As filed with the Securities and Exchange Commission on February 16, 2024

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| | | TELEPHONE AND DATA SYSTEMS, INC. (Exact name of registrant as specified in its charter) | | | |

| | | Delaware (State or other jurisdiction of incorporation or organization) | 36-2669023 (IRS Employer Identification Number) | | | |

| | | | 30 North LaSalle Street, Suite 4000,

Chicago, Illinois 60602

(312) 630-1900 | | | | |

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices) | | |

| | | | | | | | |

| | | LeRoy T. Carlson, Jr., President and Chief Executive Officer, Telephone and Data Systems, Inc. 30 North LaSalle Street, Suite 4000 Chicago, Illinois 60602 (312) 630-1900 | with a copy to: John P. Kelsh, Esq. Sidley Austin LLP One South Dearborn Street Chicago, Illinois 60603 (312) 853-7000 | | | |

| | | (Name, address, including zip code, and telephone number, including area code, of agent for service) | | | |

| | | | | | | | |

| Approximate date of commencement of proposed sale to the public: From time to time after the Registration Statement becomes effective. | |

| | | | | | | | |

| | If the only securities being registered on this form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☒ |

| | If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. ☐ |

| | If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐ |

| | If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐ |

| | If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐ |

| | If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐ |

| | Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. |

| | Large accelerated filer ☒ | | | Accelerated filer ☐ | | | |

| | Non-accelerated filer ☐ | | | Smaller reporting company ☐ | | | |

| | | | | | Emerging growth company ☐ | | | |

| | If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of Securities Act. ☐ |

| | | | | | | | |

EXPLANATORY NOTE

The Registrant filed a Registration Statement (the “Prior Registration Statement”) on Form S-3 (File No. 333-266691), which first became effective on August 9, 2022, relating to the registration of 200,000 Series A Common Shares, par value $0.01 per share, of the Registrant, for the Registrant’s Series A Common Share Automatic Dividend Reinvestment Plan (the “Plan”), 91,597 of which remain unissued as of the date hereof.

The Registrant is filing this Registration Statement to register 500,000 additional Series A Common Shares for issuance under the Plan.

Pursuant to Rule 429 under the Securities Act of 1933, as amended (the “1933 Act”), the Prospectus contained herein also relates to the 91,597 Series A Common Shares that remain unissued under Registration Statement No. 333-266691.

Pursuant to Rule 462 under the 1933 Act, this Registration Statement shall become effective upon filing with the Securities and Exchange Commission.

PROSPECTUS

TELEPHONE AND DATA SYSTEMS, INC.

SERIES A COMMON SHARE

AUTOMATIC DIVIDEND REINVESTMENT PLAN

Series A Common Shares

($0.01 Par Value)

The Series A Common Share Automatic Dividend Reinvestment Plan, as amended, which we refer to in this Prospectus as the “Plan” is sponsored by Telephone and Data Systems, Inc., a Delaware corporation which we refer to as “TDS”, and relates to its Series A Common Shares, par value $.01 per share. The Plan provides eligible holders, as defined in the Plan, of TDS’ Series A Common Shares with a systematic, economic and convenient method of investing cash dividends from such shares in newly issued Series A Common Shares without payment of any brokerage commission or service charge and at a 5% discount from market value, as determined below. This Prospectus relates to 91,597 Series A Common Shares covered by the Registration Statement No. 333-266691 that remain available as of the date hereof, and 500,000 Series A Common Shares covered by the Registration Statement of which this Prospectus is a part.

As a participant in the Plan you may:

1.have cash dividends on all of your Series A Common Shares automatically reinvested, or

2.have cash dividends on less than all of your Series A Common Shares automatically invested while continuing to receive the remainder of your cash dividends.

The TDS Series A Common Shares are generally not publicly traded. However, the Series A Common Shares are convertible on a share-for-share basis into TDS’ Common Shares. Accordingly, the price for the Series A Common Shares purchased with reinvested dividends will be 95% of the average daily high and low sales prices for TDS’ Common Shares on the New York Stock Exchange (“NYSE”), listing symbol “TDS”, for a period of ten consecutive trading days ending on the trading day immediately preceding the day on which the purchase is made. The investment dates for reinvested dividends will be the dividend payment dates.

Investment in our Series A Common Shares involves a number of risks. See section titled “Risk Factors” on page 2 below to read about certain factors you should consider before buying our Series A Common Shares.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or has passed upon the accuracy or adequacy of this Prospectus. Any representation to the contrary is a criminal offense.

The date of this Prospectus is February 16, 2024

TABLE OF CONTENTS

SUMMARY OF THE PLAN

•PARTICIPATION: TDS record shareholders who own at least one whole Series A Common Share can participate in the Plan by submitting a completed Enrollment Form. You may obtain Enrollment Forms from TDS Investor Relations at (312) 630-1900. If your shares are held in a brokerage account, you may participate by having your broker register the Series A Common Shares in the Plan. No action is required if you are already participating in the Plan.

•REINVESTMENT OF DIVIDENDS: You can reinvest your cash dividends on all or a portion of your Series A Common Shares toward the purchase of additional Series A Common Shares of TDS stock without paying fees.

•PRICE FOR SHARES: The price for the Series A Common Shares purchased with reinvested dividends will be 95% of the average daily high and low sales prices for TDS’ Common Shares on the NYSE for a period of ten consecutive trading days ending on the trading day immediately preceding the day on which the purchase is made.

•INVESTMENT DATES: The Investment Dates for reinvested dividends will be the dividend payment dates.

•SAFEKEEPING OF CERTIFICATES: You can deposit your Series A Common certificate(s) into your Plan account. There is no charge for this service.

•WITHDRAWAL FROM THE PLAN: You may withdraw from the Plan at any time by notifying the Plan Administrator in writing, by telephone or through the Internet. The Plan Administrator will issue your whole shares in a certificate. If your dividend reinvestment account has a fractional share, a check for the value of the fractional share will be mailed to you. The amount of the check will be based on the then-current market value of the fractional share less any applicable fees.

•TRACKING YOUR INVESTMENT: You will receive a statement of your Plan account with respect to each month in which a transaction takes place. These statements provide details of the transactions and the share balance in your program account.

•ADDRESS AND TELEPHONE: The mailing address of TDS’ principal executive office is 30 N. LaSalle Street, Suite 4000, Chicago, IL 60602, and its telephone number is (312) 630-1900.

•ADMINISTRATOR: Computershare Trust Company, N.A. or (“Computershare” or “the Plan Administrator”), serves as Plan Administrator.

RISK FACTORS

Risks Related to Investment in Series A Common Shares

There is generally no public trading of the Series A Common Shares.

There is generally no public trading of the Series A Common Shares. However, Series A Common Shares are convertible on a share-for-share basis into Common Shares of TDS, traded on the NYSE.

There is no assurance that TDS will continue to pay dividends.

Although TDS has paid dividends on its common shares in the past, there is no assurance that TDS will continue to pay dividends or even at the same rate.

Risks Related to TDS’ Business

For a discussion of the risks related to TDS’ business, see “Risk Factors” in TDS’ most recent Annual Report on Form 10-K, which is incorporated by reference herein. See “Where You Can Find More Information” below.

TELEPHONE AND DATA SYSTEMS, INC.

