May 30, 2024May 30, 2024TRINITY INDUSTRIES INC0000099780false00000997802024-05-302024-05-30

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

| | | | | | | | |

| Date of Report (Date of Earliest Event Reported): | | May 30, 2024 |

_______________________________________

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| | | | | |

| Delaware | | 1-6903 | | 75-0225040 |

(State or other jurisdiction

of incorporation) | | (Commission File No.) | | (I.R.S. Employer

Identification No.) |

14221 N. Dallas Parkway, Suite 1100,

Dallas, Texas 75254-2957

(Address of Principal Executive Offices, and Zip Code)

(214) 631-4420

Registrant's Telephone Number, Including Area Code

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

______________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock | TRN | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

On May 30, 2024, Trinity Rail Leasing 2021 LLC, a Delaware limited liability company (“TRL-2021”) and a limited purpose, indirect wholly-owned subsidiary of Trinity Industries, Inc. (the “Company”), owned by the Company through the Company's direct wholly-owned subsidiary Trinity Industries Leasing Company (“TILC”), issued an aggregate principal amount of $432,430,000 of TRL-2021’s Series 2024-1 Class A Green Secured Railcar Equipment Notes (the “Notes”). The Notes were issued pursuant to a Master Indenture, dated June 30, 2021 (the “Indenture”) between TRL-2021 and U.S. Bank National Association, as indenture trustee, as supplemented by a Series 2024-1 Supplement dated May 30, 2024 (the “Indenture Supplement”). The Notes bear interest at a fixed rate of 5.78%, are payable monthly, and have a stated final maturity date of May 19, 2054.

TRL-2021 previously issued (i) an aggregate principal amount of $305,200,000 of its Series 2021-1 Class A Green Secured Railcar Equipment Notes (the “2021 Class A Notes”) and (ii) an aggregate principal amount of $19,800,000 of its Series 2021-1 Class B Green Secured Railcar Equipment Notes (the “2021 Class B Notes”) (the 2021 Class A Notes and the 2021 Class B Notes are, collectively, the “Existing Notes”) (the “Existing Notes”) under the Indenture.

The Notes are obligations of TRL-2021 only. The Notes and the Existing Notes are secured by a portfolio of railcars and operating leases thereon acquired and owned by TRL-2021 (the “Railcar Portfolio”) and other assets of TRL-2021. The Notes were offered and sold in a private placement solely to qualified institutional buyers in reliance on Rule 144A of the Securities Act of 1933, as amended (the “Securities Act”), and to persons who are not U.S. persons in offers and sales that occur outside the United States in reliance on Regulation S under the Securities Act, pursuant to a note purchase agreement as described in the Company's Form 8-K filed May 23, 2024.

While the stated final maturity of the Notes is May 19, 2054, the cash flows from TRL-2021's assets will be applied, pursuant to the payment priorities of the Indenture, so as to amortize the Notes to achieve monthly targeted principal balances. If the cash flow assumptions used in determining the targeted balances are met, it is anticipated that the Notes will be repaid well in advance of their stated final maturity date. There can be no assurance, however, that such cash flow assumptions will be realized. In addition, the Notes may be subject to acceleration upon the occurrence of certain events of default under the Indenture, including a failure to pay interest on the Notes, and a failure of the Notes to amortize to the extent that, over time, the outstanding principal balance of the Notes together with the Existing Notes were to eventually exceed the sum of the depreciated value of the Railcar Portfolio and the amounts on deposit in certain accounts of TRL-2021. The decision whether to accelerate or exercise other remedies against TRL-2021 and its assets will be under the control of holders representing a majority of the senior class of the outstanding principal balance of the Notes together with the Existing Notes.

TRL-2021 purchased the Railcar Portfolio directly, in multiple tranches, from TILC and from TILC’s affiliates, Trinity Rail Leasing Warehouse Trust (“TRLWT”) and Trinity Rail Leasing VII LLC (“TRL-VII”). Net proceeds received from the railcars acquired in connection with the issuance of the Notes will be used (i) to repay approximately $218.9 million of borrowings under TRLWT’s secured warehouse credit facility, (ii) to redeem an aggregate principal amount of $94,117,281 of TRL-VII’s Series 2009-1 Secured Railcar Equipment Notes, and (iii) for general corporate purposes.

As noted above, the Notes are solely the obligations of TRL-2021. TILC has, however, entered into certain agreements relating to the transfer of the Railcar Portfolio to TRL-2021 and the management and servicing of TRL-2021's assets. These agreements contain certain representations, undertakings and indemnities customary for asset sellers and service providers in transactions of this type.

The Indenture was filed as Exhibit 10.5.1 to the Company’s Quarterly Report on Form 10-Q for the quarterly period ended June 30, 2021, and is incorporated by reference. A copy of the Indenture Supplement is attached as Exhibit 10.1 hereto and is incorporated by reference. The description of the Indenture and the Indenture Supplement contained herein does not purport to be complete and is qualified in its entirety by the full text of the relevant exhibit.

Item 9.01 Financial Statements and Exhibits.

(a) - (c) Not applicable.

(d) Exhibits:

| | | | | | | | |

| NO. | | DESCRIPTION |

| 10.1 | | |

| | |

| 101.SCH | | Inline XBRL Taxonomy Extension Schema Document (filed electronically herewith). |

| | |

| 101.LAB | | Inline XBRL Taxonomy Extension Label Linkbase Document (filed electronically herewith). |

| 101.PRE | | Inline XBRL Taxonomy Extension Presentation Linkbase Document (filed electronically herewith). |

| | |

| 104 | | Cover Page Interactive Data File (formatted as Inline XBRL and contained in Exhibit 101). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| Trinity Industries, Inc. |

