Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

24 Janvier 2025 - 9:46PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of January 2025

Commission File Number: 001-15092

TURKCELL ILETISIM HIZMETLERI A.S.

(Translation of registrant’s name into English)

Aydınevler Mahallesi

İnönü Caddesi No:20

Küçükyalı

Ofispark

34854 Maltepe

Istanbul, Türkiye

(Address of Principal Executive Offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F:

x Form 20-F ¨

Form 40-F

Enclosure: A press release dated January 24, 2025 announcing the

registrant’s completion of debt instrument issuance.

Istanbul, January 24, 2025

Announcement Regarding Completion of Debt

Instrument Issuance

The

sale process of the sustainable bond issuance of our Company with a nominal amount of USD 500 million, 7-year maturity, a redemption

date of 24.01.2032, a fixed annual coupon rate of 7.65%, and a sales price of 100% of the nominal value, to qualified investors abroad

was completed on January 24, 2025. The subscription agreement for the issuance was signed on January 22, 2025. The sustainable

bond is listed on the Irish Stock Exchange (Euronext Dublin). The proceeds were transferred to our Company's accounts.

Notification Regarding Issue of Capital Market Instrument (Debt

Instrument)

| Board

Decision Date |

:

25.10.2024 |

| |

|

| Related

Issue Limit Info |

|

| Currency

Unit |

:

USD |

| Limit |

:

500,000,000 USD |

| Issue

Limit Security Type |

:

Debt Securities |

| Sale

Type |

:

Oversea |

| Domestic

/ Oversea |

:

Oversea |

| Capital

Market Board Approval Date |

:

28.11.2024 |

| |

|

| Capital

Market Instrument to be Issued Info |

|

| Type |

:

Sustainable Bond |

| Maturity

Date |

:

24.01.2032 |

| Maturity

(Day) |

:

2556 |

| Sale

Type |

:

Oversea |

| The

country where the issue takes place |

:

Ireland |

| Is

The Issued Capital Market Instrument Green/Sustainability-Themed? |

:

Sustainable |

| Central

Securities Depository |

:

DTC/Euroclear/Clearstream |

| Nominal

Value of Capital Market Instrument Sold |

:

500,000,000 |

| Maturity

Starting Date |

:

24.01.2025 |

| Issue

Exchange Rate |

:

35.599 |

| Interest

Rate Type |

:

Fixed Rate |

| Traded

in the Stock Exchange |

:

Yes |

| Payment

Type |

:

Foreign Exchange Payment |

| ISIN

Code |

:

XS2981975613 |

| Coupon

Number |

:

14 |

| Currency

Unit |

:

USD |

| Coupon

Payment Frequency |

:

Once Every Six Months |

Redemption Plan of Capital Market Instrument Sold

| Coupon

Number |

Payment

Date** |

Was

The Payment Made? |

| 1 |

24

July 2025 |

|

| 2 |

24

January 2026 |

|

| 3 |

24

July 2026 |

|

| 4 |

24

January 2027 |

|

| 5 |

24

July 2027 |

|

| 6 |

24

January 2028 |

|

| 7 |

24

July 2028 |

|

| 8 |

24

January 2029 |

|

| 9 |

24

July 2029 |

|

| 10 |

24

January 2030 |

|

| 11 |

24

July 2030 |

|

| 12 |

24

January 2031 |

|

| 13 |

24

July 2031 |

|

| 14 |

24

January 2032 |

|

| Principal/Maturity

Date Payment Amount |

24

January 2032 |

|

** If

the payment date is not a business day, it shall mean the following business day

Issuer Rating Note

| Rating

Company |

Rating

Note |

Rating

Date |

Is

it Investment Grade? |

| Fitch

Ratings, S&P Ratings |

Fitch:

BB- (Stable), S&P: BB (Stable), |

20.12.2024 |

No |

Capital Market Instrument Rating Note

| Rating

Company |

Rating

Note |

Rating

Date |

Is

it Investment Grade? |

| Fitch

Ratings, S&P Ratings, |

Fitch:

BB-, S&P: BB |

13.01.2025 |

No |

Disclaimer

This press release does not constitute an

offer to sell, or a solicitation of offers to purchase or subscribe for securities in the United States or any other jurisdiction in

which such offer or solicitation would be unlawful. The securities referred to herein have not been and will not be registered under

the U.S. Securities Act of 1933, as amended (the “Securities Act”), and may not be offered, sold or delivered within the

United States or to or for the benefit of, U.S. persons (as defined in Regulation S under the Securities Act) absent registration or

an applicable exemption from the registration requirements of thes Securities Act. This press release is being issued pursuant to and

in accordance with Rule 135c under the Securities Act.

For more information:

Turkcell Investor Relations

investor.relations@turkcell.com.tr

Tel: + 90 212 313 1888

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, Turkcell Iletisim Hizmetleri A.S. has duly caused this report to be signed on its behalf by the

undersigned, thereunto duly authorized.

| |

TURKCELL ILETISIM HIZMETLERI A.S. |

| |

|

|

| Date: January 24, 2025 |

By: |

/s/

Özlem Yardım |

| |

|

|

| |

|

Name: |

Özlem

Yardım |

| |

|

Title: |

Investor Relations Corporate

Finance Director |

| |

TURKCELL ILETISIM HIZMETLERI A.S. |

| |

|

|

| Date: January 24, 2025 |

By: |

/s/

Kamil Kalyon |

| |

|

|

| |

|

Name: |

Kamil Kalyon |

| |

|

Title: |

Chief Financial Officer |

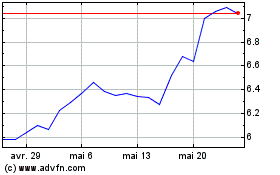

Turkcell lletism Hizmetl... (NYSE:TKC)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

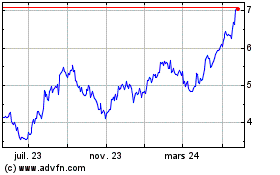

Turkcell lletism Hizmetl... (NYSE:TKC)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025