WEX Announces Pricing and Upsizing of $550 Million Senior Unsecured Notes Offering

27 Février 2025 - 11:22PM

Business Wire

WEX Inc. (NYSE: WEX) (the “Company”), the global commerce

platform that simplifies the business of running a business, today

announced that it had priced and upsized its previously announced

offering (the “Offering”) of $550 million in aggregate principal

amount of its new 6.500% senior unsecured notes due 2033 (the

“Notes”) in a private offering that is exempt from registration

under the Securities Act of 1933, as amended (the “Securities

Act”). This represents an increase of $50 million in the aggregate

principal amount of the Notes, from the previously announced amount

of $500 million. The Notes will be guaranteed on a senior unsecured

basis by each of the Company’s wholly-owned domestic subsidiaries

that guarantee the Company’s senior secured credit facilities.

The Offering is expected to close on March 6, 2025, subject to

the satisfaction of customary closing conditions. The Notes will

pay interest on a semi-annual basis.

The Company intends to use the net proceeds of the Offering,

together with the net proceeds of borrowings under a proposed new

incremental term loan B facility in an aggregate principal amount

of $450 million (the “Incremental Term Loan B facility”) and cash

on hand, to fund a tender offer that the Company previously

announced to purchase shares of the Company’s outstanding common

stock for a cash purchase price of up to $750 million (the “Tender

Offer”), to repay approximately $250 million outstanding under the

revolving portion of the Company’s senior secured credit facilities

(the “RCF Facility”), and to pay related fees and expenses, with

any amounts remaining thereafter for general corporate purposes,

which may include additional repurchases of the Company’s common

stock after the expiration of the Tender Offer. There is no

guarantee that we consummate the Incremental Term Loan B facility

or the Tender Offer. In the event that the Tender Offer is not

consummated, the Company may use the net proceeds of the Offering

for general corporate purposes, which may include repayments of

outstanding amounts under the RCF Facility and repurchases of the

Company’s common stock. This announcement is not an offer to

purchase or a solicitation of an offer to sell the Company’s common

stock.

Nothing contained herein shall constitute an offer to sell or

the solicitation of an offer to buy the Notes or any other

securities nor shall there be any offer, solicitation or sale of

the Notes or any other securities in any state in which such offer,

solicitation or sale would be unlawful. The Notes are being offered

only to persons reasonably believed to be qualified institutional

buyers in reliance on Rule 144A under the Securities Act, and

outside the United States, only to non-U.S. investors pursuant to

Regulation S under the Securities Act. The Notes and related

guarantees have not been and will not be registered under the

Securities Act, or applicable state securities laws, and may not be

offered or sold in the United States absent registration or

pursuant to an applicable exemption from the registration

requirements of the Securities Act and applicable state securities

laws.

This press release is being issued pursuant to and in accordance

with Rule 135c under the Securities Act.

Forward-Looking Statements

This press release contains forward-looking statements

including, but not limited to, statements about management’s plans,

goals and expectations with respect to the Offering and the use of

proceeds therefrom. Any statements in this press release that are

not statements of historical facts are forward-looking statements.

When used in this press release, the words “anticipate,” “believe,”

“continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,”

“project,” “will,” “positions,” “confidence,” and similar

expressions are intended to identify forward-looking statements,

although not all forward-looking statements contain such words.

Forward-looking statements relate to the Company’s future plans,

objectives, expectations, and intentions and are not historical

facts and accordingly involve known and unknown risks and

uncertainties and other factors that may cause the actual results

or performance to be materially different from future results or

performance expressed or implied by these forward-looking

statements, including the Company’s ability to successfully market

and consummate the Offering on the terms described or at all, such

that such Offering does not close or is not as successful as it is

intended to be, the use of proceeds therefrom, the Company’s

ability to successfully market and consummate the Incremental Term

Loan B facility on the terms described or at all and the Company’s

ability to successfully consummate the Tender Offer on the terms

described or at all; as well as other risks and uncertainties

identified in Item 1A of the Company’s Annual Report on Form 10-K

for the year ended December 31, 2024, filed with the Securities and

Exchange Commission on February 20, 2025 and subsequent filings

with the Securities and Exchange Commission. The forward-looking

statements speak only as of the date of this press release and

undue reliance should not be placed on these statements. The

Company disclaims any obligation to update any forward-looking

statements as a result of new information, future events, or

otherwise.

All of the forward-looking information contained in this press

release is expressly qualified by the foregoing cautionary

statements.

About WEX

WEX (NYSE: WEX) is the global commerce platform that simplifies

the business of running a business. WEX has created a powerful

ecosystem that offers seamlessly embedded, personalized solutions

for its customers around the world. Through its rich data and

specialized expertise in simplifying benefits, reimagining mobility

and paying and getting paid, WEX aims to make it easy for companies

to overcome complexity and reach their full potential. For more

information, please visit www.wexinc.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250227872874/en/

News Media: WEX Megan Zaroda, 610-379-6211

Megan.Zaroda@wexinc.com

Investor: WEX Steve Elder, 207-523-7769

Steve.Elder@wexinc.com

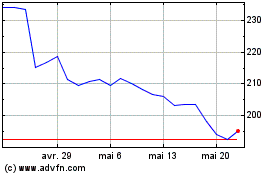

WEX (NYSE:WEX)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

WEX (NYSE:WEX)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025