Telephone and Data Systems, Inc. (“TDS”), a diversified telecommunications company, provides wireless; broadband, video and voice; and hosted and managed services through its business units, United States Cellular Corporation (“UScellular”), TDS Telecommunications LLC, and OneNeck IT Solutions LLC. Founded in 1969, TDS has its principal executive offices at 30 North LaSalle Street, Suite 4000, Chicago, Illinois 60602; and its telephone number is (312) 630-1900. TDS was incorporated in 1968 and changed its corporate domicile from Iowa to Delaware in 1998.

For current selected financial information and other information about TDS, see TDS’ Annual Report on Form 10-K for the most recent fiscal year. See also our Quarterly Reports on Form 10-Q and other SEC filings filed after such Annual Report, which are incorporated by reference herein. See “Where You Can Find More Information” below.

USE OF PROCEEDS

The number of Series A Common Shares that will be sold under the Plan and the prices at which such shares will be sold cannot now be determined. The net proceeds from the sale of such shares will be used by TDS for general corporate purposes of TDS. Until the proceeds are used for these purposes, TDS may deposit them in interest-bearing accounts or invest them in certificates of deposit, United States Government securities or prime commercial paper.

SERIES A COMMON SHARE AUTOMATIC DIVIDEND

REINVESTMENT PLAN

The following is a question and answer statement of the provisions of TDS’ Series A Common Share Automatic Dividend Reinvestment Plan. The Questions and Answers below both explain and constitute the Plan.

PURPOSE

What Is The Purpose Of The Plan?

The purpose of the Plan is to provide eligible holders of TDS’ Series A Common Shares with a systematic, economic and convenient method of investing some or all of their cash dividends from such shares in newly issued Series A Common Shares of TDS without payment of any transaction or per share fees, and at a 5% discount from market value. Since the additional Series A Common Shares will be purchased directly from TDS, the Plan will provide TDS with additional capital funds.

What Are The Advantages Of The Plan?

You may purchase Series A Common Shares of TDS with cash dividends on all or less than all of TDS’ Series A Common Shares registered in your name. The price of Series A Common Shares purchased with cash dividends will be 95% of market value.

No transaction or per share fees are paid by participants in connection with purchases under the Plan. Full investment of funds is possible under the Plan because the Plan permits fractions of shares, as well as full shares, to be credited to participants’ accounts.

Who Administers The Plan?

Computershare Trust Company, N.A. administers the Plan. The Plan Administrator keeps a continuing record of each participant’s account, sends periodic statements of account to each participant with respect to each month in which a transaction takes place and performs other duties relating to the Plan. Series A Common Shares of TDS purchased under the Plan will be registered in the name of the Plan Administrator or its nominee, as Plan Administrator for each participant in the Plan, and will be credited to the accounts of the respective participants. Should the Plan Administrator resign, another bank will be asked to serve as the Plan Administrator. All communications regarding the Plan should be sent to the Plan Administrator addressed as follows:

| | | | | | | | |

| In writing: | Telephone and Data Systems, Inc.

Series A Common Share Automatic Dividend Reinvestment Plan

c/o Computershare Trust Company, N.A.

P.O. Box 43006

Providence, RI 02940-3006 |

| | |

| By telephone: | 877/337-1575 (U.S. and Canada)

312/360-5337 (Outside U.S. and Canada) |

| | |

| Through the Internet: | www.computershare.com/investor |

The Plan Administrator also acts as dividend disbursing and transfer agent for TDS’ Series A Common Shares.

ELIGIBILITY

Who Is Eligible To Participate?

Holders of record of at least one whole Series A Common Share are eligible to participate in the Plan. Beneficial owners of Series A Common Shares which currently are registered in names other than their own, for example, in the name of a broker or bank nominee, who wish to participate in the Plan must either make appropriate arrangements for their nominee to do so or must become security owners of record of Series A Common Shares.

All holders of record of at least one whole Series A Common Share are eligible to participate in the Plan, unless they are citizens of a state or foreign jurisdiction in which it would be unlawful for TDS to allow such participation. TDS is not aware of any jurisdiction in which the making of the offer is not in compliance with valid applicable law. If TDS becomes aware of any jurisdiction in which the making of the offer would not be in compliance with valid applicable law, TDS will make a good faith effort to comply with any such law. If, after such good faith effort, TDS cannot comply with any such law, the offer will not be made to holders of shares residing in any such jurisdiction. In those jurisdictions whose securities or blue sky laws require the offer to be made by a licensed broker or dealer, the offer shall not be deemed to be made unless it is made on behalf of TDS by one or more registered brokers or dealers which are licensed under the laws of such jurisdiction, as may be designated by TDS.

How Does A Series A Common Shareholder Participate?

A holder of Series A Common Shares may join the Plan at any time by visiting the Plan Administrator’s website, www.computershare.com/investor, and following the instructions provided, or by sending a completed enrollment form to the Plan Administrator. You may also obtain an enrollment form by either:

•Calling 877/337-1575 (U.S. and Canada) or 312/360-5337 (Outside U.S. or Canada)

•Contacting TDS’ Investor Relations department at 312/630-1900

When Does A Series A Common Shareholder’s Participation Start?

If an Enrollment Form directing dividend reinvestment is received from a Series A Common Shareholder by the record date of the next dividend payment, that dividend will be applied to the purchase of Series A Common Shares under the Plan. If the Enrollment Form directing dividend reinvestment is received after that date, dividend reinvestment will begin with the next succeeding payment. Cash dividends are ordinarily paid in March, June, September and December.

Can I Purchase Shares with Optional Cash Payments?

No. You can only reinvest dividends. You cannot purchase Series A Common Shares with optional cash payments under the plan.

What Does The Enrollment Form Provide?

The Enrollment Form provides for the purchase of new Series A Common Shares through the following investment options offered under the Plan:

Full Dividend Reinvestment — Cash dividends on all Series A Common Shares held of record by a holder of Series A Common Shares will be invested at 95% of market value.

Partial Reinvestment — Cash dividends on less than all of the shares, but not less than one whole share, held of record by a holder of Series A Common Shares will be invested at 95% of market value and the shareholder will continue to receive cash dividends on the other shares.

Shareholders have the option of stopping their dividend reinvestment and receiving cash dividends on their dividend reinvestment balances.

The Enrollment Form also serves to appoint Computershare Trust Company, N.A. as Plan Administrator for the participant.

If a holder of Series A Common Shares has more than one eligible account pursuant to which he or she is eligible to participate in the Plan a separate Enrollment Form is required for each account.

Is Partial Participation Possible Under The Plan?

Yes. An eligible shareholder who desires the dividends on only some of his or her full Series A Common Shares to be invested under the Plan may indicate such number of shares upon the applicable Enrollment Form(s) under “Partial Dividend Reinvestment,” provided that in no event may an eligible shareholder elect to invest dividends on less than one such share.

May A Participant Change His Or Her Method Of Participation After Enrollment?

Yes. If a shareholder elects to participate through the reinvestment of dividends but later decides to change the number of Series A Common Shares for which dividends are being reinvested, a new Enrollment Form may be executed and returned to the Plan Administrator. A shareholder can also change his or her method of participation by telephone at 877/337-1575 (U.S. or Canada) or 312/360-5337 (Outside U.S. and Canada) or online at www.computershare.com/investor.

