false

0001452857

0001452857

2024-01-08

2024-01-08

0001452857

SPLP:CommonUnitsNoParValueMember

2024-01-08

2024-01-08

0001452857

SPLP:Sec6.0SeriesPreferredUnitsMember

2024-01-08

2024-01-08

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

January 8, 2024

STEEL PARTNERS HOLDINGS L.P.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-35493 |

|

13-3727655 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

| 590 Madison Avenue, 32nd Floor, New York, New York

| |

10022 |

| (Address of principal executive offices) | |

(Zip Code) |

Registrant’s telephone number,

including area code: (212) 520-2300

N/A

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see

General Instruction A.2. below):

| ☐ | Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading Symbols |

|

Name of each exchange on which registered |

| Common Units, no par value |

|

SPLP |

|

New York Stock Exchange |

| 6.0% Series A Preferred Units |

|

SPLP-PRA |

|

New York Stock Exchange |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01 Other Events.

On January 8, 2024, Steel

Partners Holdings L.P., a Delaware limited partnership (the “Company”), issued a press release announcing an extension of the

effective date of its previously announced reverse/forward unit split of its common units, no par value, has been extended to January

11, 2024 (as it may be further extended, the “Effective Date”). The Company reserves the right to abandon, modify or extend the reverse/forward

unit split any time prior to the Effective Date. If the Company further extends the Effective Date to a later date, the Company will disclose

such extension via press release and/or a current report on Form 8-K prior to the Effective Date. The press release is filed as Exhibit

99.1 hereto and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| January 8, 2024 |

STEEL PARTNERS HOLDINGS L.P. |

| |

|

| |

By: |

Steel Partners Holdings GP Inc. |

| |

|

Its General Partner |

| |

|

| |

By: |

/s/ Ryan O’Herrin |

| |

|

Ryan O’Herrin |

| |

|

Chief Financial Officer |

2

Exhibit 99.1

Steel Partners Holdings

L.P. Announces Extension of Effective Date for Reverse/Forward Unit Split

NEW YORK, NY—January

8, 2024—Steel Partners Holdings L.P. (NYSE: SPLP), a Delaware limited partnership (the “Company” or “Steel Partners”),

announced today that it will extend the effective date of its previously announced 1-for-12,500 reverse unit split (“Reverse Unit

Split”) of its common units, no par value (the “Company Common Units”), followed immediately by a 12,500-for-1 forward

unit split of the Company Common Units (the “Forward Unit Split,” and, together with the Reverse Unit Split, the “Reverse/Forward

Unit Split”). The Reverse Unit Split is now expected to become effective as of 5:00 p.m. Eastern Time on January 11, 2024, and immediately

thereafter, the Forward Unit Split is expected to become effective as of 5:01 p.m. Eastern Time on January 11, 2024 (as it may be further

extended, the “Effective Date”). The Company reserves the right to abandon, modify or extend the Reverse/Forward

Unit Split at any time prior to the Effective Date.

The Company Common Units

are expected to begin trading on a split-adjusted basis when the market opens on January 12, 2024. Certain holders of the Company’s

Common Units who are employees will have their Company Common Units excluded from the Reverse/Forward Unit Split. If the Company further

extends the Effective Date to a later date, the Company will disclose such extension via press release and/or a current report on Form

8-K prior to the Effective Date.

No fractional units will

be issued in connection with the Reverse/Forward Unit Split. Instead, the Company will pay cash (without interest) to any unitholder who

would be entitled to receive a fractional unit as a result of the Reverse/Forward Unit Split. Unitholders who hold fewer than 12,500 units

immediately prior to the Reverse Unit Split will be paid in cash (without interest) an amount equal to such number of Company Common Units

held multiplied by volume-weighted average price for the ten consecutive trading days immediately preceding the effective date of the

Reverse/Forward Unit Split.

The Company’s transfer

agent, Equiniti Trust Company, LLC, will serve as exchange and paying agent for the Reverse/Forward Unit Split. Registered unitholders

holding pre-split Company Common Units electronically in book-entry form are not required to take any action to receive post-split units.

Unitholders owning Common Units via a broker, bank, trust or other nominee will have their positions automatically adjusted to reflect

the Reverse/Forward Unit Split, subject to such broker’s particular processes, and will not be required to take any action in connection

with the Reverse/Forward Unit Split.

About Steel Partners

Holdings L.P.

Steel Partners Holdings

L.P. is a diversified global holding company that owns and operates businesses and has significant interests in leading companies in

various industries, including diversified industrial products, energy, defense, supply chain management and logistics, banking and youth

sports.

Forward-Looking Statements

This press release contains certain “forward-looking statements”

within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as

amended, that reflect the Company’s current expectations and projections about its future results, performance, prospects and opportunities.

The Company identifies these forward-looking statements by using words such as “expect,” “anticipate,” “intend,”

“plan,” “believe,” “seek,” “estimate,” and similar expressions. These forward-looking statements

are only predictions based upon the Company’s current expectations and projections about future events, and are based on information currently

available to the Company and are subject to risks, uncertainties, and other factors that could cause its actual results, performance,

prospects, or opportunities in 2024 and beyond to differ materially from those expressed in, or implied by, these forward-looking statements.

These factors include, without limitation, risk factors detailed from time to time in filings the Company makes with the Securities and

Exchange Commission, including the Company’s Form 10-K for the year ended December 31, 2022 and subsequent quarterly reports on Form 10-Q

and annual reports on Form 10-K. Any forward-looking statement made in this press release speaks only as of the date hereof, and investors

should not rely upon forward-looking statements as predictions of future events. Except as otherwise required by law, the Company undertakes

no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events, changed

circumstances, or any other reason.

Investor Relations Contact

Jennifer Golembeske

212-520-2300

jgolembeske@steelpartners.com

v3.23.4

Cover

|

Jan. 08, 2024 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jan. 08, 2024

|

| Entity File Number |

001-35493

|

| Entity Registrant Name |

STEEL PARTNERS HOLDINGS L.P.

|

| Entity Central Index Key |

0001452857

|

| Entity Tax Identification Number |

13-3727655

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

590 Madison Avenue

|

| Entity Address, Address Line Two |

32nd Floor

|

| Entity Address, City or Town |

New York

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10022

|

| City Area Code |

212

|

| Local Phone Number |

520-2300

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Units, no par value |

|

| Title of 12(b) Security |

Common Units, no par value

|

| Trading Symbol |

SPLP

|

| Security Exchange Name |

NYSE

|

| 6.0% Series A Preferred Units |

|

| Title of 12(b) Security |

6.0% Series A Preferred Units

|

| Trading Symbol |

SPLP-PRA

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=SPLP_CommonUnitsNoParValueMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=SPLP_Sec6.0SeriesPreferredUnitsMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

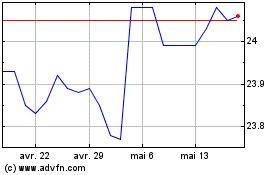

Steel Partners (NYSE:SPLP-A)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Steel Partners (NYSE:SPLP-A)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024