UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________________________

FORM 6-K

_______________________________

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

For the month of March 2024

Commission File No. 001-36675

_______________________________

STELLANTIS N.V.

(Translation of Registrant’s Name Into English)

_______________________________

Taurusavenue 1

2132LS, Hoofddorp

The Netherlands

Tel. No.: +31 237001511

(Address of Principal Executive Offices)

_______________________________

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form 40-F o

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule101(b)(1): o

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule101(b)(7): o

The following exhibit is furnished herewith:

| | | | | |

| Exhibit 99.1 | Press release issued by Stellantis N.V. dated March 4, 2024. |

| Exhibit 99.2 | Notice of Annual General Meeting |

| Exhibit 99.3 | Agenda and Explanatory Notes |

| Exhibit 99.4 | Bio of Claudia Parzani |

| Exhibit 99.5 | Corporate Governance Statement |

| Exhibit 99.6 | Outstanding share capital and voting rights at the date of the notice |

| Exhibit 99.7 | Shares registered in the United States - Proxy card |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | | | | |

Date: March 5, 2024 | STELLANTIS N.V. |

| | | |

| | | |

| By: | /s/ Giorgio Fossati |

| | Name: Giorgio Fossati |

| | Title: General Counsel |

Index of Exhibits

| | | | | |

Exhibit Number | Description of Exhibit |

| |

| 99.1 | Press release issued by Stellantis N.V. dated March 4, 2024. |

| 99.2 | Notice of Annual General Meeting |

| 99.3 | Agenda and Explanatory Notes |

| 99.4 | Bio of Claudia Parzani |

| 99.5 | Corporate Governance Statement |

| 99.6 | Outstanding share capital and voting rights at the date of the notice |

| 99.7 | Shares registered in the United States - Proxy card |

Stellantis Publishes Agenda for 2024 AGM

AMSTERDAM, March 4, 2024 – Stellantis N.V. announced today it has published the agenda and explanatory notes for the 2024 Annual General Meeting of Shareholders (AGM), which will take place on April 16, 2024, in Amsterdam.

Stellantis’ AGM notice and explanatory notes, other AGM materials and instructions for voting, are available under the Investors section of the Stellantis corporate website at www.stellantis.com, where they can be viewed and downloaded. Shareholders may request a hard copy of these materials, which include Stellantis’ audited financial statements for the fiscal year ended December 31, 2023, free of charge, through the contact below.

# # #

Stellantis

Stellantis N.V. (NYSE: STLA / Euronext Milan: STLAM / Euronext Paris: STLAP) is one of the world’s leading automakers aiming to provide clean, safe and affordable freedom of mobility to all. It’s best known for its unique portfolio of iconic and innovative brands including Abarth, Alfa Romeo, Chrysler, Citroën, Dodge, DS Automobiles, Fiat, Jeep®, Lancia, Maserati, Opel, Peugeot, Ram, Vauxhall, Free2move and Leasys. Stellantis is executing its Dare Forward 2030, a bold strategic plan that paves the way to achieve the ambitious target of becoming a carbon net zero mobility tech company by 2038, with single-digit percentage compensation of the remaining emissions, while creating added value for all stakeholders. For more information, visit www.stellantis.com.

| | | | | | | | | | | |

@Stellantis @Stellantis |  Stellantis Stellantis |  Stellantis Stellantis |  Stellantis Stellantis |

| | |

For more information, contact:

|

communications@stellantis.com |

www.stellantis.com |

NOTICE OF THE ANNUAL GENERAL MEETING STELLANTIS N.V.

The annual general meeting of shareholders (the “AGM”) of Stellantis N.V. (the “Company” or “Stellantis”) will be held on April 16, 2024 at 2:00 p.m. CEST.

The AGM will be held at the offices of Freshfields Bruckhaus Deringer LLP, Strawinskylaan 10, 1077 XZ Amsterdam, the Netherlands. The AGM will be held in English.

