By Denise Roland in London and Rory Jones in Tel Aviv

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (August 4, 2017).

The world's biggest seller of generic drugs lost a quarter of

its market value Thursday as concerns mounted about the future of

the company, which has no chief executive and is struggling under

the weight of an acquisition streak.

Adding to the woes, Teva Pharmaceutical Industries Ltd.'s

biggest shareholder, Allergan PLC, said it planned to sell its

stake, further weighing on the stock. Teva's shares tumbled 24% on

Thursday to $23.75 in New York trading.

Since the end of 2015, Teva's shares are down 64%, a decline

that has erased more than $40 billion in market capitalization.

The Israeli drugmaker posted disappointing second-quarter

results, cut its full-year outlook and slashed its dividend,

blaming the rapid deterioration of its all-important U.S.

generic-drug business.

Teva is confronting multiple challenges without a permanent

chief executive after the abrupt February departure of former boss

Erez Vigodman. Like other generic drugmakers, Teva faces a tough

pricing environment and increasing competition that is squeezing

already-tight margins. It is also saddled with about $35 billion in

debt and a sprawling supply chain accumulated through

acquisitions.

A series of deals has transformed Teva, founded before the state

of Israel to ship drugs by camel across Ottoman-controlled

Palestine, from an obscure player in generic drugs to the

industry's most important. One in every seven prescriptions in the

U.S. is for a Teva drug.

But last year's acquisition of Allergan's generics unit --

Teva's biggest-ever deal -- handed the company a huge debt pile

that it is struggling to pay down amid an industrywide

slowdown.

Allergan acquired its 9.9% stake in the company when it sold its

generics business to Teva for $40.5 billion 2016. On a conference

call Thursday, Allergan's chief financial officer said the company

intended to sell the shares now that a one-year lockup period had

expired.

Many investors have said they believe Teva paid too high a price

for the Allergan business, given the subsequent deceleration in

generic-drug sales. On Thursday, Teva said it had taken a $6.1

billion write-down on its U.S. generics unit to reflect dimming

prospects, dragging the company's quarterly net loss down to $6.04

billion. That compares with a $188 million net profit in the second

quarter of 2016.

Another recent deal, the $2.3 billion acquisition of Mexican

generic drugmaker Rimsa, has also created problems. Teva bought the

company last year but shut down Rimsa's sole manufacturing plant

immediately, saying it was improperly managed. Teva is locked in a

legal battle with the Rimsa's former owners over alleged breach of

contract.

Teva said it now expects adjusted earnings per share of $4.30 to

$4.50 for 2017, down from earlier guidance. It also cut revenue

expectations.

Adjusted for the write-down and other items, Teva's quarterly

profit was $1.04 billion, compared with $1.23 billion in the

year-earlier period, falling short of Wall Street expectations.

Revenue rose 13% to $5.69 billion but also missed forecasts.

The company also slashed its dividend in the second quarter to

8.5 cents, from 34 cents for the first three months of the

year.

Interim President and CEO Yitzhak Peterburg said he understood

"the frustration and disappointment of our shareholders" and

promised to "aggressively confront our challenges" by cutting

costs, selling off parts of the business and paying down debt.

But Teva is in a tough spot. Mike McClellan, interim chief

financial officer, told analysts on Thursday that the company

risked breaching its debt covenants this year should its potential

asset sales generate lower proceeds than hoped.

In June, Teva nominated four new directors in an effort to

address investor concerns that its board lacked international

pharmaceutical experience. But without a permanent CEO, investors

are skeptical of the company's ability to get a turnaround under

way.

"It's a rudderless ship until Teva gets a real CEO," said Benny

Landa, an activist investor in the firm. "The most important thing

is getting leadership on the board and a CEO with global

experience."

Mr. Landa and some other shareholders have advocated for the

company to be split into different divisions, one focused on

generic drugs and the other on specialty medicine. Some investors

argue the two businesses should be run by different management or

separated entirely.

Teva Chairman Sol Barer wouldn't comment on the prospects of a

breakup on a call with analysts Thursday. He said management was

focusing on its business and financial priorities "very

aggressively right now."

In June, Mr. Barer said the company was interviewing candidates

for the top job, and the choice would likely be someone with global

drug-industry experience, from outside Israel but willing to live

in the country.

AstraZeneca PLC CEO Pascal Soriot was last month linked to the

job, but neither company has commented on what both described as

"market rumors."

Teva has been trying for several years to make progress on an

overhaul. In 2012, Teva hired Jeremy Levin from Bristol-Myers

Squibb Co. to take the helm, but he was forced out the next year

during a dispute with the board over the company's direction.

His replacement, Mr. Vigodman, an Israeli who was familiar with

the firm from his time serving on its board but lacked a

drug-industry background, left the company in February amid

investor criticism over the Allergan generics deal and a deep fall

in Teva's share price.

Mr. Vigodman has declined to comment on the reasons for his

departure. Longtime CFO Eyal Desheh left Teva in June.

Underscoring the challenge a new chief faces in making wholesale

changes, Teva last month said it would cut roughly 350 jobs in

Israel at two factories, causing an uproar among the firm's

unionized employees.

An Israeli parliamentary committee last week examined the issue

and called on Teva to negotiate with union employees or risk losing

tax breaks.

"The committee will take off its gloves" if Teva doesn't

negotiate, lawmaker Micky Rosenthal told Israeli media.

He said the firm had received 18 billion Israeli shekels, or $5

billion, over the past decade in tax benefits, calling that an

"inconceivable amount."

Write to Denise Roland at Denise.Roland@wsj.com and Rory Jones

at rory.jones@wsj.com

(END) Dow Jones Newswires

August 04, 2017 02:47 ET (06:47 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

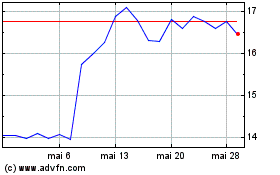

Teva Pharmaceutical Indu... (NYSE:TEVA)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Teva Pharmaceutical Indu... (NYSE:TEVA)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024