0001452857FALSE590 Madison Avenue, 32nd FloorNew YorkNew York00014528572024-03-082024-03-080001452857us-gaap:CommonStockMember2024-03-082024-03-080001452857splp:SeriesAPreferredUnitsMember2024-03-082024-03-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 8, 2024

| | | | | | | | |

| STEEL PARTNERS HOLDINGS L.P. |

| (Exact name of registrant as specified in its charter) |

| | | |

| Delaware | 001-35493 | 13-3727655 |

(State or other jurisdiction

of incorporation) | (Commission

File Number) | (IRS Employer

Identification No.) |

| | | |

590 Madison Avenue, 32nd Floor , New York, New York | 10022 |

| (Address of principal executive offices) | (Zip Code) |

Registrant's telephone number, including area code: (212) 520-2300

| | |

| N/A |

| (Former name or former address, if changed since last report.) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbols | Name of each exchange on which registered |

| Common Units, $0 par | SPLP | New York Stock Exchange |

| 6.0% Series A Preferred Units | SPLP-PRA | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On March 8, 2024, Steel Partners Holdings L.P., a Delaware limited partnership (the "Company"), issued a press release announcing its financial results for the quarter and year ended December 31, 2023 and other financial information. A copy of the press release is being furnished as Exhibit 99.1 hereto and is incorporated herein by reference.

The information in this Item 2.02, including Exhibit 99.1 attached hereto, is being furnished and shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or otherwise subject to the liabilities of such section. The information in this Current Report, including the exhibit, shall not be incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any incorporation by reference language in any such filing, unless the Company expressly sets forth in such future filing that such information is to be considered "filed" or incorporated by reference therein.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | |

Exhibit No. | Exhibits |

| |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| March 8, 2024 | STEEL PARTNERS HOLDINGS L.P. |

| | |

| | By: | Steel Partners Holdings GP Inc. |

| | | Its General Partner |

| | | |

| | |

| By: | /s/ Ryan O'Herrin |

| | Ryan O'Herrin |

| | Chief Financial Officer |

EXHIBIT 99.1

Steel Partners Holdings Reports Fourth Quarter and Full Year Results

Fourth Quarter 2023 Results

•Revenue totaled $466.9 million

•Net income was $42.7 million

•Net income attributable to common unitholders was $41.3 million, or $1.75 per diluted common unit

•Adjusted EBITDA* totaled $59.4 million; Adjusted EBITDA margin* was 12.7%

•Net cash provided by operating activities was $9.5 million

•Adjusted free cash flow* totaled $87.6 million

•Total debt was $191.4 million; net cash,* which also includes our pension and preferred unit liabilities, less cash and investments, totaled $56.4 million

Full Year 2023 Results

•Revenue totaled $1.9 billion

•Net income was $154.0 million

•Net income attributable to common unitholders was $150.8 million, or $6.43 per diluted common unit

•Adjusted EBITDA* totaled to $240.6 million; Adjusted EBITDA margin* was 12.6%

•Net cash provided by operating activities was $21.2 million

•Adjusted free cash flow* totaled $236.0 million

NEW YORK, N.Y., March 8, 2024 - Steel Partners Holdings L.P. (NYSE: SPLP), a diversified global holding company, today announced operating results for the fourth quarter and year ended December 31, 2023. The financial results of Steel Connect, Inc. ("Steel Connect" or "STCN") have been included in the Company's consolidated financial statements since the exchange transaction on May 1, 2023.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Unaudited | | | | | | |

Q4 2023 | | Q4 2022 | | ($ in thousands) | | FY 2023 | | FY 2022 |

| $466,907 | | $422,615 | | Revenue | | $1,905,457 | | $1,695,441 |

| 42,697 | | 73,083 | | Net income | | 154,002 | | 206,165 |

| 41,261 | | 73,012 | | Net income attributable to common unitholders | | 150,829 | | 205,972 |

| 59,358 | | 44,649 | | Adjusted EBITDA* | | 240,559 | | 228,434 |

| 12.7% | | 10.6% | | Adjusted EBITDA margin* | | 12.6% | | 13.5% |

| 14,784 | | 17,353 | | Purchases of property, plant and equipment | | 51,451 | | 47,541 |

| 87,587 | | 30,260 | | Adjusted free cash flow* | | 235,980 | | 146,272 |

* See reconciliations to the nearest GAAP measure included in the financial tables. See "Note Regarding Use of Non-GAAP Financial Measurements" below for the definition of these non-GAAP measures.

Results of Operations

Comparisons of the Three Months and Years Ended December 31, 2023 and 2022

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Unaudited | | | | | | |

| (Dollar amounts in table in thousands, unless otherwise indicated) | Three Months Ended December 31, | | Year Ended December 31, |

| 2023 | | 2022 | | 2023 | | 2022 | | |

| Revenue | $ | 466,907 | | | $ | 422,615 | | | $ | 1,905,457 | | | $ | 1,695,441 | | | |

| Cost of goods sold | 269,040 | | | 266,296 | | | 1,103,017 | | | 1,096,936 | | | |

| Selling, general and administrative expenses | 128,708 | | | 102,778 | | | 504,960 | | | 383,377 | | | |

