Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

26 Novembre 2024 - 1:29PM

Edgar (US Regulatory)

United States

Securities and Exchange Commission

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the

Securities Exchange Act of 1934

For the month of

November 2024

Vale S.A.

Praia de Botafogo nº 186, 18º andar,

Botafogo

22250-145 Rio de Janeiro, RJ, Brazil

(Address of principal executive office)

(Indicate by check mark whether the registrant files

or will file annual reports under cover of Form 20-F or Form 40-F.)

(Check One)

Form 20-F x Form 40-F ¨

Communication of transaction with related party

Rio de Janeiro, November 26, 2024 – Vale S.A. ("Vale"

or "Company"), in accordance with Article 33, item XXXII, of CVM Resolution No. 80, dated March 29, 2022, hereby announces the

following transaction with a related party:

| Related party’s name |

Edge Comercialização S.A. (“Edge”) |

| Relationship with the issuer |

Cosan is a shareholder with significant influence in Vale. Edge is an indirect subsidiary of Cosan and, consequently, is also a related party of Vale. |

| Transaction date |

11/13/2024 |

| Object of the contract |

Sale of natural gas from Edge to Vale. |

| Duration of the object of the contract |

01/01/2025 to 12/31/2025 |

| Issuer’s contractual position |

Debtor |

| Amount involved in the transaction |

R$101 million |

| Existing outstanding balance |

None related to this transaction. |

| Main terms and conditions |

Obligations of Edge: To carry out the supply of natural gas

in full compliance with the provisions of the contract, in strict compliance with the provisions of the applicable legislation, directly

answering for their quality and suitability, and may suspend the supply with prior notice in the event of non-payment or partial payment

by Vale.

Obligations of Vale: To make the payment for the purchase of

natural gas, in accordance with the provisions of the contract. To withdraw 90% of the quantity of natural gas contracted each month,

and to pay a Take or Pay (“ToP”) penalty in the event of non-withdrawal. This “ToP” can be recovered over the

term of the agreement. |

| Justification of the reasons why the issuer’s management considers that the transaction has met commuting conditions or provides for adequate compensatory payment |

A competitive bidding process was carried out inviting 21 suppliers and Edge was contracted based on the competitiveness of its proposal, out of the 7 proposals received. |

| Eventual participation of the counterparty, its partners, or administrators in the issuer's decision-making process regarding the transaction or negotiation of the transaction as representatives of the issuer, describing these interests. |

As part of the decision-making process, the transaction was carried out in strict compliance with the Company’s Policy on Related Party Transactions and Conflict of Interest (“Policy”). The matter was deliberated by the Board of Directors and, as established in the Policy, among other actions, the restrained member of the Board of Directors did not receive any documentation pertinent to the matter nor did he participate in the discussions of this matter in Vale’s governance bodies, and the abstention and absence of the Director at the time of discussion and deliberation of this matter was recorded in the minutes. |

For further information, please contact:

Vale.RI@vale.com

Thiago Lofiego: thiago.lofiego@vale.com

Mariana Rocha: mariana.rocha@vale.com

Luciana Oliveti: luciana.oliveti@vale.com

Pedro Terra: pedro.terra@vale.com

Patricia Tinoco: patricia.tinoco@vale.com

This press release may include statements that

present Vale’s expectations about future events or results. All statements, when based upon expectations about the future, involve

various risks and uncertainties. Vale cannot guarantee that such statements will prove correct. These risks and uncertainties include

factors related to the following: (a)the countries where we operate, especially Brazil and Canada; (b) the global economy; (c) the capital

markets; (d) the mining and metals prices and their dependence on global industrial production, which is cyclical by nature; and (e)

global competition in the markets in which Vale operates. To obtain further information on factors that may lead to results different

from those forecast by Vale, please consult the reports Vale files with the U.S. Securities and Exchange Commission (SEC), the Brazilian

Comissão de Valores Mobiliários (CVM) and in particular the factors discussed under “Forward-Looking Statements”

and “Risk Factors” in Vale’s annual report on Form 20-F.

Signatures

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Vale S.A.

(Registrant) |

| |

|

| |

By: |

/s/ Thiago Lofiego |

| Date: November 26, 2024 |

|

Director of Investor Relations |

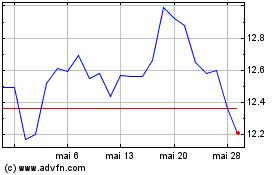

Vale (NYSE:VALE)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Vale (NYSE:VALE)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024