| | |

| June 4, 2024 | By: | /s/ Eric R. Marchetto |

| | Name: Eric R. Marchetto |

| | Title: Executive Vice President and Chief Financial Officer |

Exhibit 10.1

EXECUTION VERSION

SERIES 2024-1

SUPPLEMENT

TRINITY RAIL LEASING 2021 LLC,

as Issuer,

and

U.S. BANK NATIONAL ASSOCIATION,

as Indenture Trustee

dated as of May 30, 2024

______________________________

SERIES 2024-1 NOTES

______________________________

| | | | | | | | |

| ARTICLE I | DEFINITIONS | 1 |

| Section 1.01. | Definitions | 1 |

| ARTICLE II | THE SERIES 2024-1 NOTES | 3 |

| Section 2.01. | Designation of Series; Series 2024-1 Notes | 3 |

| Section 2.02. | Grant of Security Interest in 2024-1 Series Account | 4 |

| Section 2.03. | Authentication and Delivery | 4 |

| Section 2.04. | Interest Payments on the Series 2024-1 Notes | 5 |

| Section 2.05. | Principal Payments on the Series 2024-1 Notes | 5 |

| Section 2.06. | Prepayment of Principal on the Series 2024-1 Notes | 6 |

| Section 2.07. | Manner of Payment | 7 |

| Section 2.08. | Restrictions on Transfer | 8 |

| Section 2.09. | Final Maturity Date | 8 |

| ARTICLE III | 2024-1 SERIES ACCOUNT | 8 |

| Section 3.01. | 2024-1 Series Account | 8 |

| Section 3.02. | Distributions from 2024-1 Series Account | 8 |

| Section 3.03. | Liquidity Reserve Target Amount | 8 |

| ARTICLE IV | CONDITIONS TO ISSUANCE | 9 |

| Section 4.01. | Conditions to Issuance | 9 |

| ARTICLE V | REPRESENTATIONS AND WARRANTIES | 9 |

| Section 5.01. | Master Indenture Representations and Warranties | 9 |

| ARTICLE VI | MISCELLANEOUS PROVISIONS | 9 |

| Section 6.01. | Ratification of Master Indenture | 9 |

| Section 6.02. | Counterparts | 9 |

| Section 6.03. | Governing Law | 9 |

| Section 6.04. | Notices to the Rating Agency | 9 |

| Section 6.05. | Notices to Liquidity Facility Provider | 10 |

| Section 6.06. | Amendments and Modifications | 10 |

EXHIBITS

| | | | | |

| EXHIBIT A | Form of Class A Note |

SCHEDULES

| | | | | |

| SCHEDULE 1 | Description of Additional Railcars |

| SCHEDULE 2 | Description of Additional Leases |

SERIES 2024-1 SUPPLEMENT, dated as of May 30, 2024 (this “Series 2024-1 Supplement”), issued pursuant to, and incorporating the terms of, the Master Indenture, dated as of June 30, 2021 (as amended, modified or supplemented from time to time, the “Master Indenture”, and, together with this Series 2024-1 Supplement, the “Series 2024-1 Indenture”) between TRINITY RAIL LEASING 2021 LLC, a Delaware limited liability company (the “Issuer”), and U.S. BANK NATIONAL ASSOCIATION, a national banking association, as Indenture Trustee (the “Indenture Trustee”).

WITNESSETH THAT:

WHEREAS, the Issuer and the Indenture Trustee wish to set forth the Principal Terms of a Series of Notes with a single Class (the Class A Notes) within such Series to be issued pursuant to this Series 2024-1 Supplement; and

NOW THEREFORE, in consideration of the mutual agreements herein contained, the parties hereto agree as follows:

ARTICLE I

DEFINITIONS

Section 1.01. Definitions. Capitalized terms used herein and not otherwise defined shall have the meaning set forth in the Master Indenture. Whenever used in this Series 2024-1 Supplement, the following words and phrases shall have the following meanings, and the definitions of such terms are applicable to the singular as well as the plural forms of such terms and to the masculine as well as to the feminine and neuter genders of such terms.

“144A Book-Entry Notes” means Series 2024-1 Notes substantially in the form attached as Exhibit A hereto, with the applicable legend for 144A Book-Entry Notes required by Section 2.02 of the Master Indenture inscribed on the face thereof.

“2024-1 Series Account” means the Series Account for the Series 2024-1 Notes, established in accordance with Section 3.01 hereof and Sections 3.01 and 3.07 of the Master Indenture. The account number of the 2024-1 Series Account is 237243000.

“Average Life Date” is defined in Section 2.06(b).

“Class A Note” means an Equipment Note substantially in the form of Exhibit A hereto.

“Class A Optional Redemption” is defined in Section 2.06(a).

“Class A Optional Redemption Date” is defined in Section 2.06(a).

“Closing Date” for the Series 2024-1 Notes means May 30, 2024.

“Control Party” for the Series 2024-1 Notes means the Majority Noteholders.

[Series Supplement (Series 2024-1)]

“Equipment Note Purchase Agreement” means, with respect to the Equipment Notes, the Note Purchase Agreement, dated as of May 22, 2024, among the Issuer, TILC and the Initial Purchasers signatory thereto.

“H.15(519)” is defined in Section 2.06(b).

“Initial Purchasers” means each “Initial Purchaser” within the meaning of and as defined in the Equipment Note Purchase Agreement.

“Liquidity Facility Provider” means Bank of America, N.A., a national banking association.

“Majority Noteholders” means with respect to the Series 2024-1 Notes, as of any date of determination, Noteholders of Series 2024-1 Notes that, individually or in the aggregate, evidence more than fifty percent (50%) of the then aggregate Outstanding Principal Balance of the Series 2024-1 Notes.

“Marginal Interest” is defined in Section 2.04(b).

“November 2026 Payment Date” means the Payment Date occurring in November 2026.

“Offering Circular” means the Issuer’s final offering circular dated May 22, 2024, relating to the offering of the Series 2024-1 Notes.

“Optional Redemption” means a voluntary prepayment by the Issuer of all of the Outstanding Principal Balance of the Series 2024-1 Notes (or a Class thereof) in accordance with the terms of this Series 2024-1 Supplement.

“Rapid Amortization Additional Interest Rate” means four percent (4%) per annum.

“Rapid Amortization Date” means the date, if any, on which the Rapid Amortization Event occurs with respect to the Series 2024-1 Notes.

“Rapid Amortization Event” means, with respect to the Series 2024-1 Notes, that the aggregate Outstanding Principal Balance of the Series 2024-1 Notes (after all payments on the Series 2024-1 Notes on the applicable Payment Date) exceeds zero on the Payment Date falling in May 2031.

“Rating Agency” means, in connection with the Series 2024-1 Notes, S&P.

“Redemption Premium” is defined in Section 2.06(a).

“Regulation S Temporary Book-Entry Notes” means Series 2024-1 Notes in the form attached as Exhibit A hereto, with the applicable legend for Regulation S Temporary Book-Entry Notes required by Section 2.02 of the Master Indenture inscribed on the face thereof.

[Series Supplement (Series 2024-1)]

“Remaining Weighted Average Life” is defined in Section 2.06(b).

“Scheduled Targeted Principal Balance” means with respect to the Class A Notes and each Payment Date, the amount set forth opposite such Payment Date on Appendix B to the Offering Circular under the column titled “Principal Balance ($)”; provided that the Scheduled Targeted Principal Balance for the Series 2024-1 Notes is subject to adjustment from time to time pursuant to Section 3.14 of the Master Indenture.

