Added approximately 7,000 net new Locations in

third quarter 2024

Annualized recurring run-rate (ARR) as of

September 30, 2024 grew 28% to $1.6 billion

Net income was $56 million and Adjusted EBITDA

was $113 million in third quarter

Toast (NYSE: TOST), the all-in-one digital technology platform

built for restaurants, today reported financial results for the

third quarter ended September 30, 2024.

“Toast delivered a strong third quarter, adding approximately

7,000 net new locations, growing our recurring gross profit

streams1 35%, and achieving Adjusted EBITDA of $113 million. We are

well positioned to finish out the year strong and carry this

momentum into 2025. Our differentiated vertical software platform

is at the foundation of that success, and we continue to innovate

to deliver more value to our customers: this fall we launched new

products like Branded Mobile App and SMS Marketing alongside over a

dozen feature updates,” said Toast CEO and Co-Founder Aman Narang.

“Today we proudly serve nearly 127,000 locations, and we’re just

getting started. With the disciplined investments we’re making to

further differentiate our platform and expand into new verticals

and geographies, our vision is to serve multiples of that number

over time, delivering durable, efficient growth over the long

term.”

Financial Highlights for the Third Quarter of 2024

- ARR as of September 30, 2024 was $1.6 billion, up 28% year over

year.

- Gross Payment Volume (GPV) increased 24% year over year to

$41.7 billion.

- Total Locations increased 28% year over year to nearly

127,000.

- GAAP subscription services and financial technology solutions

gross profit was up 35% year over year to $365 million. Non-GAAP

subscription services and financial technology solutions gross

profit grew 35% year over year to $378 million.

- GAAP income from operations was $34 million in Q3 2024 compared

to GAAP loss from operations of $(59) million in Q3 2023.

- GAAP net income was $56 million in Q3 2024 compared to GAAP net

loss of $(31) million in Q3 2023. Adjusted EBITDA was $113 million

in Q3 2024 compared to Adjusted EBITDA of $35 million in Q3

2023.

- Net cash provided by operating activities of $109 million and

Free Cash Flow of $97 million in Q3 2024, compared to net cash

provided by operating activities of $47 million and Free Cash Flow

of $37 million, respectively, in Q3 2023.

Percentages may not tie due to rounding. For more information on

the non-GAAP financial measures and key metrics discussed in this

press release, please see the sections titled “Key Business

Metrics” and “Non-GAAP Financial Measures,” as well as the

reconciliations of non-GAAP financial measures to their nearest

comparable GAAP financial measures at the end of this press

release.

Outlook2

For the fourth quarter ending December 31, 2024, Toast expects

to report:

- Non-GAAP subscription services and financial technology

solutions gross profit in the range of $370 million to $380 million

(32-35% growth compared to Q4 2023)

- Adjusted EBITDA in the range of $90 million to $100

million

For the full year ending December 31, 2024, Toast expects to

report:

- Non-GAAP subscription services and financial technology

solutions gross profit in the range of $1,395 million to $1,405

million (32-33% growth compared to 2023, up from 27-29%

growth)

- Adjusted EBITDA in the range of $352 million to $362 million

(up from $285 million to $305 million)

The outlook provided above constitutes forward-looking

information within the meaning of applicable securities laws and is

based on a number of assumptions and subject to a number of risks.

See cautionary note regarding “Forward-looking Statements” in this

press release.

Recent Business Highlights

- Toast announced its Fall Product Release with new mobile

features designed to help restaurants unlock new revenue streams,

boost their brand presence, and deepen the connection with their

guests. Highlights include a Branded Mobile App and SMS Marketing

to drive diner engagement on mobile devices.

- Toast recently released the results of its third Voice of the

Restaurant Industry Survey3, a poll of restaurant decision-makers

which highlights the current state of the restaurant industry and

how business owners are feeling about the future. Amongst the top

findings, 28% of restaurant owners surveyed hope to open a new

location over the next 12 months. Additionally, restaurant

operators say they are very likely to implement AI in several ways

over the next year, with approximately 40% of respondents selecting

options including optimizing menu performance, making

recommendations for guests, benchmarking their business performance

against their peers, and optimizing pricing.

