|

|

|

| ICAP Bond (5-98) Form 17-02-1421 (Ed. 5-98) |

|

Page 17 of 19 |

Conditions and

Limitations

|

|

|

| Termination (continued) |

|

If any partner, director, trustee, or officer or supervisory employee of an ASSURED not acting in collusion with

an Employee learns of any dishonest act committed by such Employee at any time, whether in the employment of the ASSURED or otherwise, whether or not such act is of the type covered under this Bond, and whether against the ASSURED or

any other person or entity, the ASSURED: |

|

|

|

|

a. shall immediately remove such Employee from a position that

would enable such Employee to cause the ASSURED to suffer a loss covered by this Bond; and |

|

|

|

|

b. within forty-eight (48) hours of learning that an Employee

has committed any dishonest act, shall notify the COMPANY, of such action and provide full particulars of such dishonest act. |

|

|

|

|

The COMPANY may terminate coverage as respects any Employee sixty (60) days after written notice is

received by each ASSURED Investment Company and the Securities and Exchange Commission, Washington, D.C. of its desire to terminate this Bond as to such Employee. |

|

|

| |

|

|

| Other Insurance |

|

14. Coverage

under this Bond shall apply only as excess over any valid and collectible insurance, indemnity or suretyship obtained by or on behalf of: |

|

|

|

|

a. the ASSURED, |

|

|

|

|

b. a Transportation Company, or |

|

|

|

|

c. another entity on whose premises the loss occurred or which employed

the person causing the loss or engaged the messenger conveying the Property involved. |

|

|

| |

|

|

| Conformity |

|

15. If any

limitation within this Bond is prohibited by any law controlling this Bond’s construction, such limitation shall be deemed to be amended so as to equal the minimum period of limitation provided by such law. |

|

|

| |

|

|

| Change or Modification |

|

16. This

Bond or any instrument amending or affecting this Bond may not be changed or modified orally. No change in or modification of this Bond shall be effective except when made by written endorsement to this Bond signed by an authorized representative of

the COMPANY. |

|

|

|

|

If this Bond is for a sole ASSURED, no change or modification which would adversely affect the rights of the

ASSURED shall be effective prior to sixty (60) days after written notice has been furnished to the Securities and Exchange Commission, Washington, D.C., by the acting party. |

|

|

|

| ICAP Bond (5-98) Form 17-02-1421 (Ed. 5-98) |

|

Page 18 of 19 |

Conditions And

Limitations

|

|

|

| Change or Modification (continued) |

|

If this Bond is for a joint ASSURED, no charge or modification which would adversely affect the rights of the

ASSURED shall be effective prior to sixty (60) days after written notice has been furnished to all insured Investment Companies and to the Securities and Exchange Commission, Washington, D.C., by the COMPANY. |

|

|

|

| ICAP Bond (5-98) Form 17-02-1421 (Ed. 5-98) |

|

Page 19 of 19 |

Important Notice:

The SEC Requires Proof of Your Fidelity Insurance Policy

Your company is

now required to file an electronic copy of your fidelity insurance coverage (Chubb’s ICAP Bond policy) to the Securities and Exchange Commission (SEC), according to rules adopted by the SEC on June 12, 2006.

Chubb is in the process of providing your agent/broker with an electronic copy of your insurance policy as well as instructions on how to submit this proof of fidelity

insurance coverage to the SEC. You can expect to receive this information from your agent/broker shortly.

The electronic copy of your policy is provided by Chubb

solely as a convenience and does not affect the terms and conditions of coverage as set forth in the paper policy you receive by mail. The terms and conditions of the policy mailed to you, which are the same as those set forth in the electronic

copy, constitute the entire agreement between your company and Chubb.

If you have any questions, please contact your agent or broker.

Form 14-02-12160 (ed. 7/2006)

IMPORTANT NOTICE TO POLICYHOLDERS

All of the members of the Chubb Group of Insurance companies doing business in the United States (hereinafter “Chubb”) distribute their

products through licensed insurance brokers and agents (“producers”). Detailed information regarding the types of compensation paid by Chubb to producers on US insurance transactions is available under the Producer Compensation link

located at the bottom of the page at www.chubb.com, or by calling 1-866-588-9478. Additional information may be available from

your producer.

Thank you for choosing Chubb.

10-02-1295 (ed. 6/2007)

ENDORSEMENT/RIDER

|

|

|

| Effective date of |

|

|

| this endorsement/rider: June 30, 2022 |

|

FEDERAL INSURANCE COMPANY |

|

|

|

|

Endorsement/Rider No. 1 |

|

|

|

|

To be attached to and |

|

|

form a part of Policy No. 82484952 |

Issued to: METWEST FUNDS; TCW STRATEGIC INCOME FUND, INC.;

TCW FUNDS, INC.

COMPLIANCE WITH APPLICABLE TRADE SANCTION LAWS

It is agreed

that this insurance does not apply to the extent that trade or economic sanctions or other similar laws or regulations prohibit the coverage provided by this insurance.

The title and any headings in this endorsement/rider are solely for convenience and form no part of the terms and conditions of coverage.

All other terms, conditions and limitations of this Policy shall remain unchanged.

|

|

|

| Authorized Representative |

|

|

|

|

|

| 14-02-9228 (2/2010) |

|

Page 1 |

|

|

ENDORSEMENT/RIDER

|

|

|

| Effective date of |

|

|

| this endorsement/rider: June 30, 2022 |

|

FEDERAL INSURANCE COMPANY |

|

|

|

|

Endorsement/Rider No. 2 |

|

|

|

|

To be attached to and |

|

|

form a part of Bond No. 82484952 |

Issued to: METWEST FUNDS; TCW STRATEGIC INCOME FUND, INC.;TCW FUNDS, INC.

AUTOMATIC INCREASE IN LIMITS ENDORSEMENT

In consideration of the

premium charged, it is agreed that GENERAL AGREEMENTS, Section C. Additional Offices Or Employees-Consolidation, Merger Or Purchase Or Acquisition Of Assets Or Liabilities-Notice To Company, is amended by adding the following subsection:

Automatic Increase in Limits for Investment Companies

If an increase in bonding

limits is required pursuant to rule 17g-1 of the Investment Company Act of 1940 (“the Act”), due to:

| (i) |

the creation of a new Investment Company, other than by consolidation or merger with, or purchase or acquisition

of assets or liabilities of, another institution; or |

| (ii) |

an increase in asset size of current Investment Companies covered under this Bond, |

then the minimum required increase in limits shall take place automatically without payment of additional premium for the remainder of the BOND PERIOD.