AGENDA

1. Opening

2. Annual Report 2023

a.Report of the Board of Directors for the financial year 2023 (discussion)

b.Policy on additions to reserves and on dividends (discussion)

c.Corporate Governance Chapter of the Annual Report 2023 (discussion)

d.Remuneration Report 2023 (advisory voting)

e.Adoption of the Annual Accounts 2023 (voting)

f.Approval of 2023 dividend (voting)

g.Granting of discharge to the directors in respect of the performance of their duties during the financial year 2023 (voting)

3. Appointment of Non-Executive Director

Proposal to appoint Ms. Claudia Parzani as Non-Executive Director (voting)

4. Delegation to the Board of Directors of the authority to issue shares in the capital of the Company and to limit or to exclude pre-emptive rights

a.Proposal to designate the Board of Directors as the corporate body authorized to issue common shares and to grant rights to subscribe for common shares as provided for in article 7 of the Company’s articles of association (voting)

b.Proposal to designate the Board of Directors as the corporate body authorized to limit or to exclude pre-emption rights for common shares as provided for in article 8 of the Company’s articles of association (voting)

5. Delegation to the Board of Directors of the authority to acquire common shares in the Company's capital

Proposal to authorize the Board of Directors to acquire fully paid-up common shares in the Company’s own share capital in accordance with article 9 of the Company’s articles of association (voting)

6. Cancellation of shares in the capital of the Company

a.Proposal to cancel common shares held by the Company in its own share capital as specified in article 10 of the Company’s articles of association (voting)

b.Proposal to cancel all class B special voting shares held by the Company in its own share capital as specified in article 10 of the Company’s articles of association (voting)

7. Closing

AGM DOCUMENTS

This notice, the agenda with explanatory notes, the Annual Report 2023 (including the financial statements), and other documents relevant for the AGM are available on the Company's website (www.stellantis.com).

The relevant AGM materials are also available at the Company's offices (Taurusavenue 1, 2132 LS Hoofddorp, the Netherlands) for shareholders and other persons entitled to attend the meeting who will receive a copy free of charge upon request.

HOLDING SHARES IN STELLANTIS' CAPITAL

Stellantis' shareholders can hold their shares in Stellantis as follows:

1) Loyalty register. Shareholders holding special voting shares and common shares or shareholders holding common shares electing to receive special voting shares upon completion of the required holding period (the “Loyalty Shareholders”) registered in the Company's loyalty register (the “Loyalty Register”).

The Loyalty Register is maintained on the Company's behalf in the records of the Company’s agents being Computershare Trust Co. NA, Computershare S.p.A. and Société Générale Securities Services France (the “Agents” and each the “Agent”);

2) Euroclear France (EFR). Shareholders holding common shares in an intermediary account with a participant in the EFR system (the “EFR Participant Account”);

3) Monte Titoli (MT). Shareholders holding common shares in an intermediary account with a participant in the Monte Titoli system (the “MT Participant Account”);

4) Depository Trust Co. (DTC). Shareholders holding common shares in a bank, brokerage or other intermediary account with a participant in the DTC system (the “DTC Participant Account”); and

5) Registered shareholders. Shareholders holding common shares in registered form (the “Registered Shareholders”) in the Company's shareholders register (the “Shareholders Register”), maintained by Computershare Trust Co. NA, as the Company's transfer agent (the “Transfer Agent” and together with the Agents, the “AGM Agents”).

RECORD DATE AND FINAL REGISTRATION DATE

Under Dutch law and the Company’s articles of association, in order to be entitled to attend and, if applicable, to vote at the AGM, shareholders and other persons entitled to attend the AGM, must (i) be registered as of Tuesday March 19, 2024 (the “Record Date”), in the register established for that purpose by the Board of Directors (the “AGM Register”) after reflecting all debit and credit entries as of the Record Date, regardless of whether the shares are still held by such holders at the date of the AGM and (ii) request registration in the manner mentioned below.

The AGM Register established by the Board of Directors is: (i) in respect of Loyalty Shareholders, the Loyalty Register, (ii) in respect of shareholders holding common shares in (a) a EFR Participant Account, (b) a MT Participant Account or (c) a DTC Participant Account, the administration of the relevant bank, brokerage or other intermediary (the “Intermediary”) and (iii) in respect of Registered Shareholders, the Shareholders Register.

The Final Registration Date (as referred to in the Company's articles of association) for this AGM is Tuesday April 9, 2024 at 5 p.m. CEST.

