false

0001126956

0001126956

2024-03-05

2024-03-05

0001126956

sr:CommonStockCustomMember

2024-03-05

2024-03-05

0001126956

sr:DepositarySharesCustomMember

2024-03-05

2024-03-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 5, 2024

|

Commission

File Number

|

|

Name of Registrant, Address of Principal

Executive Offices and Telephone Number

|

|

State of

Incorporation

|

|

IRS Employer

Identification No.

|

|

1-16681

|

|

Spire Inc.

700 Market Street

St. Louis, MO 63101

314-342-0500

|

|

Missouri

|

|

74-2976504

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 13e-4(c))

Securities registered pursuant to Section 12(b) of the Exchange Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

| |

|

|

|

|

|

Common Stock $1.00 par value

|

|

SR

|

|

New York Stock Exchange LLC

|

| |

|

|

|

|

|

Depositary Shares, each representing a 1/1,000th interest in a share of 5.90% Series A Cumulative Redeemable Perpetual Preferred Stock, par value $25.00 per share

|

|

SR.PRA

|

|

New York Stock Exchange LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 3.02 Unregistered Sales of Equity Securities

As disclosed in the Current Report on Form 8-K filed with the Securities and Exchange Commission (the “SEC”) on February 16, 2021 (the “February 16 Form 8-K”), Spire Inc. (the “Company”) consummated the issuance and sale of 3,200,000 Equity Units, initially consisting of Corporate Units (the “Corporate Units”), for an aggregate stated amount of $160.0 million, as more fully described below, pursuant to an underwriting agreement, dated February 9, 2021 (the “Underwriting Agreement”), with the several Underwriters named in Exhibit A thereto (the “Underwriters”), for whom Credit Suisse Securities (USA) LLC, BofA Securities, Inc. and Wells Fargo Securities, LLC acted as representatives. The Company granted an option pursuant to the Underwriting Agreement to the Underwriters to purchase, within the 13-day period beginning on (and including) February 16, 2021, up to an additional 300,000 Corporate Units, and such option was exercised. The Corporate Units were issued pursuant to the Company’s Registration Statement on Form S-3 (Registration No. 333-231443) (as amended, the “Registration Statement”), which became effective upon filing with the Securities and Exchange Commission (the “SEC”), and the related Prospectus contained therein, as supplemented by the Prospectus Supplement dated February 9, 2021. Copies of the Underwriting Agreement and opinions related to the Corporate Units were attached to the February 16 Form 8-K as Exhibits 1.1, 5.1, 5.2, 23.1 and 23.2.

Each Corporate Unit had a stated amount of $50 and was comprised of (i) a purchase contract obligating the holder to purchase from the Company for a price in cash of $50, on the purchase contract settlement date, or March 1, 2024, subject to earlier termination or settlement, a certain number of shares of the Company’s common stock and (ii) a 1/20th, or 5%, undivided beneficial ownership interest in $1,000 principal amount of the Company’s 2021 Series A 0.75% Remarketable Senior Notes due 2026 (the “Notes”).

The Corporate Units were issued pursuant to a Purchase Contract and Pledge Agreement (the “Purchase Contract and Pledge Agreement”), dated as of February 16, 2021, between the Company and U.S. Bank National Association, as purchase contract agent, collateral agent, custodial agent and securities intermediary.

Each Corporate Unit purchase contract obligated holders to purchase from the Company, on March 1, 2024, for a price of $50 in cash, the following number of shares of common stock of the Company, subject to anti-dilution adjustments:

| |

●

|

if the applicable market value, which is the average volume-weighted average price of common stock on each trading day during the 20 consecutive trading day period beginning on, and including, the 21st scheduled trading day immediately preceding March 1, 2024, subject to certain adjustments, equaled or exceeded $78.6906, 0.6354 shares of common stock;

|

| |

●

|

if the applicable market value was less than $78.6906 but greater than $64.24, a number of shares of common stock equal to $50 divided by the applicable market value, rounded to the nearest ten thousandth of a share; and

|

| |

●

|

if the applicable market value was less than or equal to $64.24, 0.7783 shares of common stock.

|

The applicable market value was calculated to be $58.6809, and after adjustment the holders were obligated to purchase 0.7845 shares of common stock.