The title and any headings in this endorsement/rider are solely for convenience and form no part of the terms and conditions of coverage.

All other terms, conditions and limitations of this Bond shall remain unchanged.

|

|

|

| Authorized Representative |

|

|

|

|

|

| 14-02-14098 (04/2008) |

|

Page 1 |

|

|

|

|

|

| FEDERAL INSURANCE COMPANY |

|

|

| Endorsement No. |

|

3 |

|

|

| Bond Number: |

|

82484952 |

|

|

|

| NAME OF ASSURED: |

|

METWEST FUNDS; TCW STRATEGIC INCOME FUND, INC.; |

|

|

TCW FUNDS, INC. |

REVISE ITEM 2. ENDORSEMENT

It is agreed that

this Bond is amended by deleting ITEM 2. in its entirety on the DECLARATIONS and substituting the following:

ITEM 2. LIMITS OF LIABILITY-DEDUCTIBLE AMOUNTS:

If “Not Covered” is inserted below opposite any specified INSURING CLAUSE, such INSURING CLAUSE and any other reference to such INSURING

CLAUSE in this Bond shall be deemed to be deleted. There shall be no deductible applicable to any loss under INSURING CLAUSE 1 sustained by any Investment Company.

|

|

|

|

|

|

|

|

|

| INSURING CLAUSE |

|

SINGLE LOSS

LIMIT OF LIABILITY |

|

|

DEDUCTIBLE

AMOUNT |

|

|

|

|

| 1. Employee |

|

$ |

5,750,000 |

|

|

$ |

0 |

|

| 2. On Premises |

|

$ |

5,750,000 |

|

|

$ |

10,000 |

|

| 3. In Transit |

|

$ |

5,750,000 |

|

|

$ |

10,000 |

|

| 4. Forgery or Alteration |

|

$ |

5,750,000 |

|

|

$ |

10,000 |

|

| 5. Extended Forgery |

|

$ |

5,750,000 |

|

|

$ |

10,000 |

|

| 6. Counterfeit Money |

|

$ |

5,750,000 |

|

|

$ |

10,000 |

|

| 7. Threats to Person |

|

$ |

5,750,000 |

|

|

$ |

10,000 |

|

| 8. Computer System |

|

$ |

5,750,000 |

|

|

$ |

10,000 |

|

| 9. Voice Initiated Funds Transfer Instruction |

|

$ |

5,750,000 |

|

|

$ |

10,000 |

|

| 10. Uncollectible Items of Deposit |

|

$ |

5,750,000 |

|

|

$ |

10,000 |

|

| 11. Audit Expense |

|

$ |

50,000 |

|

|

$ |

5,000 |

|

| 12. Extended Computer Systems |

|

$ |

5,750,000 |

|

|

$ |

10,000 |

|

| 13. Unauthorized Signature |

|

$ |

5,750,000 |

|

|

$ |

10,000 |

|

| 14. Claims Expense |

|

$ |

50,000 |

|

|

$ |

5,000 |

|

| 15. Stop Payment Order or Refusal |

|

$ |

50,000 |

|

|

$ |

5,000 |

|

This Endorsement applies to loss discovered after 12:01 a.m. on June 30, 2022.

ALL OTHER TERMS AND CONDITIONS OF THIS BOND REMAIN UNCHANGED.

|

|

|

|

|

|

|

|

|

| Date: |

|

July 19, 2022 |

|

|

|

By |

|

|

|

|

|

|

|

|

|

|

Authorized Representative |

|

|

|

| ICAP Bond Form 17-02-1582 (Ed. 5-98) |

|

Page 1 |

ENDORSEMENT/RIDER

|

|

|

|

|

|

|

|

|

| Effective date of

this endorsement/rider: June 30, 2022 |

|

|

|

FEDERAL INSURANCE COMPANY |

|

|

|

|

|

|

|

|

|

|

|

Endorsement/Rider No. |

|

4 |

|

|

|

|

|

|

|

|

|

|

|

To be attached to and |

|

|

|

|

|

|

|

|

form a part of Bond No. |

|

82484952 |

|

|

Issued to: METWEST FUNDS; TCW STRATEGIC INCOME FUND, INC.;

TCW FUNDS, INC.

FRAUDULENT TRANSFER INSTRUCTIONS ENDORSEMENT

(For use

with the ICAP bond)

In consideration of the premium charged, it is agreed that this bond is amended as follows:

| (1) |

The following Insuring Clause is added: |

FRAUDULENT TRANSFER INSTRUCTIONS

Loss resulting directly from the ASSURED having, in good faith, transferred money on deposit in a Customer’s account, or a

Customer’s Certificated Security or Uncertificated Security, in reliance upon a fraudulent instruction transmitted to the ASSURED via telefacsimile, telephone or electronic mail; provided, however, that:

| |

A. |

the fraudulent instruction purports, and reasonably appears, to have originated from: |

| |

ii. |

an Employee acting on instructions of such Customer, or |

| |

iii. |

another financial institution acting on behalf of such Customer with authority to make such instructions; and

|

| |

B. |

the sender of the fraudulent instruction verified the instruction with the password, PIN, or other security code of

such Customer; and |

| |

C. |

the sender was not, in fact, such Customer, was not authorized to act on behalf of such Customer, and

was not an Employee; and |

| |

D. |

the instruction was received by an Employee specifically authorized by the ASSURED to receive and act upon such

instructions; and |

| |

E. |

for any transfer exceeding the amount set forth in paragraph (8) of this endorsement, the ASSURED verified the

instructions via a call back to a predetermined telephone number set forth in the ASSURED’s written agreement with such Customer or other verification procedure approved in writing by the COMPANY; and |

| |

F. |

the ASSURED preserved a contemporaneous record of the call back, if any, and the instruction which verifies use of the

authorized password, PIN or other security code of the Customer. |

| (2) |

For the purposes of the coverage afforded by this endorsement, the following terms shall have the following meanings:

|

Certificated Security means a share, participation or other interest in property of, or an enterprise of,

the issuer or an obligation of the issuer, which is:

| |

(1) |

represented by an instrument issued in bearer or registered form, and |

| |

(2) |

of a type commonly dealt in on securities exchanges or markets or commonly recognized in any area in which it is

issued or dealt in as a medium for investment, and |

|

|

|

| 14-02-21330 (10/2014) |

|

Page 1 of 3 |

| |

(3) |

either one of a class or series or by its terms divisible into a class or series of shares, participations, interests

or obligations. |

Customer means any individual, corporate partnership, proprietor, trust customer,

shareholder or subscriber of an Investment Company which has a written agreement with the ASSURED authorizing the ASSURED to transfer Money on deposit in an account or Certificated Security or Uncertificated Security in

reliance upon instructions transmitted to the ASSURED via telefacsimile, telephone or electronic mail to transmit the fraudulent instruction.

