d) (Cross-Border Third-Party Tender Offer) |

INTRODUCTION

This

Tender Offer Statement on Schedule TO relates to the offer (the “Offer”) by Steel Partners Holdings L.P., a Delaware limited

partnership (the “Company”), through its wholly owned subsidiary Steel Excel, Inc., a Delaware corporation (“Steel

Excel”), to purchase up to $100 million in value of the Company’s common units, no par value, at a price not less than $40.00

nor greater than $42.00 per unit, net to the seller in cash, less any applicable withholding taxes and without interest, upon the terms

and subject to the conditions set forth in the Offer to Purchase for Cash dated April 7, 2022 (the “Offer to Purchase”),

a copy of which is attached hereto as Exhibit (a)(1)(A), and in the related Letter of Transmittal (the “Letter of Transmittal”),

a copy of which is attached hereto as Exhibit (a)(1)(B). This Tender Offer Statement on Schedule TO is intended to satisfy the reporting

requirements of Rule 13e-4(c)(2) of the Securities Exchange Act of 1934, as amended. The information contained in the Offer

to Purchase and the related Letter of Transmittal is incorporated herein by reference in response to all of the items of this Schedule

TO, as more particularly described below. Unless otherwise indicated, all references to “units” are to the Company’s

common units, no par value.

| Item

1. | SUMMARY

TERM SHEET |

The

information set forth in the Offer to Purchase under “Summary Term Sheet” is incorporated herein by reference.

| Item

2. | SUBJECT

COMPANY INFORMATION |

| (a) | The

name of the subject company and issuer is Steel Partners Holdings L.P., a Delaware limited

partnership. The address of the Company’s principal executive office is

590 Madison Avenue, 32nd Floor, New York, New York 10022, and its telephone number is (212)

520-2300. |

| (b) | The

information set forth in the Offer to Purchase under “Summary Term Sheet”, “The

Offer, Section 1, General Terms of the Offer”, and “The Offer, Section 2, Number

of Units; Proration” is incorporated herein by reference. As of April 7,

2022, the Company had issued and outstanding approximately 20,715,251 of its units. |

| (c) | Information

about the trading market and price of the units and dividends is set forth under ‘‘The

Offer, Section 8, Price Range of Units and Unitholders’’ of the Offer to Purchase

and is incorporated herein by reference. |

| Item

3. | IDENTITY

AND BACKGROUND OF FILING PERSON |

| (a) | The

Company and Steel Excel are the filing persons and the Company is the subject company. The

Company’s general partner is Steel Partners Holdings GP Inc. (the “General Partner”).

The names of the executive officers and directors of the General Partner are as follows: |

|

|

Position

with the General Partner |

| Warren

G. Lichtenstein |

|

Executive

Chairman |

| Jack

L. Howard |

|

President,

Director |

| Jason

Wong |

|

Chief

Financial Officer |

| Gordon

A. Walker |

|

Senior

Vice President |

| Rory

Tahari |

|

Director |

| John

P. McNiff |

|

Director |

| Lon

Rosen |

|

Director |

| General

Richard I. Neal |

|

Director |

| James

Benenson III |

|

Director |

| Eric

P. Karros |

|

Director |

(b) The

names of the executive officers and directors of Steel Excel are as follows:

|

|

Position

with Steel Excel |

| Gordon

A. Walker |

|

President,

Director |

| Jason

Wong |

|

Senior

Vice President and Treasurer, Director |

| Maureen

Mattera |

|

Vice

President |

| Maria

Reda |

|

Secretary |

| Jack

L. Howard |

|

Director |

The

address and telephone number of the Company, its General Partner, Steel Excel and each of the executive officers and directors of the

General Partner and Steel Excel is 590 Madison Avenue, 32nd Floor, New York, New York 10022, telephone number (212) 520-2300. The information

set forth in the Offer to Purchase under “The Offer, Section 7, Information Concerning the Company and Purposes of the Offer”

is incorporated herein by reference.

| Item

4. | TERMS

OF THE TRANSACTION |

| (a) | Information

about the terms of the transaction under “Summary Term Sheet” and “The

Offer, Sections 1 through 13” of the Offer to Purchase is incorporated herein by reference. |

| (b) | The

information set forth in the Offer to Purchase under “The Offer, Section 7, Information

