Teva Revenue Declines as Some Drugs Lose Exclusivity

09 Mai 2016 - 2:40PM

Dow Jones News

Teva Pharmaceuticals Industries Ltd. reported a decline in

revenue as some of its medications lost exclusivity, though

expenses also fell, driving profit upward.

Results beat analysts' expectations, and shares rose 3% to

$51.76 premarket.

The company also gave projections for the current quarter,

saying it expects adjusted earnings in the range of $1.16 to $1.20

and revenue of $4.7 billion to $4.9 billion. When the impacts of a

December equity offering are removed, earnings will be between

$1.32 and $1.36 a share. Analysts had predicted earnings of $1.18

on revenue of $4.89 billion.

The Israeli pharmaceutical company known for its generic-drugs

business said last July it would buy the generics operations of

Allergan PLC for about $40 billion, a move that followed a

several-way tug of war among drugmakers. In March, the European

Union approved the deal on the condition that the companies divest

several assets.

Revenue in its generic medicine segment fell 17% to $2.2

billion, hurt by the loss of exclusivity of proton pump inhibitor

Esomeprazole and Crohn's disease treatment budesonide. In its

specialty segment, revenue increased 10% to $2.2 billion on higher

sales of CNS and respiratory products.

For the quarter, Teva reported a profit of $636 million, or 62

cents a share, up from $446 million, or 52 cents a share. Excluding

certain items, per-share earnings were $1.20, down from $1.36 a

share in the prior quarter. Revenue fell 3.5% to $4.81 billion.

Analysts polled by Thomson Reuters had expected earnings of

$1.17 a share on $4.77 billion in revenue.

Teva has been working to develop and get approval for biosimilar

drugs, which are the genetic equivalent of drugs created by living

cells. These drugs, known as biologicals, are more complex and

harder to make than normal drugs. The U.S. Food and Drug

Administration approved the first biosimilar last March.

The development of complex products including for sterile and

respiratory medicines lead research and development costs up 14% to

$375 million for the quarter. They were 7.8% of quarterly revenues,

compared with 6.6% a year before.

Write to Austen Hufford at austen.hufford@wsj.com

(END) Dow Jones Newswires

May 09, 2016 08:25 ET (12:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

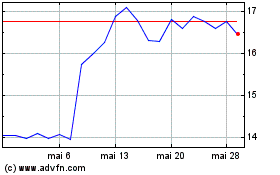

Teva Pharmaceutical Indu... (NYSE:TEVA)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Teva Pharmaceutical Indu... (NYSE:TEVA)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024