PLAN OF DISTRIBUTION—COSTS

How Will The Series A Common Shares Be Distributed And Are There Any Expenses To Participants In Connection With Purchases Under The Plan?

TDS will distribute the shares issued under the plan for dividend reinvestment directly to shareholders by crediting their accounts under the Plan. Participants will incur no costs. There are no fees because Series A Common Shares are purchased directly from TDS.

PURCHASES

When Are The Purchase or Investment Dates?

The Investment Dates for Series A Common Shares purchased under the Plan with cash dividends on Series A Common Shares are the cash dividend payment dates. TDS usually pays cash dividends on its Series A Common Shares in March, June, September and December.

How Will The Purchase Price Of Series A Common Shares Be Determined?

There is generally no public trading of the Series A Common Shares. Therefore, TDS is assuming for purposes hereof that each Series A Common Share has a fair market value equal to one of TDS’ Common Shares because the Series A Common Shares are presently convertible into Common Shares on a one-for-one basis. Accordingly, the price of Series A Common Shares purchased with reinvested cash dividends will be 95% of the average daily high and low sales prices for TDS’ Common Shares on the NYSE for a period of ten consecutive trading days ending on the trading day immediately preceding the Investment Date. If there is no trading in the Common Shares reported on the NYSE for a substantial amount of time during any such trading period, the purchase price per share shall be determined by TDS on the basis of such market quotations as it shall deem appropriate. No Series A Common Shares will be sold by TDS at less than the par value of such shares.

How Many Series A Common Shares Will Be Purchased For Participants?

The number of Series A Common Shares to be purchased on an Investment Date will be determined by the amount of each participant’s dividends, including dividends on Series A Common Shares purchased under the Plan, and the applicable price of TDS’ Common Shares. Each participant’s account in the Plan will be credited with the number of Series A Common Shares, including fractional shares computed to six decimal places, equal to the amount of the dividends being invested divided by 95% of the applicable purchase price.

REPORTS TO PARTICIPANTS

What Reports Will Be Sent To Participants In The Plan?

Each participant in the Plan will receive a statement of his or her account with respect to each month in which a transaction takes place. These statements are a participant’s continuing record of the cost of his or her purchases. Participants should retain these statements for income tax purposes. Each statement will set forth the following information when applicable:

a. The total number of Series A Common Shares registered in the name of the participant which is participating in the Plan.

b. The total number of Series A Common Shares which have been accumulated under the Plan by the participant but for which shares have not been issued.

c. The following information for each transaction during the month and all transactions to date during the current year:

•the amount of dividends invested;

•the price per share for each transaction;

•the number of shares purchased; and

•certain tax information.

d. For Series A Common Shares acquired in the Plan after January 1, 2011, specific cost basis information will be included in your statement in accordance with applicable law.

In addition, each participant will receive copies of communications sent to every other holder of TDS’ Series A Common Shares, including communications with respect to the Annual Report to Shareholders, Notice of Annual Meeting of Shareholders and Proxy Statement, and IRS information on Form 1099 for reporting dividend income.

DIVIDENDS

Will Participants Be Credited With Dividends On Fractions Of Shares?

Yes. Participants will be credited with the amount of dividends attributable to fractions of shares in their accounts under the Plan and such dividends will be reinvested.

CERTIFICATE ISSUANCES

Will Certificates Be Issued For Series A Common Shares Purchased Under The Plan?

Stock purchased in the Plan will be registered in the name of Computershare (or its nominee), and shares will not be issued unless requested through written, telephone or Internet request. If requested, shares for any number of whole shares credited to your account will be issued. Issuance of shares will not terminate participation in the Plan. Any remaining full shares and fraction of a share will continue to be credited to the participant’s Plan account.

Dividends on Plan Series A Common Shares for which a participant requests and receives a certificate will be reinvested in TDS’ Series A Common Shares at the 5% discount under the Plan and the Series A Common Shares purchased will be credited to the participant’s Plan if the participant continues to own these Series A Common Shares and has elected full dividend reinvestment of Series A Common Shares on his or her current Series A Common Share Enrollment Form. A participant who continues to own the Series A Common Shares in question and desires to have the dividends on these shares reinvested in TDS’ Series A Common Shares but who does not have an existing Enrollment Form for Series A Common Shares or has elected only partial reinvestment of his or her Series A Common Share dividends on the current Enrollment Form will have to execute a new Enrollment Form and return it to the Plan Administrator. Otherwise, dividends on these Series A Common Shares will not be reinvested in TDS’ Series A Common Shares at the 5% discount as they were when they were held for the participant in the Plan. Rather, the dividends on the Series A Common Shares in question will be paid to the Shareholder in cash.

Series A Common Shares credited to the account of a participant under the Plan may not be pledged as collateral or otherwise transferred. A participant who wishes to pledge or transfer such shares must request that certificates for such shares be issued in his or her name.

Certificates for fractional shares will not be issued under any circumstances.

An institution that is required by law to maintain physical possession of certificates may request a special arrangement regarding the issuance of certificates for Series A Common Shares purchased under the Plan. This request should be sent to the Plan Administrator.

In Whose Name Will Certificates Be Issued?

Accounts under the Plan are maintained in the names in which certificates of the participants were registered at the time they entered the Plan. Consequently, certificates for whole shares issued upon the request of participants will be similarly registered.

CERTIFICATE DEPOSITS

May Participants Deposit Some or All Stock Certificates with the Plan Administrator for Retention?

Yes. Participants may transfer to the Plan Administrator for safekeeping certificates representing Series A Common Shares registered in their names. These shares will be credited to the participants’ accounts under the Plan along with shares purchased for them under the Plan. There is no charge for this service. The stock certificates should be sent by registered mail, return receipt requested and properly insured, to the Plan Administrator. Certificates should not be endorsed.

Dividends will be reinvested in accordance with a participant’s dividend reinvestment option.

Can I Discontinue Reinvestment?

You may discontinue dividend reinvestment at any time by giving written, telephonic or Internet notice to the Plan Administrator. Upon processing your request to discontinue dividend reinvestment, your shares will continue to be held in book-entry form. Dividends on any shares held in book-entry form and held in certificate(s) will be paid in cash.

WITHDRAWAL

When May A Participant Withdraw From The Plan?

A participant may withdraw from the Plan at any time by notifying the Plan Administrator in writing, by telephone or through the Internet. The termination request must be made by all registered holders listed on the account. In the event a participant has been reinvesting dividends and the notice of withdrawal is received by the Plan Administrator after a record date for a dividend payment, the Plan Administrator, in its sole discretion, may either distribute that dividend in cash or reinvest it in shares on the participant’s behalf. In the event the dividend is reinvested, the Plan Administrator will process the withdrawal from the Plan as soon as practicable, but in no event later than five business days after the purchase is completed.

Dividends paid after withdrawal from the Plan will be paid in cash directly to the shareholder unless he or she elects to rejoin the Plan.

What Happens When A Participant Withdraws From The Plan Or The Plan Is Terminated?

When a participant withdraws from the Plan, or ceases to be a shareholder of record, or ceases to be an eligible shareholder, or upon termination of the Plan by TDS, a certificate for the whole Series A Common Shares credited to his or her account under the Plan will be issued and a cash payment will be made for any fractional share. This cash payment will be based on the then-current market value of the fractional share of TDS Common Shares less any applicable fees.