Pursuant to the Purchase Contract and Pledge Agreement, the Corporate Unit holders purchased an aggregate of 2,745,750 shares of Common Stock for $175 million, which purchase was settled on March 5, 2024. The proceeds will be used to repay short-term borrowings and for general corporate purposes.

The shares of Common Stock delivered in connection with these conversions have been issued in reliance on the exemption from registration provided by Section 4(a)(2) of the Securities Act of 1933, as amended (the “Securities Act”).

This Current Report on Form 8-K does not constitute an offer to sell or a solicitation of an offer to buy any securities, nor shall there be any sale of securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities law of any such state or jurisdiction. The Corporate Units and the shares of Common Stock issuable upon the conversion of the Corporate Units have not been and will not be registered under the Securities Act or the securities laws of any other jurisdiction and may not be offered or sold in the United States absent registration or an applicable exemption from registration requirements. The foregoing descriptions of the Corporate Units and the Purchase Contract and Pledge Agreement do not purport to be complete and are qualified in their entirety by reference to the Purchase Contract and Pledge Agreement. Copies of the Purchase Contract and Pledge Agreement, the Indenture, the form of remarketing agreement, the form of Corporate Units, the form of Treasury Units and the form of Note were attached as Exhibits 4.4, 4.1, 4.2, 4.5, 4.6, 4.7 to the February 16 Form 8-K.

Forward-Looking Statements

Statements contained in this Current Report on Form 8-K, which are not historical facts, such as the expected conversion settlement dates are forward-looking statements. In addition, the Company, through its senior management, may from time to time make forward-looking public statements concerning the matters described herein. All such estimates, projections, and forward-looking information speak only as of the date hereof, and the Company undertakes no duty to publicly update or revise such forward-looking information, whether as a result of new information, future events, or otherwise. Such forward-looking statements are necessarily estimates based upon current information and involve a number of risks and uncertainties. Actual events or results may differ materially from those anticipated in these forward-looking statements as a result of a variety of factors. While it is impossible to identify all such factors, factors which could cause actual events or results to differ materially from those estimated by the Company include, but are not limited to, the price of the Company’s common stock as it affects the tax and accounting impacts resulting from conversions of the Notes and Corporate Units; potential disruptions, breaches, or other incidents affecting the proper operation, availability, or security of the Company’s information systems, including unauthorized access to or theft of patient, business associate, or other sensitive information; general conditions or significant disruptions in the economy and capital markets; and other factors which may be identified from time to time in the Company’s SEC filings and other public announcements, including its Form 10‑K for the fiscal year ended September 30, 2023 and Form 10-Q for the quarter ended December 31, 2023.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

|

Spire Inc.

|

| |

|

|

|

|

|

Date:

|

March 8, 2024

|

|

By:

|

/s/ Steven P. Rasche

|

| |

|

|

|

Steven P. Rasche

Executive Vice President,

Chief Financial Officer

|

v3.24.0.1

Document And Entity Information

|

Mar. 05, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

Spire Inc.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Mar. 05, 2024

|

| Entity, File Number |

1-16681

|

| Entity, Address, Address Line One |

700 Market Street

|

| Entity, Address, City or Town |

St. Louis

|

| Entity, Address, State or Province |

MO

|

| Entity, Address, Postal Zip Code |

63101

|

| City Area Code |

314

|

| Local Phone Number |

342-0500

|

| Entity, Incorporation, State or Country Code |

MO

|

| Entity, Tax Identification Number |

74-2976504

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001126956

|

| CommonStock Custom [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

SR

|

| Security Exchange Name |

NYSE

|

| DepositaryShares Custom [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Depositary Shares

|

| Trading Symbol |

SR.PRA

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=sr_CommonStockCustomMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=sr_DepositarySharesCustomMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

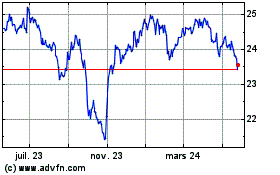

Spire (NYSE:SR-A)

Graphique Historique de l'Action

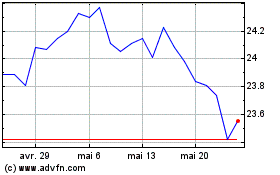

De Avr 2024 à Mai 2024

Spire (NYSE:SR-A)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024