Uncertificated Security means a share, participation or other interest in property of or an enterprise of the issuer or an

obligation of the issuer, which is:

| |

(1) |

not represented by an instrument and the transfer of which is registered on books maintained for that purpose by or on

behalf of the issuer, and |

| |

(2) |

of a type commonly dealt in on securities exchanges or markets, and |

| |

(3) |

either one of a class or series or by its terms divisible into a class or series of shares, participations, interests

or obligations. |

| (3) |

It shall be a condition precedent to coverage under this Insuring Clause that the ASSURED assert any available claims,

offsets or defenses against such Customer, any financial institution or any other party to the transaction. |

| (4) |

Solely with respect to the Fraudulent Transfer Instruction Insuring Clause, the following Exclusions are added:

|

| |

A. |

Loss resulting directly or indirectly from a fraudulent instruction if the sender, or anyone acting in collusion with

the sender, ever had authorized access to such Customer’s password, PIN or other security code; and |

| |

B. |

Loss resulting directly or indirectly from the fraudulent alteration of an instruction to initiate an automated

clearing house (ACH) entry, or group of ACH entries, transmitted as an electronic message, or as an attachment to an electronic message, sent via the internet, unless: |

| |

i. |

each ACH entry was individually verified via the call back procedure without regard to the amount of the entry; or

|

| |

ii. |

the instruction was formatted, encoded or encrypted so that any altercation in the ACH entry or group of ACH entries

would be apparent to the ASSURED. |

| (5) |

Solely with respect to the Fraudulent Transfer Instruction Insuring Clause, Exclusion 2.k. is deleted and replaced

with the following: |

| |

k. |

loss resulting from voice requests or instructions received over the telephone, provided however, this Section 2.k.

shall not apply to INSURING CLAUSE 7. or 9. or the Fraudulent Transfer Instruction Insuring Clause. |

| (6) |

For the purposes of the Fraudulent Transfer Instruction Insuring Clause, all loss or losses involving one natural

person or entity, or one group of natural persons or entities acting together, shall be a Single Loss without regard to the number of transfers or the number of instructions involved. |

| (7) |

For the purposes of the Fraudulent Transfer Instruction Insuring Clause, the Single Loss Limit of Liability shall be $

5,750,000. The Deductible Amount shall be $ 10,000. |

| (8) |

The amount of any single transfer for which verification via call back will be required is: $ 10,000.

|

|

|

|

| 14-02-21330 (10/2014) |

|

Page 2 of 3 |

The title and any headings in this endorsement/rider are solely for convenience and form no part of the

terms and conditions of coverage.

All other terms, conditions and limitations of this Policy shall remain unchanged.

|

|

|

|

|

|

|

|

|

|

|

|

Authorized Representative |

|

|

|

|

|

| 14-02-21330 (10/2014) |

|

Page 3 of 3 |

|

|

|

| FEDERAL INSURANCE COMPANY |

|

|

| Endorsement No.: |

|

5 |

|

|

| Bond Number: |

|

82484952 |

|

|

|

| NAME OF ASSURED: METWEST FUNDS; TCW STRATEGIC INCOME FUND, INC.; |

|

TCW FUNDS, INC. |

AUTOMATED TELEPHONE TRANSACTION ENDORSEMENT

It is agreed that this Bond is amended as follows:

| 1. |

By adding the following INSURING CLAUSE: |

| |

16. |

Automated Telephone System Transaction |

Loss resulting directly from the ASSURED having transferred funds on the faith of any Automated Phone System (APS) Transaction,

where the request for such APS Transaction is unauthorized or fraudulent and is made with the intent to deceive. In order for coverage to apply under this INSURING CLAUSE the ASSURED shall maintain and follow all APS Designated

Procedures. A single failure of the ASSURED to maintain and follow a particular APS Designated Procedure in a particular APS Transaction will not preclude coverage under this INSURING CLAUSE.

| 2. |

By adding to Section 1., Definitions, the following: |

r. APS Designated Procedures means all of the following procedures:

| |

(1) |

No APS Transaction shall be executed unless the shareholder or unitholder to whose account such an APS

Transaction relates has previously elected to APS Transactions. (Election in Application) |

| |

(2) |

All APS Transactions shall be logged or otherwise recorded and the records shall be retained for at least six

(6) months. (Logging) |

| |

|

Information contained in the records shall be capable of being retrieved and produced within a reasonable time after

retrieval of specific information is requested, at a success rate of no less than 85 percent. |

| |

(3) |

The caller in any request for an APS Transaction, before executing that APS Transaction must enter a

personal identification number (PIN), social security number and account number. (Identity Test) |

If the caller

fails to enter a correct PIN within three (3) attempts, the caller must not be allowed additional attempts during the same telephone call to enter the PIN. The caller may either be instructed to redial a customer service representative or may

be immediately connected to such a representative. (Limited attempts to Enter PIN)

|

|

|

| ICAP Bond Form 17-02-2345 (Ed.

10-00) |

|

Page 1 |

| |

(4) |

A written confirmation of any APS Transaction or change of address shall be mailed to the shareholder or

unitholder to whose account such transaction relates, at the record address, by the end of the insured’s next regular processing cycle, but in no event later than five (5) business days following such APS Transaction. (Written

Confirmation) |

| |

(5) |

Access to the equipment which permits the entity receiving the APS Transaction request to process and effect

the transaction shall be limited in the following manner: (Access to APS Equipment) |

| |

s. |

APS Election means any election concerning various account features available to the shareholder or unitholder

which is made through the Automated Phone System by means of information transmitted by an individual caller through use of a Automated Phone System. These features include account statements, auto exchange, auto asset builder,

automatic withdrawal, dividend/capital gain options, dividend sweep, telephone balance consent and change of address. |

| |

t. |

APS Exchange means any exchange of shares or units in a registered account of one fund into shares or units in

an account with the same tax identification number and same ownership-type code of another fund in the same complex pursuant to exchange privileges of the two funds, which exchange is requested through the Automated Phone System by means of

information transmitted by an individual caller through use of an Automated Phone System. |

| |

u. |

APS Purchase means any purchase of shares or units issued by an Investment Company which is requested

through an Automated Phone System. |

| |

v. |

APS Redemption means any redemption of shares or units issued by an Investment Company which it

requested through the telephone by means of information transmitted by an individual caller through use of a Automated Phone System. |

| |

w. |

APS Transaction means any APS Purchase, APS Redemption, APS Election or APS Exchange.