TAX AND OTHER INFORMATION

When May A Shareholder Rejoin The Plan?

Generally, a shareholder may rejoin the Plan at any time, provided he or she is an eligible shareholder, by submitting a new Enrollment Form or going online at www.computershare.com/investor. However, TDS reserves the right to reject any Enrollment Form from a previous participant on the grounds of repeated joining and withdrawals from Plan participation. Such reservation is intended to minimize administrative expenses and to encourage use of the Plan as a long-term investment service.

What Happens If A Participant Sells Or Transfers All Of His Or Her Series A Common Shares or Ceases To Be An Eligible Shareholder?

If a participant ceases to be an eligible shareholder of record holding a minimum of one share on the books of TDS, the account will be terminated. A check will be issued for the fractional share remaining in the Plan. The amount of the check will be based on the then-current market value of the fractional share less any applicable fees.

What Happens When A Participant Who Is Reinvesting Dividends On All Or Less Than All Of The Shares Registered In His Or Her Name Sells Or Transfers A Portion Of Such Shares?

If a participant, who is reinvesting dividends on all or only a portion of Series A Common Shares registered in his or her name disposes of a portion of such shares, TDS will continue to reinvest dividends on the remainder of the Series A Common Shares registered in the participant’s name up to the number indicated on the participant’s Enrollment Form as the number of Series A Common Shares for which dividends are to be reinvested, provided the participant remains an eligible shareholder owning one share.

Does Participation In The Plan Involve Risk?

The risk to participants is the same as with any other investment in TDS’ Series A Common Shares. It should be recognized that since investment prices are determined as an average of the daily high and low sales prices for a period of ten consecutive trading dates on which TDS’ Common Shares are traded, a participant loses any advantage otherwise available from being able to select the timing of his or her investment. PARTICIPANTS MUST RECOGNIZE THAT NEITHER TDS NOR THE PLAN ADMINISTRATOR CAN ASSURE A PROFIT OR PROTECT AGAINST A LOSS ON THE SHARES PURCHASED UNDER THE PLAN.

SHAREHOLDERS ARE REFERRED TO THE RISKS DESCRIBED IN THIS PROSPECTUS UNDER THE CAPTIONS “SAFE HARBOR CAUTIONARY STATEMENT” AND “RISK FACTORS” AND OTHER RISKS DESCRIBED IN THE DOCUMENTS INCORPORATED BY REFERENCE HEREIN AS DESCRIBED UNDER “WHERE YOU CAN FIND MORE INFORMATION.”

What Happens If TDS Issues A Stock Dividend, Declares A Stock Split Or Has A Rights Offering?

Any Series A Common Shares distributed by TDS as a stock dividend on shares credited to a participant’s Plan account, or upon any split of such shares, will be credited to the participant’s Plan account. Stock dividends distributed on Series A Common Shares in shares of any other class of capital stock will be mailed directly to the shareholder in the same manner as to shareholders not participating in the Plan. However, if a dividend reinvestment plan or bookkeeping entry facility is established for the shares of such other capital stock distributed as a dividend, the participant will automatically become a participant of such dividend reinvestment plan or bookkeeping entry facility and the shares distributed to such participant will instead be credited to the participant’s account. In a rights offering, a participant’s entitlement will be based upon his or her total holdings, including shares credited to the participant’s account under the Plan. Rights certificates will be issued for the number of whole Series A Common Shares only, however, and rights based on a fraction of a Series A Common Share held in a participant’s Plan account will be sold for the participant’s account and the net proceeds will be forwarded to the participant.

How Will A Participant’s Shares Be Voted At Shareholders’ Meetings?

All Series A Common Shares held in the Plan for a participant will be voted as the participant directs on a proxy or voting instruction form which will be furnished to the participant. If the participant does not return the proxy or voting instruction form to the Plan Administrator, the Plan Administrator will not vote the participant’s Plan shares.

What Are The Federal Income Tax Consequences Of Participation In The Plan?

The following discussion sets forth the general Federal income tax consequences for participants in the Plan. However, the discussion is not intended to be an exhaustive treatment of such tax consequences. For example, the discussion does not address the treatment of stock dividends, stock splits or a rights offering to participants in the Plan. It also does not address differences in tax treatment with respect to participants who do not hold the Series A Common Shares as capital assets. Because the tax laws are complex and constantly changing, participants are urged to consult their own tax advisors regarding the tax consequences of participating in the Plan, including the effects of any applicable state, local or foreign tax laws, and for rules regarding the tax basis in special cases such as the death of a participant or a gift of Series A Common Shares held under the Plan and for other tax consequences. Future legislative changes or changes in administrative or judicial interpretation, some or all of which may be retroactive, could significantly alter the Federal income tax treatment discussed herein.

In general, participants in the Plan who elect to reinvest cash dividends will be treated, for Federal income tax purposes, as having received, on the dividend payment date, a distribution in an amount equal to the fair market value on the dividend payment date of the Series A Common Shares purchased with reinvested dividends, rather than a distribution in the amount of cash otherwise payable to the participant. Participants should not be treated as receiving an additional distribution based upon their pro rata share of the Plan administration costs paid by TDS; however, there can be no assurance that the IRS will agree with this position. TDS has no present plans to seek formal advice from the IRS on this issue.

Generally, the distribution described above—the fair market value of the Series A Common Shares purchased with reinvested dividends—will be taxable to participants as ordinary dividend income to the extent of TDS’ current or accumulated earnings and profits for Federal income tax purposes. The amount of the distribution in excess of such earnings and profits will reduce a participant’s tax basis in the Series A Common Shares with respect to which such distribution was received, and, to the extent in excess of such basis, result in capital gain. Certain corporate participants may be entitled to a dividends received deduction with respect to amounts treated as ordinary dividend income. Corporate participants should consult their own tax advisors regarding their eligibility for and the extent of such deduction. Certain participants may be eligible for lower capital gains rates with respect to amounts treated as qualified dividend income. Participants should consult their own tax advisors regarding treatment of qualified dividend income on their income tax returns.

Tax information will be shown on the statements of account sent to participants which participants should retain for tax purposes. These statements are important for computing the tax basis of Series A Common Shares acquired under the Plan. The Form 1099 which each participant will receive annually will include the income which is deemed to result from the receipt of the Series A Common Shares under the Plan. As a general rule, the tax basis of shares or any fraction of a share purchased with reinvested dividends will equal the fair market value of such shares or fractional share as reported to participants on their statements.

The holding period for Series A Common Shares or a fraction thereof received as a result of reinvestment of dividends under the Plan will begin on the day following the purchase date.

Participants will generally not realize any taxable income when they receive shares for whole Series A Common Shares, the value of which was previously taxed when credited to their accounts under the Plan, either upon their request, upon ceasing to be a shareholder of record, upon ceasing to be an eligible shareholder, or upon withdrawal from or termination of the Plan. However, a participant may realize a gain or loss when Series A Common Shares acquired under the Plan are subsequently sold. In addition, participants may realize gain or loss when they receive a cash adjustment for fractional shares credited to their accounts upon withdrawal from or termination of the Plan. The amount of such gain or loss will be the difference between the amount which the participant receives for his or her shares or fractional share, and his or her tax basis therefor (with special rules applying to determine the basis allocable to shares that are not specifically identified when the participant sells less than all of his or her shares). Such gain or loss will generally be capital gain or loss, and will be long-term capital gain or loss if the holding period for such shares or fractional shares exceeds one year. The excess of net long-term capital gains over net short-term capital losses is taxed at a lower rate than ordinary income for certain taxpayers. The distinction between capital gain or loss and ordinary income and loss is also relevant for purposes of, among other things, limitations on the deductibility of capital losses. Any loss may be disallowed under the ‘‘wash sale’’ rules to the extent the shares disposed of are replaced, through the Plan or otherwise during the 61-day period beginning 30 days before and ending 30 days after the date of disposition.