| | | | | | | | | |

| Asset impairment charges | 536 | | | 278 | | | 865 | | | 3,162 | | | |

| Interest expense | 2,466 | | | 6,197 | | | 18,400 | | | 20,649 | | | |

| Realized and unrealized gains on securities, net | (923) | | | (57,361) | | | (7,074) | | | (34,791) | | | |

| Gains from sales of businesses | (58) | | | (203) | | | (58) | | | (85,683) | | | |

| All other expenses, net * | 27,474 | | | 20,237 | | | 124,141 | | | 36,293 | | | |

| Total costs and expenses | 427,243 | | | 338,222 | | | 1,744,251 | | | 1,419,943 | | | |

| Income before income taxes and equity method investments | 39,664 | | | 84,393 | | | 161,206 | | | 275,498 | | | |

| Income tax provision (benefit) | 33 | | | 17,688 | | | (1,674) | | | 73,944 | | | |

| (Income) loss of associated companies, net of taxes | (3,066) | | | (6,378) | | | 8,878 | | | (4,611) | | | |

| | | | | | | | | |

| | | | | | | | | |

| Net income | 42,697 | | | 73,083 | | | 154,002 | | | 206,165 | | | |

| Net income attributable to noncontrolling interests in consolidated entities | (1,436) | | | (71) | | | (3,173) | | | (193) | | | |

| Net income attributable to common unitholders | $ | 41,261 | | | $ | 73,012 | | | $ | 150,829 | | | $ | 205,972 | | | |

| * includes finance interest, provision (benefit) for credit losses, and other expenses (income) from the consolidated statements of operations | | |

Revenue

Revenue for the three months ended December 31, 2023 increased $44.3 million , or 10.5%, as compared to the same period last year. The increase was driven primarily by favorable impact of the recently added Supply Chain segment and higher revenue for the Financial Services segment, partially offset by lower sales from the Diversified Industrial segment and lower revenue from the Energy segment.

Revenue in the year ended December 31, 2023 increased $210.0 million, or 12.4%, as compared to 2022, as a result of higher revenue from the Financial Services segment and favorable impact of the recently added Supply Chain segment, partially offset by lower sales from the Diversified Industrial segment and lower revenue from the Energy segment.

Cost of Goods Sold

Cost of goods sold for the three months ended December 31, 2023 increased $2.7 million, or 1.0%, as compared to the same period last year. The increase was primarily due to the recently added Supply Chain segment, partially offset by lower revenue for the Diversified Industrial and Energy segments, discussed above.

Cost of goods sold in the year ended December 31, 2023 increased $6.1 million, or 0.6%, as compared to 2022, resulting from the recently added Supply Chain segment, partially offset by lower revenue for the Diversified Industrial and Energy segments discussed above.

Selling, General and Administrative Expenses

Selling, general and administrative expenses ("SG&A") for the three months ended December 31, 2023 increased $25.9 million, or 25.2%, as compared to the same period last year. The SG&A increase was primarily driven by: (1) $18.1 million increase in the Financial Services segment primarily due to higher credit performance fees due to higher credit risk transfer ("CRT") balances and higher personnel expenses related to incremental headcount and (2) $9.3 million for the recently added Supply Chain segment. The increases were partially offset by $3.7 million lower Corporate SG&A expenses primarily due to lower legal expenses as compared to the last year period.

SG&A in 2023 increased $121.6 million, or 31.7%, as compared to 2022. The SG&A increase was primarily driven by: (1) $86.8 million increase in the Financial Services segment primarily due to higher credit performance fees due to higher CRT balances and higher personnel expenses related to incremental headcount, (2) $25.2 million increase for the Supply Chain

segment, and (3) $24.1 million increase for the Diversified Industrial segment primarily due to net pension expense, despite the impact of the divestiture of the SLPE business of $5.0 million. These increases were partially offset by lower Corporate SG&A expenses of $15.4 million due primarily to lower legal fees as compared to the last year period.

Asset Impairment Charges

The Company recorded asset impairment charges of $0.5 million and $0.3 million for the three months ended December 31, 2023 and 2022, respectively. These charges were primarily related to idle machinery and equipment from the Diversified Industrial segment.

The Company recorded asset impairment charges of $0.9 million and $3.2 million for the twelve months ended December 31, 2023 and 2022, respectively. The 2023 charges were primarily driven by idle machinery and equipment associated with the Building Materials and Electrical Products business units within the Diversified Industrial segment. The 2022 charges were primarily related to the implementation costs of an ERP project associated with the Kasco business within the Diversified Industrial segment.

Interest Expense

Interest expense for the three months ended December 31, 2023 and 2022 was $2.5 million and $6.2 million, respectively. Interest expense for the years ended December 31, 2023 and 2022 was $18.4 million and $20.6 million, respectively. The lower interest expense for the three months and the year ended December 31, 2023 was primarily due to lower average debt levels, partially offset by higher average interest rates.

Realized and Unrealized Gains on Securities, Net

The Company recorded gains of $0.9 million for the three months ended December 31, 2023, as compared to $57.4 million in 2022, and gains of $7.1 million and $34.8 million for the years ended December 31, 2023 and 2022, respectively. The changes in realized and unrealized gains on securities, net over the respective periods are primarily due to mark-to-market adjustments on the Company's portfolio of securities.

All Other Expenses, Net

All other expense, net totaled $27.5 million for the three months ended December 31, 2023, as compared to $20.2 million for the year ended December 31, 2022. The incremental all other expense, net for the three months ended December 31, 2023 was primarily due to higher finance interest expense of $16.6 million, partially offset by lower provisions for credit losses of $7.6 million related to the Financial Service segment, as compared to 2022.