“Series 2024-1 Final Maturity Date” means the Payment Date occurring in May 2054, which shall constitute the Final Maturity Date with respect to the Series 2024-1 Notes.

“Series 2024-1 Issuance Expenses” means the Issuance Expenses relating to the issuance of the Series 2024-1 Notes.

“Series 2024-1 Noteholders” means the Noteholders of the Series 2024-1 Notes, or any Class of such Notes, as the context may require.

“Series 2024-1 Notes” means Equipment Notes, designated as the Class A Notes, to be issued on the Closing Date and having the terms and conditions specified in this Series 2024-1 Supplement, substantially in the form of Exhibit A hereto and including any and all replacements, extensions, substitutions or renewals of such Equipment Notes.

“Series 2024-1 Optional Redemption Date” is defined in Section 2.06(c).

“Series Account” means, with respect to the Series 2024-1 Notes, the 2024-1 Series Account.

“Stated Rate” means five and seventy eight hundredths percent (5.78%) per annum.

“Treasury Rate” is defined in Section 2.06(b).

“Unrestricted Book-Entry Notes” means Series 2024-1 Notes substantially in the form of Exhibit A hereto, with the applicable legend required by Section 2.02 of the Master Indenture for Unrestricted Book-Entry Notes inscribed on the face thereof.

ARTICLE II

THE SERIES 2024-1 NOTES

Section 2.01. Designation of Series; Series 2024-1 Notes.

(a) There is hereby created a Series of Equipment Notes under the Series 2024-1 Indenture to be known as the “Series 2024-1 Notes” or, with respect to any Equipment Notes, the “Secured Railcar Equipment Notes, Series 2024-1”.

(b) There is hereby created within the Series 2024-1 Notes a single Class, designated as the “Class A Notes”. The Class A Notes will be issued in the initial principal

[Series Supplement (Series 2024-1)]

balance of Four Hundred Thirty-Two Million Four Hundred Thirty Thousand and 0/100 Dollars ($432,430,000).

(c) The Class A Notes are classified as “Additional Notes”, “Series 2024-1 Notes”, “Class A Equipment Notes” and “Fixed Rate Notes”, as each such term is used in the Master Indenture. The Series 2024-1 Notes will be rated on the Closing Date by S&P, and the Series 2024-1 Notes will be paid in accordance with the Flow of Funds.

(d) The first Payment Date with respect to the Series 2024-1 Notes shall be the Payment Date in June 2024.

(e) Payments of principal on the Series 2024-1 Notes shall be payable from funds on deposit in the 2024-1 Series Account or otherwise at the times and in the amounts set forth in Article III of the Master Indenture and Sections 2.05, 2.06 and 3.02 of this Series 2024-1 Supplement.

(f) The Issuer shall pay Series 2024-1 Issuance Expenses out of the proceeds of the Series 2024-1 Notes on the Closing Date and/or from Capital Contributions made to the Issuer on or prior to the Closing Date.

Section 2.02. Grant of Security Interest in 2024-1 Series Account. The Issuer hereby pledges, transfers, assigns, and otherwise conveys to the Indenture Trustee for the benefit and security of the Series 2024-1 Noteholders, and grants to the Indenture Trustee for the benefit and security of the Series 2024-1 Noteholders a security interest in and Encumbrance on, all of the Issuer’s right, title and interest, whether now existing or hereafter created or acquired and wherever located, in, to and under the assets and property described below: (a) the 2024-1 Series Account, and all funds from time to time on deposit therein; and (b) all Proceeds, accessions, profits, products, income benefits, substitutions and replacements, whether voluntary or involuntary, of and to any of the property of the Issuer described in the preceding clause (a).

Section 2.03. Authentication and Delivery.

(a) On the Closing Date, the Issuer shall sign, and shall direct the Indenture Trustee in writing pursuant to Section 2.01(b) of the Master Indenture to duly authenticate, and the Indenture Trustee, upon receiving such direction, (i) shall authenticate, subject to compliance with the conditions precedent set forth in Section 4.01 hereof, the Series 2024-1 Notes in accordance with such written directions, and (ii) subject to compliance with the conditions precedent set forth in Section 4.01 hereof, shall deliver such Series 2024-1 Notes to the Initial Purchasers in accordance with such written directions.

(b) The Series 2024-1 Notes are not being registered with the U.S. Securities and Exchange Commission and, after their sale to the Initial Purchasers in accordance with the Equipment Note Purchase Agreement, may not be sold, transferred or otherwise disposed of except in compliance with the provisions of the Master Indenture and as set forth in the applicable Series 2024-1 Notes.

[Series Supplement (Series 2024-1)]

(c) In accordance with Section 2.01(c) of the Master Indenture, any Class A Notes of the Series 2024-1 Notes resold in reliance on Rule 144A shall be represented by a 144A Book-Entry Note. Any Class A Notes of the Series 2024-1 Notes sold in reliance on Regulation S shall initially be represented by a Regulation S Temporary Book-Entry Note and shall be exchangeable for interests in the related Unrestricted Book-Entry Note.

(d) The Series 2024-1 Notes shall be executed by manual or facsimile signature on behalf of the Issuer by a Responsible Officer and shall be substantially in the form of Exhibit A hereto, with the appropriate legend required by Section 2.02 of the Master Indenture inscribed on the face thereof.

Section 2.04. Interest Payments on the Series 2024-1 Notes.

(a) Interest on Series 2024-1 Notes. Interest on the Outstanding Principal Balance of the Class A Notes shall (i) accrue during each Interest Accrual Period at the Stated Rate, (ii) be calculated on the basis of a 360-day year consisting of twelve 30-day months and (iii) be due and payable in arrears on each Payment Date. Notwithstanding anything to the contrary in the Master Indenture or this Series 2024-1 Supplement, the initial Interest Accrual Period for the Series 2024-1 Notes shall begin on the Closing Date and end on (but exclude) June 19, 2024, and and each subsequent Interest Accrual Period for the Series 2024-1 Notes shall be the period beginning on the 19th day of a calendar month and ending on (but excluding) the 19th day of the next calendar month.