- Toast was named an honoree of the Inc. 2024 Power Partners

Awards, a premier list of the best B2B providers for small- and

medium-sized businesses. The annual list recognizes organizations

across the country for awardees’ support of entrepreneurs across a

number of facets of their business, and being instrumental to their

growth.

Conference Call Information

Toast will host a live conference call at 5:00 p.m. Eastern Time

on Thursday, November 7, 2024. The live webcast of the conference

call can be accessed through Toast’s investor relations website at

http://investors.toasttab.com. A replay of the webcast will be

available for a period of 90 days after the call.

Toast has used, and intends to continue to use, its Investor

Relations website (http://investors.toasttab.com), as well as the

Toast Newsroom (https://pos.toasttab.com/news), as a means of

disclosing material non-public information and for complying with

its disclosure obligations under Regulation FD. Information on or

that can be accessed through Toast’s Investor Relations website, or

that is contained in any website to which a hyperlink is provided

herein is not part of this press release, and the inclusion of

Toast’s Investor Relations website address, and any hyperlinks are

only inactive textual references.

About Toast

Toast is a cloud-based, all-in-one digital technology platform

purpose-built for the entire restaurant community. Toast provides a

comprehensive platform of software as a service (SaaS) products and

financial technology solutions that give restaurants everything

they need to run their business across point of sale, payments,

operations, digital ordering and delivery, marketing and loyalty,

and team management. We serve as the restaurant operating system,

connecting front of house and back of house operations across

service models including dine-in, takeout, delivery, catering, and

retail. Toast helps restaurants streamline operations, increase

revenue and deliver amazing guest experiences. For more

information, visit www.toasttab.com.

____________________________________

1 Toast considers Non-GAAP subscription

services and financial technology solutions gross profit to be its

recurring gross profit streams.

2 A reconciliation of these forward

looking Non-GAAP measures to the corresponding GAAP measure is not

available without unreasonable effort because of the inherent

difficulty of accurately forecasting the occurrence and financial

impact of the various adjusting items necessary for such

reconciliations that have not yet occurred, are out of our control,

or cannot be reasonably predicted, including but not limited to the

change in fair value of our warrant liability and stock-based

compensation. For the same reasons, the Company is unable to assess

the probable significance of the unavailable information, which

could have a material impact on its future GAAP financial

results.

3 To help better understand the restaurant

industry, Toast conducted a blind survey of 755 restaurant

decision-makers operating 16 or fewer locations in the United

States, including both Toast customers and non-Toast restaurants,

from May 17, 2024 to June 2, 2024. Respondents include a mix of

both full-service and quick-service restaurants. Respondents were

not made aware that Toast was fielding the study. Panel providers

granted incentives to restaurant respondents for participation.

Using a standard margin of error calculation, at a confidence

interval of 95%, the margin of error on average is +/- 4%.

Forward-looking Statements

This press release contains “forward-looking statements,” within

the meaning of Section 27A of the Securities Act of 1933, Section

21E of the Securities Exchange Act of 1934 and the Private

Securities Litigation Reform Act of 1995. Forward-looking

statements may be identified by the context of the statement and

generally arise when Toast or its management is discussing its

beliefs, estimates or expectations. Such statements generally

include the words “believes,” “plans,” “intends,” “targets,” “may,”

“could,” “should,” “will,” “expects,” “estimates,” “suggests,”

“anticipates,” “outlook,” “continues,” or similar expressions.