What Provision Is Made For Shareholders, Foreign And Domestic, Whose Dividends Are Subject To Income Tax Withholding?

Federal law requires the Plan Administrator to withhold an amount (based upon the current applicable rate) from the amount of dividends and the proceeds of any sale of fractional shares if:

•A participant fails to certify to the Plan Administrator that he or she is not subject to backup withholding and that the taxpayer identification number on his or her account is correct (on Form W-9, or W-8, for non-U.S. persons), or

•The IRS notifies TDS or the Plan Administrator that the participant is subject to backup withholding.

Any amounts withheld will be deducted from the dividends and/or from the proceeds of any sale of fractional shares, and the remaining amount will be reinvested or paid as the participant has instructed.

In addition, if a participant is not a U.S. person, additional U.S. income tax withholding that is not fully discussed here may apply. Any amounts withheld will be deducted from the dividends and/or from the proceeds of any sale of fractional shares, and the remaining amount will be reinvested or paid as the participant has instructed.

Participants may obtain Forms W-8 or W-9 from the IRS or by contacting the Plan Administrator.

The above discussion is not a complete discussion of all of the tax considerations that may be relevant to participation in the Plan.

A Participant should consult his or her tax advisor about the tax consequences associated with participation in the Plan.

What Are The Responsibilities Of The Shareholders’ Plan Administrator And TDS Under The Plan?

In performing their duties under the Plan, the Plan Administrator and TDS will at all times act in good faith. However, they will not be liable for any act performed in good faith, or for any good faith omission to act, including, without limitation, any claims of liability arising out of failure to terminate a participant’s account upon such participant’s death prior to receipt of notice in writing of such death.

Although the Plan contemplates the continuation of quarterly Series A Common Share dividend payments, the payment of future Series A Common Share dividends will depend upon future earnings, the amount available for the payment of dividends by TDS, the financial condition of TDS and other factors.

Neither TDS nor the Plan Administrator can assure participants a profit or protect them against a loss on the shares purchased under the Plan.

TERMINATION BY TDS

May The Plan Be Changed Or Discontinued?

TDS reserves the right to suspend, modify or terminate the Plan at any time. All participants will receive notice of such suspension, modification or termination.

LEGAL MATTERS

Certain legal matters relating to the securities offered by this Prospectus have been passed upon for TDS by the law firm of Sidley Austin LLP, Chicago, Illinois. Walter C. D. Carlson, a trustee and beneficiary of a voting trust that controls TDS, the non-executive chairman of the board and member of the board of directors of TDS and a director of UScellular is Senior Counsel at Sidley Austin LLP, and John P. Kelsh, the General Counsel and/or an Assistant Secretary of TDS and certain subsidiaries of TDS is a partner at Sidley Austin LLP. Walter C. D. Carlson does not perform any legal services for TDS, UScellular or their subsidiaries.

EXPERTS

The financial statements and management’s assessment of the effectiveness of internal control over financial reporting (which is included in Management’s Report on Internal Control over Financial Reporting) incorporated in this Prospectus by reference to the Annual Report on Form 10-K for the year ended December 31, 2023, have been so incorporated in reliance on the report of PricewaterhouseCoopers LLP, an independent registered public accounting firm, given on the authority of said firm as experts in auditing and accounting.

WHERE YOU CAN FIND MORE INFORMATION

TDS files reports, proxy statements and other information with the Securities and Exchange Commission (‘‘SEC’’). Such materials may be accessed electronically by means of the SEC’s web site at www.sec.gov or at TDS’ website at www.tdsinc.com.

TDS filed Registration Statements related to the offering described in this Prospectus. As of the date of this Prospectus, a total of 91,597 Series A Common Shares remain available for issuance under Registration Statement No. 333-266691, and 500,000 Series A Common Shares are available for issuance under the Registration Statement of which this Prospectus is a part.

As allowed by SEC rules, this Prospectus does not contain all of the information which you can find in the Registration Statements. You are referred to the Registration Statements and the Exhibits thereto for further information. This document is qualified in its entirety by such other information.

The SEC allows us to ‘‘incorporate by reference’’ previously-filed information into this Prospectus, which means that we can disclose important information to you by referring you to another document filed separately with the SEC. The information incorporated by reference is deemed to be part of this Prospectus, except for any information superseded by information in this Prospectus.

This Prospectus incorporates by reference the documents set forth below that have been previously filed with the SEC. These documents contain important information about TDS’ business and finances.

2.All other reports filed by TDS pursuant to Section 13(a) and 15(d) of the Securities Exchange Act of 1934 since December 31, 2023; provided that any information in any Form 8-K that is not deemed to be “filed” pursuant to Item 2.02 or 7.01 shall not be incorporated by reference herein.

This Prospectus also incorporates by reference additional documents that may be filed by us with the SEC pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Securities Exchange Act of 1934 between the date of this Prospectus and the date our offering is completed or terminated.

You may obtain copies of such documents which are incorporated by reference in this Prospectus, other than exhibits thereto which are not specifically incorporated by reference herein, without charge, upon written or oral request to Investor Relations, Telephone and Data Systems, Inc., 30 N. LaSalle Street, Suite 4000, Chicago, IL 60602, (312) 630-1900. In order to ensure timely delivery of documents, any request should be made not later than five business days prior to making an investment decision.

You should rely only on the information contained in or incorporated by reference in this Prospectus. We have not authorized anyone to provide you with information that is different from what is contained in this Prospectus. You should not assume that the information contained in this Prospectus is accurate as of any date other than the date of such Prospectus, and neither the mailing of this Prospectus to shareholders nor the issuance of any securities hereunder shall create any implication to the contrary. This Prospectus does not offer to buy or sell securities in any jurisdiction where it is unlawful to do so.

FORWARD LOOKING STATEMENTS

This Prospectus and the documents incorporated by reference herein contain statements that are not based on historical facts and represent “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the "Securities Act"), Section 21E of the Securities Exchange Act of 1934, as amended (the "Exchange Act") and the rules of the Securities and Exchange Commission ("SEC"). All statements, other than statements of historical facts, are forward-looking statements. The words “believes,” “anticipates,” “estimates,” “expects,” “plans,” “intends,” “projects” and similar expressions are intended to identify these forward-looking statements, but are not the exclusive means of identifying them. Such forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause actual results, events or developments to be significantly different from any future results, events or developments expressed or implied by such forward-looking statements. Such risks, uncertainties and other factors include those set forth below and the risks included or incorporated by reference under “Risk Factors.” However, such factors are not necessarily all of the important factors that could cause actual results, performance or achievements to differ materially from those expressed in, or implied by, the forward-looking statements contained in this Prospectus and the documents incorporated by reference herein. Other unknown or unpredictable factors also could have material adverse effects on future results, performance or achievements. TDS undertakes no obligation to update publicly any forward-looking statements whether as a result of new information, future events or otherwise. You should carefully consider the Risk Factors included or incorporated by reference herein, the following factors and other information contained in, or incorporated by reference into, this Prospectus to understand the material risks relating to TDS’ business.