(b) Additional Interest. If any interest payment on any Class of the Series 2024-1 Notes is not timely paid in full when due, such overdue interest will bear interest at the applicable Stated Rate, payable as Additional Interest to the extent permitted by applicable law at the times and subject to the priorities set forth in the Flow of Funds. If a Rapid Amortization Event occurs with respect to a Class of Series 2024-1 Notes, the Issuer will also be required to pay the Noteholders of such Class of Series 2024-1 Notes, as part of, Additional Interest, interest on each Payment Date occurring on and after the Rapid Amortization Date in an amount equal to the Rapid Amortization Additional Interest Rate multiplied by the Outstanding Principal Balance of such Class of Series 2024-1 Notes (after giving effect to all payments on the relevant Class of Series 2024-1 Notes made on such day) (such interest, the “Marginal Interest”) to the extent permitted by applicable law at the times and subject to the priorities set forth in the Flow of Funds. Such Marginal Interest due (if any) shall be (i) calculated on the basis of a 360-day year consisting of twelve 30-day months and (ii) due and payable in arrears on each Payment Date on or after the Rapid Amortization Date.

Section 2.05. Principal Payments on the Series 2024-1 Notes. The Scheduled Principal Payment Amount calculated for the Series 2024-1 Notes for each Payment Date shall be payable to the Series 2024-1 Noteholders on each Payment Date from amounts deposited in the 2024-1 Series Account on such Payment Date as provided in (and subject to the provisions of) the Flow of Funds under the Master Indenture and Section 3.02 hereof. At any time that an Early Amortization Event or an Event of Default is then continuing, or if a Rapid Amortization Event with respect to the Series 2024-1 Notes has occurred, then, in addition to the foregoing, the Outstanding Principal Balance of the Series 2024-1 Notes shall be payable on each Payment

[Series Supplement (Series 2024-1)]

Date to the extent that amounts are available for such purpose in accordance with the Flow of Funds and Section 3.02 hereof.

Section 2.06. Prepayment of Principal on the Series 2024-1 Notes. (a) No Class A Optional Redemption may occur prior to the first anniversary of the Closing Date. Subject to the restrictions in Sections 3.12 and 3.13 of the Master Indenture, the Issuer will have the option to prepay, in an Optional Redemption on any Business Day occurring on or after the first anniversary of the Closing Date (each such date, a “Class A Optional Redemption Date”), all or a portion of the Outstanding Principal Balance of the Class A Notes (such redemption, a “Class A Optional Redemption”), for a Redemption Price equal to the sum of (i) the amount of the Outstanding Principal Balance of the Class A Notes being redeemed on such Class A Optional Redemption Date, plus (ii) accrued and unpaid interest (including Additional Interest, if any) thereon to the Class A Optional Redemption Date, plus (iii) if occurring prior to the November 2026 Payment Date, a redemption premium (the “Redemption Premium”) calculated as follows:

The Redemption Premium will be an amount equal to the product of (x) a fraction (expressed as a percentage), the numerator of which is the amount of the Outstanding Principal Balance of the Class A Notes being redeemed and the denominator of which is the Outstanding Principal Balance of all Class A Notes immediately prior to such redemption and (y) the excess, if any, of (i) the sum of the present values of all the scheduled payments of principal and interest based upon Scheduled Targeted Principal Balances of the Class A Notes from the Class A Optional Redemption Date to and including the November 2026 Payment Date (assuming full prepayment on such date) discounted monthly to the Class A Optional Redemption Date at a rate equal to the Treasury Rate plus three-quarters of one percent (0.75%), based on a 360-day year of twelve 30-day months, over (ii) the Outstanding Principal Balance of the Class A Notes, plus any accrued but unpaid interest thereon.

(b) For purposes of calculating the Redemption Premium, the term “Treasury Rate” means, with respect to each applicable Series 2024-1 Note, a per annum rate (expressed as a monthly equivalent and as a decimal and, in the case of United States Treasury bills, converted to a bond equivalent yield), determined to be the per annum rate equal to the monthly yield to maturity for United States Treasury securities maturing on the Average Life Date of such applicable Series 2024-1 Note as determined by interpolation between the most recent weekly average yields to maturity for two series of United States Treasury securities, (i) one maturing as close as possible to, but earlier than, the Average Life Date of such Series 2024-1 Note and (ii) the other maturing as close as possible to, but later than, the Average Life Date of such Series 2024-1 Note, in each case, as published in the most recent H.15(519) (or, if a weekly average yield to maturity of United States Treasury securities maturing on the Average Life Date of such Series 2024-1 Note is reported in the most recent H.15(519), as published in H.15(519)). “H.15(519)” means “Statistical Release H.15(519), Selected Interest Rates,” or any successor publication published by the Board of Governors of the Federal Reserve System. The most

[Series Supplement (Series 2024-1)]

recent H.15(519) means the latest H.15(519) which is published prior to the close of business on the third (3rd) Business Day preceding the scheduled prepayment date.

The term “Average Life Date” of each applicable Series 2024-1 Note means the date which follows the prepayment date by a period equal to the Remaining Weighted Average Life of such Series 2024-1 Note. The “Remaining Weighted Average Life” of a Series 2024-1 Note at the prepayment or determination date of such Series 2024-1 Note shall be the number of days equal to the quotient obtained by dividing (a) the sum of the products obtained by multiplying (i) the Scheduled Principal Payment Amount for each remaining Payment Date (from the applicable Optional Redemption Date to the November 2026 Payment Date, assuming full prepayment on such Payment Date) by (ii) the number of days from and including the prepayment or determination date to but excluding the scheduled payment date of such principal payment, by (b) the Outstanding Principal Balance of the applicable Series 2024-1 Notes on such date of prepayment or determination. The Issuer will calculate (or cause to be calculated) the applicable Redemption Price and Redemption Premium (if any) and deliver such information in writing to the Indenture Trustee at the time that it gives notice of an Optional Redemption pursuant to Sections 3.12 and 3.13 of the Master Indenture.

(c) Subject to the restrictions in Sections 3.12 and 3.13 of the Master Indenture, the Issuer will have the option to prepay, in an Optional Redemption on any Business Day occurring on or after the November 2026 Payment Date (each such Payment Date, a “Series 2024-1 Optional Redemption Date”), all of the Outstanding Principal Balance of the Series 2024-1 Notes, for the Redemption Price equal to the Outstanding Principal Balance of the Series 2024-1 Notes, plus accrued and unpaid interest thereon (including Additional Interest, if any) to the Series 2024-1 Optional Redemption Date; provided, however, that such Redemption Price shall not include any Redemption Premium.

(d) Any Optional Redemption may be funded with funds in the Collections Account, with the proceeds of Additional Notes or cash Capital Contributions or with any other funds of the Issuer.