ATTENDANCE AND VOTING

Ad (i). Loyalty shareholders

The AGM Agents will send the AGM documentation to Loyalty Shareholders at the email addresses of such shareholders as they appear from the records maintained by the relevant AGM Agent, including instructions that allows them to attend the AGM or to give their voting instructions by proxy or online vote.

Loyalty Shareholders should give their voting instructions to the relevant AGM Agent by 5 p.m. CEST on the Final Registration Date in writing (contact details below) or electronically via the web procedure made available by the relevant Agent.

Ad (ii)(a). Shareholders holding common shares via Euroclear France

Shareholders holding common shares in a EFR Participant Account (the “EFR Investors”) who wish to attend the AGM, provide instructions or grant a power of attorney to vote on their behalf should use their banking institution website allowing access to the VOTACCESS platform from Wednesday, March 20, 2024 at 9 a.m. CET and until Final Registration Date at 5 p.m. CEST.

Shareholders holding registered shares wishing to attend the AGM, provide instructions or grant a power of attorney to vote on their behalf will have to connect, with their usual access codes or their email address, if their Sharinbox by SG Markets account is already activated, to the Sharinbox platform (www.sharinbox.societegenerale.com) to access to the VOTACCESS platform from Wednesday, March 20, 2024 at 9 a.m. CET and until Final Registration Date at 5 p.m. CEST.

Ad (ii)(b). Shareholders holding common shares via Monte Titoli

Shareholders holding common shares in a MT Participant Account (the “MT Investors”) who wish to attend or vote at the AGM by proxy should request their Intermediary to issue a statement (the “Notice of Participation”) confirming their shareholding (including the shareholder’s name and address and the number of shares notified for attendance and held by the relevant shareholder on the Record Date). Intermediaries must submit the Notice of Participation no later than on the Final Registration Date at 5 p.m. CEST to Computershare S.p.A. The MT Investors may also give their voting instructions through the relevant proxy form published on the Company’s website (www.stellantis.com). They can also cast their votes in advance of the AGM via the web procedure made available to MT Investors by Computershare S.p.A. through the Company’s website.

Ad (ii)(c). Shareholders holding common shares in a DTC Participant Account

Shareholders holding common shares in a DTC Participant Account should give instructions to their Intermediary, as the record holder of their shares, who is required to vote their shares according to their instructions. In order to vote their shares or to attend at the AGM, they will need to follow the directions provided by their Intermediary.

Ad (iii). Registered Shareholders

The Transfer Agent will send the AGM documentation to Registered Shareholders at the addresses of such shareholders as they appear from the Shareholders Register, including the Proxy Card with the instructions that allows them to attend at the AGM or give their voting instructions by telephone at +1-800-652-VOTE or internet at www.investorvote.com/STLA. Such Proxy Card will also be available on the Company’s website (www.stellantis.com).

VOTE BY PROXY

Subject to compliance with the paragraphs referred to above, shareholders can vote at the AGM by proxy. In order to give proxy and voting instructions, the shareholder (a) must have registered his or her shares as set out above and (b) must ensure that the duly completed and signed proxy including, as appropriate, voting instructions, will be received by the relevant AGM Agent (contact details below) by 5 p.m. CEST on the Final Registration Date in writing or electronically pursuant to instructions contained in the proxy forms. All votes shall be cast electronically or in writing ahead of the AGM in accordance with the proxy and voting instructions.

ATTENDANCE

Shareholders holding common shares who wish to attend the AGM (either in person or by proxy) (a) must have registered his or her shares as set out above and (b) should request their Intermediary to submit an attendance request no later than 5:00 p.m. CEST on the Final Registration date to the relevant Agent.

These shareholders will receive an attendance card issued in their name (the “Attendance Card”). This will serve as admission certificate and the shareholder (or his or her proxy) will need to submit the Attendance Card at the AGM to enter the AGM. For this purpose the Attendance Card also contains a proxy form section. Prior to the AGM, the Attendance Card as

well as a copy of the written power of attorney (when applicable), shall have to be handed over at the registration desk.