Operational Risk Factors

•Intense competition involving products, services, pricing, promotions and network speed and technologies could adversely affect TDS’ revenues or increase its costs to compete.

•Changes in roaming practices or other factors could cause TDS’ roaming revenues to decline from current levels, roaming expenses to increase from current levels and/or impact TDS’ ability to service its customers in geographic areas where TDS does not have its own network, which could have an adverse effect on TDS’ business, financial condition or results of operations.

•An inability to attract diverse people of outstanding talent throughout all levels of the organization, to develop their potential through education and assignments, and to retain them by keeping them engaged, challenged and properly rewarded could have an adverse effect on TDS’ business, financial condition or results of operations.

•TDS’ smaller scale relative to larger competitors that may have greater financial and other resources than TDS could cause TDS to be unable to compete successfully, which could adversely affect its business, financial condition or results of operations.

•Changes in various business factors, including changes in demand, consumer preferences and perceptions, price competition, churn from customer switching activity and other factors, could have an adverse effect on TDS’ business, financial condition or results of operations.

•A failure by TDS to obtain access to adequate radio spectrum to meet current or anticipated future needs and/or to accurately predict future needs for radio spectrum could have an adverse effect on TDS’ business, financial condition or results of operations.

•Advances or changes in technology could render certain technologies used by TDS obsolete, could put TDS at a competitive disadvantage, could reduce TDS’ revenues or could increase its costs of doing business.

•Complexities associated with deploying new technologies present substantial risk and TDS’ investments in unproven technologies may not produce the benefits that TDS expects.

•Costs, integration problems or other factors associated with acquisitions, divestitures or exchanges of properties or wireless spectrum licenses and/or expansion of TDS’ businesses could have an adverse effect on TDS’ business, financial condition or results of operations.

•A failure by TDS to complete significant network construction and systems implementation activities as part of its plans to improve the quality, coverage, capabilities and capacity of its network, support and other systems and infrastructure could have an adverse effect on its operations.

•Difficulties involving third parties with which TDS does business, including changes in TDS’ relationships with or financial or operational difficulties, including supply chain disruptions, of key suppliers or independent agents and third-party national retailers who market TDS’ services, could adversely affect TDS’ business, financial condition or results of operations.

•A failure by TDS to maintain flexible and capable telecommunication networks or information technologies, or a material disruption thereof, could have an adverse effect on TDS’ business, financial condition or results of operations.

Financial Risk Factors

•Uncertainty in TDS’ or UScellular's future cash flow and liquidity or the inability to access capital, deterioration in the capital markets, changes in interest rates, other changes in TDS’ or UScellular's performance or market conditions, changes in TDS’ or UScellular's credit ratings or other factors could limit or restrict the availability of financing on terms and prices acceptable to TDS, which has required and could in the future require TDS to reduce or delay its construction, development or acquisition programs, reduce the amount of wireless spectrum licenses acquired, divest assets or businesses, and/or reduce or cease share repurchases and/or the payment of dividends.

•TDS has a significant amount of indebtedness which could adversely affect its financial performance and in turn adversely affect its ability to make payments on its indebtedness, comply with terms of debt covenants and incur additional debt.

•TDS has entered into a new Senior Secured Credit Agreement that imposes certain restrictions on its business and operations that may affect its ability to operate its business and make payments on its indebtedness.

•TDS’ assets and revenue are concentrated primarily in the U.S. telecommunications industry. Consequently, its operating results may fluctuate based on factors related primarily to conditions in this industry.

•TDS has significant investments in entities that it does not control. Losses in the value of such investments could have an adverse effect on TDS’ financial condition or results of operations.

Regulatory, Legal and Governance Risk Factors

•TDS and UScellular have initiated a process to explore a range of strategic alternatives for UScellular and there can be no assurance that any strategic alternative will be successfully identified or completed, that any such strategic alternative will result in additional value for TDS and its shareholders, or that the process will not have an adverse impact on TDS' business or financial statements.

•Failure by TDS to timely or fully comply with any existing applicable legislative and/or regulatory requirements or changes thereto could adversely affect TDS’ business, financial condition or results of operations.

•TDS receives significant regulatory support, and is also subject to numerous surcharges and fees from federal, state and local governments – the applicability and the amount of the support and fees are subject to great uncertainty, including the ability to pass through certain fees to customers, and this uncertainty could have an adverse effect on TDS’ business, financial condition or results of operations.

•Settlements, judgments, restraints on its current or future manner of doing business and/or legal costs resulting from pending and future litigation could have an adverse effect on TDS’ business, financial condition or results of operations.

•The possible development of adverse precedent in litigation or conclusions in professional or environmental studies to the effect that potentially harmful emissions from devices or network equipment, including but not limited to radio frequencies emitted by wireless signals or due to contamination from network cabling, may cause harmful health or environmental consequences, including cancer, tumors or otherwise harmful impacts, or may interfere with various electronic medical devices or frequencies used by other industries, could have an adverse effect on TDS’ wireless and/or wireline business, financial condition or results of operations.

•Claims of infringement of intellectual property and proprietary rights of others, primarily involving patent infringement claims, could prevent TDS from using necessary technology to provide products or services or subject TDS to expensive intellectual property litigation or monetary penalties, which could have an adverse effect on TDS’ business, financial condition or results of operations.

•Certain matters, such as control by the TDS Voting Trust and provisions in the TDS Restated Certificate of Incorporation, may serve to discourage or make more difficult a change in control of TDS or have other consequences.

General Risk Factors

•TDS has experienced, and in the future expects to experience, cyber-attacks or other breaches of network or information technology security of varying degrees on a regular basis, which could have an adverse effect on TDS’ business, financial condition or results of operations.

•Disruption in credit or other financial markets, a deterioration of U.S. or global economic conditions or other events could, among other things, impede TDS’ access to or increase the cost of financing its operating and investment activities and/or result in reduced revenues and lower operating income and cash flows, which would have an adverse effect on TDS’ business, financial condition or results of operations.

•The impact of public health emergencies on TDS' business is uncertain, but depending on duration and severity could have a material adverse effect on TDS' business, financial condition or results of operations.

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

Item 14. Other Expenses of Issuance and Distribution.

The following table sets forth the expenses in connection with the issuance and distribution of the securities registered under this registration statement. There will not be any underwriting discounts or commissions. All of the amounts shown only include amounts previously paid in connection with this registration statement and estimates for additional amounts to be incurred in connection with this registration statement.

| | | | | | | | |

| SEC registration fee | $ | 1,361 |

| Legal fees and expenses | | 10,000 |

| Printing and mailing costs | | 1,000 |

| Fees of accountants | | 15,000 |

| Listing Fee and Miscellaneous | | 10,000 |

| $ | 37,361 |

Item 15. Indemnification of Directors and Officers.

