FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

REPORT OF FOREIGN ISSUER

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

Dated September

13, 2024

Commission

File Number: 001-04546

UNILEVER PLC

(Translation

of registrant's name into English)

UNILEVER HOUSE, BLACKFRIARS, LONDON, ENGLAND

(Address

of principal executive offices)

Indicate

by check mark whether the registrant files or will file annual

reports

under

cover Form 20-F or Form 40-F.

Form

20-F..X.. Form 40-F

Indicate

by check mark if the registrant is submitting the Form 6-K in

paper

as

permitted by Regulation S-T Rule 101(b)(1):_____

Indicate

by check mark if the registrant is submitting the Form 6-K in

paper

as

permitted by Regulation S-T Rule 101(b)(7):_____

Indicate

by check mark whether the registrant by furnishing the

information

contained

in this Form is also thereby furnishing the information to

the

Commission

pursuant to Rule 12g3-2(b) under the Securities Exchange Act of

1934.

Yes

No .X..

If

"Yes" is marked, indicate below the file number assigned to the

registrant

in

connection with Rule 12g3-2(b): 82- _______

Exhibit

99 attached hereto is incorporated herein by

reference.

Signatures

Pursuant

to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorized.

|

UNILEVER

PLC

|

|

|

|

|

|

|

|

/S/ M VARSELLONA

|

|

BY M VARSELLONA

|

|

CHIEF LEGAL OFFICER AND GROUP SECRETARY

|

Date:

13 September, 2024

EXHIBIT INDEX

------------------------

|

EXHIBIT

NUMBER

|

EXHIBIT

DESCRIPTION

|

|

99

|

Notice

to London Stock Exchange dated 13 September 2024

|

|

|

Share

Buyback Commencement of 2024 Second Tranche

|

Exhibit

99

2024 Share Buyback Programme – Commencement of Second

Tranche

London, 13 September 2024. Unilever PLC announces the

commencement of the second and final tranche of its up to

€1.5 billion share buyback

With

our full year 2023 results on 8 February 2024, Unilever PLC

announced a programme to buy back shares with an aggregate market

value equivalent of up to €1.5 billion to be conducted during

2024 (the “Programme”).

The

first tranche of the Programme (the “First Tranche”)

commenced on 17 May 2024 and completed on 30 August 2024. Under the

First Tranche, a total of 13,437,701 ordinary Unilever PLC shares

were purchased with an aggregate market value equivalent of

€700,101,906.

Unilever

PLC now announces the commencement of the second and final tranche

of the Programme (the “Second Tranche”) for an

aggregate market value equivalent of up to €799,898,000. The

purpose of the Second Tranche is to reduce the capital of Unilever

PLC and it will take place within the limitations of the authority

granted to the Board of Unilever PLC by its general meeting, held

on 1 May 2024, pursuant to which the maximum number of shares to be

bought back by Unilever PLC is 236,762,299.

The

Second Tranche will commence on 13 September 2024 and will end on

or before 13 December 2024.

Unilever

PLC has entered into non-discretionary instructions with BNP

Paribas Financial Markets to conduct the Second Tranche on its

behalf and to make trading decisions under the Second Tranche

independently of Unilever PLC.

ENDS

Enquiries

Media:

Unilever

Press Office

press-office.london@unilever.com

Investors:

Investor

Relations Team investor.relations@unilever.com

About Unilever

Unilever

is one of the world’s leading suppliers of Beauty &

Wellbeing, Personal Care, Home Care, Nutrition and Ice Cream

products, with sales in over 190 countries and products used by 3.4

billion people every day. We have 128,000 employees and generated

sales of €59.6 billion in 2023.

For

more information about Unilever and our brands, please visit

www.unilever.com.

Notes to editors

Important information

This announcement contains inside information. This is a public

announcement pursuant to Article 17 Paragraph 1 of the European

Market Abuse Regulation (596/2014), including as it forms part of

UK law.

Safe Harbour

This announcement may contain forward-looking statements, including

‘forward-looking statements’ within the meaning of the

United States Private Securities Litigation Reform Act of 1995,

including with relation to Unilever’s share buyback

programme, its purpose and timetable. All statements other than

statements of historical fact are, or may be deemed to be,

forward-looking statements. Words and terminology such as

‘will’, ‘aim’, ‘expects’,

‘anticipates’, ‘intends’,

‘looks’, ‘believes’, ‘vision’,

‘ambition’, ‘target’, ‘goal’,

‘plan’, ‘potential’, ‘work

towards’, ‘may’, ‘milestone’,

‘objectives’, ‘outlook’,

‘probably’, ‘project’, ‘risk’,

‘seek’, ‘continue’,

‘projected’, ‘estimate’,

‘achieve’ or the negative of these terms and other

similar expressions of future performance, results, actions or

events, and their negatives, are intended to identify such

forward-looking statements. These forward-looking statements are

based upon current beliefs, expectations and assumptions regarding

anticipated developments and other factors affecting the Unilever

Group (the ‘Group’). They are not historical facts, nor

are they guarantees of future performance or outcomes. All

forward-looking statements contained in this announcement are

expressly qualified in their entirety by the cautionary statements

contained or referred to in this section. Readers should not place

undue reliance on forward-looking statements.

Because these forward-looking statements involve known and unknown

risks and uncertainties, a number of which may be beyond the

Group’s control, there are important factors that could cause

actual results to differ materially from those expressed or implied

by these forward-looking statements. The forward-looking statements

are based on our beliefs, assumptions and expectations of our

future performance, taking into account all information currently

available to us. Forward-looking statements are not predictions of

future events. These beliefs, assumptions and expectations can

change as a result of many possible events or factors, not all of

which are known to us.

The forward-looking statements speak only as of the date of this

announcement. Except as required by any applicable law or

regulation, the Group expressly disclaims any intention, obligation

or undertaking to release publicly any updates or revisions to any

forward-looking statements contained herein to reflect any change

in the Group’s expectations with regard thereto or any change

in events, conditions or circumstances on which any such statement

is based. New risks and uncertainties arise over time, and it is

not possible for us to predict those events or how they may affect

us. In addition, we cannot assess the impact of each factor on our

business or the extent to which any factor, or combination of

factors, may cause actual results to differ materially from those

contained in any forward-looking statements.

Further details of potential risks and uncertainties affecting the

Group are described in the Group’s filings with the London

Stock Exchange, Euronext Amsterdam and the US Securities and

Exchange Commission, including in the Annual Report on Form 20-F

2023 and the Unilever Annual Report and Accounts 2023 available on

our corporate website www.unilever.com.

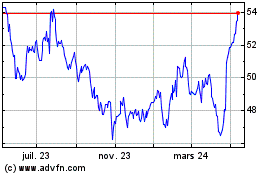

Unilever (NYSE:UL)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

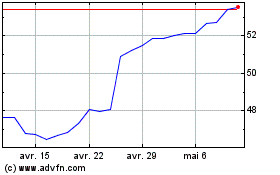

Unilever (NYSE:UL)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024