VOTING LIMITATION AND NOTIFICATION OBLIGATION

As further set out in the Company's articles of association, no shareholder, acting alone or in concert, together with votes exercised by affiliates of such shareholder or pursuant to proxies or other arrangements conferring the right to vote, may be able to exercise, directly or indirectly, 30 percent (the “Maximum Voting Threshold”) or more of the votes that could be cast at a general meeting of the Company. Any voting right of such shareholder in excess of the Maximum Voting Threshold for a general meeting will be suspended by the Company. This voting limitation also applies with respect to the AGM. The Maximum Voting Threshold with respect to the AGM will be published on the Company's website on the day following the Final Registration Date.

Furthermore, the Company's articles of association provide that, before each general meeting, any shareholder holding voting rights in excess of the Maximum Voting Threshold is required to notify the Company, in writing, of its shareholding and total voting rights in the Company and provide, upon written request by the Company, any information necessary to ascertain the composition, nature and size of its shareholding and any other person acting in concert with it. This notification obligation also applies with respect to the AGM.

CONTACT DETAILS OF AGENTS

1) Computershare S.p.A.

Via Nizza 262/73, 10126 Torino

Italy

e-mail: stellantis@computershare.it

2) Computershare Investor Services

P.O. Box 43078

Providence, RI 02940-3078

By overnight delivery:

Computershare Investor Services

150 Royall Street - Suite 101

Canton, MA 02021

email: web.queries@computershare.com

3) Société Générale Securities Services France

Assemblées Générales

32 Rue du Champ de Tir

CS 30812 – 44308 NANTES cedex 3

France

email: service.assemblee-generale@sgss.socgen.com

March 4, 2024

Stellantis N.V.

The Board of Directors

AGENDA AND EXPLANATORY NOTES

FOR THE ANNUAL GENERAL MEETING OF STELLANTIS N.V.

To be held on Tuesday April 16, 2024 at 2:00 p.m. CEST at

the offices of Freshfields Bruckhaus Deringer LLP,

Strawinskylaan 10, 1077 XZ, Amsterdam,

The Netherlands

AGENDA FOR THE 2024 ANNUAL GENERAL MEETING OF STELLANTIS N.V. ("STELLANTIS" OR "COMPANY")

1. Opening

2. Annual Report 2023

a.Report of the Board of Directors for the financial year 2023 (discussion)

b.Policy on additions to reserves and on dividends (discussion)

c.Corporate Governance Chapter of the Annual Report 2023 (discussion)

d.Remuneration Report 2023 (advisory voting)

e.Adoption of the Annual Accounts 2023 (voting)

f.Approval of 2023 dividend (voting)

g.Granting of discharge to the directors in respect of the performance of their duties during the financial year 2023 (voting)

3 Appointment of Non-Executive Director

Proposal to appoint Ms. Claudia Parzani as Non-Executive Director (voting)

4. Delegation to the Board of Directors of the authority to issue shares in the capital of the Company and to limit or to exclude pre-emptive rights

a.Proposal to designate the Board of Directors as the corporate body authorized to issue common shares and to grant rights to subscribe for common shares as provided for in article 7 of the Company’s articles of association (voting)

b.Proposal to designate the Board of Directors as the corporate body authorized to limit or to exclude pre-emption rights for common shares as provided for in article 8 of the Company’s articles of association (voting)

5. Delegation to the Board of Directors of the authority to acquire common shares in the Company's capital

Proposal to authorize the Board of Directors to acquire fully paid-up common shares in the Company’s own share capital in accordance with article 9 of the Company’s articles of association (voting)

6. Cancellation of shares in the capital of the Company

a.Proposal to cancel common shares held by the Company in its own share capital as specified in article 10 of the Company’s articles of association (voting)

b.Proposal to cancel all class B special voting shares held by the Company in its own share capital as specified in article 10 of the Company’s articles of association (voting)

7. Closing

EXPLANATORY NOTES TO THE AGENDA FOR THE 2024 AGM OF STELLANTIS

1. Opening

The chairperson of the meeting will open the meeting.

2. Annual Report 2023

A. Report of the Board of Directors for the financial year 2023 (discussion)

The Report on Operations of the Company is contained in the Company’s Annual Report 2023. For further details please refer to the “Report on Operations” section of the Annual Report.

B. Policy on additions to reserves and on dividends (discussion)

The Company's dividend policy as referred to below contemplates an annual ordinary dividend to be distributed by the Company to the holders of common shares.