These statements are not historical facts or guarantees of future

performance, but represent the beliefs of Toast and its management

at the time the statements were made regarding future events which

are subject to certain risks, uncertainties and other factors, many

of which are outside Toast’s control. Actual results and outcomes

may differ materially from what is expressed or forecast in such

forward-looking statements. Forward-looking statements include,

without limitation, statements about expected financial positions

or growth; results of operations; cash flows; guidance on financial

results for the fourth fiscal quarter and full year of 2024;

statements about future operating results; the expectations of

demand for Toast’s products and growth of its business; statements

about new products and offerings and the benefits thereof; the

growth rates in the markets in which Toast competes; Toast’s

investments in technology and infrastructure; Toast’s ability to

deliver innovative solutions; Toast’s ability to attract and retain

customers and the commitments from its customers; financing plans;

business strategy; operating plans; competitive positions; and

growth opportunities for existing products.

The forward-looking statements contained in this release are

also subject to other risks and uncertainties, including those more

fully described in Toast’s filings with the Securities and Exchange

Commission (“SEC”), including in the sections entitled “Risk

Factors” and “Management’s Discussion and Analysis of Financial

Condition and Results of Operations'' in Toast’s Annual Report on

Form 10-K for the year ended December 31, 2023, Toast’s Quarterly

Report on Form 10-Q for the three and nine months ended September

30, 2024 that will be filed following this earnings release, and

Toast’s subsequent SEC filings. Toast can give no assurance that

the plans, intentions, expectations or strategies as reflected in

or suggested by those forward-looking statements will be attained

or achieved. The forward-looking statements in this release are

based on information available to Toast as of the date hereof, and

Toast disclaims any obligation to update any forward-looking

statements, except as required by law. These forward-looking

statements should not be relied upon as representing Toast’s views

as of any date subsequent to the date of this press release.

TOAST, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(unaudited)

(in millions, except per share

amounts)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Revenue:

Subscription services

$

189

$

131

$

506

$

358

Financial technology solutions

1,067

856

2,963

2,338

Hardware and professional services

49

45

153

133

Total revenue

1,305

1,032

3,622

2,829

Costs of revenue:

Subscription services

56

43

159

118

Financial technology solutions

835

674

2,323

1,828

Hardware and professional services

91

88

279

271

Amortization of acquired intangible

assets

1

1

4

4

Total costs of revenue

983

806

2,765

2,221

Gross profit

322

226

857

608

Operating expenses:

Sales and marketing

119

100

340

299

Research and development

89

87

258

264

General and administrative

80

98

229

276

Restructuring expenses

—

—

46

—

Total operating expenses

288

285

873

839

Income (loss) from operations

34

(59

)

(16

)

(231

)

Other income (expense):

Interest income, net

9

10

30

27

Change in fair value of warrant

liability

(1

)

18

(37

)

(5

)

Other income (expense), net

15

—

13

—

Income (loss) before taxes

57

(31

)

(10

)

(209

)

Income tax expense

(1

)

—

(3

)

(1

)

Net income (loss)

$

56

$

(31

)

$

(13

)

$

(210

)

Earnings (loss) per share attributable to

common stockholders:

Basic

$

0.10

$

(0.06

)

$

(0.02

)

$

(0.40

)

Diluted

$

0.07

$

(0.09

)

$

(0.02

)

$

(0.40

)

Weighted-average shares used in computing

earnings (loss) per share:

Basic

563

535

556

530

Diluted

590

536

556

530

TOAST, INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(unaudited)

(in millions, except per share

amounts)

September 30, 2024

December 31, 2023

Assets:

Current assets:

Cash and cash equivalents

$

761

$

605

Marketable securities

511

519

Accounts receivable, net

105

69

Inventories, net

106

118

Other current assets

319

259

Total current assets

1,802

1,570

Property and equipment, net

95

75

Operating lease right-of-use assets

31

36

Intangible assets, net

22

26

Goodwill

113

113

Restricted cash

56

55

Other non-current assets

108

83

Total non-current assets

425

388

Total assets

$

2,227

$

1,958

Liabilities and Stockholders’

Equity:

Current liabilities:

Accounts payable

$

30

$

32

Deferred revenue

62

39

Accrued expenses and other current

liabilities

656

592

Total current liabilities

748

663

Warrants to purchase common stock

27

64

Operating lease liabilities

27

33

Other long-term liabilities

5

4

Total liabilities

807

764

Commitments and Contingencies

Stockholders’ Equity:

