VMWare Down After FT Reports China Holding Up Broadcom Buyout

19 Octobre 2023 - 2:06PM

Dow Jones News

By Rob Curran

Shares of VMWare slid premarket after the Financial Times

reported that authorities in China were holding up chipmaker

Broadcom's multibillion dollar buyout of the maker of

virtualization software in the latest salvo of the U.S.-China tech

battle.

The State Administration of Market Regulation in Beijing is

delaying approval of the merger deal struck in May 2022, largely in

response to the Biden administration's crackdown on exchanging U.S.

semiconductor technology with China, the FT reported, citing three

people familiar with the matter. The cash-and-stock deal was

originally valued at around $61 billion. Approvals for

merger-and-acquisitions among U.S. companies active in China are

now subject to scrutiny from the more political Foreign Affairs and

State Council ministries, the British financial newspaper

reported.

Shares of VMWare fell 7% to $154.55 premarket. Broadcom rose

0.5% to $891.32.

Write to Rob Curran at rob.curran@wsj.com

(END) Dow Jones Newswires

October 19, 2023 07:51 ET (11:51 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

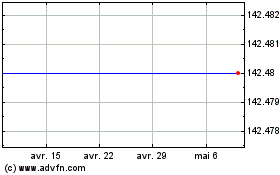

Vmware (NYSE:VMW)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

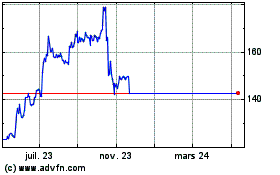

Vmware (NYSE:VMW)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024