|

| |

x. |

Automated Phone System means an automated system which receives and converts to executable instructions

transmissions through the Automated Phone System through use of a touch-tone keypad or other tone system; and always excluding transmissions from a computer system or part thereof. |

| 3. |

By adding the following Section after Section 4., Specific Exclusions-Applicable To All Insuring Clauses Except 1.,

4., 5.: |

Section 4.A.. Specific Exclusion-Applicable to Insuring Clause 16

This Bond does not directly or indirectly cover under Insuring Clause 16:

Loss resulting from:

| |

a. |

the redemption of shares or units, where the proceeds of such redemption are made payable to other than:

|

| |

(1) |

the shares or units of record, |

| |

(2) |

a person designated to receive redemption proceeds, or |

| |

(3) |

a bank account designated to receive redemption proceeds, or |

| |

b. |

the redemption of shares or units, where the proceeds of such redemption are paid by check mailed to any address,

unless such address has either been designated the shareholder or |

|

|

|

| ICAP Bond Form 17-02-2345 (Ed.

10-00) |

|

Page 2 |

| |

unitholder by voice through an Automated Phone System or in writing, at least thirty (30) days prior to such redemption, or |

| |

c. |

the redemption of shares or units, where shareholder or unitholder of the ASSURED designated bank account of record.

|

This Endorsement applies to loss discovered after 12:01 a.m. on June 30, 2022.

ALL OTHER TERMS AND CONDITIONS OF THIS BOND REMAIN UNCHANGED.

|

|

|

|

|

|

|

| Date: July 19, 2022 |

|

|

|

By |

|

|

|

|

|

|

|

|

Authorized Representative |

|

|

|

| ICAP Bond Form 17-02-2345 (Ed.

10-00) |

|

Page 3 |

|

|

|

|

|

FEDERAL INSURANCE COMPANY |

|

|

|

|

Endorsement No.: 6 |

|

|

|

|

Bond Number: 82484952 |

NAME OF ASSURED: METWEST FUNDS; TCW STRATEGIC INCOME FUND, INC.;

TCW FUNDS, INC.

EXTENDED COMPUTER SYSTEMS ENDORSEMENT

It is agreed that this Bond is amended as follows:

| 1. |

By adding the following INSURING CLAUSE: |

| |

12. |

Extended Computer Systems |

| |

A. |

Electronic Data, Electronic Media, Electronic Instruction |

Loss resulting directly from:

| |

(1) |

the fraudulent modification of Electronic Data, Electronic Media or Electronic Instruction being stored

within or being run within any system covered under this INSURING CLAUSE, |

| |

(2) |

robbery, burglary, larceny or theft of Electronic Data, Electronic Media or Electronic Instructions,

|

| |

(3) |

the acts of a hacker causing damage or destruction of Electronic Data, Electronic Media or Electronic

Instruction owned by the ASSURED or for which the ASSURED is legally liable, while stored within a Computer System covered under this INSURING CLAUSE, or |

| |

(4) |

the damage or destruction of Electronic Data, Electronic Media or Electronic Instruction owned by the

ASSURED or for which the ASSURED is legally liable while stored within a Computer System covered under INSURING CLAUSE 12, provided such damage or destruction was caused by a computer program or similar instruction which was written or

altered to intentionally incorporate a hidden instruction designed to damage or destroy Electronic Data, Electronic Media, or Electronic Instruction in the Computer System in which the computer program or instruction so written

or so altered is used. |

|

|

|

| ICAP2 Bond Form 17-02-2976 (Ed.

1-02) |

|

Page 1 |

| |

B. |

Electronic Communication |

Loss resulting directly from the ASSURED having transferred, paid or delivered any funds or property, established any credit, debited

any account or given any value on the faith of any electronic communications directed to the ASSURED, which were transmitted or appear to have been transmitted through:

| |

(1) |

an Electronic Communication System, |

| |

(2) |

an automated clearing house or custodian, or |

| |

(3) |

a Telex, TWX, or similar means of communication, |

directly into the ASSURED’S Computer System or Communication Terminal, and fraudulently purport to have been sent by

a customer, automated clearing house, custodian, or financial institution, but which communications were either not sent by said customer, automated clearing house, custodian, or financial institution, or were fraudulently modified during physical

transit of Electronic Media to the ASSURED or during electronic transmission to the ASSURED’S Computer System or Communication Terminal.

| |

C. |

Electronic Transmission |

Loss resulting directly from a customer of the ASSURED, any automated clearing house, custodian, or financial institution having

transferred, paid or delivered any funds or property, established any credit, debited any account or given any value on the faith of any electronic communications, purporting to have been directed by the ASSURED to such customer, automated clearing

house, custodian, or financial institution initiating, authorizing, or acknowledging, the transfer, payment, delivery or receipt of funds or property, which communications were transmitted through:

| |

(1) |

an Electronic Communication System, |

| |

(2) |

an automated clearing house or custodian, or |

| |

(3) |

a Telex, TWX, or similar means of communication, |

directly into a Computer System or Communication Terminal of said customer, automated clearing house, custodian, or

financial institution, and fraudulently purport to have been directed by the ASSURED, but which communications were either not sent by the ASSURED, or were fraudulently modified during physical transit of Electronic Media from the ASSURED or

during electronic transmission from the ASSURED’S Computer System or Communication Terminal, and for which loss the ASSURED is held to be legally liable.

|

|

|

| ICAP2 Bond Form 17-02-2976 (Ed.

