Instant One Key tier upgrades, OneKeyCash™ introductory offers

and generous earn rates on everyday purchases for cardholders

Expedia Group, Inc. (NASDAQ: EXPE), one of the world’s largest

online travel platforms, has finalized a multiyear agreement with

Wells Fargo (NYSE: WFC) and Mastercard (NYSE: MA) to launch two new

co-branded credit cards. Designed to complement One Key™, Expedia

Group’s groundbreaking loyalty program, the One Key™ Card, and One

Key+™ Card, will offer more flexibility, savings and perks for U.S.

travelers.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20240711334943/en/

(Photo: Wells Fargo)

Launching with all types of travelers in mind, the One Key Cards

offer a host of benefits, including the ability to earn rewards as

OneKeyCash™, which can be used across Expedia®, Hotels.com®, and

vacation rental site Vrbo® to book eligible hotels, vacation

rentals, car rentals, activities and flights.*

“As we celebrate one year of One Key launching in the U.S., we

are excited to offer travelers the new One Key credit cards,

further delivering on our mission to make travel more rewarding and

flexible, and helping travelers achieve higher tiers for more

rewards, faster,” said Katrina Lane, SVP, Traveler Engagement &

Loyalty, Expedia Group. “The new credit cards will enhance our

unique travel rewards program that lets members earn and redeem

OneKeyCash across eligible Expedia, Hotels.com, and Vrbo

bookings.”

In addition to earning OneKeyCash rewards, the currency used

across Expedia, Hotels.com, and Vrbo apps, on Expedia Group

purchases and everyday purchases, One Key and One Key+ cardholders

will instantly jump to One Key Silver tier and One Key Gold tier,

respectively. With these automatic tier upgrades, travelers can

unlock savings of 15% and 20% or more on over 10,000 hotels

worldwide, as well as receive priority travel support and in-stay

perks, such as food and beverage extras or complimentary room

upgrades when available at select VIP Access properties.

One Key cardholders will enjoy the following features and

benefits:

One Key+ Card (terms

apply)

One Key Card (terms

apply)

- $99 Annual Fee

- Earn $600 in OneKeyCash after spending $3,000 on purchases in

the first three months

- Earn 3% in OneKeyCash on Expedia, Hotels.com, and Vrbo. When

combined with One Key benefits, Platinum tier members earn 9% on

Expedia and Hotels.com when booking VIP Access properties, and 5%

on Vrbo**

- Earn 3% in OneKeyCash at gas stations, grocery stores, and on

dining

- Earn 2% in OneKeyCash on all other purchases

- Automatic Gold Tier

- Path to next tier: Unlock Platinum when you spend $30,000 per

calendar year

- Get $100 in OneKeyCash each cardholder anniversary

- Receive a statement credit of up to $100 for Global Entry® or

TSA PreCheck®

- No foreign transaction fees

- Cell phone protection

- Trip protections:

- Trip Cancellation and Interruption

- Auto Rental Collision Damage Waiver

- Common Carrier Travel Accident Insurance

- Additional Mastercard World Elite benefits include: advanced

security features including Mastercard ID Theft Protection, Zero

Liability Protection and Global Services for emergency

assistance

- No Annual Fee

- Earn $400 in OneKeyCash after spending $1,000 on purchases in

the first three months

- Earn 3% in OneKeyCash on Expedia, Hotels.com, and Vrbo. When

combined with One Key benefits, Platinum tier members earn 9% on

Expedia and Hotels.com when booking VIP Access properties, and 5%

on Vrbo**

- Earn 3% in OneKeyCash at gas stations, grocery stores, and on

dining

- Earn 1.5% in OneKeyCash on all other purchases

- Automatic Silver Tier

- Path to next tier: Unlock Gold when you spend $15,000 per

calendar year

- No foreign transaction fees

- Cell phone protection

- Trip protections:

- Trip Cancellation and Interruption

- Auto Rental Collision Damage Waiver

- Common Carrier Travel Accident Insurance

- Additional Mastercard World Elite benefits include: advanced

security features including Mastercard ID Theft Protection, Zero

Liability Protection and Global Services for emergency

assistance

“We’re excited to enter a new era with Expedia Group and

Mastercard to bring the One Key Cards to market,” said Krista

Phillips, EVP, Head of Consumer Credit Cards and Consumer Lending

Marketing, Wells Fargo. “The program is uniquely designed to offer

immediate value to our customers through instant discounts,

enhanced perks, and accelerated rewards.”

