TEVA PHARMACEUTICAL

Allergan to Sell Generics Distributor

Teva Pharmaceutical Industries Ltd. said it would purchase

Allergan PLC's generic pharmaceuticals distributor for $500

million, just a day after Teva closed its much larger deal to buy

Allergan's generics business.

Teva is buying Allergan's Anda Inc., the fourth-largest

distributor of generic pharmaceuticals in the U.S.

On Tuesday, Teva closed its $40.5 billion deal for Allergan's

generics business. They first struck that deal last July, but it

was delayed due to regulatory hurdles. Teva ended up having to

divest 75 drugs to rivals to win Federal Trade Commission

approval.

Anda distributes drugs from more than 300 manufacturers to

pharmacies across the U.S. In 2016 Anda is expected to generate

more than $1 billion in third-party net revenue.

As part of the deal, Teva will acquire distribution centers in

Olive Branch, Miss., Weston, Fla., and Groveport, Ohio. Anda will

operate as a stand-alone business. The deal is subject to

regulatory approval and other closing conditions and is expected to

close in the second half of the year.

--Austen Hufford

RIO TINTO

Price Upturn Called Unlikely to Last

SYDNEY -- Rio Tinto PLC's new chief joined the ranks of mining

executives quashing the idea that this year's recovery in minerals

prices will last, as the iron-ore giant reported its worst

first-half results in 12 years.

Jean-Sébastien Jacques said an about-turn in metals and bulk

commodities prices stems from a credit-fueled bounce in Chinese

construction activity that might not be sustained, while a

deepening iron-ore supply glut weighs on the division that accounts

for most of the company's profits.

"Growth in China has stabilized, but it is on a long transition

path of slower and less commodity-intensive growth," Rio Tinto

said. "Meanwhile the global economy seems stuck in a subdued

low-productivity growth pattern which would indicate that continued

caution is required for the second half of 2016."

On Wednesday, Rio Tinto said underlying earnings, which strip

out one-time items, fell 47% to $1.56 billion in the first half of

the year. That was in line with the median forecast of seven

analysts surveyed by The Wall Street Journal.

The Anglo-Australian mining company said its net profit for the

first half was $1.71 billion. That compared with $806 million in

the same period of last year, when write-downs and exchange-rate

and derivative losses hurt its bottom line. Rio Tinto cut its

interim dividend to 45 cents a share from $1.075 a year

earlier.

Prices for commodities including coal, iron ore and industrial

metals climbed in recent months, many bouncing from multiyear lows

as the pace of mining growth slowed, China's appetite for imports

remained strong and investors poured money back into the

markets.

The S&P GSCI Industrial Metals index increased roughly 8%

during the first half and iron ore held mainly above $50 a metric

ton versus a price as low as $37 a ton in December. Iron ore was

supported by strong steel output in China, even after a pledge to

curb overproduction. Still, prices remained well below those in the

heady days of the China-led commodities boom.

Last week, Anglo American PLC Chief Executive Mark Cutifani

warned that the mining industry probably faces a tougher market in

the last half of the year. He was downbeat about the iron-ore

market because of expanding supply.

The International Monetary Fund in July downgraded its forecast

for global economic growth for this year and next. It said that the

U.K.'s vote to leave the European Union would weigh on the world

economy, and warned that a host of threats including geopolitical

turmoil, rising protectionism and terrorist attacks could send

growth into a deeper rut.

In China, recent data has offered a mixed reading of its

economy. A government survey showed manufacturing contracted for

the first time in five months in July, while a private-sector gauge

of factory activity pointed to its first expansion in 17

months.

Economists have recommended that China maintain a loose monetary

policy and strong infrastructure spending as it targets annual

growth of 6.5% to 7% in the face of weak exports, declining demand

and a cooling property market.

China is the largest buyer of most metals and bulk commodities.

Rio Tinto's iron-ore division, which reported a 17% fall in

underlying earnings, is exposed to any further slowdown in China's

economy.

Also, the startup of new mines and Rio Tinto's own increased

shipments of the steelmaking commodity are contributing to a cloudy

price outlook.

While Citigroup last month increased its price forecasts for

iron ore for the coming 18 months, it still projected the commodity

would head back to decade-low territory in 2017. Morgan Stanley

predicts a glut in the international market will continue to swell

until at least the end of this decade.

"We expect the overall market conditions to remain challenging

and volatile," said Mr. Jacques, who succeeded Sam Walsh as Rio

Tinto's chief executive last month.

To counter the uncertain outlook for commodity prices, Rio Tinto

has been cutting costs and repaying debt. It reduced costs by $580

million in the first half and aims to cut a further $1.42 billion

by the end of 2017. Its net debt fell 6% during the six-month

period, to $12.90 billion.

Rio Tinto has also abandoned a policy of keeping investor

payouts stable or rising year after year.

The company said in February it could no longer justify the

commitment when the outlook for the global economy was worsening

and that future dividends would be more closely linked to market

conditions.

Still, the company is laying out plans for new mines, seeking to

be in pole position when global commodity markets recover.

Projects include an underground copper mine in Mongolia and a

bauxite mine in Australia. This week, it also approved a $338

million plan to complete the development of its Silvergrass

iron-ore mine in the iron-rich Pilbara region of Western

Australia.

"One might say it was a boring set of results," Goldman Sachs

said in a note about Rio Tinto's earnings. "But in this day and

age, boring is good."

--Rhiannon Hoyle

SKULLCANDY

Incipio Set to Buy Headphone Maker

Skullcandy Inc. agreed to be acquired by Incipio LLC with a

sweetened offer that values the headphone maker at roughly $188.6

million, potentially ending a takeover battle with private-equity

firm Mill Road Capital Management.

Incipio, whose products include accessories for smartphones and

tablets, raised its offer to $6.10 a share, topping shareholder

Mill Road Capital's bid of $6.05 a share for the stake in the

company it didn't already own.

Skullcandy said it no longer considers the offer by Mill Road,

which valued the company at $173.2 million, superior to Incipio's

initial offer of $5.75.

Mill Road, which disclosed a 9.8% stake in Skullcandy in June,

made its offer just days after the headphone maker reached its

initial deal with Incipio. That agreement with Incipio had included

a one month "go-shop" period to look for higher offers and a

termination fee of $6.2 million that Skullcandy could pay to

Incipio.

Earlier in June, the investment firm of Skullcandy founder and

former Chief Executive Rick Alden said it was exploring whether to

pursue taking the headphone maker private.

Skullcandy shares, down 15% in the past year, closed Tuesday at

$6.06 a share and were inactive premarket.

--Tess Stynes

(END) Dow Jones Newswires

August 04, 2016 02:48 ET (06:48 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

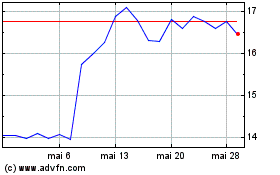

Teva Pharmaceutical Indu... (NYSE:TEVA)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Teva Pharmaceutical Indu... (NYSE:TEVA)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024