1-02) |

|

Page 2 |

| 2. |

By adding to Section 1., Definitions, the following: |

| |

bb. |

Communication Terminal means a teletype, teleprinter or video display terminal, or similar device capable of

sending or receiving information electronically. Communication Terminal does not mean a telephone. |

| |

cc. |

Electronic Communication System means electronic communication operations by Fedwire, Clearing House Interbank

Payment System (CHIPS), Society of Worldwide International Financial Telecommunication (SWIFT), similar automated interbank communication systems, and Internet access facilities. |

| |

dd. |

Electronic Data means facts or information converted to a form usable in Computer Systems and which is

stored on Electronic Media for use by computer programs. |

| |

ee. |

Electronic Instruction means computer programs converted to a form usable in a Computer System to act

upon Electronic Data. |

| |

ff. |

Electronic Media means the magnetic tape, magnetic disk, optical disk, or any other bulk media on which data is

recorded. |

| 3. |

By adding the following Section after Section 4., Specific Exclusions-Applicable to All INSURING CLAUSES except

1., 4., and 5.: |

Section 4.A. Specific Exclusions-Applicable to INSURING CLAUSE 12

This Bond does not directly or indirectly cover:

| |

a. |

loss resulting directly or indirectly from Forged, altered or fraudulent negotiable instruments, securities,

documents or written instruments used as source documentation in the preparation of Electronic Data; |

| |

b. |

loss of negotiable instruments, securities, documents or written instruments except as converted to Electronic Data

and then only in that converted form; |

| |

c. |

loss resulting from mechanical failure, faulty construction, error in design, latent defect, wear or tear, gradual

deterioration, electrical disturbance, Electronic Media failure or breakdown or any malfunction or error in programming or error or omission in processing; |

| |

d. |

loss resulting directly or indirectly from the input of Electronic Data at an authorized electronic terminal of

an Electronic Funds Transfer System or a Customer Communication System by a person who had authorized access from a customer to that customer’s authentication mechanism; or |

| |

e. |

liability assumed by the ASSURED by agreement under any contract, unless such liability would have attached to the

ASSURED even in the absence of such agreement; or |

| |

f. |

loss resulting directly or indirectly from: |

| |

(1) |

written instruction unless covered under this INSURING CLAUSE; or |

| |

(2) |

instruction by voice over the telephone, unless covered under this INSURING CLAUSE. |

|

|

|

| ICAP2 Bond Form 17-02-2976 (Ed.

1-02) |

|

Page 3 |

| 4. |

By adding to Section 9., Valuation, the following: |

Electronic Data, Electronic Media, Or Electronic Instruction

In case of loss of, or damage to, Electronic Data, Electronic Media or Electronic Instruction used by the ASSURED in its

business, the COMPANY shall be liable under this Bond only if such items are actually reproduced form other Electronic Data, Electronic Media or Electronic Instruction of the same kind or quality and then for not more than the cost of

the blank media and/or the cost of labor for the actual transcription or copying of data which shall have been furnished by the ASSURED in order to reproduce such Electronic Data, Electronic Media or Electronic Instruction subject to

the applicable SINGLE LOSS LIMIT OF LIABILITY.

However, if such Electronic Data can not be reproduced and said Electronic

Data represents Securities or financial instruments having a value, then the loss will be valued as indicated in the SECURITIES and OTHER PROPERTY paragraphs of this Section.

This Endorsement applies to loss discovered after 12:01 a.m. on June 30, 2022.

ALL OTHER TERMS AND CONDITIONS OF THIS BOND REMAIN UNCHANGED.

|

|

|

|

|

|

|

| Date: July 19, 2022 |

|

|

|

By |

|

|

|

|

|

|

|

|

Authorized Representative |

|

|

|

| ICAP2 Bond Form 17-02-2976 (Ed.

1-02) |

|

Page 4 |

|

|

|

|

|

|

|

FEDERAL INSURANCE COMPANY |

|

|

|

|

|

|

|

Endorsement No.: 7 |

|

|

|

|

|

|

|

Bond Number: 82484952 |

|

|

NAME OF ASSURED: METWEST FUNDS; TCW STRATEGIC INCOME FUND, INC.;

TCW FUNDS, INC.

UNAUTHORIZED SIGNATURE ENDORSEMENT

It is agreed that this Bond is amended as follows:

| 1. |

By adding the following INSURING CLAUSE: |

| |

13. |

Unauthorized Signature |

Loss resulting directly from the ASSURED having accepted, paid or cashed any check or Withdrawal Order made or drawn on or

against the account of the ASSURED’S customer which bears the signature or endorsement of one other than a person whose name and signature is on file with the ASSURED as a signatory on such account.

It shall be a condition precedent to the ASSURED’S right of recovery under this INSURING CLAUSE that the ASSURED shall have on file

signatures of all the persons who are signatories on such account.

| 2. |

By adding to Section 1., Definitions, the following: |

| |

y. |

Instruction means a written order to the issuer of an Uncertificated Security requesting that the

transfer, pledge or release from pledge of the specified Uncertificated Security be registered. |

| |

z. |

Uncertificated Security means a share, participation or other interest in property of or an enterprise of the

issuer or an obligation of the issuer, which is: |

| |

(1) |

not represented by an instrument and the transfer of which is registered on books maintained for that purpose by or on

behalf of the issuer, and |

| |

(2) |

of a type commonly dealt in on securities exchanges or markets, and |

| |

(3) |

either one of a class or series or by its terms divisible into a class or series of shares, participations, interests

or obligations. |

|

|

|

| ICAP Bond Form 17-02-5602 (Ed.

10-03) |

|

Page 1 |

| |

aa. |

Withdrawal Order means a non-negotiable instrument, other than an

Instruction, signed by a customer of the ASSURED authorizing the ASSURED to debit the customer’s account in the amount of funds stated therein. |

This Endorsement applies to loss discovered after 12:01 a.m. on June 30, 2022.

ALL OTHER TERMS AND CONDITIONS OF THIS BOND REMAIN UNCHANGED.

|

|

|

|

|

|

|

| Date: July 19, 2022 |

|

|

|

By |

|

|

|

|

|

|

|

|

Authorized Representative |

|

|

|

| ICAP Bond Form 17-02-5602 (Ed.

10-03) |

|

Page 2 |

|

|

|

|

|

|

|

FEDERAL INSURANCE COMPANY |

|

|

|

|

|

|

|

Endorsement No.: 8 |

|

|

|

|

|

|

|

Bond Number: 82484952 |

|

|

NAME OF ASSURED: METWEST FUNDS; TCW STRATEGIC INCOME FUND, INC.;

TCW FUNDS, INC.

CLAIMS EXPENSE ENDORSEMENT

It is agreed that this Bond is amended as follows:

| 1. |

By adding the following INSURING CLAUSE: |

Reasonable expense incurred by the ASSURED, solely for independent firms or individuals to determine the amount of loss where:

| |

(1) |

the loss is covered under the Bond, and |

| |

(2) |

the loss is in excess of the applicable DEDUCTIBLE AMOUNT. |

| 2. |

Under General Exclusions-Applicable To All Insuring Clauses, Section 2.f. does not apply to loss covered under

this INSURING CLAUSE. |

This Endorsement applies to loss discovered after 12:01 a.m. on June 30, 2022.