All other expense, net totaled $124.1 million for the year ended December 31, 2023, as compared to $36.3 million for the year ended December 31, 2022. The incremental all other expense, net for the years ended December 31, 2023 was primarily due to higher finance interest expense of $63.5 million and higher provisions for credit losses of $28.6 million related to the Financial Service segment, as compared to 2022.

Income Taxes

The Company recorded income tax provisions of $0.03 million and $17.7 million for the three months ended December 31, 2023 and 2022, respectively. The lower effective tax rate for the three months ended December 31, 2023, is primarily due to a decrease in U.S. tax expense related to unrealized gains on investment from related parties which are eliminated for financial statement purposes, as well as the partial release of valuation allowances on the Company's deferred tax assets.

For the year ended December 31, 2023, a tax benefit of $1.7 million was recorded, as compared to a tax provision of $73.9 million in 2022. The Company's effective tax rate for the year ended December 31, 2023 was a benefit of 1.0% as compared to a provision of 26.8% for the year ended December 31, 2022. The lower effective tax rate for the year ended December 31, 2023, was primarily due to certain tax-deferred transactions associated with internal restructurings undertaken by the Company and the partial release of valuation allowances on the Company's deferred tax assets, partially offset by increased state and foreign income taxes associated with the Company's operations.

As a limited partnership, we are generally not responsible for federal and state income taxes, and our profits and losses are passed directly to our limited partners for inclusion in their respective income tax returns. The Company's tax provision

represents the income tax expense or benefit of its consolidated corporate subsidiaries.

(Income) Loss of Associated Companies, Net of Taxes

The Company recorded income from associated companies, net of taxes of $3.1 million for the three months ended December 31, 2023, as compared to $6.4 million for the same period of 2022. The Company recorded loss from associated companies, net of taxes, of $8.9 million in 2023 as compared to income, net of taxes of $4.6 million in 2022.

Net Income

Net income for the three months ended December 31, 2023 was $42.7 million, as compared to $73.1 million for the same period in 2022. The decrease in net income was primarily due to lower realized and unrealized gains on securities, net, partially offset by higher income from the Financial Service segment resulting from higher revenue and favorable impact of added Supply Chain segment, as well as lower income tax expense. See above explanations for further details.

Net income for the year ended December 31, 2023 was $154.0 million, as compared to $206.2 million for the year ended December 31, 2022. The decrease in net income for the year ended December 31, 2023 was primarily due to a pre-tax gain of $85.7 million in 2022, primarily related to the divestiture of the SLPE business from the Diversified Industrial segment and lower realized and unrealized gains on securities, net, partially offset by higher income from the Financial Services segment resulting from higher revenue and favorable impact of the recently added Supply Chain segment, as well as lower income tax expense. See above explanations for further details.

Purchases of Property, Plant and Equipment (Capital Expenditures)

Capital expenditures for the three months ended December 31, 2023 totaled $14.8 million, or 3.2% of revenue, as compared to $17.4 million, or 4.1% of revenue, in the three months ended December 31, 2022. For the year ended December 31, 2023, capital expenditures were $51.5 million, or 2.7% of revenue, as compared to $47.5 million, or 2.8% of revenue, for the year ended December 31, 2022.

Additional Non-GAAP Financial Measures

Adjusted EBITDA for the three months ended December 31, 2023 was $59.4 million, as compared to $44.6 million for the same period in 2022. Adjusted EBITDA margin increased to 12.7% in the quarter from 10.6% in the three months ended December 31, 2022, primarily due to the higher revenue impact of the Financial Services segment, favorable impact from the newly acquired Supply Chain segment, and lower SG&A costs from Corporate as compared to the same period of 2022. Adjusted free cash flow was $87.6 million for the three months ended December 31, 2023, as compared to $30.3 million for the same period in 2022.

For the year ended December 31, 2023, Adjusted EBITDA and Adjusted EBITDA margin were $240.6 million and 12.6%, respectively, as compared to $228.4 million and 13.5% in 2022. Adjusted EBITDA increased by $12.1 million primarily due to increases in the Financial Service segment due to higher revenue, favorable impact from the newly acquired Supply Chain segment, and lower SG&A costs from Corporate, partially offset by lower revenue from the Diversified Industrial segment. Adjusted free cash flow was $236.0 million, as compared to $146.3 million for the same period in 2022.

Liquidity and Capital Resources

As of December 31, 2023, the Company had $399.3 million in available liquidity under its senior credit agreement, as well as $407.6 million in cash and cash equivalents, excluding WebBank cash, and $41.2 million in long-term investments.

As of December 31, 2023, total debt was $191.4 million, an increase of $11.0 million, as compared to December 31, 2022. As of December 31, 2023, net cash totaled $56.4 million, an increase of $104.0 million, as compared to December 31, 2022. Net cash position in 2023 was primarily due to higher cash balance of $347.5 million and $38.8 million lower accrued pension liabilities, partially offset by $268.5 million of lower investment balances and $11.0 million increase of total debt due to additional borrowing of debt, as compared to the net debt position in 2022. Total leverage (as defined in the Company's senior credit agreement) was approximately 1.5x as of December 31, 2023 versus 1.4x as of December 31, 2022.