The Registrant’s Restated Certificate of Incorporation contains a provision providing that no director or officer of the Registrant shall be personally liable to the Registrant or its stockholders for monetary damages for breach of fiduciary duty as a director or officer except for breach of the director’s or officer’s duty of loyalty to the Registrant or its stockholders, acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of law, unlawful payment of dividends, unlawful stock redemptions or repurchases and transactions from which the director or officer derived an improper personal benefit.

The Restated Certificate of Incorporation also provides that the Registrant shall indemnify directors and officers of the Registrant, its consolidated subsidiaries and certain other related entities generally in the same manner and to the extent permitted by the Delaware General Corporation Law, as more specifically provided in the Restated Bylaws of the Registrant. The Restated Bylaws provide for indemnification and permit the advancement of expenses by the Registrant generally in the same manner and to the extent permitted by the Delaware General Corporation Law, subject to compliance with certain requirements and procedures specified in the Restated Bylaws. In general, the Restated Bylaws require that any person seeking indemnification must provide the Registrant with sufficient documentation as described in the Restated Bylaws and, if an undertaking to return advances is required, to deliver an undertaking in the form prescribed by the Registrant and provide security for such undertaking if considered necessary by the Registrant. In addition, the Restated Bylaws specify that, except to the extent required by law, the Registrant does not intend to provide indemnification to persons under certain circumstances, such as where the person was not acting in the interests of the Registrant or was otherwise involved in a crime or tort against the Registrant.

Under the Delaware General Corporation Law, directors and officers, as well as other employees or persons, may be indemnified against judgments, fines and amounts paid in settlement in connection with specified actions, suits or proceedings, whether civil, criminal, administrative or investigative (other than an action by or in the right of the corporation - a “derivative action”), and against expenses (including attorneys' fees) in any action (including a derivative action), if they acted in good faith and in a manner they reasonably believed to be in or not opposed to the best interests of the corporation and, with respect to any criminal action or proceeding, had no reasonable cause to believe their conduct was unlawful. However, in the case of a derivative action, a person cannot be indemnified for expenses in respect of any matter as to which the person is adjudged to be liable to the corporation unless and to the extent a court determines that such person is fairly and reasonably entitled to indemnity for such expenses.

Delaware law also provides that, to the extent a director, officer, employee or agent of a corporation has been successful on the merits or otherwise in defense of any action or matter, the corporation must indemnify such party against expenses (including attorneys’ fees) actually and reasonably incurred by such party in connection therewith.

Expenses incurred by a director or officer in defending any action may be paid by a Delaware corporation in advance of the final disposition of the action upon receipt of an undertaking by or on behalf of such director or officer to repay such amount if it is ultimately determined that such party is not entitled to be indemnified by the corporation.

The Delaware General Corporation Law provides that the indemnification and advancement of expenses provided thereby are not exclusive of any other rights granted by bylaws, agreements or otherwise, and provides that a corporation shall have the power to purchase and maintain insurance on behalf of any person, whether or not the corporation would have the power to indemnify such person under Delaware law.

The Registrant has directors’ and officers’ liability insurance which provides, subject to certain policy limits, deductible amounts and exclusions, coverage for all persons who have been, are or may in the future be, directors or officers of the Registrant, against amounts which such persons must pay resulting from claims against them by reason of their being such directors or officers during the policy period for certain breaches of duty, omissions or other acts done or wrongfully attempted or alleged.

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers or controlling persons of the Registrant pursuant to the foregoing provisions, or otherwise, the Registrant has been informed that in the opinion of the SEC such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable.

Item 16. Exhibits.

The following documents are filed herewith or incorporated herein by reference.

| | | | | | | | |

Exhibit No. | | Description of Document |

| | |

| 4.1 | | |

| | |

| 4.2 | | |

| | |

| 4.3 | | |

| | |

| 4.4 | | |

| | |

| 5 | | |

| | |

| 23.1 | | |

| | |

| 23.2 | | |

| | |

| 24 | | Powers of Attorney for certain officers and directors (included on signature page) |

| | |

| 107 | | |

Item 17. Undertakings.

(a) The undersigned Registrant hereby undertakes:

(1)To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

(i)to include any prospectus required by Section 10(a)(3) of the Securities Act of 1933;

(ii)to reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the SEC pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than a 20% change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective registration statement; and

(iii)to include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement;

provided, however, that paragraphs (a)(1)(i), (a)(1)(ii) and (a)(1)(iii) above do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the SEC by the registrant pursuant to Section 13 or Section 15(d) of the Securities Exchange Act of 1934 that are incorporated by reference in the registration statement, or is contained in a form of prospectus filed pursuant to Rule 424(b) that is part of the registration statement.

(2)That, for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(3)To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

(4)That, for the purpose of determining liability of the Registrant under the Securities Act of 1933 to any purchaser in the initial distribution of the securities:

The undersigned Registrant undertakes that in a primary offering of securities of the undersigned Registrant pursuant to this registration statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities are offered or sold to such purchaser by means of any of the following communications, the undersigned Registrant will be a seller to the purchaser and will be considered to offer or sell such securities to such purchaser:

(i)Any preliminary prospectus or prospectus of the undersigned Registrant relating to the offering required to be filed pursuant to Rule 424;

(ii)Any free writing prospectus relating to the offering prepared by or on behalf of the undersigned Registrant or used or referred to by the undersigned Registrant;

(iii)The portion of any other free writing prospectus relating to the offering containing material information about the undersigned Registrant or its securities provided by or on behalf of the undersigned Registrant; and

(iv)Any other communication that is an offer in the offering made by the undersigned Registrant to the purchaser.

(b)The undersigned Registrant hereby undertakes that, for purposes of determining any liability under the Securities Act of 1933, each filing of the registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Securities Exchange Act of 1934 (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the Securities Exchange Act of 1934) that is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the securities offered herein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

SIGNATURES

Pursuant to requirements of the Securities Act of 1933, as amended, the Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-3 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Chicago, State of Illinois, on February 16, 2024.

| | | | | | | | |

| TELEPHONE AND DATA SYSTEMS, INC. | |

| | |

| By: | /s/ LeRoy T. Carlson, Jr. | |

| LeRoy T. Carlson, Jr. | |

| President and Chief Executive Officer | |

POWER OF ATTORNEY

Each person whose signature appears below constitutes and appoints LeRoy T. Carlson, Jr. as his or her true and lawful attorney-in-fact and agent, with full power of substitution and resubstitution for him or her and in his or her name, place and stead, in any and all capacities to sign any and all amendments (including post-effective amendments) to this Registration Statement and/or any filings pursuant to Rule 462(b) or 462(e) under the Securities Act, and to file the same, with all exhibits thereto, and other documents in connection therewith, with the Securities and Exchange Commission, and to take such actions in, and file with, the appropriate applications, statements, consents and other documents as may be necessary or expedient to register any securities of the Registrant for sale, granting unto said attorney-in-fact and agent full power and authority to do so and perform each and every act and thing requisite or necessary to be done in and about the premises, as fully to all intents and purposes as he or she might or could do in person, hereby ratifying and confirming all the said attorney-in-fact and agent or any of them, or their or his or her substitute or substitutes, may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Act of 1933, as amended, this Registration Statement has been signed below by the following persons in the capacities indicated on February 16, 2024.