(e) Notwithstanding anything herein to the contrary, no Redemption Premium will be due as a result of (i) any Permitted Discretionary Sales which, in the aggregate, are less than 25% of the sum of (x) the Adjusted Value of the Portfolio Railcars owned by the Issuer on the Closing Date calculated as of the Closing Date and (y) the Adjusted Value of the Portfolio Railcars acquired by the Issuer after the Closing Date (if any) calculated as of the relevant Delivery Date, (ii) any Involuntary Railcar Dispositions, Purchase Option Dispositions or Scrap Value Disposition, (iii) in respect of, or during, an Early Amortization Event or if an Event of Default shall have occurred and is continuing, or (iv) a redemption of the Series 2024-1 Notes occurring on or after the November 2026 Payment Date.

Section 2.07. Manner of Payment. Except as otherwise provided in Section 2.05 of the Master Indenture, all payments on the Series 2024-1 Notes payable on each Payment Date shall be paid to the Series 2024-1 Noteholders reflected in the Register as of the related Record Date by wire transfer of immediately available funds for receipt prior to 2:00 p.m. (New York City time) on such Payment Date. Any payments received by the Series 2024-1 Noteholders after

[Series Supplement (Series 2024-1)]

2:00 p.m. (New York City time) on any day shall be considered to have been received on the next succeeding Business Day.

Section 2.08. Restrictions on Transfer. On the Closing Date, the Issuer shall sell the Series 2024-1 Notes to the Initial Purchasers pursuant to the Equipment Note Purchase Agreement and deliver such Series 2024-1 Notes in accordance herewith and therewith. Thereafter, no Series 2024-1 Note may be sold, transferred or otherwise disposed of except in compliance with the provisions of the Master Indenture. Except as provided in the Master Indenture, the Indenture Trustee shall have no obligations or duties with respect to determining whether any transfers of the Series 2024-1 Notes are made in accordance with the Securities Act or any other law; provided that with respect to Definitive Notes, the Indenture Trustee shall enforce such transfer restrictions in accordance with the terms set forth in the Series 2024-1 Indenture.

Section 2.09. Final Maturity Date. The Outstanding Principal Balance of the Series 2024-1 Notes together with all accrued and unpaid interest (including all Additional Interest) thereon, and other amounts payable by the Issuer to the Series 2024-1 Noteholders pursuant to the terms of the Series 2024-1 Indenture, shall be due and payable in full on the earlier to occur of (i) the date on which the Series 2024-1 Notes have been accelerated in accordance with the provisions of Section 4.02 of the Master Indenture and (ii) the Series 2024-1 Final Maturity Date.

ARTICLE III

2024-1 SERIES ACCOUNT

Section 3.01. 2024-1 Series Account. The Indenture Trustee shall establish on the Closing Date pursuant to Sections 3.01 and 3.07 of the Master Indenture and shall maintain, so long as any Series 2024-1 Note is Outstanding, an Indenture Account which shall be designated as the “2024-1 Series Account,” which account shall be held in the name of the Indenture Trustee for the benefit of the Series 2024-1 Noteholders, and which account constitutes a Series Account for the Series 2024-1 Notes for all purposes under the Master Indenture. All deposits of funds for the benefit of the Series 2024-1 Noteholders from the Collections Account and the Liquidity Reserve Account shall be accumulated in, and withdrawn from, the 2024-1 Series Account in accordance with the provisions of the Series 2024-1 Indenture. Notwithstanding anything to the contrary herein, amounts on deposit in the 2024-1 Series Account shall not be invested.

Section 3.02. Distributions from 2024-1 Series Account. On each Payment Date (to the extent sufficient cleared and immediately available funds are available in the 2024-1 Series Account), the Indenture Trustee, as specified in the related Payment Date Schedule with respect to the Flow of Funds, shall distribute funds then on deposit in the 2024-1 Series Account to the Series 2024-1 Noteholders in accordance with Section 3.11 of the Master Indenture.

Section 3.03. Liquidity Reserve Target Amount. On the Closing Date, the Liquidity Reserve Target Amount will be $0.

[Series Supplement (Series 2024-1)]

ARTICLE IV

CONDITIONS TO ISSUANCE

Section 4.01. Conditions to Issuance. The Indenture Trustee shall not authenticate the Series 2024-1 Notes unless (a) all conditions to the issuance of the Series 2024-1 Notes under the Equipment Note Purchase Agreement shall have been satisfied, and (b) the Issuer shall have delivered a certificate to the Indenture Trustee to the effect that all conditions set forth in the Equipment Note Purchase Agreement shall have been satisfied.

ARTICLE V

REPRESENTATIONS AND WARRANTIES

Section 5.01. Master Indenture Representations and Warranties. To induce the Series 2024-1 Noteholders to purchase the Series 2024-1 Notes, the Issuer hereby makes to the Indenture Trustee for the benefit of the Series 2024-1 Noteholders, as of the Closing Date and as of the other dates specified for the applicable representations in the Master Indenture, all of the representations and warranties set forth in Section 5.01 of the Master Indenture.

ARTICLE VI

MISCELLANEOUS PROVISIONS

Section 6.01. Ratification of Master Indenture. As supplemented by this Series 2024-1 Supplement, the Master Indenture is in all respects ratified and confirmed and the Master Indenture as so supplemented by this Series 2024-1 Supplement shall be read, taken and construed as one and the same instrument. In the event that any term or provision contained herein shall conflict with or be inconsistent with any term or provision contained in the Master Indenture, the terms and provisions of this Series 2024-1 Supplement shall govern.

Section 6.02. Counterparts. This Series 2024-1 Supplement may be executed in two or more counterparts, and by different parties on separate counterparts, each of which shall be an original, but all of which shall constitute one and the same instrument.

Section 6.03. Governing Law. THIS SERIES 2024-1 SUPPLEMENT SHALL BE CONSTRUED IN ACCORDANCE WITH THE LAWS OF THE STATE OF NEW YORK, INCLUDING SECTIONS 5-1401 AND 5-1402 OF THE GENERAL OBLIGATIONS LAWS BUT OTHERWISE WITHOUT REFERENCE TO ITS CONFLICTS OF LAW PROVISIONS, AND THE OBLIGATIONS, RIGHTS AND REMEDIES OF THE PARTIES HEREUNDER SHALL BE DETERMINED IN ACCORDANCE WITH SUCH LAWS.

Section 6.04. Notices to the Rating Agency. Whenever any notice or other communication is required to be given to the Rating Agency in respect of the Series 2024-1 Notes pursuant to the Master Indenture, a Series Supplement or this Series 2024-1 Supplement,

[Series Supplement (Series 2024-1)]

such notice or communication shall be delivered to S&P, at 55 Water Street, New York, NY 10041, Attention: S&P Surveillance (Facsimile: (212) 438-0122).