Both cards start accepting applications nationally later this

summer. Existing Hotels.com cardholders will be notified of the

changes to their card beginning today, and should use their current

card to continue earning OneKeyCash until they receive their new

no-annual-fee One Key Card in September.

Consumers who apply for the One Key Card can earn $400 in

OneKeyCash after spending $1,000 on purchases in the first three

months; approved One Key+ cardholders can earn $600 in OneKeyCash

after spending $3,000 on purchases in the first three months (terms

apply).

“Consumers are continuing to prioritize experiences over

material goods, and with that, have a growing desire to travel,”

said Chiro Aikat, Co-President, U.S., Mastercard. “We’re delighted

to partner with Expedia Group and Wells Fargo to help consumers

unlock meaningful travel opportunities. With the launch of both One

Key Cards, we’re helping consumers make the most of their trips

through enhanced loyalty benefits and choice.”

*OneKeyCash is not redeemable for cash

**Excludes taxes and fees. U.S. vacation rentals only. Earn

rates will not apply in conjunction with any other OneKeyCash

offers

For more information about One Key, visit

www.expedia.com/welcome-one-key.

For more information, visit

www.expedia.com/one-key-cards-launch.

About Wells Fargo

Wells Fargo & Company (NYSE: WFC) is a leading financial

services company that has approximately $1.9 trillion in assets. We

provide a diversified set of banking, investment and mortgage

products and services, as well as consumer and commercial finance,

through our four reportable operating segments: Consumer Banking

and Lending, Commercial Banking, Corporate and Investment Banking,

and Wealth & Investment Management. Wells Fargo ranked No. 34

on Fortune’s 2024 rankings of America’s largest corporations. In

the communities we serve, the company focuses its social impact on

building a sustainable, inclusive future for all by supporting

housing affordability, small business growth, financial health, and

a low-carbon economy. News, insights, and perspectives from Wells

Fargo are also available at Wells Fargo Stories.

Additional information may be found at www.wellsfargo.com

LinkedIn: https://www.linkedin.com/company/wellsfargo

About Expedia Group

Expedia Group, Inc. (NASDAQ: EXPE) brands power travel for

everyone, everywhere through our global platform. Driven by the

core belief that travel is a force for good, we help people

experience the world in new ways and build lasting connections. We

provide industry-leading technology solutions to fuel partner

growth and success, while facilitating memorable experiences for

travelers. Our organization is made up of three pillars: Expedia

Brands, housing all our consumer brands; Expedia Product &

Technology, focused on the group’s product and technical strategy

and offerings; and Expedia for Business, consisting of

business-to-business solutions and relationships throughout the

travel ecosystem.

Expedia Group’s three flagship consumer brands includes:

Expedia®, Hotels.com®, and Vrbo®. One Key™ is our comprehensive

loyalty program that unifies Expedia, Hotels.com and Vrbo into one

simple, flexible travel rewards experience. To enroll in One Key,

download Expedia, Hotels.com and Vrbo mobile apps for free on iOS

and Android devices. One Key is currently available in the U.S. and

will become available globally soon.

For more information, visit www.expediagroup.com. Follow us on

Twitter @expediagroup and check out our LinkedIn

www.linkedin.com/company/expedia.

About Mastercard

Mastercard is a global technology company in the payments

industry. Our mission is to connect and power an inclusive, digital

economy that benefits everyone, everywhere by making transactions

safe, simple, smart and accessible. Using secure data and networks,

partnerships and passion, our innovations and solutions help

individuals, financial institutions, governments and businesses

realize their greatest potential. With connections across more than

210 countries and territories, we are building a sustainable world

that unlocks priceless possibilities for all.

For more information, visit www.mastercard.com.

News Release Category: WF-PS

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240711334943/en/

Media Nicole Dye-Anderson

Nicole.Dye-Anderson@wellsfargo.com Laura Lopez

Laulopez@expedia.com

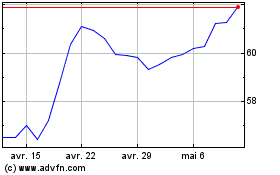

Wells Fargo (NYSE:WFC)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

Wells Fargo (NYSE:WFC)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024