UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________________

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

________________________

| | | | | | | | |

Filed by the Registrant x | | Filed by a Party other than the Registrant o |

Check the appropriate box:

| | | | | |

| o | Preliminary Proxy Statement |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| o | Definitive Proxy Statement |

x | Definitive Additional Materials |

| o | Soliciting Material under §240.14a-12 |

SYNCHRONY FINANCIAL

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| | | | | | | | |

| x | No fee required. |

| o | Fee paid previously with preliminary materials. |

| o | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| | |

777 Long Ridge Road

Stamford, CT 06902

Re: Synchrony Financial 2024 Annual Meeting of Stockholders (June 11, 2024)

VOTE "FOR" Proposal #3 — Advisory Vote to Approve Named Executive Officer Compensation

Dear Synchrony Financial Shareholder,

On behalf of the Board of Directors and the Management Development and Compensation Committee of Synchrony Financial (MDCC), we are writing to request your support at the 2024 Annual Meeting of Stockholders by voting according to the Board’s recommendations on all proposals.

In particular, we request you vote "FOR" Proposal #3: Advisory Vote to Approve Named Executive Officer Compensation (the “Say-on-Pay Proposal”) in Synchrony's 2024 Proxy Statement.

PROXY ADVISORY OVERVIEW

Glass Lewis, a proxy advisor, issued a report recommending that shareholders vote “FOR” Synchrony’s Say-on-Pay Proposal, appropriately highlighting that Synchrony “paid moderately more than its peers and performed better than its peers” and exhibited “adequate alignment of pay with performance”.

Institutional Shareholder Services (ISS), another proxy advisor, found Synchrony’s pay and performance to be in alignment both in terms of relative pay and performance rankings and absolute alignment between pay and Total Shareholder Return (TSR). Despite this recognition of the alignment between pay and performance on these two key metrics, ISS issued a report recommending a vote “AGAINST” the Say-on-Pay Proposal.

We disagree with ISS’ recommendation and believe they reached their conclusion based on a flawed approach to a third part of their analysis (detailed below), which if corrected, would align with Glass Lewis’ view that our CEO pay is aligned with performance.

SYNCHRONY’S INTENTIONAL APPROACH TO SETTING CEO PAY

The MDCC believes our competitive positioning relative to the Consumer Finance peers is critical in sustaining a high-performing leadership team and maintaining and creating shareholder value. In keeping with this objective, the MDCC set our CEO pay level in 2023 based on:

•Our Transition Approach – as outlined in prior and current proxy statements, our Board implemented a multi-year transition plan to move pay for our CEO, who was appointed in 2021, to a competitive market level. The MDCC and the Board considered this approach to be responsible, yielding strong business results and delivering shareholder value in a highly competitive business and talent market.

•2023 Positioning vs Market – in 2023, we intentionally positioned Mr. Doubles to be competitive with Synchrony's peer group, positioning him 3rd compared to our five Consumer Finance peers (Ally, American Express, Bread, Capital One, and Discover). This strategy has paid off for our company and shareholders, as demonstrated by our performance and ability to mitigate retention risks (as two of our competitors, Discover and Ally, faced prolonged CEO searches).

FLAWS IN ISS APPROACH

For investors that track ISS voting recommendations, we strongly believe ISS’s analysis has two major flaws:

•ISS Peer Data is Distorted: ISS calculations are based on interim CEO data of $2.2M for one of our main competitors, Discover Financial Services (for a non-employee director who served as the interim CEO for 4.5 months during 2023). This is substantially below the approximately $11M Discover has paid its CEO over the last three years. This approach has a material impact on ISS pay-for-performance assessment.

•ISS Peer Group Selection Not Comparable to Synchrony: ISS uses a peer group that includes several companies that Synchrony does not compete with for business and/or talent. We do not consider seven of the companies ISS selected as peers – i.e., Block, East West Bank, New York Community Bank, Zions Bank, Comerica, First Horizon and Voya Financial. The majority are regional commercial banks that do not rank on the Fortune 500, none have credit card businesses comparable to Synchrony and their average market caps are a fraction of Synchrony.

In addition, ISS criticizes the rigor in our goal setting without context related to market conditions. Their analysis does not consider market and regulatory conditions, future expectations, or our position to avoid excessive risk taking as a regulated institution. Synchrony set targets based on our rigorous internal budgeting process, factoring in investor consensus for the year, anticipated changes in interest rates and credit conditions and inflationary pressure on consumer spending.

CONCLUSION

The MDCC and Board believe our CEO pay is aligned with market, our performance, and shareholder interests. Our compensation strategy has paid off for our company and shareholders through management’s prudent strategic decisions and effective execution in the face of the aforementioned headwinds that resulted in the delivery of +14% total shareholder return during the first five months of 2024.

Based on all of this, we request you vote “FOR” our Say-on-Pay Proposal (Proposal #3). Even if voting instructions for your proxy have already been given, you may change your vote at any time before our Annual Meeting of Stockholders on June 11, 2024, by providing revised voting instructions to your proxy or by voting at the meeting.

Sincerely,

Laurel J. Richie

Chair, Management Development and Compensation Committee

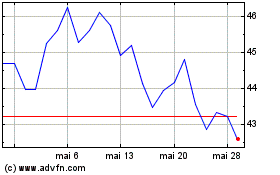

Synchrony Financiall (NYSE:SYF)

Graphique Historique de l'Action

De Mai 2024 à Juin 2024

Synchrony Financiall (NYSE:SYF)

Graphique Historique de l'Action

De Juin 2023 à Juin 2024