Teva Shares Rise as Investors Greet Progress in Turnaround

01 Novembre 2018 - 3:19PM

Dow Jones News

By Denise Roland

Teva Pharmaceutical Industries Ltd swung to a loss in the third

quarter as it continued to battle intensifying competition, but

raised its full-year guidance as efforts to turn around the world's

largest generic drugmaker progress.

The Israeli company, whose drugs account for one in seven

prescriptions in the U.S., is being hammered on several fronts.

It's grappling with weaker prices for generics in America and

lower-price rivals hurting sales of its branded treatments, while

also trying to reduce its huge debt pile.

In response, new Chief Executive Kåre Schultz has moved swiftly

to cut costs by laying off more than a quarter of Teva's workforce,

about 14,000 employees, and shut factories and research

centers.

However, such efforts couldn't stop the company on Thursday

reporting a net loss of $273 million for the three months ending

Sept. 30, compared with a $530 million profit in the same period

last year. Revenue fell 19% to $4.5 billion.

Nevertheless, investors welcomed the earnings -- which beat

forecasts on some measures -- and the company's brightened outlook.

It now expected adjusted full-year earnings a share of $2.80 to

$2.95, compared with earlier guidance of $2.55 to $2.80. It also

affirmed its revenue guidance of up to $19 billion.

Teva traded up more than 6% after the release.

Mr. Schultz said he was "very satisfied" with the company's

progress and that it was on track to meet its cost-savings goal. He

wants to cut $3 billion from the company's $16 billion cost base by

the end of 2019.

However, the results also underscore the challenge facing the

company.

Teva said revenue at its generic-drugs business fell 25% to $922

million, its seventh straight quarterly decline. Generic drug

prices are being hurt because of a wave of consolidation among

pharmacy chains and a higher number of copycat drugs on the

market.

It also said its smaller brand-name drug arm is struggling as

cut-price rivals eat into sales of its best-selling multiple

sclerosis treatment Copaxone. North American sales of Copaxone fell

43% to $463 million in the quarter.

And, the company still has $29.5 billion of debt -- accrued

through an acquisition spree under former CEO Erez Vigodman --

albeit down from $35 billion a year ago.

Teva is counting on new drug launches to boost sales and

earnings, but it has also suffered a setback here. Its

recently-approved migraine prevention drug Ajovy last month lost

out to rivals for a coveted spot on the preferred drug list of

Express Scripts Holding Co., one of the largest prescription drug

managers in the U.S. Nevertheless, Mr. Schultz said there were

positive signs since the drug launched four week ago.

Write to Denise Roland at Denise.Roland@wsj.com

(END) Dow Jones Newswires

November 01, 2018 10:04 ET (14:04 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

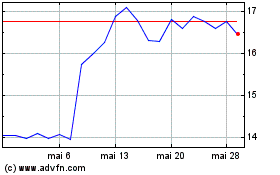

Teva Pharmaceutical Indu... (NYSE:TEVA)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Teva Pharmaceutical Indu... (NYSE:TEVA)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024