Common shares

The Company’s dividend policy contemplates an annual ordinary dividend to the holders of common shares targeting a payout ratio of 25%-30% of the Company’s net profit for the relevant prior financial year.

The actual level of dividend to be distributed by the Company will be determined by the Board of Directors in its sole discretion and will be subject to earnings, cash balances, commitments, strategic plans and any other factors that the Board of Directors may deem relevant at the time of a dividend distribution, including adjustments for income or costs that are significant in nature but expected to occur infrequently.

Special voting shares

The holders of special voting shares are not entitled to any distributions. However, pursuant to article 29.4 of the Company's articles of association, from any amount of profits not reserved by the Board of Directors, first an amount shall be allocated and added to a separate special voting shares dividend reserve for the benefit of the holders of special voting shares (the "Special Voting Shares Dividend Reserve"). The Company has no intention to propose any distribution from the Special Voting Shares Dividend Reserve.

C. Corporate Governance Chapter of the Annual Report 2023 (discussion)

On 20 December 2022 an updated version of the Dutch Corporate Governance Code was published (the "2022 Code"). The Company is required to first report on its compliance with the 2022 Code in the annual report over the financial year 2023.

The Company complies with the majority of the best practice provisions of the 2022 Code. For further details please refer to the Compliance with Dutch Corporate Governance Code section of the Annual Report.

D. Remuneration Report 2023 (advisory voting)

Pursuant to article 2:135b subsection 2 of the Dutch Civil Code, the Remuneration Report 2023 is submitted to the General Meeting of Shareholders for its advisory vote. It is proposed to the General Meeting of Shareholders to cast a favorable advisory vote.

Following the advisory voting on the 2023 Remuneration Report at the Annual General Meeting of Shareholders (“AGM”) of 2023, which was positive for 80.4%, the Company and the Remuneration Committee continued its engagement with shareholders since 2022 for feedback and dialogue regarding the Company’s compensation philosophy and pay practices. Beginning in 2023, a number of changes were made to the Company’s remuneration practices and disclosures. Such changes include modifying the payout schedule for relative total shareholder return (“TSR”) metric for long term incentive compensation, which will not allow for any vesting/payout for below-median performance relative to the TSR peer group. An amendment to Compensation Policy, as approved by shareholders at the AGM of 2023, provided 100% Performance Share Units (“PSUs") for Executive Directors in the Long-Term Incentive Plan (time-based Restricted Stock Units are no longer provided). Based on the feedback received by shareholders from the continuing shareholder outreach campaign, the overall disclosures and transparency of the 2023 Remuneration Report has been enhanced to reflect the Company’s pay-for-performance philosophy in aligning Company performance with the Company’s incentive plans, in particular the CEO Transformation Incentive, as significant progress has been achieved with the transformation to electrification and technology versus the industry. For the 2023 annual incentive plan, the Remuneration Committee approved the addition of an ESG metric focusing on carbon emissions reductions through the sale of our low emissions vehicles in Europe and the U.S. The Company’s practice of providing more transparency and clearer representations of its pay and governance practices have continued within the 2023 Remuneration report.

The Remuneration Report for 2023 is contained in the Annual Report 2023 and is available on the Company's website. For further details, please refer to the "Remuneration Report" section of the Annual Report 2023.

E. Adoption of the Annual Accounts 2023 (voting)

The Company's Annual Accounts 2023 have been drawn up by the Board of Directors and audited by the external auditor of the Company, Ernst & Young Accountants LLP, who have

issued an unqualified opinion. It is proposed that the Annual Accounts 2023 be adopted by the General Meeting of Shareholders.

F. Approval of 2023 dividend (voting)

Subject to the adoption of the Company’s Annual Accounts 2023 (including the consolidated and statutory financial statements) by the General Meeting of Shareholders and in accordance with article 29 of the articles of association of the Company, the Board of Directors proposes to approve a dividend payment from the profits shown in the Annual Accounts 2023 on the Company’s common shares of EUR 1.55 per common share. This results in a total cash distribution for the financial year 2023 of approximately EUR 4.7 billion. The dividend will be paid fully in cash.