ALL OTHER TERMS AND CONDITIONS OF THIS BOND REMAIN UNCHANGED.

|

|

|

|

|

|

|

| Date: July 19, 2022 |

|

|

|

By |

|

|

|

|

|

|

|

|

Authorized Representative |

|

|

|

| ICAP Bond Form 17-02-6282 (Ed.

11-04) |

|

|

|

|

|

|

|

FEDERAL INSURANCE COMPANY |

|

|

|

|

Endorsement No.: 9 |

|

|

|

|

Bond Number:

82484952 |

NAME OF ASSURED: METWEST

FUNDS; TCW STRATEGIC INCOME FUND, INC.;

TCW FUNDS, INC.

STOP PAYMENT ORDER OR REFUSAL TO PAY CHECK ENDORSEMENT

It is

agreed that this Bond is amended as follows:

| 1. |

By adding the following INSURING CLAUSE: |

| |

“15. |

Stop Payment Order or Refusal to Pay Check |

Loss resulting directly from the ASSURED being legally liable to pay compensatory damages for:

| |

a. |

complying or failing to comply with notice from any customer of the ASSURED or any authorized representative of such

customer, to stop payment on any check or draft made or drawn upon or against the ASSURED by such customer or by any authorized representative of such customer, or |

| |

b. |

refusing to pay any check or draft made or drawn upon or against the ASSURED by any customer of the ASSURED or by any

authorized representative of such customer.” |

| 2. |

By adding the following Specific Exclusion: |

“Section 4.A. Specific Exclusions – Applicable to INSURING CLAUSE 15

This Bond does not directly or indirectly cover:

| |

a. |

liability assumed by the ASSURED by agreement under any contract, unless such liability would have attached to the

ASSURED even in the absence of such agreement, |

| |

(1) |

libel, slander, wrongful entry, eviction, defamation, false arrest, false imprisonment, malicious prosecution, assault

or battery, |

| |

(2) |

sickness, disease, physical bodily harm, mental or emotional distress or anguish, or death of any person, or

|

This Endorsement applies to loss discovered after 12:01 a.m. on June 30, 2022.

ALL OTHER TERMS AND CONDITIONS OF THIS BOND REMAIN UNCHANGED.

|

|

|

|

|

|

|

| Date: July 19, 2022 |

|

|

|

By |

|

|

|

|

|

|

|

|

Authorized Representative |

ICAP Bond

Form 17-02-2365 (Ed. 10-00)

|

|

|

|

|

ENDORSEMENT/RIDER |

|

|

| Effective date of |

|

|

|

|

| this endorsement/rider: June 30, 2022 |

|

FEDERAL INSURANCE COMPANY |

|

|

|

|

Endorsement/Rider No. 10 |

|

|

|

|

To be attached to and |

|

|

form a part of Bond No. 82484952 |

Issued to: METWEST FUNDS; TCW STRATEGIC INCOME FUND, INC.;

TCW FUNDS, INC.

AMEND DEFINITION OF FORGERY ENDORSEMENT

In consideration of the premium charged, it is agreed that the definition of Forgery set forth in Section 1, Definitions, of the Conditions

and Limitations of this bond is deleted and replaced with the following:

Forgery means:

| (1) |

affixing the handwritten signature, or a reproduction of the handwritten signature, of another natural person without

authorization and with the intent to deceive; or |

| (2) |

affixing the name of an organization as an endorsement to a check without authority and with the intent to deceive.

|

Provided, however, that a signature which consists in whole or in part of one’s own name signed with or without authority, in

any capacity, for any purpose is not a Forgery. An electronic or digital signature is not a reproduction of a handwritten signature or the name of an organization.

The title and any headings in this endorsement/rider are solely for convenience and form no part of the terms and conditions of coverage.

All other terms, conditions and limitations of this Policy shall remain unchanged.

|

|

|

|

|

|

|

| Authorized Representative |

|

|

|

|

|

| 14-02-21353 (11/2014) |

|

Page 1 of 1 |

|

|

|

|

|

ENDORSEMENT/RIDER |

|

|

| Effective date of |

|

|

| this endorsement/rider: June 30, 2022 |

|

FEDERAL INSURANCE COMPANY |

|

|

|

|

Endorsement/Rider No. 11 |

|

|

|

|

To be attached to and |

|

|

form a part of Bond No. 82484952 |

Issued to: METWEST FUNDS; TCW STRATEGIC INCOME FUND, INC.;

TCW FUNDS, INC.

DELETING VALUATION-OTHER PROPERTY AND

AMENDING CHANGE OR MODIFICATION

ENDORSEMENT

In consideration of

the premium charged, it is agreed that this Bond is amended as follows:

| 1. |

The paragraph titled Other Property in Section 9, Valuation, is deleted in its entirety. |

| 2. |

The third paragraph in Section 16, Change or Modification, is deleted in its entirety and replaced with the

following: If this Bond is for a joint ASSURED, no change or modification which would adversely affect the rights of the ASSURED shall be effective prior to sixty (60) days after written notice has been furnished to all insured Investment

Companies and the Securities and Exchange Commission, Washington, D.C., by the COMPANY. |

The title and any headings in this

endorsement/rider are solely for convenience and form no part of the terms and conditions of coverage.

All other terms, conditions and limitations

of this Bond shall remain unchanged.

|

|

|

| Authorized Representative |

|

|

|

|

|

| 17-02-2437 (12/2006) rev. |

|

Page 1 |

|

|

AMENDED AND RESTATED JOINT INSURED BOND AGREEMENT

AGREEMENT dated as of June 13, 2022, between Metropolitan West Funds, TCW Strategic Income Fund, Inc. and TCW Funds, Inc.

BACKGROUND

A. Each of the parties to this Agreement is a management investment company (“Fund”) registered under the

Investment company Act of 1940 (the “Act”).

B. Rule 17g-1 under

the Act requires each registered management investment company to provide and maintain in effect a bond against larceny and embezzlement by its officers and employees.

C. Rule 17g-1 authorizes the parties hereto to secure a joint insured bond

naming each of them as insureds.

D. Each of the parties hereto is, or will be, named as an insured on a joint

fidelity bond which has a term of one year commencing on or about June 30, 2022.

E. A majority of the Boards

of Directors of the respective parties hereto, who are not “interested persons’ of such party as defined by Section 2(a)(19) of the Act, have given due consideration to all factors relevant to the form, amount and ratable allocation

of premiums of such joint insured bonds and each such governing body of the representative parties has approved the terms and amount of the bonds and the portion of the premiums payable by that party hereunder.