Preferred stock- par value $0.000001; 100

shares authorized, no shares issued or outstanding

—

—

Common stock, $0.000001 par value:

Class A - 7,000 shares authorized; 468 and

429 shares issued and outstanding as of September 30, 2024 and

December 31, 2023, respectively

Class B - 700 shares authorized; 97 and

114 shares issued and outstanding as of September 30, 2024 and

December 31, 2023, respectively

—

—

Accumulated other comprehensive income

3

—

Additional paid-in capital

3,053

2,817

Accumulated deficit

(1,636

)

(1,623

)

Total stockholders’ equity

1,420

1,194

Total liabilities and stockholders’

equity

$

2,227

$

1,958

TOAST, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(unaudited) (in

millions)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Cash flows from operating

activities:

Net income (loss)

$

56

$

(31

)

$

(13

)

$

(210

)

Adjustments to reconcile net income (loss)

to net cash provided by operating activities:

Depreciation and amortization

12

8

35

22

Stock-based compensation expense

60

71

193

206

Amortization of deferred contract

acquisition costs

21

16

59

44

Change in fair value of warrant

liability

1

(18

)

37

5

Credit loss expense

18

19

50

44

Stock-based charitable contribution

expense

5

10

5

10

Asset impairments

1

—

2

15

Gain on warrant extinguishment

(14

)

—

(14

)

—

Other non-cash items

(2

)

(2

)

(5

)

(14

)

Changes in operating assets and

liabilities:

Accounts receivable, net

(9

)

18

(54

)

(24

)

Other current assets

3

(4

)

(11

)

(7

)

Deferred contract acquisition costs

(32

)

(27

)

(95

)

(77

)

Inventories, net

4

9

12

13

Accounts payable

(3

)

(15

)

(1

)

(3

)

Accrued expenses and other current

liabilities

(8

)

(7

)

(7

)

17

Deferred revenue

(1

)

(1

)

23

6

Operating lease right-of-use assets and

operating lease liabilities, net

(1

)

(1

)

(1

)

—

Other assets and liabilities

(2

)

2

(2

)

(4

)

Net cash provided by operating

activities

109

47

213

43

Cash flows from investing

activities:

Cash paid for acquisition, net of cash

acquired

—

—

—

(9

)

Capital expenditures

(12

)

(10

)

(41

)

(31

)

Purchases of marketable securities

(76

)

(128

)

(353

)

(479

)

Proceeds from the sale of marketable

securities

27

10

80

23

Maturities of marketable securities

71

99

290

414

Other investing activities

—

(2

)

—

(3

)

Net cash provided by (used in) investing

activities

10

(31

)

(24

)

(85

)

Cash flows from financing

activities:

Change in customer funds obligations,

net

13

(4

)

40

27

Proceeds from issuance of common stock

29

16

84

31

Warrant repurchase

(61

)

—

(61

)

—

Repurchases of Class A common stock

(20

)

—

(56

)

—

Net cash provided by (used in) financing

activities

(39

)

12

7

58

Net increase in cash, cash equivalents,

cash held on behalf of customers and restricted cash

80

28

196

16

Effect of exchange rate changes on cash

and cash equivalents and restricted cash

—

—

1

(1

)