Concerning the Company and Purposes of the Offer—Beneficial Ownership of Common Units

by Directors and Executive Officers” is incorporated herein by reference. |

| Item

5. | PAST

CONTRACTS, TRANSACTIONS, NEGOTIATIONS AND AGREEMENTS |

| (a) | The

information set forth in the Offer to Purchase under “The Offer, Section 10, Transactions

and Agreements Concerning Units” is incorporated herein by reference. |

| Item

6. | PURPOSES

OF THE TRANSACTION AND PLANS OR PROPOSALS |

| (a) | The

information set forth in the Offer to Purchase under “The Offer, Section 7, Information

Concerning the Company and Purposes of the Offer—Purposes of the Offer; Certain Effects

of the Offer” is incorporated herein by reference. |

| (b) | The

information set forth in the Offer to Purchase under “The Offer, Section 7, Information

Concerning the Company and Purposes of the Offer—Purposes of the Offer; Certain Effects

of the Offer” is incorporated herein by reference. |

| (c) | The

information set forth in the Offer to Purchase under “The Offer, Section 7, Information

Concerning the Company and Purposes of the Offer—Purposes of the Offer; Certain Effects

of the Offer” is incorporated herein by reference. |

| Item

7. | SOURCE

AND AMOUNT OF FUNDS OR OTHER CONSIDERATION |

| (a) | The

information set forth in the Offer to Purchase under “The Offer, Section 9, Source

and Amount of Funds” is incorporated herein by reference. |

| (b) | The

information set forth in the Offer to Purchase under “The Offer, Section 9, Source

and Amount of Funds” is incorporated herein by reference. |

| (c) | The

information set forth in the Offer to Purchase under “The Offer, Section 9, Source

and Amount of Funds” is incorporated herein by reference. |

| Item

8. | INTEREST

IN SECURITIES OF THE SUBJECT COMPANY |

| (a) | The

information set forth in the Offer to Purchase under “The Offer, Section 7, Information

Concerning the Company and Purposes of the Offer—Beneficial Ownership of Common Units

by Directors and Executive Officers” is incorporated herein by reference. |

| (b) | The

information set forth in the Offer to Purchase under “The Offer, Section 7, Information

Concerning the Company and Purposes of the Offer—Securities Transactions” is

incorporated herein by reference. |

| Item

9. | PERSONS/ASSETS,

RETAINED, EMPLOYED, COMPENSATED OR USED |

| (a) | The

Company has retained MacKenzie Partners, Inc. (“MacKenzie”) as the Information

Agent in connection with the Offer and will pay MacKenzie a fee for its services. In addition,

MacKenzie is entitled to reimbursement of its reasonable out-of-pocket expenses. MacKenzie

may contact unitholders by mail, telephone, facsimile, telex, telegraph or other electronic

means, and may request brokers, dealers, commercial banks, trust companies and other nominee

unitholders to forward material relating to the Offer to beneficial owners. |

The

Company has retained American Stock Transfer & Trust Company, LLC (“American Stock”) to act as the Depositary in connection

with the Offer and will pay American Stock a fee for its services, plus other costs and reimbursement for out-of-pocket expenses.

Each

of MacKenzie and American Stock will be indemnified by the Company against certain liabilities and expenses in connection therewith.

Neither

the Company nor any of its directors, officers or employees, nor the Information Agent or Depositary, makes any recommendation to unitholders

as to whether to tender or refrain from tendering their units.

| Item

10. | FINANCIAL

STATEMENTS |

Not

applicable.

