Allergan Revenue Increases, Though Loss Widens

08 Août 2016 - 2:50PM

Dow Jones News

Allergan PLC posted revenue growth, but its loss doubled in its

latest quarter as the Botox maker moves on from the sale of its

generics business to Teva Pharmaceutical Industries Ltd. and its

failed $150 billion merger with Pfizer Inc.

The Dublin-based drug company, which counts wrinkle-eraser

Botox, eyelash plumper Latisse and dry-eye treatment Restasis among

its portfolio of specialty pharmaceuticals, closed its $40.5

billion deal last week to sell its generics business to Teva . In

April, Allergan and Pfizer terminated their planned megamerger

after the Obama administration took aim at the so-called inversion

deal.

During the quarter, several drugs across Allergan's portfolio

logged double-digit sales increases, with Botox revenue increasing

14% to $719.7 million and Restasis sales increasing 20% to $390.6

million.

Sales in its U.S. general medicine segment fell 9.9% to $1.45

billion as its Namenda IR alzheimer's treatment lost exclusivity.

U.S. specialized therapeutics revenue grew 10% to $1.49 billion on

growth in eye care, facial aesthetics and neuroscience.

International sales grew 5.6% to $757 million on eye care, facial

aesthetics and Botox growth.

In all for the quarter, Allergan reported a loss of $501.7

million, compared with its loss of $243.1 million a year prior.

Much of the increased loss came from the impact of discontinued

operations.

On a per-share basis after the payout of preferred dividends,

the company posted a loss of $1.44, compared with its loss of 80

cents a year prior. Excluding special charges and items related to

acquisitions and divestitures, earnings per share were $3.35.

Revenue increased 1.5% to $3.68 billion.

Analysts had projected $3.34 in adjusted per-share earnings and

$4.08 billion in revenue, according to Thomson Reuters. Last week

Allergan said Teva would purchase its generic pharmaceuticals

distributor for $500 million and that the impact of that sale might

not be yet taken into account by Wall Street analysts, potentially

skewing estimates.

Shares in the company, up 26% over the past three months,

declined 0.7% to $251.99 in premarket trading.

Write to Austen Hufford at austen.hufford@wsj.com

(END) Dow Jones Newswires

August 08, 2016 08:35 ET (12:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

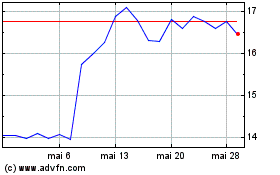

Teva Pharmaceutical Indu... (NYSE:TEVA)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Teva Pharmaceutical Indu... (NYSE:TEVA)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024