Cash, cash equivalents, cash held on

behalf of customers and restricted cash at beginning of period

864

622

747

635

Cash, cash equivalents, cash held on

behalf of customers and restricted cash at end of period

$

944

$

650

$

944

$

650

Reconciliation of cash, cash

equivalents, cash held on behalf of customers and restricted

cash

Cash and cash equivalents

$

761

$

514

$

761

$

514

Cash held on behalf of customers

127

87

127

87

Restricted cash

56

49

56

49

Total cash, cash equivalents, cash held on

behalf of customers and restricted cash

$

944

$

650

$

944

$

650

Non-GAAP Financial Measures

In this press release, Toast refers to non-GAAP financial

measures that are derived on the basis of methodologies other than

in accordance with United States generally accepted accounting

principles (“GAAP”). Toast uses certain non-GAAP financial

measures, as described below, to understand and evaluate its core

operating performance. These non-GAAP financial measures, which may

be different than similarly-titled measures used by other

companies, are presented to enhance investors’ overall

understanding of Toast’s financial performance and should not be

considered substitutes for, or superior to, the financial

information prepared and presented in accordance with GAAP. Toast

believes that these non-GAAP financial measures provide useful

information about its financial performance, enhance the overall

understanding of its past performance and future prospects, and

allow for greater transparency with respect to important metrics

used by Toast’s management for financial and operational

decision-making.

In the tables below, Toast has provided reconciliations of these

non-GAAP financial measures to the most directly comparable

financial measures calculated and presented in accordance with

GAAP. These non-GAAP financial measures should not be considered

substitutes for financial measures calculated in accordance with

GAAP, and the financial results that Toast calculates and presents

in the table in accordance with GAAP, as well as the corresponding

reconciliations from those results, should be carefully

evaluated.

The following are the non-GAAP financial measures referenced in

this press release and presented in the tables below:

- Adjusted EBITDA is defined as net income (loss), adjusted to

exclude stock-based compensation expense and related payroll tax

expense, depreciation and amortization expense, interest income

(expense), net, income taxes and certain other items that are not

considered to reflect our operating activities and performance

within the ordinary course of business, such as restructuring and

restructuring-related expenses, acquisition expenses, fair value

adjustments on warrant liabilities, gain on warrant extinguishment,

expenses related to early termination of leases (which includes

associated asset impairments) and stock-based charitable

contribution expense, as applicable.

- Non-GAAP Subscription Services and Financial Technology

Solutions Gross Profit is defined as subscription services gross

profit and financial technology solutions gross profit, adjusted to

exclude stock-based compensation expense and related payroll tax

expense, and depreciation and amortization expense.

- Non-GAAP Costs of Revenue are defined as costs of revenue

excluding stock-based compensation expense and related payroll tax

expense, and depreciation and amortization expense.

- Non-GAAP Gross Profit is defined as gross profit excluding

stock-based compensation expense and related payroll tax expense,

and depreciation and amortization expense.

- Non-GAAP Subscription Services Gross Profit is defined as

subscription services gross profit excluding stock-based

compensation expense and related payroll tax expense, and

depreciation and amortization expense.

- Non-GAAP Financial Technology Solutions Gross Profit is defined

as financial technology solutions gross profit excluding

stock-based compensation expense and related payroll tax expense,

and depreciation and amortization expense.

- Non-GAAP Hardware and Professional Services Gross Profit is

defined as hardware and professional services gross profit

excluding stock-based compensation expense and related payroll tax

expense, and depreciation and amortization expense.

- Non-GAAP Non-Payments Financial Technology Solutions Gross

Profit is defined as financial technology gross profit excluding

payments financial technology gross profit.

- Non-GAAP Sales and Marketing Expenses are defined as sales and

marketing expenses excluding stock-based compensation expense and

related payroll tax expense, and depreciation and amortization

expense.

- Non-GAAP Research and Development Expenses are defined as

research and development expenses excluding stock-based

compensation expense and related payroll tax expense, and

depreciation and amortization expense.

- Non-GAAP General and Administrative Expenses are defined as

general and administrative expenses excluding stock-based

compensation expense and related payroll tax expense, depreciation

and amortization expense, acquisition expenses, expenses related to

early termination of leases (which includes associated asset

impairments), and stock-based charitable contribution expense.

- Free Cash Flow is defined as net cash provided by (used in)

operating activities reduced by purchases of property and equipment

and capitalization of internal-use software costs (collectively

referred to as capital expenditures).