About Steel Partners Holdings L.P.

Steel Partners Holdings L.P. (www.steelpartners.com) is a diversified global holding company that owns and operates

businesses and has significant interests in various companies, including diversified industrial products, energy, defense, supply chain management and logistics, banking and youth sports. At Steel Partners, our culture and core values of Teamwork, Respect, Integrity, and Commitment guide our Kids First purpose, which is to forge a path of success for the next generation by instilling values, building character, and teaching life lessons through sports.

(Financial Tables Follow)

Consolidated Balance Sheets

| | | | | | | | | | | |

| December 31, 2023 | | December 31, 2022 |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 577,928 | | | $ | 234,448 | |

| | | |

| | | |

| Trade and other receivables - net of allowance for doubtful accounts of $2,481 and $2,414, respectively | 216,429 | | | 183,861 | |

| Receivables from related parties | 234 | | | 961 | |

| Loans receivable, including loans held for sale of $868,884 and $602,675, respectively, net | 1,582,536 | | | 1,131,745 | |

| Inventories, net | 202,294 | | | 214,084 | |

| Prepaid expenses and other current assets | 47,935 | | | 40,129 | |

| | | |

| Total current assets | 2,627,356 | | | 1,805,228 | |

| Long-term loans receivable, net | 386,072 | | | 423,248 | |

| Goodwill | 148,838 | | | 125,813 | |

| Other intangible assets, net | 114,177 | | | 94,783 | |

| Other non-current assets | 342,046 | | | 195,859 | |

| Property, plant and equipment, net | 253,980 | | | 238,510 | |

| Operating lease right-of-use assets | 76,746 | | | 42,711 | |

| Long-term investments | 41,225 | | | 309,697 | |

| | | |

| Total Assets | $ | 3,990,440 | | | $ | 3,235,849 | |

| LIABILITIES AND CAPITAL | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 131,922 | | | $ | 109,572 | |

| Accrued liabilities | 117,943 | | | 112,744 | |

| | | |

| Deposits | 1,711,585 | | | 1,360,477 | |

| Payables to related parties | 2,529 | | | 2,881 | |

| Short-term debt | — | | | 685 | |

| Current portion of long-term debt | 67 | | | 67 | |

| | | |

| Other current liabilities | 101,086 | | | 62,717 | |

| | | |

| Total current liabilities | 2,065,132 | | | 1,649,143 | |

| Long-term deposits | 370,107 | | | 208,004 | |

| Long-term debt | 191,304 | | | 179,572 | |

| Other borrowings | 15,065 | | | 41,682 | |

| Preferred unit liability | 154,925 | | | 152,247 | |

| Accrued pension liabilities | 46,195 | | | 84,948 | |

| Deferred tax liabilities | 18,353 | | | 41,055 | |

| Long-term operating lease liabilities | 61,790 | | | 35,512 | |

| Other non-current liabilities | 62,161 | | | 42,226 | |

| | | |

| Total Liabilities | 2,985,032 | | | 2,434,389 | |

| Commitments and Contingencies | | | |

| Capital: | | | |

| Partners' capital common units: 21,296,067 and 21,605,093 issued and outstanding (after deducting 18,367,307 and 17,904,679 units held in treasury, at cost of $329,297 and $309,257, respectively | 1,079,853 | | | 952,094 | |

| Accumulated other comprehensive loss | (121,223) | | | (151,874) | |

| Total Partners' Capital | 958,630 | | | 800,220 | |

| Noncontrolling interests in consolidated entities | 46,778 | | | 1,240 | |

| Total Capital | 1,005,408 | | | 801,460 | |

| Total Liabilities and Capital | $ | 3,990,440 | | | $ | 3,235,849 | |

Consolidated Statements of Operations | | | | | | | | | | | | | | | | | | | | | | | | | |

| Unaudited | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, | | |

| 2023 | | 2022 | | 2023 | | 2022 | | |

| Revenue: | | | | | | | | | |

| Diversified Industrial net sales | $ | 275,394 | | | $ | 299,553 | | | $ | 1,193,964 | | | $ | 1,285,666 | | | |

| Energy net revenue | 34,218 | | | 45,061 | | | 179,438 | | | 181,811 | | | |

| Financial Services revenue | 112,341 | | | 78,001 | | | 416,911 | | | 227,964 | | | |

| Supply Chain revenue | 44,954 | | | — | | | 115,144 | | | — | | | |

| Total revenue | 466,907 | | | 422,615 | | | 1,905,457 | | | 1,695,441 | | | |

| Costs and expenses: | | | | | | | | | |

| Cost of goods sold | 269,040 | | | 266,296 | | | 1,103,017 | | | 1,096,936 | | | |

| Selling, general and administrative expenses | 128,708 | | | 102,778 | | | 504,960 | | | 383,377 | | | |

| | | | | | | | | |

| Asset impairment charges | 536 | | | 278 | | | 865 | | | 3,162 | | | |

| Finance interest expense | 25,938 | | | 9,301 | | | 80,432 | | | 16,907 | | | |

| Provision for credit losses | 3,845 | | | 11,419 | | | 51,824 | | | 23,177 | | | |

| Interest expense | 2,466 | | | 6,197 | | | 18,400 | | | 20,649 | | | |

| Gains from sales of businesses | (58) | | | (203) | | | (58) | | | (85,683) | | | |