Upon approval by the General Meeting of Shareholders, the expected calendar for the common shares listed on the New York Stock Exchange, Euronext Milan and Euronext Paris will be as follows: (i) ex-date April 22, 2024, (ii) record date April 23, 2024, and (iii) payment date May 3 2024.

The balance between the total amount of the dividend distribution for the financial year 2023 and the full amount of profits shown in the Company’s Annual Accounts 2023 shall be reserved and added to the relevant reserves of the Company (in accordance with the Company's articles of association and Dutch law) in order to further strengthen the capital position of the Group.

G. Granting of discharge to the directors in respect of the performance of their duties during the financial year 2023 (voting)

In accordance with article 24.9 of the Company’s articles of association, the General Meeting of Shareholders is requested to grant discharge to:

(i) the executive directors in office in 2023 in respect of the performance of their management duties; and

(ii) the non-executive directors in office in 2023 in respect of the performance of their non-executive duties,

as such performance is apparent from the Annual Report 2023 or otherwise disclosed to the General Meeting of Shareholders prior to the adoption of the Annual Accounts 2023.

3. Appointment of Non-Executive Director

On February 15, 2023 Mr. Kevin Scott, an independent non-executive director of Stellantis appointed on January 4, 2021 for the term of office of four years beginning on January 17, 2021, announced his resignation from his position as member of the Board of Directors of Stellantis. The resignation will become effective at the closing of the 2024 General Meeting of Shareholders.

Taking into account the requirements set out in the Company's articles of association, the Company's board regulations and the arrangements originally agreed between FCA and PSA in relation to the first four-year period following the merger of FCA and PSA, it is proposed to the General Meeting of Shareholders to appoint Ms. Claudia Parzani as the successor independent non-executive director. In accordance with article 19.10, second sentence, of the Company's articles of association, it is proposed by the Board of Directors that the appointment of Ms. Claudia Parzani as non-executive director will be for an initial period of one year, provided however that unless she resigns at an earlier date, the term of office shall lapse immediately after the close of the first annual General Meeting of Shareholders held after one year have lapsed since her appointment.

The relevant biographical details and curriculum vitae of Ms. Claudia Parzani are available for inspection at the offices of the Company as well as on the Company’s website (www.stellantis.com).

4. Delegation to the Board of Directors of the authority to issue shares in the capital of the Company and to limit or to exclude pre-emptive rights

A. Proposal to designate the Board of Directors as the corporate body authorized to issue common shares and to grant rights to subscribe for common shares as provided for in article 7 of the Company’s articles of association (voting)

In accordance with article 7 of the Company’s articles of association, it is proposed to designate the Board of Directors as the corporate body authorized to issue common shares in the Company's capital and to grant rights to subscribe for common shares in the Company's capital.

This proposal concerns the extension of the authorization of the Board of Directors as per the date of the 2024 General Meeting of Shareholders (April 16, 2024) for a period of 18 months and therefore up to and including October 15, 2025 (being the date 18 months from the date of the 2024 General Meeting of Shareholders), and is limited to 10% of the issued common shares for general corporate purposes as per the date of the 2024 General Meeting of Shareholders (April 16, 2024), which can be used for any and all purposes.

The proposed authorization will allow the Board of Directors to be flexible and to respond quickly to circumstances that require the issuance of and/or the grant of rights to subscribe for common shares. If approved, the authorization granted will replace the current authorization of the Board of Directors to issue common shares and to grant rights to subscribe for common shares in the Company's capital, which was granted by the General Meeting of Shareholders held on April 13, 2023 for a period of eighteen months starting on April 13, 2023.

B. Proposal to designate the Board of Directors as the corporate body authorized to limit or to exclude pre-emption rights for common shares as provided for in article 8 of the Company’s articles of association (voting)

In accordance with article 8 of the Company’s articles of association, it is proposed to designate the Board of Directors as the corporate body authorized to limit or to exclude pre-emption rights

in connection with the issue of and/or the granting of rights to subscribe for common shares in the Company's capital. This proposal concerns the extension of the authorization of the Board of Directors as per the date of the 2024 General Meeting of Shareholders (April 16, 2024) for a period of 18 months and therefore up to and including October 15, 2025 (being the date 18 months from the date of the 2024 General Meeting of Shareholders).

