SolarWinds shareholders to receive $18.50 per share in cash,

with a total enterprise value of $4.4 billion; SolarWinds to become

a privately held company upon completion of the transaction

SolarWinds Corporation (NYSE:SWI) (“SolarWinds” or the

“Company”), a leading provider of simple, powerful, secure

observability and IT management software, today announced that it

has entered into a definitive agreement to be acquired by

Turn/River Capital in an all-cash transaction for $18.50 per share

or approximately $4.4 billion. The per-share price represents a

premium of approximately 35% to the volume-weighted average closing

price of SolarWinds stock for the 90 trading days ended on February

6, 2025.

“We have built a great track record of helping customers

accelerate business transformations through simple, powerful,

secure solutions designed for hybrid and multi-cloud environments.

We now look forward to partnering with Turn/River to deliver

operational resilience solutions for our customers on our

SolarWinds Platform, leveraging our premier observability,

monitoring, and service desk solutions,” said Sudhakar Ramakrishna,

President and CEO of SolarWinds.

“This successful transaction and exciting partnership are

testaments to our employees’ outstanding work of building

exceptional solutions and delivering great customer success,”

Ramakrishna continued. “We are confident that Turn/River’s

expertise and growth orientation will help us ensure SolarWinds

continues to drive innovation and deliver even greater value for

customers and stakeholders.”

"SolarWinds is a global leader in software that helps a wide

range of businesses securely manage and optimize their systems,

networks, and IT infrastructure. Their deep commitment to

understanding and solving customer needs has led to decades of

innovation, impact, and consistent growth,” said Dominic Ang,

Founder and Managing Partner of Turn/River Capital. “We are

incredibly excited to partner with SolarWinds. By pairing our team

of software operators and investors with their relentless focus on

customer success, together we aim to accelerate growth and further

innovation.”

Additional Transaction Terms

The transaction, which was unanimously approved by SolarWinds’

Board of Directors, is currently expected to close in the second

quarter of 2025, subject to the satisfaction of required regulatory

clearances and other customary closing conditions. In addition to

approval by the SolarWinds Board of Directors, Thoma Bravo, and

Silver Lake, SolarWinds’ majority shareholders, who collectively

hold approximately 65% of the outstanding voting securities of

SolarWinds, have approved the transaction by delivering written

consent. No further shareholder approval is required to complete

the transaction.

Upon completion of the transaction, SolarWinds’ common stock

will no longer be listed on the New York Stock Exchange, and

SolarWinds will become a privately held company. The Company will

continue to operate under the SolarWinds name and brand and remain

headquartered in Austin, Texas.

Advisors

Goldman Sachs & Co. LLC acted as the lead financial advisor

to SolarWinds, Jefferies LLC also acted as a financial advisor to

SolarWinds, and DLA Piper LLP (US) acted as SolarWinds' legal

advisor. J.P. Morgan, Barclays, Santander, and RBC Capital Markets

acted as the financial advisors, and Kirkland & Ellis LLP acted

as legal counsel for Turn/River.

Fourth Quarter 2024 Financial Results

The Company will no longer hold its conference call to discuss

its financial results for the fourth quarter and full year 2024,

originally scheduled for Tuesday, February 11, 2025, at 7:00 a.m.

CT, due to the announcement of the pending transaction.

The Company plans to report its financial results for the fourth

quarter and full year 2024 on or before February 14, 2025.

About SolarWinds

SolarWinds (NYSE:SWI) is a leading provider of simple, powerful,

secure observability and IT management software built to enable

customers to accelerate their digital transformation. Our solutions

provide organizations worldwide—regardless of type, size, or

complexity—with a comprehensive and unified view of today’s modern,

distributed, and hybrid network environments. We continuously

engage with IT service and operations professionals, DevOps and

SecOps professionals, and database administrators (DBAs) to

understand the challenges they face in maintaining high-performing

and highly available hybrid IT infrastructures, applications, and

environments. The insights we gain from them, in places like our

THWACK community, allow us to address customers’ needs now and in

the future. Our focus on the user and our commitment to excellence

in end-to-end hybrid IT management have established SolarWinds as a

worldwide leader in solutions for observability, IT service

management, application performance, and database management. Learn

more today at www.solarwinds.com.

About Turn/River Capital

Turn/River Capital is a private equity firm that applies a

proprietary growth engineering strategy to investing, partnering

with software businesses to accelerate growth and build enduring

value. The firm's team of equal parts investors and operators

provides hands-on operational support and the flexible capital to

systematically scale marketing, sales and customer success at its

portfolio companies. Founded in 2012 and based in San Francisco,

Turn/River invests globally with a focus on North America and

Europe. For more information, visit www.turnriver.com.

#SWIfinancials #SWIcorporate #SWI

Additional Information and Where to Find It

This communication is being made in respect of the pending

transaction pursuant to which the Company would be acquired by

Turn/River. The Company will prepare an information statement for

its stockholders, containing the information with respect to the

proposed transaction specified in Schedule 14C promulgated under

the Securities Exchange Act of 1934, as amended, and describing the

pending transaction. When completed, a definitive information

statement will be mailed or delivered to the Company’s

shareholders. This press release is not a substitute for the

information statement on Schedule 14C, or any other document that

the Company may file with the SEC or send to its shareholders in

connection with the proposed transaction.