| | | | | | | | |

| Signature | Title |

| | |

| /s/ LeRoy T. Carlson, Jr. | Director and President and Chief Executive Officer |

| LeRoy T. Carlson, Jr. | (principal executive officer) |

| | |

| /s/ Walter C. D. Carlson | Director and Chairman of the Board |

| Walter C. D. Carlson | |

| | |

| /s/ James W. Butman | Director |

| James W. Butman | |

| | |

| /s/ Letitia G. Carlson, M.D. | Director |

| Letitia G. Carlson, M.D. | |

| | |

| /s/ Prudence E. Carlson | Director |

| Prudence E. Carlson | |

| | |

| /s/ Kimberly D. Dixon | Director |

| Kimberly D. Dixon | |

| | |

| /s/ George W. Off | Director |

| George W. Off | |

| | |

| /s/ Christopher D. O'Leary | Director |

| Christopher D. O’Leary | |

| | |

| /s/ Wade Oosterman | Director |

| Wade Oosterman | |

| | |

| /s/ Dirk S. Woessner | Director |

| Dirk S. Woessner | |

| | |

| /s/ Vicki L. Villacrez | Director and Executive Vice President and Chief Financial Officer |

| Vicki L. Villacrez | (principal financial officer) |

| | |

| /s/ Anita J. Kroll | Vice President – Controller and Chief Accounting Officer |

| Anita J. Kroll | (principal accounting officer) |

Exhibit 107

Calculation of Filing Fee Tables

Form S-3D

(Form Type)

Telephone and Data Systems, Inc.

(Exact Name of Registrant as Specified in its Charter)

Newly Registered Securities

| | | | | | | | | | | | | | | | | | | | | | | |

Security Type | Security Class Title | Fee Calculation Rule | Amount Registered (1) | Proposed Maximum Offering Price Per Unit (2) | Maximum Aggregate Offering Price (2) | Fee Rate | Amount of Registration Fee (2) |

Equity | Series A Common Shares, $0.01 par value per share | Rule 457(c) | 500,000 Series A Common Shares | $18.43 | $9,215,000 | $0.0001476 | $1,361 |

Total Offering Amounts |

| $9,215,000 |

| $1,361 |

Total Fee Offsets |

|

|

| $0 |

Net Fee Due |

|

|

| $1,361 |

(1) In addition to the 500,000 Series A Common Shares registered hereby, pursuant to Rule 429 of the Securities Act of 1933, as amended (the “1933 Act”), the Prospectus contained herein also relates to 91,597 Series A Common Shares which remain unissued under Registration Statement No. 333-266691. Pursuant to Rule 416(a) of the 1933 Act, the number of Series A Common Shares registered shall include an indeterminate number of additional Series A Common Shares that may become issuable pursuant to the anti-dilution provisions of the above-referenced Plan as a result of stock splits, stock dividends, or similar transactions.

(2) Estimated in accordance with Rule 457(c) of the 1933 Act solely for the purpose of calculating the registration fee on the basis of the average of the high and low prices of the Common Shares of the Registrant as reported on The New York Stock Exchange on February 13, 2024.

Exhibit 5

| | | | | | | | |

| SIDLEY AUSTIN LLP

ONE SOUTH DEARBORN STREET

CHICAGO, IL 60603

+1 312 853 7000

+1 312 853 7036

AMERICA ASIA PACIFIC EUROPE |

|

February 16, 2024

Telephone and Data Systems, Inc.

30 North LaSalle Street, Suite 4000

Chicago, Illinois 60602

Re: 500,000 shares of Series A Common Stock, $0.01 par value per share (“Series A Common Stock”)

Ladies and Gentlemen:

We refer to the Registration Statement on Form S-3 (the “Registration Statement”) being filed by Telephone and Data Systems, Inc., a Delaware corporation (the “Company”), with the Securities and Exchange Commission under the Securities Act of 1933, as amended (the “Securities Act”), relating to the registration of 500,000 shares of Series A Common Stock of the Company (the “Registered Shares”) which may be issued under the Company’s Series A Common Share Automatic Dividend Reinvestment Plan (the “Plan”).

This opinion letter is being delivered in accordance with the requirements of Item 601(b)(5) of Regulation S-K under the Securities Act.

We have examined the Registration Statement, the Company’s certificate of incorporation and bylaws, the Plan and the resolutions adopted by the board of directors of the Company relating to the Registration Statement and the Plan. We have also examined originals, or copies of originals certified to our satisfaction, of such agreements, documents, certificates and statements of the Company and other corporate documents and instruments, and have examined such questions of law, as we have considered relevant and necessary as a basis for this opinion letter. We have assumed the authenticity of all documents submitted to us as originals, the genuineness of all signatures, the legal capacity of all persons and the conformity with the original documents of any copies thereof submitted to us for examination. As to facts relevant to the opinions expressed herein, we have relied without independent investigation or verification upon, and assumed the accuracy and completeness of, certificates, letters and oral and written statements and representations of public officials and officers and other representatives of the Company.

Based on the foregoing, we are of the opinion that each Registered Share that is newly issued pursuant to the Plan will be validly issued, fully paid and non-assessable when: (i) the Registration Statement, as finally amended, shall have become effective under the Securities Act; (ii) such Registered Share shall have been duly issued and delivered in accordance with the Plan; and (iii) a certificate representing such Registered Share shall have been duly executed, countersigned and registered and duly delivered to the person entitled thereto against payment of the agreed consideration therefor in an amount not less than the par value thereof or, if any such Registered Share is to be issued in uncertificated form, the Company’s books shall reflect the issuance of such Registered Share to the person entitled thereto against payment of the agreed consideration therefor in an amount not less than the par value thereof, all in accordance with the Plan.

This opinion letter is limited to the General Corporation Law of the State of Delaware. We express no opinion as to the laws, rules or regulations of any other jurisdiction, including, without limitation, the federal laws of the United States of America or any state securities or blue sky laws.

Walter C. D. Carlson, a trustee and beneficiary of a voting trust that controls the Company, the non-executive Chairman of the board and member of the board of directors of the Company and a director of a subsidiary of the Company, is Senior Counsel at the Firm; and John P. Kelsh, the General Counsel and an Assistant Secretary of the Company and the General Counsel and/or an Assistant Secretary of certain subsidiaries of the Company, is a partner at the Firm.

We hereby consent to the filing of this opinion letter as an exhibit to the Registration Statement and to all references to our Firm included in or made a part of the Registration Statement. In giving such consent, we do not thereby admit that we are in the category of persons whose consent is required under Section 7 of the Securities Act.

| | |

| Very truly yours, |

|

| /s/ Sidley Austin LLP |

Exhibit 23.1

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We hereby consent to the incorporation by reference in this Registration Statement on Form S-3 of Telephone and Data Systems, Inc. of our report dated February 16, 2024 relating to the financial statements and the effectiveness of internal control over financial reporting, which appears in Telephone and Data Systems, Inc.’s Annual Report on Form 10-K for the year ended December 31, 2023. We also consent to the reference to us under the heading "Experts" in such Registration Statement.

/s/ PricewaterhouseCoopers LLP

Chicago, Illinois

February 16, 2024

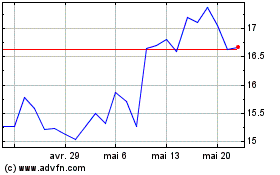

Telephone and Data Systems (NYSE:TDS-V)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Telephone and Data Systems (NYSE:TDS-V)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024