Section 6.05. Notices to Liquidity Facility Provider. Whenever any notice or other communication is required to be given to the Liquidity Facility Provider in respect of the Series 2024-1 Notes pursuant to the Master Indenture, a Series Supplement or this Series 2024-1 Supplement, such notice or communication shall be delivered to Bank of America, N.A., at BOA Tower, 620 S. Tyron Street, Charlotte, NC 28202, Attn: Christi Thomas, Global Structured Finance, Email: christi.thomas@bofa.com, Telephone: (980) 683-4906, Facsimile: (980) 387-2828, with a copy to Bank of America, N.A., at One Bryant Park, New York, NY 10036, Attention: ABS Banking & Finance, Email: brad.sohl@bofa.com; andrew.cantillon@bofa.com; guoxun.yao@bofa.com; Nikolai.bottitta@bofa.com.

Section 6.06. Amendments and Modifications. The terms of this Series 2024-1 Supplement may be waived, modified or amended only in a written instrument signed by each of the Issuer and the Indenture Trustee in accordance with Article IX of the Master Indenture. Amendments, waivers and modifications of this Series 2024-1 Supplement that constitute matters set forth in clauses (i) through (viii) of Section 9.02(a) of the Master Indenture, may be effected only with the prior written Direction of Noteholders of each Outstanding Series 2024-1 Note adversely affected thereby.

[Signature pages follow]

[Series Supplement (Series 2024-1)]

IN WITNESS WHEREOF, the Issuer and the Indenture Trustee have caused this Series 2024-1 Supplement to be duly executed and delivered all as of the day and year first above written.

| | | | | |

| TRINITY RAIL LEASING 2021 LLC

By: Trinity Industries Leasing Company, its manager

By: /s/ Sara E. McCoy

Name: Sara E. McCoy

Title: Senior Vice President and Managing Director |

[Series Supplement (Series 2024-1)]

| | | | | |

| U.S. BANK NATIONAL ASSOCIATION, as Indenture Trustee

By: /s/ Chris McKim

Name: Chris McKim

Title: Vice President |

[Series Supplement (Series 2024-1)]

EXHIBIT A

SERIES 2024-1 SUPPLEMENT

FORM OF CLASS A NOTE

THIS NOTE HAS NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”) OR ANY STATE SECURITIES OR “BLUE SKY” LAWS. THE HOLDER HEREOF, BY PURCHASING THIS NOTE, AGREES FOR THE BENEFIT OF TRINITY RAIL LEASING 2021 LLC (THE “ISSUER”) THAT THIS NOTE IS BEING ACQUIRED FOR ITS OWN ACCOUNT AND NOT WITH A VIEW TO DISTRIBUTION AND MAY BE RESOLD, PLEDGED OR OTHERWISE TRANSFERRED ONLY (1) TO THE ISSUER (UPON REDEMPTION THEREOF OR OTHERWISE), (2) TO A PERSON WHOM THE TRANSFEROR REASONABLY BELIEVES IS A QUALIFIED INSTITUTIONAL BUYER (AS DEFINED IN RULE 144A UNDER THE SECURITIES ACT) IN A TRANSACTION MEETING THE REQUIREMENTS OF RULE 144A, (3) OUTSIDE THE UNITED STATES TO A PERSON WHO IS NOT A U.S. PERSON (AS SUCH TERM IS DEFINED IN REGULATION S OF THE SECURITIES ACT) IN A TRANSACTION IN COMPLIANCE WITH REGULATION S OF THE SECURITIES ACT OR (4) IN A TRANSACTION COMPLYING WITH OR EXEMPT FROM THE REGISTRATION REQUIREMENTS OF THE SECURITIES ACT (SUBJECT IN THE CASE OF THIS CLAUSE (4) TO RECEIPT OF AN OPINION OF COUNSEL AND SUCH CERTIFICATES AND OTHER DOCUMENTS AS ARE REQUIRED UNDER THE SERIES 2024-1 INDENTURE REFERRED TO BELOW), IN EACH CASE IN ACCORDANCE WITH ANY APPLICABLE SECURITIES LAWS OF ANY STATE OF THE UNITED STATES OR ANY OTHER JURISDICTION. THE HOLDER WILL, AND EACH SUBSEQUENT HOLDER IS REQUIRED TO, NOTIFY ANY PURCHASER FROM IT OF THE RESALE RESTRICTIONS SET FORTH ABOVE.

BY ITS ACQUISITION OF THIS NOTE, EACH PURCHASER AND TRANSFEREE (AND ITS FIDUCIARY, IF APPLICABLE) WILL BE DEEMED TO HAVE REPRESENTED AND WARRANTED EITHER THAT (A) IT IS NOT AND IS NOT USING THE ASSETS OF AN “EMPLOYEE BENEFIT PLAN” (AS DEFINED IN SECTION 3(3) OF THE EMPLOYEE RETIREMENT INCOME SECURITY ACT OF 1974, AS AMENDED (“ERISA”)) THAT IS SUBJECT TO THE PROVISIONS OF TITLE I OF ERISA, A “PLAN” AS DEFINED BY AND SUBJECT TO SECTION 4975 OF THE INTERNAL REVENUE CODE OF 1986, AS AMENDED (THE “CODE”), AN ENTITY WHOSE UNDERLYING ASSETS INCLUDE “PLAN ASSETS” BY REASON OF AN EMPLOYEE BENEFIT PLAN’S OR OTHER PLAN’S INVESTMENT IN SUCH ENTITY (EACH, A “BENEFIT PLAN”), OR A GOVERNMENTAL, NON-U.S. OR CHURCH PLAN SUBJECT TO ANY FEDERAL, STATE, LOCAL OR OTHER LAW THAT IS SUBSTANTIALLY SIMILAR TO TITLE I OF ERISA OR SECTION 4975 OF THE CODE (“SIMILAR LAW”), OR (B) THE PURCHASE AND HOLDING OF THIS NOTE WILL NOT RESULT IN A NON-EXEMPT PROHIBITED TRANSACTION UNDER SECTION 406 OF ERISA OR SECTION 4975 OF THE CODE OR A VIOLATION OF SIMILAR LAW.

