0001489096false00014890962023-12-062023-12-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 6, 2023

THERMON GROUP HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | |

| Delaware | 001-35159 | 27-2228185 |

(State or other jurisdiction

of incorporation) | (Commission

File Number) | (I.R.S. Employer

Identification Number) |

| | | | | | | | | | | |

| 7171 Southwest Parkway | | |

| Building 300, | Suite 200 | | |

| Austin | TX | | 78735 |

| (Address of principal executive offices) | | (Zip code) |

Registrant’s telephone number, including area code: (512) 690-0600

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | | | | | | | | | | | | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange

on which registered | |

| Common Stock, $0.001 par value per share | | THR | | New York Stock Exchange | |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging Growth Company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | |

| Item 5.02 | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

(d) The Board of Directors (the “Board”) of Thermon Group Holdings, Inc. (the “Company”), on the recommendation of the Nominating and Corporate Governance Committee of the Board, appointed Victor L. Richey as a director of the Company, effective as of December 6, 2023. In connection with the appointment of Mr. Richey, the Board increased its size from eight to nine members effective as of the same date.

Mr. Richey is appointed to serve as a director until the Company’s next annual meeting of stockholders in 2024. Effective as of December 6, 2023, Mr. Richey has also been appointed to serve on the Audit, Human Capital Management and Compensation, and Finance Committees of the Board.

Victor L. Richey, age 66, is a retired chief executive officer. Until his retirement in September 2022, Mr. Richey was the chairman and chief executive officer of ESCO Technologies, Inc (NYSE: ESE) (“ESCO”), a global provider of highly engineered products and solutions serving diverse end-markets, including aerospace and defense, industrial, utility and renewable energy sectors, and radio frequency shielding and testing. At ESCO, Mr. Richey served as Chief Executive Officer from 2002, as well as Chairman of the Board from 2006, until his retirement in 2022. Mr. Richey has served on the board of directors of Nordson Corporation (NASDAQ: NDSN), a precision technology company serving consumer non-durable, medical, electronics and industrial end-markets, since 2010. He served in the United States Army from 1979 to 1985. Mr. Richey holds a Bachelor of Arts degree from Western Kentucky University and a Master of Business Administration degree from Washington University. Mr. Richey brings a wealth of experience in industrial manufacturing and international business to the Board, as well as significant experience as a former chief executive officer and chairman of a publicly-traded company.

There is no arrangement or understanding between Mr. Richey, on the one hand, and any other person, on the other hand, pursuant to which he was selected as a director. There are no transactions involving the Company, on the one hand, and Mr. Richey, on the other hand, that are required to be disclosed pursuant to Item 404(a) of Regulation S-K. Mr. Richey will receive compensation for his Board service in accordance with the Company’s standard compensatory program for non-employee directors and is eligible to participate in the Company's 2020 Long-Term Incentive Plan, under which he has been awarded a pro-rated annual grant of shares of Company common stock with a grant date market value of approximately US$6,700.00. A description of the Company's compensatory program for non-employee directors is set forth under the heading “Director Compensation” in the Company’s definitive proxy statement filed with the Securities and Exchange Commission (“SEC”) on June 21, 2023, which may be adjusted by the Board from time to time. Mr. Richey has entered into an indemnification agreement with the Company, the form of which was previously filed as Exhibit 10.22 to the Company's Registration Statement on Form S-1/A filed with the SEC on April 1, 2011.

The Board has determined that Mr. Richey is independent under the listing standards of the New York Stock Exchange and applicable law.

| | | | | |

| Item 7.01 | Regulation FD Disclosure |

On December 7, 2023, the Company issued a press release announcing the appointment of Mr. Richey as a member of the Board. A copy of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The information in this Current Report on Form 8-K is being “furnished” pursuant to Item 7.01 and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section, and is not incorporated by reference into any Company filing, whether made before or after the date hereof, except as shall be expressly set forth by specific reference in such filing and regardless of any general incorporation language in such filing.

