0000097216false00000972162023-12-142023-12-14

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported) December 14, 2023

TEREX CORPORATION

(Exact Name of Registrant as Specified in Charter)

| | | | | | | | |

| Delaware | 1-10702 | 34-1531521 |

| (State or Other Jurisdiction | (Commission | (IRS Employer |

| of Incorporation) | File Number) | Identification No.) |

| | | | | | | | | | | |

| 45 Glover Avenue | Norwalk | Connecticut | 06850 |

| (Address of Principal Executive Offices) | (Zip Code) |

Registrant's telephone number, including area code (203) 222-7170

| | |

| NOT APPLICABLE |

| (Former Name or Former Address, if Changed Since Last Report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock ($0.01 par value) | TEX | New York Stock Exchange |

| | | | | |

| Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2). | |

| Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ☐ |

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Terex Corporation (“Terex” or the “Company”) previously disclosed John L. Garrison, Jr. the current Chairman and Chief Executive Officer of the Company would retire from the Company effective January 1, 2024 and would continue as a consultant for the Company from January 1, 2024 through June 30, 2024.

On December 14, 2023, the Company and Mr. Garrison entered into a Consulting Agreement (the “Consulting Agreement”). Pursuant to the Consulting Agreement, Mr. Garrison will receive $540,000 for consulting services provided to the Company in the first six months of 2024. The foregoing description of the Consulting Agreement is qualified in its entirety by reference to the full and complete text of the Consulting Agreement, which is attached hereto and incorporated by reference herein as Exhibit 10.1 to this report.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

104 Cover Page Interactive Data File (embedded within the Inline XBRL document)

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: December 18, 2023

| | |

| TEREX CORPORATION |

|

By: /s/Scott J. Posner |

| Scott J. Posner |

| Senior Vice President |

| General Counsel and Secretary |

|

CONSULTING AGREEMENT

THIS CONSULTING AGREEMENT (“Agreement”), dated as of December 14, 2023, between Terex Corporation, a corporation organized under the laws of the State of Delaware (the “Company”), and John L. Garrison, Jr., an individual (the “Consultant”).

WHEREAS, Consultant has served as Chairman of the Board for over 5 years and Chief Executive Officer of the Company for over 8 years and has extensive knowledge and experience concerning the Company, its businesses and operations, products, markets, customers, team members, etc.;

WHEREAS, Consultant will be retiring as Chief Executive Officer of the Company effective January 1, 2024 after which time he will no longer be an active employee of the Company; and

WHEREAS, the Company desires to obtain consulting services from the Consultant and the Consultant desires to provide consulting services to the Company pursuant to the terms and conditions as set forth in this Agreement.

NOW, THEREFORE, in consideration of the foregoing premises and the respective agreements hereinafter set forth and the mutual benefits to be derived from this Agreement, the Consultant and the Company hereby agree as follows:

1. Engagement. The Company hereby engages the Consultant as a consultant, and the Consultant hereby agrees to provide consulting services to the Company or its Affiliates, all on the terms and subject to the conditions set forth below. For the purposes of this Agreement, “Affiliate” shall mean any individual, a corporation, a partnership, a joint venture, a trust, an unincorporated organization or any other entity or organization (each, a “Person”) controlled by, in control of or under common control with the subject Person.

2. Services of the Consultant. The Consultant hereby agrees during the term of this engagement to consult with the management of the Company and its Affiliates in such manner and on such business matters as may be reasonably requested from time to time by the Board of Directors or Chief Executive Officer of the Company including, but not limited to, business development, maintenance of customer relationships, executive transition and development, special projects, and such other matters as may be reasonably requested.

3. Performance. The Consultant shall provide and devote to the performance of this Agreement such time as is reasonably requested by the Company as needed to perform the consulting services required under this Agreement. The consulting services shall be provided in

a high quality, professional manner and the Consultant shall diligently and to the best of the Consultant’s ability perform the services required under this Agreement. Consultant shall have the sole discretion to determine the work schedule and the manner in which the consulting services will be performed.

4.Consulting Fee.

(a) In respect of the services to be provided hereunder, the Company shall pay to the Consultant a monthly fee in the amount of $90,000, payable monthly in arrears in 6 equal installments on or before the 10th day of each calendar month, with the first payment being in February 2024 and the last payment being in July 2024.

(b) The parties intend that any payment provided under this Agreement shall be exempt from, or shall be paid or provided in compliance with, Internal Revenue Code Section 409A, and the Treasury Regulations thereunder such that there shall be no adverse tax consequences, interest or penalties as a result of the payments, and the parties shall administer and interpret the Agreement in accordance with Internal Revenue Code Section 409A and the Treasury Regulations thereunder. Notwithstanding any other provision of this Agreement, the Company shall not be obligated to guarantee any particular tax result for the Consultant with respect to any payment provided to the Consultant hereunder and the Consultant shall be responsible for any taxes imposed on the Consultant with respect to any such payment.

5.Expenses. The Company shall reimburse the Consultant for reasonable (i) travel expenses and (ii) other out-of-pocket fees and expenses as have been or may be incurred by the Consultant in connection with the rendering of requested services hereunder.

6.Confidentiality. The Consultant shall not, either during the continuance of this Agreement or after its termination, disclose to any Person (except with the written authority of the Company or unless ordered to do so by a court of competent jurisdiction), or use for any purpose other than as contemplated by this Agreement, any information relating to the business, assets, finances or other affairs of a confidential nature of the Company or its Affiliates (“Confidential Information”) of which the Consultant may have become possessed prior to or during the period of this Agreement. Upon termination of this Agreement for any reason or at any time upon the request of the Company, Consultant shall promptly return to the Company all documents, records, notebooks, computer diskettes and similar repositories of or containing such Confidential Information, including copies thereof, then directly or indirectly in Consultant’s possession, whether prepared by Company, its Affiliates or otherwise.