[Series Supplement (Series 2024-1)]

ADDITIONALLY, IF A PURCHASER OR TRANSFEREE IS A BENEFIT PLAN, IT WILL BE DEEMED TO REPRESENT BY ITS PURCHASE OR ACQUISITION OF THIS NOTE (OR AN INTEREST THEREIN) THAT (I) NONE OF THE TRANSACTION PARTIES HAVE PROVIDED ANY INVESTMENT ADVICE WITHIN THE MEANING OF SECTION 3(21) OF ERISA TO THE BENEFIT PLAN, OR TO ANY FIDUCIARY OR OTHER PERSON INVESTING ON BEHALF OF THE BENEFIT PLAN OR WHO OTHERWISE HAS DISCRETION OR AUTHORITY OVER THE INVESTMENT AND MANAGEMENT OF “PLAN ASSETS” OF THE BENEFIT PLAN, IN CONNECTION WITH ITS ACQUISITION OF THIS NOTE AND (II) NO TRANSACTION PARTY IS ACTING AS A FIDUCIARY TO THE BENEFIT PLAN IN CONNECTION WITH THE BENEFIT PLAN’S PURCHASE OR ACQUISITION OF THIS NOTE.

[IF THIS NOTE IS A BOOK-ENTRY NOTE] THIS NOTE IS A GLOBAL BOOK-ENTRY NOTE WITHIN THE MEANING OF SERIES 2024-1 INDENTURE HEREINAFTER REFERRED TO AND IS REGISTERED IN THE NAME OF A DEPOSITARY OR A NOMINEE THEREOF. THIS NOTE MAY NOT BE EXCHANGED IN WHOLE OR IN PART FOR A NOTE REGISTERED, AND NO TRANSFER OF THIS NOTE IN WHOLE OR IN PART MAY BE REGISTERED, IN THE NAME OF ANY PERSON OTHER THAN SUCH DEPOSITARY OR A NOMINEE THEREOF, EXCEPT IN THE LIMITED CIRCUMSTANCES DESCRIBED IN THE SERIES 2024-1 INDENTURE REFERRED TO BELOW.

[IF THIS NOTE IS A BOOK-ENTRY NOTE] UNLESS THIS NOTE IS PRESENTED BY AN AUTHORIZED REPRESENTATIVE OF THE DEPOSITORY TRUST COMPANY, A NEW YORK CORPORATION (“DTC”), TO THE ISSUER OR ITS AGENT FOR REGISTRATION OF TRANSFER, EXCHANGE OR PAYMENT, AND ANY NOTE ISSUED IS REGISTERED IN THE NAME OF CEDE & CO. OR IN SUCH OTHER NAME AS IS REQUESTED BY AN AUTHORIZED REPRESENTATIVE OF DTC (AND ANY PAYMENT IS MADE TO CEDE & CO. OR TO SUCH OTHER ENTITY AS IS REQUESTED BY AN AUTHORIZED REPRESENTATIVE OF DTC), ANY TRANSFER, PLEDGE OR OTHER USE HEREOF FOR VALUE OR OTHERWISE BY OR TO ANY PERSON IS WRONGFUL INASMUCH AS THE REGISTERED OWNER HEREOF, CEDE & CO., HAS AN INTEREST HEREIN.

[IF THIS NOTE IS A BOOK-ENTRY NOTE] TRANSFERS OF THIS NOTE SHALL BE LIMITED TO TRANSFERS IN WHOLE, BUT NOT IN PART, TO NOMINEES OF THE DEPOSITORY TRUST COMPANY OR TO A SUCCESSOR THEREOF OR SUCH SUCCESSOR’S NOMINEE, AND TRANSFERS OF PORTIONS OF THIS GLOBAL NOTE SHALL BE LIMITED TO TRANSFERS MADE IN ACCORDANCE WITH THE RESTRICTIONS SET FORTH IN THE SERIES 2024-1 INDENTURE REFERRED TO BELOW.

[In the case of a Class A Note issued with original issue discount, as defined in Section 1271 et seq. of the Code:

[Series Supplement (Series 2024-1)]

THIS NOTE WAS ISSUED WITH ORIGINAL ISSUE DISCOUNT (“OID”) FOR PURPOSES OF SECTION 1271 ET SEQ. OF THE U.S. INTERNAL REVENUE CODE OF 1986, AS AMENDED. FOR INFORMATION REGARDING THE ISSUE DATE, ISSUE PRICE, YIELD TO MATURITY AND THE AMOUNT OF OID, PLEASE CONTACT [ ], ATTN: [ ]]

EACH NOTEHOLDER OF THIS NOTE AGREES TO TREAT THIS NOTE AS DEBT FOR U.S. FEDERAL INCOME TAX PURPOSES.

[Series Supplement (Series 2024-1)]

TRINITY RAIL LEASING 2021 LLC

GREEN SECURED RAILCAR EQUIPMENT NOTES, SERIES 2024-1, CLASS A

| | | | | |

| [$_____________] | CUSIP No.: [][144A] [][Reg S]

No. 1

[●], 20__ |

KNOW ALL PERSONS BY THESE PRESENTS that TRINITY RAIL LEASING 2021 LLC, a Delaware limited liability company (“Issuer”), for value received, hereby promises to pay to Cede & Co., or registered assigns, at a corporate trust office of the Indenture Trustee named below, (i) the principal sum set forth above, which sum shall be payable on each Payment Date on the dates and in the amounts set forth in the Master Indenture, dated as of June 30, 2021 (as amended, restated or otherwise modified from time to time, the “Master Indenture”) and the Series 2024-1 Supplement, dated as of May 30, 2024 (as amended, restated or otherwise modified from time to time, the “Series 2024-1 Supplement”, and, together with the Master Indenture, the “Series 2024-1 Indenture”), each between the Issuer and U.S. Bank National Association, as indenture trustee (the “Indenture Trustee”), and (ii) interest on the outstanding principal balance of this Series 2024-1 Note on the dates and in the amounts set forth in the Series 2024-1 Indenture. Capitalized terms not otherwise defined herein will have the meaning set forth in the Series 2024-1 Indenture.

Payment of the principal of and interest on this Series 2024-1 Note shall be made in lawful money of the United States of America which at the time of payment is legal tender for payment of public and private debts. The principal balance of, and interest on this Series 2024-1 Note is payable at the times and in the amounts set forth in the Series 2024-1 Indenture by wire transfer of immediately available funds to the account designated by the holder of record on the related Record Date.

This Series 2024-1 Note is one of the authorized Class A Notes identified in the title hereto and issued in the aggregate amount of [_] and [_]/100 dollars ($[_]) pursuant to the Series 2024-1 Indenture.

The Series 2024-1 Notes shall be an obligation of the Issuer and shall be secured by the Collateral, all as defined in, and subject to limitations set forth in, the Series 2024-1 Indenture.