Adjusted EBITDA, Non-GAAP Subscription Services and Financial

Technology Solutions Gross Profit, Non-GAAP Costs of Revenue,

Non-GAAP Gross Profit, Non-GAAP Subscription Services Gross Profit,

Non-GAAP Financial Technology Gross Profit, Non-GAAP Hardware and

Professional Services Gross Profit, Non-GAAP Non-Payments Financial

Technology Solutions Gross Profit, Non-GAAP Sales and Marketing

Expenses, Non-GAAP Research and Development Expenses, Non-GAAP

General and Administrative Expenses, and Free Cash Flow do not

purport to represent profitability and liquidity measures as

defined in accordance with GAAP. These measures are provided to

investors and others to improve the quarter-to-quarter and

year-to-year comparability of Toast's financial results and to

ensure that investors understand the information Toast uses to

evaluate the performance of its businesses.

Our definitions may differ from the definitions used by other

companies and therefore comparability may be limited. In addition,

other companies may not publish these or similar metrics. Further,

these metrics have certain limitations since they do not include

the impact of certain expenses and cash flows that are reflected in

our Consolidated Statements of Operations and Consolidated

Statements of Cash Flows. Thus, our Adjusted EBITDA, Non-GAAP

Subscription Services and Financial Technology Solutions Gross

Profit, Non-GAAP Costs of Revenue, Non-GAAP Gross Profit, Non-GAAP

Subscription Services Gross Profit, Non-GAAP Financial Technology

Gross Profit, Non-GAAP Hardware and Professional Services Gross

Profit, Non-GAAP Non-Payments Financial Technology Solutions Gross

Profit, Non-GAAP Sales and Marketing Expenses, Non-GAAP Research

and Development Expenses, Non-GAAP General and Administrative

Expenses, and Free Cash Flow should be considered in addition to,

not as substitutes for, or in isolation from, measures prepared in

accordance with GAAP.

Key Business Metrics

In addition, Toast also uses the following key business metrics

to help it evaluate its business, identify trends affecting its

business, formulate business plans, and make strategic

decisions:

- Gross Payment Volume (“GPV”) is defined as the sum of total

dollars processed through the Toast payments platform across Toast

Processing Locations in a given period. GPV is a key measure of the

scale of Toast’s platform, which in turn drives our financial

performance. As Toast customers generate more sales and therefore

more GPV, Toast generally sees higher financial technology

solutions revenue.

- Annualized Recurring Run-Rate (“ARR”) is defined as a key

operational measure of the scale of Toast’s subscription and

payment processing services for both new and existing customers. To

calculate ARR, Toast first calculates recurring run-rate on a

monthly basis. Monthly Recurring Run-Rate, or MRR, is measured on

the final day of each month as the sum of (i) Toast’s monthly

billings of subscription services fees, which we refer to as the

subscription component of MRR, and (ii) Toast’s in-month adjusted

payments services fees, exclusive of estimated transaction-based

costs, which we refer to as the payments component of MRR. MRR does

not include fees derived from Toast Capital or related costs. MRR

is also not burdened by the impact of SaaS credits offered. The MRR

calculation includes all locations on the Toast platform and

locations on legacy solutions, which have a negligible impact on

ARR. ARR is determined by taking the sum of (i) twelve times the

subscription component of MRR and (ii) four times the

trailing-three-month cumulative payments component of MRR. Toast

believes this approach provides an indication of its scale, while

also controlling for short-term fluctuations in payments volume.

ARR may decline or fluctuate as a result of a number of factors,

including customers’ satisfaction with the Toast platform, pricing,

competitive offerings, economic conditions, or overall changes in

Toast’s customers’ and their guests’ spending levels. ARR is an

operational measure, does not reflect Toast’s revenue or gross

profit determined in accordance with GAAP, and should be viewed

independently of, and not combined with or substituted for, Toast’s

revenue, gross profit, and other financial information determined

in accordance with GAAP. Further, ARR is not a forecast of future

revenue and investors should not place undue reliance on ARR as an

indicator of Toast’s future or expected results.