The proposed authorization, in combination with the authorization under agenda item 4.A, will enable the Board of Directors to be flexible and to respond quickly to circumstances that require an issue of and/or the grant of rights to subscribe for common shares with or without limited preemptive rights. The authorization is limited to the percentages of the capital as described under agenda item 4.A. In accordance with article 8 of the Company’s articles of association, this proposal must be adopted with a majority of at least two thirds of the votes cast if less than one half of the issued share capital is represented at the General Meeting of Shareholders. If one half or more of the issued share capital is represented at the General Meeting of Shareholders, the resolution can be adopted with a simple majority of the votes cast. If approved, the authorization granted will replace the current authorization of the Board of Directors to exclude or limit pre-emptive rights with respect to common shares, which was granted by the General Meeting of Shareholders held on April 13, 2023 for a period of eighteen months starting on April 13, 2023.

5. Delegation to the Board of Directors of the authority to acquire common shares in the Company's capital (voting)

The Board of Directors believes that it is beneficial for the Company to have the flexibility to acquire common shares, inter alia, to service employee equity plans globally and equity-based incentive plans of the Company and to enable the Board of Directors to carry out share buy-back programs if the Board of Directors considers such buy-back would be in the best interest of the Company and its stakeholders.

Therefore, it is proposed that the General Meeting of Shareholders, in accordance with article 9 of the Company's articles of the association and without prejudice to the provisions of section 2:98 of the Dutch Civil Code, delegates the authority to acquire common shares in the Company's capital to the Board of Directors, either through purchase on a stock exchange, a public tender offer, an offer for exchange or otherwise, up to a maximum number of shares equal to 10% of the Company’s issued common shares as per the date of the 2024 General Meeting of Shareholders (April 16, 2024) at a purchase price per share no lower than the nominal value of the shares and no higher than an amount equal to 110% of the market price of the shares on the New York Stock Exchange and/or the Euronext Milan and/or Euronext Paris (as the case may be); such market price being calculated as the average of the highest price on each of the five days of trading prior to the date on which the acquisition is made, as shown in the Official Price List of the New York Stock Exchange and/or Euronext Milan and/or Euronext Paris (as the case may be); the authority pursuant to this item shall be for a period of 18 months from the date of the 2024 General Meeting of Shareholders (April 16, 2024) and therefore up to and including October 15, 2025.

This authorization will allow the Board of Directors to be flexible and to respond quickly to circumstances that require a repurchase of the Company’s common shares, and can be used for any and all purposes.

The adoption of this proposal by the General Meeting of Shareholders will replace the current authorization of the Board of Directors to repurchase common shares in the Company's capital, which was granted by the General Meeting of Shareholders for a period of eighteen months from April 13, 2023. The repurchase of common shares under this agenda item includes depositary receipts thereof.

6. Cancellation of shares in the capital of the Company

A. Proposal to cancel common shares held by the Company in its own share capital as specified in article 10 of the Company’s articles of association (voting)

It is proposed to the General Meeting to cancel any or all common shares in the share capital of the Company which are held by the Company on the date of the 2024 General Meeting of Shareholders (April 16, 2024) or will be acquired by the Company under the authorization referred to under agenda item 5.

The actual number of common shares that will be cancelled will be determined by the Board of Directors, with a maximum of the number of common shares held by the Company on the date of the 2024 General Meeting of Shareholders (April 16, 2024) plus the number of common shares that may be acquired by the Company in accordance with the authorization referred to under agenda item 5. The cancellation may be effected by the Board of Directors in one or more tranches.

The common shares held by the Company in its own share capital include 142,090,297 common shares that have been acquired (i) under the €1.5 billion share buyback program and (ii) from Dongfeng Motor (Hong Kong) International Co., Limited, a subsidiary of Dongfeng Motor Group Company Limited, a major shareholder of the Company.

The purpose of this proposal is the cancellation of common shares held by the Company or that will be acquired in accordance with the authorization referred to under agenda item 5, to the extent that such common shares shall not be used to cover obligations under employee equity plans, share based compensation plans or other obligations.

The cancellation of the common shares shall be effected with due observance of the provisions of section 2:100 of the Dutch Civil Code and the Company’s articles of association. This applies to each tranche.