| | | | | |

| Item 9.01 | Financial Statements and Exhibits. |

| (d) | Exhibits. |

| | | | | | | | | | | |

| Exhibit No. | | Description of Exhibit |

| | | |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (formatted in Inline XBRL) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| December 7, 2023 | THERMON GROUP HOLDINGS, INC. |

| | By: | /s/ | Ryan Tarkington |

| | | | Ryan Tarkington |

| | | | Senior Vice President, General Counsel & Corporate Secretary |

Thermon Appoints Victor L. Richey to Board of Directors

AUSTIN, TX (December 7, 2023) Thermon Group Holdings, Inc. (NYSE: THR) (“Thermon”), a global leader in industrial process heating solutions, today announced the appointment of Mr. Victor L. Richey, retired Chairman and Chief Executive Officer of ESCO Technologies, Inc (NYSE: ESE) (“ESCO”), to Thermon’s board of directors (the “Board”). Mr. Richey’s addition is part of the Board’s ongoing succession planning efforts.

John U. Clarke, Thermon’s Chairman of the Board said, “On behalf of our entire Board, we are delighted to welcome Vic to the Board. Vic brings a track record of proven success from his tenure as Chairman and CEO of ESCO, which under his leadership, significantly increased shareholder value, driven by both organic and inorganic growth. Only recently retired, Vic brings a breadth of current and relevant experience to the Board, including strategic planning and execution, transformational leadership, management development, M&A, governance, social responsibility, and risk management – all keys to driving incremental value for Thermon stockholders.”

Mr. Richey said, “I look forward to working with the rest of the Thermon Board. I believe that management and the Board are pursuing well thought-out strategies to drive long-term value creation for stockholders. In addition, I am excited to join a board with such diversity and breadth of experience and who values a strong culture of transparency and responsible governance on behalf of all stockholders. Having managed through the many challenges of recent years, I appreciate the significant progress Thermon has made to date in transforming its business in pursuit of its strategic plan of decarbonization, digitization and diversification and I look forward to working with management to further drive this transformation in the future.”

Thermon CEO Bruce Thames noted, “Vic is an important asset for the Board. He has successfully executed a business strategy with characteristics very similar to Thermon’s ongoing journey of transformation. He brings knowledge of our targeted end-markets and insights into pursuing strategic acquisitions as a means of accelerating growth. In addition, Vic shares our focus on return-driven capital allocation, prudent balance sheet management, and the importance of investing in our human capital as critical components of sustainable growth.”

Until his retirement in September 2022, Mr. Richey, 66, was the Chairman and Chief Executive Officer of ESCO, a global provider of highly engineered products and solutions serving diverse end-markets, including aerospace and defense, industrial, the utility and renewable energy sectors, and radio frequency shielding and testing. At ESCO, Mr. Richey served as Chief Executive Officer from 2002, as well as Chairman of the Board from 2006, until his retirement in 2022. Mr. Richey has served on the board of directors of Nordson Corporation (NASDAQ: NDSN), a precision technology company serving consumer non-durable, medical, electronics and industrial end-markets, since 2010. He served in the United States Army from 1979 to 1985. Mr. Richey holds a Bachelor of Arts degree from Western Kentucky University and a Master of Business Administration degree from Washington University.

About Thermon

Through its global network, Thermon provides safe, reliable and mission critical industrial process heating solutions. Thermon specializes in providing complete flow assurance, process heating, temperature maintenance, freeze protection and environmental monitoring solutions. Thermon is headquartered in Austin, Texas. For more information, please visit www.thermon.com.

FORWARD-LOOKING STATEMENTS

This release includes forward-looking statements within the meaning of the U.S. federal securities laws in addition to historical information. These forward-looking statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include, without limitation, statements regarding our industry, business strategy and the addition of Mr. Richey to the Board and his expected contributions to the Board. When used herein, the words "anticipate," "assume," "believe," "budget," "continue," "contemplate," "could," "should" "estimate," "expect," "intend," "may," "plan," "possible," "potential," "predict," "project," "will," "would," "future," and similar terms and phrases are intended to identify forward-looking statements in this release. Forward-looking statements reflect our current expectations regarding future events, results or outcomes. These expectations may or may not be realized. Some of these expectations may be based upon assumptions, data or judgments that prove to be incorrect. In addition, our business and operations involve numerous risks and uncertainties, many of which are beyond our control, which could result in our expectations not being realized or otherwise materially affect our financial condition, results of operations and cash flows.