SHAREHOLDERS OF THE COMPANY ARE URGED TO CAREFULLY READ THE

INFORMATION STATEMENT REGARDING THE PENDING TRANSACTION AND ANY

OTHER RELEVANT DOCUMENTS IN THEIR ENTIRETY WHEN THEY BECOME

AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE

PENDING TRANSACTION.

The Company’s shareholders may obtain copies of all documents

filed by the Company with the SEC, free of charge, at the SEC’s

website, www.sec.gov, or from the Company’s website at

https://investors.solarwinds.com/financial/sec-filings or by

writing to the Company’s Secretary at 7171 Southwest Parkway,

Building 400, Austin, TX 78735.

No Offer

No person has commenced soliciting proxies in connection with

the proposed transaction referenced in this press release, and this

press release is neither an offer to purchase nor a solicitation of

an offer to sell securities.

The SolarWinds, SolarWinds & Design, Orion, and THWACK

trademarks are the exclusive property of SolarWinds Worldwide, LLC

or its affiliates, are registered with the U.S. Patent and

Trademark Office, and may be registered or pending registration in

other countries. All other SolarWinds trademarks, service marks,

and logos may be common law marks or are registered or pending

registration. All other trademarks mentioned herein are used for

identification purposes only and are trademarks of (and may be

registered trademarks of) their respective companies.

Forward-Looking Statements

This press release contains “forward-looking” statements, which

are subject to the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995, including statements regarding the

timing of the transaction and other information relating to the

transaction. These forward-looking statements are based on

management's beliefs and assumptions and on information currently

available to management. Forward-looking statements include all

statements that are not historical facts and may be identified by

terms such as “aim,” “anticipate,” “believe,” “can,” “could,”

“seek,” “should,” “feel,” “expect,” “will,” “would,” “plan,”

“project,” “intend,” “estimate,” “continue,” “may,” or similar

expressions and the negatives of those terms. Forward-looking

statements involve known and unknown risks, uncertainties and other

factors that may cause actual results, performance or achievements

to be materially different from any future results, performance or

achievements expressed or implied by the forward-looking

statements. Factors that could cause or contribute to such

differences include, but are not limited to, (i) the risk that the

proposed transaction may not be completed in a timely manner or at

all, which may adversely affect the Company’s business and the

price of the common stock of the Company, (ii) the failure to

satisfy the conditions to the consummation of the Transactions,

including the receipt of regulatory approvals from various

governmental entities (including any conditions, limitations or

restrictions placed on these approvals) and the risk that one or

more governmental entities may deny approval, (iii) the occurrence

of any event, change or other circumstance that could give rise to

the termination of the agreement governing the proposed transaction

(the “Merger Agreement”), including in circumstances that require

the Company to pay a termination fee; (iv) the inability to obtain

the necessary financing set forth in the commitment letters

received in connection with the proposed transaction, (v) the

effect of the announcement or pendency of the transaction on the

Company’s business relationships, operating results and business

generally, (vi) certain restrictions during the pendency of the

proposed transaction that may impact the Company’s ability to

pursue certain business opportunities or strategic transactions,

(vii) risks that the proposed transaction disrupts current plans

and operations, (viii) risks related to diverting management’s

attention from the Company’s ongoing business operations, (ix) the

outcome of any legal proceedings that may be instituted against the

parties to the Merger Agreement or their respective directors,

managers or officers, including the effects of any outcomes related

thereto, (x) the Company’s ability to retain, hire and integrate

skilled personnel including the Company’s senior management team

and maintain relationships with key business partners and

customers, and others with whom it does business, in light of the

proposed transaction, (xi) unexpected costs, charges or expenses

resulting from the proposed transaction; (xii) the impact of

adverse general and industry-specific economic and market

conditions, (xiii) risks caused by delays in upturns or downturns

being reflected in the Company’s financial position and results of

operations, (xiv) risks that the benefits of the proposed

transaction are not realized when and as expected, (xv) uncertainty

as to timing of completion of the proposed transaction, and (xvi)

other factors described under the heading “Risk Factors” in the

Company’s Annual Report on Form 10-K for the year ended December

31, 2023, the Company’s subsequent Quarterly Reports on Form 10-Q,

and in other reports and filings with the SEC. The Company cautions

you that the important factors referenced above may not contain all

of the factors that are important to you. In addition, the Company

cannot assure you that the Company will realize the results or

developments expected or anticipated or, even if substantially

realized, that they will result in the consequences or affect the

Company or the Company’s operations in the way the Company expects.

The forward-looking statements included in this press release are

made only as of the date hereof. Except as required by applicable

law or regulation, the Company does not undertake to update or

revise any forward-looking statements, whether as a result of new

information, future events or otherwise.

© 2025 SolarWinds Worldwide, LLC. All rights reserved.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250207410199/en/

Media Contacts Jenne Barbour SolarWinds +1-512-498-6804

pr@solarwinds.com

Christine Elswick Highwire +1-415-671-9707

christine@highwirepr.com

Investor Contacts SolarWinds Investor Relations

ir@solarwinds.com

For Turn/River Carlos Roig Clear Hill Strategies for Turn/River

Capital +1-415-305-6590 media@turnriver.com

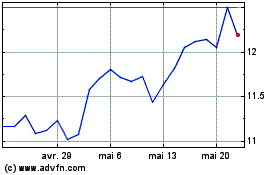

SolarWinds (NYSE:SWI)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

SolarWinds (NYSE:SWI)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025