Teva Acquisition of Allergan Generics Unit Delayed

15 Mars 2016 - 4:30PM

Dow Jones News

Teva Pharmaceutical Industries Ltd. said its acquisition of

Allergan PLC's generics unit will close later than expected, as it

works to obtain approval from federal regulators.

Shares of Teva, which have fallen about 13% over the past three

months, slid 3.7% on Tuesday morning to $220.80.

The company in July agreed to buy Actavis Generics for $40.5

billion in cash and stock, in a deal that will vault the Israeli

company into the top ranks of global drugmakers.

On Tuesday, Teva said significant progress has been made toward

completing the acquisition, but it now anticipates it could take

until as long as June to wrap up the deal based upon its current

estimate of the timing to obtain clearance from the U.S. Federal

Trade Commission. Teva previously had expected to close the

transaction as early as the end of the first quarter.

The company already has regulatory approval from the European

Commission.

The acquisition, the latest in a wave of consolidation in the

drug industry, combines Teva, the world's largest generic-drug

company by sales, with the third-largest.

It will give Teva increased scale in the competitive

generic-drug market and an opportunity to pursue further cost

reductions that could help it cope with the end of a wave of big

patent expirations.

Write to Anne Steele at Anne.Steele@wsj.com

(END) Dow Jones Newswires

March 15, 2016 11:15 ET (15:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

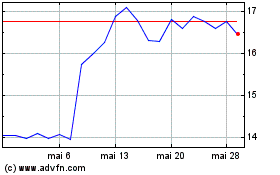

Teva Pharmaceutical Indu... (NYSE:TEVA)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Teva Pharmaceutical Indu... (NYSE:TEVA)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024