Actual events, results and outcomes may differ materially from our expectations due to a variety of factors. Although it is not possible to identify all of these factors, they include, among others, (i) the outbreak of a global pandemic, including the current pandemic (COVID-19 and its variants); (ii) general economic conditions and cyclicality in the markets we serve; (iii) future growth of energy, chemical processing and power generation capital investments; (iv) our ability to operate successfully in foreign countries; (v) our ability to successfully develop and improve our products and successfully implement new technologies; (vi) competition from various other sources providing similar heat tracing and process heating products and services, or alternative technologies, to customers; (vii) our ability to deliver existing orders within our backlog; (viii) our ability to bid and win new contracts; (ix) the imposition of certain operating and financial restrictions contained in our debt agreements; (x) our revenue mix; (xi) our ability to grow through strategic acquisitions; (xii) our ability to manage risk through insurance against potential liabilities (xiii) changes in relevant currency exchange rates; (xiv) tax liabilities and changes to tax policy; (xv) impairment of goodwill and other intangible assets; (xvi) our ability to attract and retain qualified management and employees, particularly in our overseas markets; (xvii) our ability to protect our trade secrets; (xviii) our ability to protect our intellectual property; (xix) our ability to protect data and thwart potential cyber-attacks; (xx) a material disruption at any of our manufacturing facilities; (xxi) our dependence on subcontractors and third-party suppliers; (xxii) our ability to profit on fixed-price contracts; (xxiii) the credit risk associated to our extension of credit to customers; (xxiv) our ability to achieve our operational initiatives; (xxv) unforeseen difficulties with expansions, relocations, or consolidations of existing facilities; (xxvi) potential

liability related to our products as well as the delivery of products and services; (xxvii) our ability to comply with foreign anti-corruption laws; (xxviii) export control regulations or sanctions; (xxix) changes in government administrative policy; (xxx) the current geopolitical instability in Russia and Ukraine and related sanctions by the U.S. and Canadian governments and European Union; (xxxi) environmental and health and safety laws and regulations as well as environmental liabilities; and (xxxii) climate change and related regulation of greenhouse gases, and (xxxiii) those factors listed under Item 1A "Risk Factors" included in our Annual Report on Form 10-K for the fiscal year ended March 31, 2023 filed with the Securities and Exchange Commission (the "SEC") on May 25, 2023 and in any subsequent Quarterly Reports on Form 10-Q, Current Reports on Form 8-K or other filings that we have filed or may file with the SEC. Any one of these factors or a combination of these factors could materially affect our future results of operations and could influence whether any forward-looking statements contained in this release ultimately prove to be accurate.

Our forward-looking statements are not guarantees of future performance, and actual results and future performance may differ materially from those suggested in any forward-looking statements. We do not intend to update these statements unless we are required to do so under applicable securities laws.

CONTACT

Kevin Fox, Chief Financial Officer

Ivonne Salem, Vice President, FP&A and Investor Relations

(512) 690-0600

Investor.Relations@thermon.com

v3.23.3

Cover Page Cover Page

|

Dec. 06, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Dec. 06, 2023

|

| Entity Registrant Name |

THERMON GROUP HOLDINGS, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-35159

|

| Entity Tax Identification Number |

27-2228185

|

| Entity Address, Address Line One |

7171 Southwest Parkway

|

| Entity Address, Address Line Two |

Building 300,

|

| Entity Address, Address Line Three |

Suite 200

|

| Entity Address, City or Town |

Austin

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

78735

|

| City Area Code |

512

|

| Local Phone Number |

690-0600

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.001 par value per share

|

| Trading Symbol |

THR

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001489096

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 3 such as an Office Park

| Name: |

dei_EntityAddressAddressLine3 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

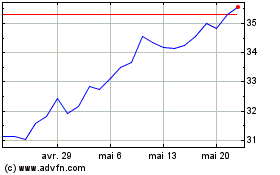

Thermon (NYSE:THR)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

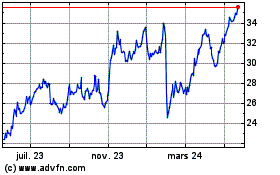

Thermon (NYSE:THR)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024