| Realized and unrealized gains on securities, net | (923) | | | (57,361) | | | (7,074) | | | (34,791) | | | |

| Other income, net | (2,309) | | | (483) | | | (8,115) | | | (3,791) | | | |

| Total costs and expenses | 427,243 | | | 338,222 | | | 1,744,251 | | | 1,419,943 | | | |

| Income from operations before income taxes and equity method investments | 39,664 | | | 84,393 | | | 161,206 | | | 275,498 | | | |

| Income tax provision (benefit) | 33 | | | 17,688 | | | (1,674) | | | 73,944 | | | |

| (Income) loss of associated companies, net of taxes | (3,066) | | | (6,378) | | | 8,878 | | | (4,611) | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Net income | 42,697 | | | 73,083 | | | 154,002 | | | 206,165 | | | |

| | | | | | | | | |

| Net income attributable to noncontrolling interests in consolidated entities | (1,436) | | | (71) | | | (3,173) | | | (193) | | | |

| | | | | | | | | |

| | | | | | | | | |

| Net income attributable to common unitholders | $ | 41,261 | | | $ | 73,012 | | | $ | 150,829 | | | $ | 205,972 | | | |

| Net income per common unit - basic | | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Net income attributable to common unitholders | $ | 1.94 | | | $ | 3.17 | | | $ | 7.04 | | | $ | 9.03 | | | |

| Net income per common unit - diluted | | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Net income attributable to common unitholders | $ | 1.75 | | | $ | 2.82 | | | $ | 6.43 | | | $ | 8.12 | | | |

| Weighted-average number of common units outstanding - basic | 21,250,547 | | | 23,038,179 | | | 21,433,900 | | | 22,813,588 | | | |

| Weighted-average number of common units outstanding - diluted | 25,348,229 | | | 27,020,358 | | | 25,356,796 | | | 26,869,440 | | | |

Consolidated Statements of Cash Flows

| | | | | | | | | | | |

| (in thousands) | Year Ended December 31, |

| 2023 | | 2022 |

Cash flows from operating activities: | | | |

| Net income | $ | 154,002 | | | $ | 206,165 | |

| | | |

| | | |

| | | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | |

| | | |

| Provision for credit losses | 51,824 | | | 23,177 | |

| Loss (income) of associated companies, net of taxes | 8,878 | | | (4,611) | |

| Realized and unrealized gains on securities, net | (7,074) | | | (34,791) | |

| Gains from sale of businesses | (58) | | | (85,683) | |

| Gain on sale of property, plant and equipment | — | | | (940) | |

| Derivative gains on economic interests in loans | (4,713) | | | (5,294) | |

| Non-cash pension expense (income) | 11,806 | | | (7,042) | |

| | | |

| Deferred income taxes | (30,069) | | | 48,546 | |

| Depreciation and amortization | 56,565 | | | 53,755 | |

| Non-cash lease expense | 18,377 | | | 10,461 | |

| Equity-based compensation | 1,617 | | | 1,280 | |

| | | |

| Asset impairment charges | 865 | | | 3,162 | |

| Other | 4,166 | | | 2,843 | |

| Net change in operating assets and liabilities: | | | |

| Trade and other receivables | 4,802 | | | (710) | |

| Inventories | 19,247 | | | (41,086) | |

| Prepaid expenses and other assets | (7,718) | | | (10,431) | |

| Accounts payable, accrued and other liabilities | 4,914 | | | 35,012 | |

| Net increase in loans held for sale | (266,209) | | | (404,043) | |

| Net cash provided by (used in) operating activities | 21,222 | | | (210,230) | |

| Cash flows from investing activities: | | | |

| Purchases of investments | (208,836) | | | (310,798) | |

| Proceeds from maturities of investments | 45,731 | | | 156,050 | |

| Proceeds from sales of investments | 213,319 | | | 19,828 | |

| Principal repayment on Steel Connect Convertible Note | 1,000 | | | — | |

| Loan originations, net of collections | (208,571) | | | (90,030) | |

| | | |

| Purchases of property, plant and equipment | (51,451) | | | (47,541) | |

| Proceeds from sale of property, plant and equipment | 1,846 | | | 1,241 | |

| Proceeds from sale of businesses | — | | | 142,426 | |

| Acquisitions, net of cash acquired | — | | | (47,280) | |

| Increase in cash upon consolidation of Steel Connect | 65,896 | | | — | |

| Other | (1,136) | | | (454) | |

| Net cash used in investing activities | (142,202) | | | (176,558) | |

| Cash flows from financing activities: | | | |

| Net revolver borrowings (repayments) | 11,115 | | | (90,616) | |

| Repayments of term loans | (67) | | | (82) | |

| Purchases of the Company's common units | (20,040) | | | (44,973) | |

| Net decrease in other borrowings | (26,486) | | | (291,117) | |

| Distribution to preferred unitholders | (9,633) | | | (9,633) | |

| Purchase of subsidiary shares from noncontrolling interests | (2,934) | | | (8,606) | |

| Tax withholding related to vesting of restricted units | (605) | | | (1,394) | |

| Net increase in deposits | 513,211 | | | 743,593 | |

| Net cash provided by financing activities | 464,561 | | | 297,172 | |

| Net change for the period | 343,581 | | | (89,616) | |

| Effect of exchange rate changes on cash and cash equivalents | (101) | | | (1,299) | |