| Item

11. | ADDITIONAL

INFORMATION |

| (a) | (1) The

information set forth in the Offer to Purchase under “The Offer, Section 10, Transactions

and Agreements Concerning Units” of the Offer to Purchase is incorporated herein by

reference. |

| (2) | There

are no applicable regulatory requirements or approvals needed for the Offer. |

| (c) | The

information in the Offer to Purchase and the related Letter of Transmittal, copies of which

are filed with this Schedule TO as Exhibits (a)(1)(A) and (a)(1)(B), respectively,

is incorporated herein by reference. |

The

following are attached as exhibits to this Schedule TO:

| (b) | (1) |

Amended and Restated Credit Agreement, dated as of December 29, 2021, by and among SPH Group Holdings, Steel Excel Inc. and iGo, Inc. (Incorporated by reference to Exhibit 10.1 to Company’s Report on Form 8-K dated December 29, 2021, filed with the Securities and Exchange Commission on December 29, 2021). |

| | | |

|

| (d) | (1) |

Preferred Stock Purchase Agreement, dated as of December 15, 2017, by and between ModusLink Global Solutions, Inc. and SPH Group Holdings LLC (Incorporated by reference to Exhibit 10.1 to Company’s Report on Form 8-K dated December 15, 2017, filed with the Securities and Exchange Commission on December 19, 2017). |

| | | |

|

|

| (2) | Sixth Amended and Restated Management Agreement by and between SP Corporate Services LLC and SP General Services LLC, effective as of January 1, 2015 (incorporated by reference to Exhibit 10.1 to Steel Partners Holdings L.P.'s Current Report on Form 8-K, filed on January 13, 2015). |

| |

| | |

|

| (3) | Incentive Unit Agreement by and between Steel Partners Holdings L.P. and SPH SPV-I LLC, effective as of May 11, 2012 (incorporated by reference to Exhibit 10.2 to Steel Partners Holdings L.P.'s Current Report on Form 8-K, filed on January 13, 2015). |

| |

| | |

|

| (4) | Amendment to Incentive Unit Agreement by and between Steel Partners Holdings L.P. and SPH SPV-I LLC, effective as of February 18, 2022 (incorporated by reference to Exhibit 10.4 to Steel Partner’s Holdings L.P.’s Form 10-K, filed on March 10, 2022). |

| |

| | |

|

| (5) | Steel Partners Holdings L.P. Second Amended and Restated 2018 Incentive Award Plan (incorporated by reference to Exhibit 10.5 to Steel Partner’s Holdings L.P.’s Form 10-K, filed on March 10, 2022). |

| |

| | |

|

| (6) | Steel Partners Holdings L.P. Second Amended and Restated 2018 Incentive Award Plan Form Restricted Unit Agreement (incorporated by reference to Exhibit 10.10 to Steel Partners Holdings L.P.’s Annual Report on Form 10-K, filed April 13, 2021). |

| |

| | |

|

| (7) | Steel Partners Holdings L.P. Second Amended and Restated 2018 Incentive Award Plan Form Restricted Unit Agreement (Directors) (incorporated by reference to Exhibit 10.2 to Steel Partners Holdings L.P.’s Quarterly Report on Form 10-Q, filed August 5, 2021). |

| |

| | |

|

| (8) | Steel Partners Holdings L.P. Second Amended and Restated 2018 Incentive Award Plan Form Restricted Unit Agreement (incorporated by reference to Exhibit 10.3 to Steel Partners Holdings L.P.’s Quarterly Report on Form 10-Q, filed August 5, 2021). |

| |

| | |

| (g) |

None. |

| | |

| |

| (h) |

Not applicable. |

| | |

| |

| 107 |

Filing Fee Table. |

| Item

13. | INFORMATION

REQUIRED BY SCHEDULE 13E-3 |

Not

applicable.

SIGNATURE

After

due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete

and correct.

| |

STEEL PARTNERS HOLDINGS L.P. |

| |

|

|

| |

By: Steel Partners Holdings GP Inc. |

| |

its General Partner |

| |

|

|

| |

By: |

/s/ Jason Wong |

| |

Name: |

Jason Wong |

| |

Title: |

Chief Financial Officer |

Date:

April 7, 2022

| |

STEEL EXCEL, INC. |

| |

By: |

|

| |

|

|

| |

By: |

/s/ Jason Wong |

| |

Name: |

Jason Wong |

| |

Title: |

Chief Financial Officer |

Date:

April 7, 2022

5

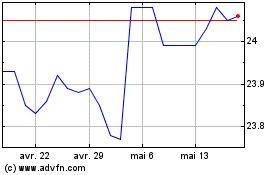

Steel Partners (NYSE:SPLP-A)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

Steel Partners (NYSE:SPLP-A)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024