Locations

We define a live location, or Location, as a unique location

that has used Toast Point of Sale to record transaction volumes

above a minimum threshold, and has not been marked as a churned

location as of the date of determination. A Location can use Toast

payment services, which we refer to as a Toast Processing Location,

or for select enterprise customers, not use Toast’s payment

services, which we refer to as a Non-Toast Processing Location.

Customers of legacy solutions provided by companies that we have

acquired, that do not use Toast Point of Sale, are not included in

our Location count.

Summary of Key Business

Metrics and Non-GAAP Results

(unaudited)

Three Months Ended September

30,

Nine Months Ended September

30,

(dollars in billions)

2024

2023

% Growth

2024

2023

% Growth

Gross Payment Volume (GPV)

$

41.7

$

33.7

24

%

$

116.9

$

92.5

26

%

As of September 30,

(dollars in millions)

2024

2023

% Growth

Payments Annualized Recurring Run-Rate

$

774

$

631

23

%

Subscription Annualized Recurring

Run-Rate

780

587

33

%

Total Annualized Recurring Run-Rate

(ARR)

$

1,554

$

1,218

28

%

Adjusted EBITDA

Three Months Ended September

30,

Nine Months Ended September

30,

(dollars in millions)

2024

2023

2024

2023

Net income (loss)

$

56

$

(31

)

$

(13

)

$

(210

)

Stock-based compensation expense and

related payroll tax

61

74

193

216

Depreciation and amortization

12

9

32

22

Interest income, net

(9

)

(10

)

(30

)

(27

)

Gain on warrant extinguishment

(14

)

—

(14

)

—

Change in fair value of warrant

liability

1

(18

)

37

5

Termination of leases

—

1

2

14

Stock-based charitable contribution

expense

5

10

5

10

Restructuring and restructuring-related

expenses(1)

—

—

46

—

Acquisition expenses

—

—

—

1

Income tax expense

1

—

3

1

Adjusted EBITDA

$

113

$

35

$

261

$

32

(1) Restructuring and

restructuring-related expenses for the nine months ended September

30, 2024 include $32 million of severance benefits, $12 million of

stock-based compensation expense, and $2 million of accelerated

depreciation related to facilities.

Non-GAAP Subscription Services and

Financial Technology Solutions Gross Profit (Non-GAAP)

Three Months Ended September

30,

Nine Months Ended September

30,

(dollars in millions)

2024

2023

2024

2023

Gross profit (GAAP):

Subscription services

$

133

$

88

$

347

$

240

Financial technology solutions

232

182

640

510

Adjustments:

Stock-based compensation expense and

related payroll tax

5

5

16

15

Depreciation and amortization

8

5

22

11

Non-GAAP subscription services and

financial technology solutions gross profit (Non-GAAP)

$

378

$

280

$

1,025

$

776

Non-GAAP Costs of Revenue

Three Months Ended September

30,

Nine Months Ended September

30,

(dollars in millions)

2024

2023

2024

2023

Costs of revenue

$

983

$

806

$

2,765

$

2,221

Stock-based compensation expense and

related payroll tax

(11

)

(12

)

(33

)

(34

)

Depreciation and amortization

(9

)

(6

)

(27

)

(16

)

Non-GAAP costs of revenue

$

963

$

788

$

2,705

$

2,171

Non-GAAP Gross Profit

Three Months Ended September

30,

Nine Months Ended September

30,

(dollars in millions)

2024

2023

2024

2023

Gross profit

$

322

$

226

$

857

$

608

Stock-based compensation expense and

related payroll tax

11

12

33

34

Depreciation and amortization

9

6

27

16

Non-GAAP gross profit

$

342

$

244

$

917

$

658

Non-GAAP Subscription Services Gross

Profit

Three Months Ended September

30,

Nine Months Ended September

30,

(dollars in millions)