7.Avoidance of Conflicts of Interest. During the term of the Consulting Period, for the purpose of avoiding a conflict of interest, Consultant agrees that he shall not directly or indirectly, whether as an employee, consultant, independent contractor or otherwise, provide services to any person or entity engaged in the design, development, manufacturing, licensing, marketing, or other exploitation of products or services that are competitive with products or services of the Company, or otherwise engage in any activity which is or could reasonably be expected to be a conflict of interest.

8.Cooperation in Proceedings. The Consultant agrees that he shall fully cooperate with respect to any claim, litigation or judicial, arbitral or investigative proceeding initiated by any private party or by an regulator, governmental entity, or self-regulatory organization, that relates to be arises from any matter with which Consultant was involved during his employment with the Company, or that concerns any matter of which Consultant has information or knowledge (collectively , a “Proceeding”). Consultant’s duty of cooperation includes, but is not limited to (i) meeting with the Company’s attorneys by telephone or in person at mutually convenient times and places in order to state truthfully Consultant’s recollection of events; (ii) appearing at the Company’s request as a witness at depositions or trials, without the necessity of a subpoena, in order to state truthfully Consultant’s knowledge of matters at issue; and (iii) signing at the Company’s request declarations or affidavits that truthfully state matters of which Consultant has knowledge. In addition, Consultant agrees to notify the Company’s General Counsel promptly of any requests for information or testimony that he receives in connection with any litigation or investigation relating to the Company’s business.

9.Term and Termination. The Consultant’s engagement by the Company pursuant to this Agreement shall begin on January 1, 2024 and shall expire on June 30, 2024 unless earlier terminated pursuant to the provisions contained herein. The Company may terminate this Agreement upon five (5) business days written notice following a material breach of this Agreement by the Consultant if such breach is not cured within the said five (5) business day period, provided such breach is capable of cure. Consultant may terminate this Agreement at any time and for any reason, upon fourteen (14) days written notice. The Company may terminate this Agreement effective immediately upon the death or disability of Consultant, or should the Consultant otherwise become unable to perform the duties requested of him.

10.Independent Contractors. The Consultant and the Company agree that the Consultant shall perform services hereunder as an independent contractor, retaining control over and responsibility for his Consultant’s activities undertaken in performance of this Agreement. The Consultant shall not be considered an employee or agent of the Company or its Affiliates as result of this Agreement nor shall Consultant have authority to contract in the name of or bind the Company or its Affiliates or be entitled to receive any benefits offered to employees of the Company or its Affiliates. The Consultant will not be treated as an employee of the Company for purposes of federal, state or local income tax withholding and unless otherwise specifically provided by law, for purposes of the Federal Insurance Contributions Act, the Social Security Act, the Federal Unemployment Tax Act or any Workers’ Compensation law of any state or country. The Consultant acknowledges and agrees that, as an independent contractor, he will be required to pay any applicable taxes on the fees paid by the Company, and the Company shall not withhold any taxes on such fees or be responsible for the payment thereof.

11. Notices. Any notice, request, instruction or other document to be given hereunder by any party hereto to any other party shall be in writing and shall be deemed to have been duly given (a) upon receipt if delivery is in person, by electronic facsimile or email transmission (provided a copy is concurrently mailed in accordance with clause (b) below), or

by overnight courier, and (b) three days after mailing if delivery is by certified mail, return receipt requested postage prepaid, in each case addressed as follows:

if to the Company:

Terex Corporation

45 Glover Avenue

Norwalk, Connecticut 06850

Attention: General Counsel

Email: scott.posner@terex.com

if to the Consultant:

John L. Garrison, Jr.

[Address on file with the Company]

Email: john.garrison@terex.com

12. Entire Agreement. This Agreement (i) contains the complete and entire understanding and agreement of the Consultant and the Company with respect to the subject matter hereof; and (ii) supersedes all prior and contemporaneous understandings, conditions and agreements, oral or written, express or implied, respecting the engagement of the Consultant in connection with the subject matter hereof.

13. Assignment; Successors and Assigns.

(a) Neither the Company nor the Consultant may assign its rights or obligations under this Agreement without the express written consent of the other; provided, however, the Company may assign this Agreement to an Affiliate or to an assignee of all or substantially all of the Company’s assets or business without the consent of the Consultant.

(b) In addition to any obligations imposed by law upon any successor to the Company, the Company will require any successor to all or substantially all of the business and/or assets of the Company (whether direct or indirect, by purchase, merger, consolidation or otherwise) to expressly assume and agree to perform this Agreement in the same manner and to the same extent that the Company would be required to perform it if no such succession had taken place.

14. Applicable Law. This Agreement shall be governed by and construed in accordance with the domestic laws of the State of Connecticut, without giving effect to any choice of law or conflict of law provision or rule (whether of the state of Connecticut or any other jurisdiction) that would cause the application of the laws of any jurisdiction other than the State of Connecticut. Each party hereto agrees to submit to the jurisdiction of the state and federal courts of Fairfield County, Connecticut, in any action or proceeding arising out of or relating to this Agreement.

IN WITNESS WHEREOF, the Consultant and the Company have caused this Agreement to be duly executed and delivered on the date and year first above written.

| | | | | |

| TEREX CORPORATION

By: /s/David A. Sachs Name: David A. Sachs Title: Lead Director |

| |

| John L. Garrison, JR.

/s/John L. Garrison, Jr. |

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

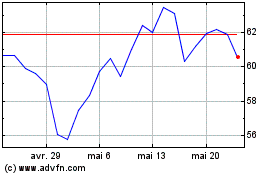

Terex (NYSE:TEX)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

Terex (NYSE:TEX)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024