F. Each party has determined that the allocation of the proceeds payable under the joint insured bonds as set forth

herein (which takes into account the minimum amount of bond required for each party by Rule 17g-1 if it maintained a single insured bond) is equitable.

G. Each of the parties now desires to enter into this Agreement, intending to replace the Amended and Restated Joint

Insured Bond Agreement dated as of June 30, 2021 among these same parties.

NOW, THEREFORE, the parties hereto, in consideration of

the mutual covenants contained herein, hereby agree as follows:

1. Joint Insured

Bond. Each party shall maintain in effect a joint fidelity insurance bond(s) (the “Bond”) from a reputable fidelity insurance company, authorized to do business in the place where the Bond is issued, insuring

such party against larceny and embezzlement and covering such of its officers and employees who may, singly or jointly with others, have access, directly or indirectly, to its securities or funds. The Bond shall name each party as an insured and

shall comply with the requirements for such bonds established by Rule 17g-1.

2. Ratable Allocation of Premium.

a) The premium will be allocated ratably among the Funds, provided, however, that should an increase in

the Bond be required by reason of an increase in the gross assets of one or more Funds, each party hereto shall pay a share of the increased premium for the increased bond equal to such party’s increase in assets divided by the total increase

in assets. With respect to named insureds that may be added to the bonds and this Agreement pursuant to Section 6 hereof subsequent to the inception date of the bonds, any such increases in gross assets for the purpose of this Section 2(a)

shall be measured from $0 dollars and prorated from the inception date of coverage under the bonds.

b) Notwithstanding the provision of Section 2(a), any additional premiums that may become due under

any Bond as a result of the addition of a named insured thereunder pursuant to Section 6 hereof, which addition did not require an increase in the amount of any such Bond, shall be payable, with respect to the Funds’ portion of such

premium, by the additional named insured.

3. Ratable Allocation of Proceeds.

a) If more than one of the parties sustains a single loss (including a loss sustained before the date hereof) for which

recovery is received under the Bond, each such party shall receive that portion of the recovery which is sufficient in amount to indemnify that party in full for the loss sustained by it, unless the recovery is inadequate to fully indemnify all such

parties sustaining a single loss.

b) If the recovery is inadequate to fully indemnify all parties

sustaining a single loss, the recovery shall be allocated among such parties as follows:

| |

i. |

Each such Fund sustaining a loss shall be allocated an amount equal to the lesser of its actual loss or the

minimum amount of the fidelity bond which would be required to be maintained by such party under a single insured bond (determined as of the time of the loss in accordance with the provisions of Rule 17g-1).

|

| |

ii. |

The remaining portion of the recovery (if any) shall be allocated to each party sustaining a loss not fully

indemnified by the allocation under subparagraph (i) in the same proportion as the portion of each party’s loss which is not fully indemnified bears to the sum of the unindemnified losses of all such parties. If such allocation would

result in any party receiving a portion of the recovery in excess of the loss actually sustained by it, the aggregate of such excess portions shall be allocated among the other parties whose losses would not be fully indemnified in the same

proportion as the portion of each such party’s loss which is not fully indemnified bears to the sum of all of the unindemnified losses of all such parties. Any allocation in excess of a loss actually sustained by any party shall be reallocated

in the same manner. |

4. Claims and Settlements. Each party shall, within five days

after the making of any claim under the Bond, provide the other parties with written notice of the amount and nature of such claim. Each party shall, within five days after the receipt thereof, provide the other parties with written notice of the

terms of settlement of any claim made under the Bond by such party. In the event that two or more parties shall agree to settlement with the fidelity company of a claim made under the Bond with respect to a single loss, such parties shall, within

five days after settlement, provide any other party not a party to such claim with written notice of the amounts to be received by each claiming responsible for filing notices required by paragraph (g) of Rule

17g-1 under the Act shall give and receive any notice required hereby.

5. Modifications and Amendments. Any party may increase the amount of the Bond. Such party must give

written notice thereof to the other parties to this Agreement. If pursuant to Rule 17g-1 any party shall determine that the coverage provided pursuant to this Agreement should otherwise be modified, it shall

so notify the other parties hereto, and indicate the nature of the modification which it believes to be appropriate. If, within 45 days of such notice, any necessary amendments to this Agreement shall not have been made and the request for

modification shall not have been withdrawn, this Agreement shall terminate with respect to such party (except with respect to losses occurring prior to such termination). Any party may withdraw from this Agreement at any time and cease to be a party

hereto (except with respect to losses occurring prior to such withdrawal) by giving written notice to the other parties of such withdrawal. Upon withdrawal, a withdrawing party shall be entitled to receive any portion of any premium rebated by the

fidelity company with respect to such withdrawal.

6. Additional Named Insureds. Any newly created

investment company managed by a direct or indirect subsidiary of The TCW Group, Inc., and required to maintain a bond pursuant to Rule 17g-1 may be added as an additional named insured to the Bond and as an

additional party to this Agreement upon execution of a Schedule I in the form attached to this Agreement as Exhibit A. Inclusion of such Company as a party to this Agreement shall be effective as of the date such company is added to the Bond as a

named insured. No payment of any portion of the initial premiums shall be required of any additional named insured company, it being hereby agreed that any such reimbursement amount due to each of the other parties to this Agreement would be de

minimis. Any additional premium due and payable as a result of, or subsequent to, addition of such investment company under the Bond shall be payable pursuant to the provisions of Section 3 hereof.

7. Governing Law. This Agreement shall be construed in accordance with the laws of the State of

California.

8. No Assignment. This Agreement is not assignable.

9. Notices. All notices and other communications hereunder shall be in writing and shall be addressed to

the appropriate party at 865 South Figueroa Street, Los Angeles, CA 90017.

Certain of the Funds are comprised of Portfolios. All

obligations of any of such respective Funds under this Agreement shall apply only on a Portfolio by Portfolio basis, and the assets of one Portfolio shall not be liable for the obligations of any other Portfolio.