B. Proposal to cancel all class B special voting shares held by the Company in its own share capital as specified in article 10 of the Company’s articles of association (voting)

It is proposed to the General Meeting of Shareholders to cancel all 208,622 class B special voting shares in the share capital of the Company held by the Company in its own capital.

Class B special voting shares were created in connection with the merger between Fiat Chrysler Automobiles N.V. and Peugeot S.A. effectuated in 2021 by the conversion of the FCA special

voting shares, the large majority of them were acquired for no consideration by the Company from Exor N.V. and cancelled in October 2021. The remaining class B special voting shares were exchanged with newly issued class A special voting shares in accordance with article 7.5 of the terms and conditions of the special voting shares. As a result, all the 208,622 issued class B special voting shares are held in the Company’s treasury.

The cancellation of the class B special voting shares shall be effected with due observance of the provisions of section 2:100 of the Dutch Civil Code and the Company’s articles of association.

7. Closing

The chairperson of the meeting will close the meeting.

Bio of Claudia Parzani

CORPORATE GOVERNANCE STATEMENT

In accordance with the Dutch Decree on requirements of the management report (Besluit inhoud bestuursverslag) (the Decree), Stellantis N.V. (the Company) publishes this statement relating to corporate governance as part of the annual report of the board of directors of the Company for 2023 (the Annual Report). As permitted by Article 2a of the Decree, the Company has opted to publish its corporate governance statement by posting it on the website (www.stellantis.com). For the statement in this declaration as stipulated in Articles 3, 3a and 3b of the Decree reference is made to the relevant pages in the Annual Report. The following statements are deemed to be included and repeated herein:

•the statement relating to the compliance with the principles and best practices of the Dutch Corporate Governance Code (the Code), including the motivated deviation of the compliance of the Code, can be found on page 158 of the Annual Report in the chapter “Corporate Governance”;

•the statement concerning the most important characteristics of the control and risk management systems in relation to the process of the financial accounting of the Company and the group, can be found on page 95 of the Annual Report;

•the statement about the functioning of the general meeting of shareholders and the most important powers thereof as well as the rights of shareholders and how these may be executed, can be found on page 146 of the Annual Report in the chapter “Corporate Governance”;

•the statement regarding the composition and functioning of the board of directors can be found on page 121 of the Annual Report in the chapter “Corporate Governance”;

•the statement regarding the diversity and inclusion policy applied in respect of the composition of the board of directors can be found on page 157 of the Annual Report in the chapter “Corporate Governance”;

•the statement in accordance with Decree Article 10 EU-Directive on Take-overs (Besluit artikel 10 overnamerichtlijn) can be found on page 398 of the Annual Report.

Stellantis N.V., March 4, 2024

OUTSTANDING SHARE CAPITAL AND TOTAL NUMBER OF VOTING RIGHTS AT THE DATE OF THE NOTICE FOR THE ANNUAL GENERAL MEETING TO BE HELD ON APRIL 16, 2024

As of March 4, 2024 – the date of the notice for the Annual General Meeting of Shareholders (the ‘AGM’) of Stellantis N.V. (the ‘Company’) to be held on April 16, 2024 the share capital of the Company consists of the following.

3,165,220,176 common shares are issued and 3.019.523.709 common shares are outstanding. Common shares are listed, freely transferable and each of them confers the right to cast one vote.

866,522,224 Class A special voting shares are issued, and 866,411,716 Class A special voting shares are outstanding, while all the issued 208,622 Class B special voting shares are owned by the Company. Special voting shares are not listed, are not transferable (with the limited exceptions set forth in the Articles of Association and Special Voting Shares Terms and Conditions) and each of them confers the right to cast one vote.

No vote may be cast on shares belonging to the Company or to a subsidiary thereof or on shares in respect of which either of them holds the depositary receipts.

The total number of voting rights which can be cast at the AGM equals to 3.885.935.425.

Stellantis N.V., March 4, 2024

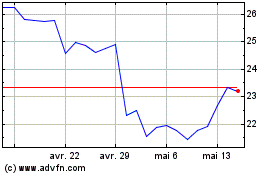

Stellantis NV (NYSE:STLA)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

Stellantis NV (NYSE:STLA)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024