| Cash and cash equivalents at beginning of period | 234,448 | | | 325,363 | |

| Cash and cash equivalents at end of period | $ | 577,928 | | | $ | 234,448 | |

Supplemental Balance Sheet Data | | | | | | | | | | | | | | | |

| (in thousands, except common and preferred units) | December 31, | | December 31, | | |

| 2023 | | 2022 | | | | |

| Cash and cash equivalents | $ | 577,928 | | | $ | 234,448 | | | | | |

| WebBank cash and cash equivalents | 170,286 | | | 174,257 | | | | | |

| Cash and cash equivalents, excluding WebBank | $ | 407,642 | | | $ | 60,191 | | | | | |

| Common units outstanding | 21,296,067 | | | 21,605,093 | | | | | |

| Preferred units outstanding | 6,422,128 | | | 6,422,128 | | | | | |

Supplemental Non-GAAP Disclosures | | | | | | | | | | | | | | | | | | | | | | | |

| Adjusted EBITDA Reconciliation: | | | | | | | |

| | | | | | | |

| Unaudited | | | | |

| (in thousands) | Three Months Ended December 31, | | Year Ended

December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Net income from continuing operations | $ | 42,697 | | $ | 73,083 | | $ | 154,002 | | $ | 206,165 |

| Income tax provision (benefit) | 33 | | 17,688 | | (1,674) | | 73,944 |

| Income from continuing operations before income taxes | 42,730 | | 90,771 | | 152,328 | | 280,109 |

| Add (Deduct): | | | | | | | |

| (Income) loss of associated companies, net of taxes | (3,066) | | (6,378) | | 8,878 | | (4,611) |

| Realized and unrealized gains on securities, net | (923) | | (57,361) | | (7,074) | | (34,791) |

| Interest expense | 2,466 | | 6,197 | | 18,400 | | 20,649 |

| Depreciation | 10,756 | | 9,758 | | 39,978 | | 38,394 |

| Amortization | 4,376 | | 3,785 | | 16,587 | | 15,361 |

| | | | | | | |

| Non-cash asset impairment charges | 536 | | 278 | | 865 | | 3,162 |

| Non-cash pension expense | 2,858 | | (1,637) | | 11,806 | | (7,042) |

| Non-cash equity-based compensation | 610 | | 438 | | 1,617 | | 1,280 |

| Gains from sales of businesses | (58) | | (203) | | (58) | | (85,683) |

| Other items, net | (927) | | (999) | | (2,768) | | 1,606 |

| Adjusted EBITDA | $ | 59,358 | | $ | 44,649 | | $ | 240,559 | | $ | 228,434 |

| | | | | | | |

| Total revenue | $ | 466,907 | | $ | 422,615 | | $ | 1,905,457 | | $ | 1,695,441 |

| Adjusted EBITDA margin | 12.7% | | 10.6% | | 12.6% | | 13.5% |

|

| | | | | | | | | | | | |

| Net Cash (Debt) Reconciliation: | | | | |

| | | | |

| (in thousands) | December 31, | | December 31, | |

| 2023 | | 2022 | |

| Total debt | $ | (191,371) | | | $ | (180,324) | | |

| | | | |

| Accrued pension liabilities | (46,195) | | | (84,948) | | |

| Preferred unit liability, including current portion | (154,925) | | | (152,247) | | |

| Cash and cash equivalents, excluding WebBank | 407,642 | | | 60,191 | | |

| | | | |

| Long-term investments | 41,225 | | | 309,697 | | |

| Net cash (debt) | $ | 56,376 | | | $ | (47,631) | | |

| | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Adjusted Free Cash Flow Reconciliation: | | | | | | | |

| | | | | | | |

| Unaudited | | | | |

| (in thousands) | Three Months Ended December 31, | | Year Ended

December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Net cash provided by (used in) operating activities of continuing operations | $ | 9,547 | | | $ | (151,706) | | | $ | 21,222 | | | $ | (210,230) | |

| Purchases of property, plant and equipment | (14,784) | | | (17,353) | | | (51,451) | | | (47,541) | |

| Net increase in loans held for sale | 92,824 | | | 199,319 | | | 266,209 | | | 404,043 | |

| Adjusted free cash flow | $ | 87,587 | | | $ | 30,260 | | | $ | 235,980 | | | $ | 146,272 | |

Segment Results | | | | | | | | | | | | | | | | | | | | | | | |

| Unaudited | | | | |

| (in thousands) | Three Months Ended December 31, | | Year Ended

December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Revenue: | | | | | | | |

| Diversified Industrial | $ | 275,394 | | | $ | 299,553 | | | $ | 1,193,964 | | | $ | 1,285,666 | |

| Energy | 34,218 | | | 45,061 | | | 179,438 | | | 181,811 | |

| Financial Services | 112,341 | | | 78,001 | | | 416,911 | | | 227,964 | |

| Supply Chain | 44,954 | | | — | | | 115,144 | | | — | |

| Total revenue | $ | 466,907 | | | $ | 422,615 | | | $ | 1,905,457 | | | $ | 1,695,441 | |

| | | | | | | |

| Income (loss) before interest expense and income taxes: | | | | | | | |

| Diversified Industrial | $ | 9,922 | | | $ | 17,095 | | | $ | 70,937 | | | $ | 200,629 | |