IN WITNESS WHEREOF, each of the parties hereto has duly executed this Agreement as of the day and year

first above written.

|

| Metropolitan West Funds |

|

| /s/ Meredith Jackson |

|

| Meredith Jackson |

| Vice President and Secretary |

|

| TCW Funds, Inc. |

|

| /s/ Meredith Jackson |

|

| Meredith Jackson |

| Senior Vice President, General Counsel and Secretary |

|

| TCW Strategic Income Fund, Inc. |

|

| /s/ Meredith Jackson |

|

| Meredith Jackson |

| Senior Vice President, General Counsel and Secretary |

SCHEDULE I

to

AMENDED AND RESTATED

JOINT INSURED BOND AGREEMENT

dated June 13, 2022

For the purpose of obtaining fidelity bond coverage under the joint insured bonds (“Bonds”) maintained by the parties to that certain

Amended and Restated Joint Insured Bond Agreement dated June 13, 2022 (“Agreement”), the undersigned hereby certifies to all other parties to such Agreement (“Parties”) as follows:

| |

a) |

That it is managed by a direct or indirect subsidiary of The TCW Group, Inc.; |

| |

b) |

That it is a regulated management investment company required to provide and maintain in effect a fidelity bond

against larceny and embezzlement by its officers and employees by Rule 17g-1 under the Investment Company Act of 1940 (the “Act”); |

| |

c) |

That the company qualifies under the terms of Rule 17g-1 for inclusion

as a named insured on the joint insured bonds maintained by the Parties; |

| |

d) |

That a majority of the Boards of Directors/Trustees/Managing General Partners of the company who are not

“interested persons” of such party was defined by Section 2(a)(19) of the Act, have given due consideration to all factors relevant to the form, amount and ratable allocation of premiums of such joint insured bonds, and such governing

body has approved the terms and amount of the bonds and the portion of the premiums payable by the company under the Agreement; |

| |

e) |

That the company has determined that the allocation of the proceeds payable under the joint insured bonds as

set forth in the Agreement (which takes into account the minimum amount of bond required for each party by Rule 17g-1 if it maintained a single insured bond) is equitable; |

The undersigned hereby requests to be added as a named insured under the Bonds maintained by the Parties and as a Party to the Agreement. The

undersigned hereby agrees to be bound by all terms and provisions of the Agreement effective as of the date it is included as a named insured under the Bonds.

Executed as of this 13th day of June, 2022.

TCW FUNDS, INC.

TCW STRATEGIC INCOME FUND, INC.

CERTIFICATE OF THE SECRETARY

The undersigned, Meredith Jackson, hereby certifies that she is the duly elected Secretary of TCW Funds, Inc.

(“TFI”) and TCW Strategic Income Fund, Inc. (“TSI”), and further certifies the following recitals and resolutions were approved and adopted by all the members of the Boards of Directors of TFI and TSI at a meeting held on

June 13, 2022, at which a quorum was at all times present, and that such resolutions remain in full force and effect as of the date hereof.

WHEREAS, the Independent Directors have given due consideration to all information deemed reasonably

relevant, necessary or appropriate by them regarding fidelity insurance coverage in the form of a joint insured bond (the “New Bond”) for TFI, TSI, and MWF issued by Chubb, including, among other things: (i) the value of the

aggregate assets of TFI, TSI and MWF to which any covered person (as defined in Rule 17g-1(a) under the 1940 Act) may have access, (ii) the type and terms of the arrangements made for the custody and

safekeeping of such assets, (iii) the nature of the securities in TFI’s, TSI’s and MWF’s investment portfolios, (iv) the number of other parties named as insureds under the New Bond, (v) the nature of the business

activities of the other parties to the New Bond, (vi) the amount of the New Bond and the premium for such New Bond, (vii) the ratable allocation of the premium among the parties named as insureds, and (viii) the extent to which the

share of the premium allocated to each participating fund is less than the premium that fund would have had to pay if it had procured and maintained a single insured bond;

WHEREAS, TFI, TSI, and MWF desire to establish criteria by which the premium for, and recoveries

under, the New Bond shall be allocated among the parties; and

WHEREAS, the Boards satisfy

the fund governance standards defined in Rule 0-1(a)(7) under the 1940 Act.

NOW, THEREFORE, BE IT RESOLVED, that the Boards find that the coverage provided by the New Bond is reasonable and

adequate to protect TFI, TSI, and MWF against larceny or embezzlement by any covered persons and approves the amount, type, form and coverage of the New Bond issued by Chubb and naming as insured parties TFI, TSI, and MWF in the aggregate amount of

$5,750,000 for the period from June 30, 2022 through June 30, 2023; and

RESOLVED FURTHER,

that the Boards hereby determine that the premium of not more than $11,470 for the New Bond (up to $9,914 allocated to MWF, up to $1,524 allocated to TFI and up to $32 allocated to TSI) is fair and reasonable and that the premium be, and it

hereby is, ratified and confirmed; and

RESOLVED FURTHER, that pursuant to Rule 17g-1 under the 1940 Act, the Boards find that the participation of TFI, TSI, and MWF in the New Bond and payment by each participating fund of its allocated share of the premium for such New Bond is in the best

interests of TFI, TSI, and MWF, and is hereby ratified and confirmed by the Boards; and

RESOLVED

FURTHER, that the officers of TFI, TSI, and MWF are authorized and directed to execute and deliver the Amended and Restated Joint Bond Agreement setting forth the manner of disposition of any recovery received under the New Bond as required by

Rule 17g-1(f) under the 1940 Act, in the form submitted to this meeting with such changes as such officers shall, with the advice of counsel, deem appropriate, any such determination to be conclusively

evidenced by such execution and delivery; and

RESOLVED FURTHER, that the appropriate officers of

TFI, TSI, and MWF shall file or cause to be filed a copy of the New Bond, any necessary exhibits, and appropriate notices with the SEC in accordance with Rule 17g-1(g) under the 1940 Act; and

RESOLVED FURTHER, that the officers of TFI, TSI, and MWF be, and each hereby is, authorized and directed to execute

such documents, including an insurance agreement among insureds pursuant to Rule 17g-1(f) under the 1940 Act, with such modifications as the officers, on advice of counsel, shall deem appropriate

consistent with the purposes and intent of the Boards, to make any and all payments, and to take such actions as may be necessary or appropriate to carry out the purposes and intent of the

preceding resolutions, the execution and delivery of such documents or taking of such actions to be conclusive evidence of the Boards’ approval, and that all actions previously taken by the officers of TFI, TSI, and MWF in connection with the

New Bond be, and they hereby are, ratified and confirmed in all respects.

Dated: August 3, 2022

|

| /s/ Meredith

Jackson

|

| Meredith Jackson Senior Vice President, General

Counsel, and Secretary |

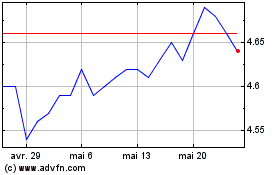

TCW Strategic Income (NYSE:TSI)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

TCW Strategic Income (NYSE:TSI)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025