2024

2023

2024

2023

Subscription services gross profit

$

133

$

88

$

347

$

240

Stock-based compensation expense and

related payroll tax

5

5

16

15

Depreciation and amortization

8

5

22

11

Non-GAAP subscription services gross

profit

$

146

$

98

$

385

$

266

Non-GAAP Financial Technology Solutions

Gross Profit

Three Months Ended September

30,

Nine Months Ended September

30,

(dollars in millions)

2024

2023

2024

2023

Financial technology solutions gross

profit

$

232

$

182

$

640

$

510

Stock-based compensation expense and

related payroll tax

—

—

—

—

Depreciation and amortization

—

—

—

—

Non-GAAP financial technology solutions

gross profit

$

232

$

182

$

640

$

510

Non-GAAP Hardware and Professional

Services Gross Profit

Three Months Ended September

30,

Nine Months Ended September

30,

(dollars in millions)

2024

2023

2024

2023

Hardware and professional services gross

profit

$

(42

)

$

(43

)

$

(126

)

$

(138

)

Stock-based compensation expense and

related payroll tax

6

6

17

19

Depreciation and amortization

—

1

1

2

Non-GAAP hardware and professional

services gross profit

$

(36

)

$

(36

)

$

(108

)

$

(117

)

Non-GAAP Non-Payments Financial

Technology Solutions Gross Profit

Three Months Ended September

30,

Nine Months Ended September

30,

(dollars in millions)

2024

2023

2024

2023

Financial technology solutions gross

profit

$

232

$

182

$

640

$

510

Payments financial technology solutions

gross profit

(189

)

(148

)

(529

)

(418

)

Non-GAAP non-payments financial technology

solutions gross profit

$

43

$

34

$

111

$

92

Non-GAAP Sales and Marketing

Expenses

Three Months Ended September

30,

Nine Months Ended September

30,

(dollars in millions)

2024

2023

2024

2023

Sales and marketing expenses

$

119

$

100

$

340

$

299

Stock-based compensation expense and

related payroll tax

(13

)

(16

)

(43

)

(47

)

Depreciation and amortization

(1

)

(1

)

(2

)

(2

)

Non-GAAP sales and marketing expenses

$

105

$

83

$

295

$

250

Non-GAAP Research and Development

Expenses

Three Months Ended September

30,

Nine Months Ended September

30,

(dollars in millions)

2024

2023

2024

2023

Research and development expenses

$

89

$

87

$

258

$

264

Stock-based compensation expense and

related payroll tax

(22

)

(24

)

(66

)

(72

)

Depreciation and amortization

(1

)

(1

)

(2

)

(2

)

Non-GAAP research and development

expenses

$

66

$

62

$

190

$

190

Non-GAAP General and Administrative

Expenses

Three Months Ended September

30,

Nine Months Ended September

30,

(dollars in millions)

2024

2023

2024

2023

General and administrative expenses

$

80

$

98

$

229

$

276

Stock-based compensation expense and

related payroll tax

(15

)

(22

)

(51

)

(64

)

Depreciation and amortization

(1

)

(1

)

(1

)

(2

)

Termination of leases

—

(1

)

(2

)

(14

)

Stock-based charitable contribution

expense

(5

)

(10

)

(5

)

(10

)

Acquisition expenses

—

—

—

(1

)

Non-GAAP general and administrative

expenses

$

59

$

64

$

170

$

185

Free Cash Flow

Three Months Ended September

30,

Nine Months Ended September

30,

(dollars in millions)

2024

2023

2024

2023

Net cash provided by operating

activities

$

109

$

47

$

213

$

43

Capital expenditures

(12

)

(10

)

(41

)

(31

)

Free cash flow

$

97

$

37

$

172

$

12

Sums may not equal totals due to rounding.

TOST-FIN

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241107524847/en/

Media: media@toasttab.com Investors: IR@toasttab.com

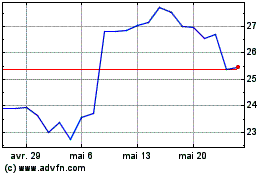

Toast (NYSE:TOST)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Toast (NYSE:TOST)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025