| Energy | 1,008 | | | (404) | | | 16,247 | | | 13,608 | |

| Financial Services | 26,002 | | | 18,706 | | | 74,248 | | | 63,477 | |

| Supply Chain | 2,880 | | | — | | | 8,726 | | | — | |

| Corporate and other | 5,384 | | | 61,571 | | | 570 | | | 23,044 | |

| Income before interest expense and income taxes | 45,196 | | | 96,968 | | | 170,728 | | | 300,758 | |

| Interest expense | 2,466 | | | 6,197 | | | 18,400 | | | 20,649 | |

| Income tax provision (benefit) | 33 | | | 17,688 | | | (1,674) | | | 73,944 | |

| Net income | $ | 42,697 | | | $ | 73,083 | | | $ | 154,002 | | | $ | 206,165 | |

| | | | | | | |

| (Income) loss of associated companies, net of taxes: | | | | | | | |

| | | | | | | |

| | | | | | | |

| Corporate and other | $ | (3,066) | | | $ | (6,378) | | | $ | 8,878 | | | $ | (4,611) | |

| Total | $ | (3,066) | | | $ | (6,378) | | | $ | 8,878 | | | $ | (4,611) | |

| | | | | | | |

Segment depreciation and amortization: | | | | | | | |

| Diversified Industrial | $ | 11,091 | | | $ | 10,177 | | | $ | 41,424 | | | $ | 41,805 | |

| Energy | 2,333 | | | 2,846 | | | 10,065 | | | 10,546 | |

| Financial Services | 205 | | | 358 | | | 835 | | | 750 | |

| Supply Chain | 1,335 | | | — | | | 3,569 | | | — | |

| Corporate and other | 168 | | | 162 | | | 672 | | | 654 | |

| Total depreciation and amortization | $ | 15,132 | | | $ | 13,543 | | | $ | 56,565 | | | $ | 53,755 | |

| | | | | | | |

Segment Adjusted EBITDA: | | | | | | | |

| Diversified Industrial | $ | 24,376 | | | $ | 23,639 | | | $ | 124,746 | | | $ | 153,120 | |

| Energy | 2,113 | | | 2,367 | | | 24,630 | | | 23,905 | |

| Financial Services | 26,207 | | | 19,199 | | | 73,780 | | | 63,499 | |

| Supply Chain | 4,373 | | | — | | | 13,179 | | | — | |

| Corporate and other | 2,289 | | | (556) | | | 4,224 | | | (12,090) | |

| Total Adjusted EBITDA | $ | 59,358 | | | $ | 44,649 | | | $ | 240,559 | | | $ | 228,434 | |

Note Regarding Use of Non-GAAP Financial Measurements

The financial data contained in this press release includes certain non-GAAP financial measurements as defined by the U.S. Securities and Exchange Commission ("SEC,"), including "Adjusted EBITDA," "Net Cash (Debt)" and "Adjusted Free Cash Flow." The Company is presenting these non-GAAP financial measurements because it believes that these measures provide useful information to investors about the Company's business and its financial condition. The Company believes these measures are useful to investors because they are measures used by the Company's Board of Directors and management to evaluate its ongoing business, including in internal management reporting, budgeting and forecasting processes, in comparing operating results across the business, as internal profitability measures, as components in assessing liquidity and evaluating the ability and the desirability of making capital expenditures and significant acquisitions, and as elements in determining executive compensation.

The Company defines Adjusted EBITDA as net income or loss from continuing operations before the effects of income or loss from investments in associated companies and other investments held at fair value, interest expense, taxes, depreciation and amortization, non-cash pension expense or income, and realized and unrealized gains or losses on investments, and excludes certain non-recurring and non-cash items.

The Company defines Net Cash (Debt) as the sum of total debt, loan guarantee liability, accrued pension liabilities and preferred unit liability, less the sum of cash and cash equivalents (excluding those used in WebBank's banking operations), marketable securities, and long-term investments.

The Company defines Adjusted Free Cash Flow as net cash provided by or used in operating activities of continuing operations less the sum of purchases of property, plant and equipment, and net increases or decreases in loans held for sale.

However, the measures are not measures of financial performance under generally accepted accounting principles in the U.S. ("U.S. GAAP"), and the items excluded from these measures are significant components in understanding and assessing financial performance. Therefore, these non-GAAP financial measurements should not be considered substitutes for net income or loss, total debt, or cash flows from operating, investing, or financing activities. Because Adjusted EBITDA is calculated before recurring cash charges, including realized losses on investments, interest expense, and taxes, and is not adjusted for capital expenditures or other recurring cash requirements of the business, it should not be considered as a measure of discretionary cash available to invest in the growth of the business. There are a number of material limitations to the use of Adjusted EBITDA as an analytical tool, including the following:

•Adjusted EBITDA does not reflect the Company's tax provision or the cash requirements to pay its taxes;

•Adjusted EBITDA does not reflect income or loss from the Company's investments in associated companies and other investments held at fair value;

•Adjusted EBITDA does not reflect the Company's interest expense;

•Although depreciation and amortization are non-cash expenses in the period recorded, the assets being depreciated and amortized may have to be replaced in the future, and Adjusted EBITDA does not reflect the cash requirements for such replacement;

•Adjusted EBITDA does not reflect the Company's net realized and unrealized gains and losses on its investments;

•Adjusted EBITDA does not include non-cash charges for pension expense and equity-based compensation;

•Adjusted EBITDA does not include amounts related to noncontrolling interests in consolidated entities;

•Adjusted EBITDA does not include certain other non-recurring and non-cash items; and

•Adjusted EBITDA does not include the Company's discontinued operations.