This Series 2024-1 Note is transferable as provided in the Series 2024-1 Indenture, subject to certain limitations therein contained, only upon the books for registration and transfer kept by the Indenture Trustee, and only upon surrender of this Series 2024-1 Note for transfer to the Indenture Trustee duly endorsed by, or accompanied by a written instrument of transfer in form reasonably satisfactory to the Indenture Trustee duly executed by, the registered holder hereof or his attorney duly authorized in writing. The Indenture Trustee or the Issuer may require payment by the Series 2024-1 Noteholder of a sum sufficient to cover any tax expense or other governmental charge payable in connection with any transfer or exchange of the Series 2024-1 Notes.

[Series Supplement (Series 2024-1)]

Each purchaser and subsequent transferee of this Series 2024-1 Note will be deemed to have represented and warranted either that (i) it is not and is not using the assets of an “employee benefit plan” (as defined in Section 3(3) of the Employee Retirement Income Security Act of 1974, as amended (“ERISA”)) that is subject to the provisions of Title I of ERISA, a “plan” as defined by and subject to Section 4975 of the Internal Revenue Code of 1986, as amended (the “Code”), an entity whose underlying assets include “plan assets” by reason of an employee benefit plan’s or other plan’s investment in such entity (a “Benefit Plan”), or a governmental, non-U.S. or church plan subject to any federal, state, local or other law that is substantially similar to Title I of ERISA or Section 4975 of the Code (“Similar Law”), or (ii) its purchase and holding of this Series 2024-1 Note will not result in a non-exempt prohibited transaction under Section 406 of ERISA or Section 4975 of the Code or a violation of Similar Law.

Additionally, if a purchaser or transferee is a Benefit Plan, it will be deemed to represent by its purchase or acquisition of this Note (or an interest therein) that (i) none of the Transaction Parties have provided any investment advice within the meaning of Section 3(21) of ERISA to the Benefit Plan, or to any fiduciary or other person investing on behalf of the Benefit Plan or who otherwise has discretion or authority over the investment and management of “plan assets” of the Benefit Plan, in connection with its acquisition of this Note, and (ii) no Transaction Party is acting as a fiduciary to the Benefit Plan in connection with the Benefit Plan’s purchase or acquisition of this Note.

Each Noteholder of this Series 2024-1 Note agrees to treat this Series 2024-1 Note as debt for U.S. federal income tax purposes.

The Issuer, the Indenture Trustee and any other agent of the Issuer shall treat the person in whose name this Series 2024-1 Note is registered as the absolute owner hereof for all purposes, and neither the Issuer, the Indenture Trustee, nor any other such agent shall be affected by notice to the contrary.

The Series 2024-1 Notes are subject to prepayment, at the times and subject to the conditions set forth in the Series 2024-1 Indenture.

If an Event of Default shall occur and be continuing, the principal of and accrued interest on this Series 2024-1 Note may be declared to be due and payable in the manner and with the effect provided in the Series 2024-1 Indenture.

The Master Indenture permits, with certain exceptions as therein provided, the issuance of supplemental indentures amending the Master Indenture with the consent of the Requisite Majority, in certain specifically described instances. Any consent given by the Requisite Majority shall be conclusive and binding upon the holder of this Series 2024-1 Note and on all future holders of this Series 2024-1 Note and of any Series 2024-1 Note issued in lieu hereof whether or not notation of such consent is made upon this Series 2024-1 Note. Supplements and amendments to the Series 2024-1 Indenture may be made only to the extent and in circumstances permitted by the Series 2024-1 Indenture.

[Series Supplement (Series 2024-1)]

The Series 2024-1 Noteholder shall have no right to enforce the provisions of the Series 2024-1 Indenture or to institute action to enforce the covenants, or to take any action with respect to a default under the Series 2024-1 Indenture, or to institute, appear in or defend any suit or other proceedings with respect thereto, except as provided under certain circumstances described in the Series 2024-1 Indenture; provided, however, that nothing contained in the Series 2024-1 Indenture shall affect or impair any right of enforcement conferred on the holder hereof to enforce any payment of the principal of and interest on this Series 2024-1 Note on or after the due date thereof; provided further, however, that by acceptance hereof the Series 2024-1 Noteholder is deemed to have covenanted and agreed that it will not institute against the Issuer any bankruptcy, reorganization, arrangement, insolvency or liquidation proceedings, or other proceedings under any applicable bankruptcy or similar law, at any time other than at such time as permitted by the Series 2024-1 Indenture.

This Series 2024-1 Note, and the rights and obligations of the parties hereunder, shall be governed by, and construed and interpreted in accordance with, the laws of the State of New York without giving effect to principles of conflict of laws.

All terms and provisions of the Series 2024-1 Indenture are herein incorporated by reference as if set forth herein in their entirety. In the event of any conflict or inconsistency between this Series 2024-1 Note, on the one hand, and the Series 2024-1 Indenture on the other hand, the Series 2024-1 Indenture shall control.

IT IS HEREBY CERTIFIED, RECITED AND DECLARED, that all acts, conditions and things required to exist, happen and be performed precedent to the execution and delivery of the Series 2024-1 Indenture and the issuance of this Series 2024-1 Note and the issue of which it is a part, do exist, have happened and have been timely performed in regular form and manner as required by law.

Unless the certificate of authentication hereon has been executed by the Indenture Trustee, this Series 2024-1 Note shall not be entitled to any benefit under the Series 2024-1 Indenture or be valid or obligatory for any purpose.

[Series Supplement (Series 2024-1)]

IN WITNESS WHEREOF, the Issuer has caused this Series 2024-1 Note to be duly executed on the date first above written.

| | | | | |

| TRINITY RAIL LEASING 2021 LLC

By: Trinity Industries Leasing Company, its manager

By:

Name:

Title: |

This Note is one of the Class A Notes described in the Series 2024-1 Supplement.

| | | | | |

| U.S. BANK NATIONAL ASSOCIATION, as Indenture Trustee

By:

Name:

Title: |

v3.24.1.1.u2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

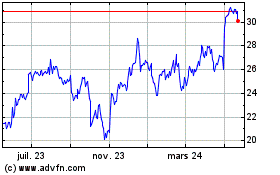

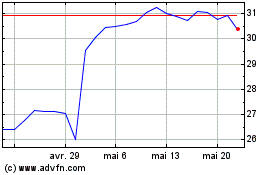

Trinity Industries (NYSE:TRN)

Graphique Historique de l'Action

De Mai 2024 à Juin 2024

Trinity Industries (NYSE:TRN)

Graphique Historique de l'Action

De Juin 2023 à Juin 2024