In addition, Net Cash (Debt) assumes the Company's cash and cash equivalents (excluding those used in WebBank's banking operations), marketable securities, and long-term investments are immediately convertible in cash and can be used to reduce outstanding debt without restriction at their recorded fair value, while Adjusted Free Cash Flow excludes net increases or decreases in loans held for sale, which can vary significantly from period-to-period since these loans are typically sold after origination and thus represent a significant component in WebBank's operating cash flow requirements.

The Company compensates for these limitations by relying primarily on its U.S. GAAP financial measures and using these measures only as supplemental information. The Company believes that consideration of Adjusted EBITDA, Net Cash (Debt), and Adjusted Free Cash Flow, together with a careful review of its U.S. GAAP financial measures, is a well-informed method of analyzing SPLP. Because Adjusted EBITDA, Net Cash (Debt), and Adjusted Free Cash Flow are not measurements determined in accordance with U.S. GAAP and are susceptible to varying calculations, Adjusted EBITDA, Net Cash (Debt), and Adjusted Free Cash Flow, as presented, may not be comparable to other similarly titled measures of other companies.

Forward-Looking Statements

This press release contains certain "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, that reflect SPLP's current expectations and projections about its future results, performance, prospects and opportunities. SPLP identifies these forward-looking statements by using words such as "expect," "anticipate," "intend," "plan," "believe," "seek," "estimate," and similar expressions. These forward-looking statements are only predictions based upon the Company's current expectations and projections about future events, and are based on information currently available to the Company and are subject to risks, uncertainties, and other factors that could cause its actual results, performance, prospects, or opportunities in 2024 and beyond to differ materially from those expressed in, or implied by, these forward-looking statements. These factors include, without limitation: disruptions to the Company’s business as a result of economic downturns; the negative impact of inflation, and supply chain disruptions; the significant volatility of crude oil and commodity prices, including from the ongoing Russia-Ukraine war or the disruptions caused by the ongoing conflict between Israel and Hamas; the effects of rising interest rates; the Company’s subsidiaries’ sponsor defined pension plans, which could subject the Company to future cash flow requirements; the ability to comply with legal and regulatory requirements, including environmental, health and safety laws and regulations, banking regulations and other extensive requirements to which the Company and its businesses are subject; risks associated with the Company’s wholly-owned subsidiary, WebBank, as a result of its Federal Deposit Insurance Corporation ("FDIC") status, highly-regulated lending programs, and capital requirements; the ability to meet obligations under the Company's senior credit facility through future cash flows or financings; the risk of recent events affecting the financial services industry, including the closures or other failures of several large banks; the risk of management diversion, increased costs and expenses, and impact on profitability in connection with the Company's business strategy to make acquisitions, including in connection with the Company’s recent majority investment in the Supply Chain segment; the impact of losses in the Company's investment portfolio; the Company’s ability to protect its intellectual property rights and obtain or retain licenses to use others' intellectual property on which the Company relies; the Company’s exposure to risks inherent to conducting business outside of the U.S.; the impact of any changes in U.S. trade policies; the adverse impact of litigation or compliance failures on the Company's profitability; a significant disruption in, or breach in security of, the Company’s technology systems or protection of personal data; the loss of any significant customer contracts; the Company’s ability to maintain effective internal control over financial reporting; the rights of unitholders with respect to voting and maintaining actions against the Company or its affiliates; potential conflicts of interest arising from certain interlocking relationships amount us and affiliates of the Company’s Executive Chairman; the Company’s dependence on the Manager and impact of the management fee on the Company’s total partners’ capital; the impact to the development of an active market for the Company’s units due to transfer restrictions and other factors; the Company’s tax treatment and its subsidiaries’ ability to fully utilize their tax benefits; the potential negative impact on our operations of changes in tax rates, laws or regulations, including U.S. government tax reform; the loss of essential employees; and other risks detailed from time to time in filings we make with the SEC. These statements involve significant risks and uncertainties, and no assurance can be given that the actual results will be consistent with these forward-looking statements. Investors should read carefully the factors described in the "Risk Factors" section of the Company's filings with the SEC, including the Company's Form 10-K for the year ended December 31, 2023 and subsequent quarterly reports on Form 10-Q and annual reports on Form 10-K, for information regarding risk factors that could affect the Company's results. Any forward-looking statement made in this press release speaks only as of the date hereof, and investors should not rely upon forward-looking statements as predictions of future events. Except as otherwise required by law, the Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events, changed circumstances or any other reason.

Investor Relations Contact

Jennifer Golembeske

212-520-2300

jgolembeske@steelpartners.com

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLine items represent financial concepts included in a table. These concepts are used to disclose reportable information associated with domain members defined in one or many axes to the table.

| Name: |

dei_EntityListingsLineItems |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=splp_SeriesAPreferredUnitsMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

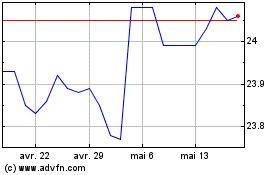

Steel Partners (NYSE:SPLP-A)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Steel Partners (NYSE:SPLP-A)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024