Allied Properties Real Estate Investment Trust Announces Strategic Portfolio Acquisition in Toronto's Downtown West

01 Avril 2008 - 3:21PM

Marketwired Canada

Allied Properties REIT (TSX:AP.UN) announced today that it has entered into an

agreement to purchase the following portfolio of properties in Toronto for

$30.75 million:

Redeveloped Properties GLA (Sq. Ft.) Parking Spaces Lot Area (Sq. Ft.)

---------------------------------------------------------------------------

183 Bathurst Street 32,559 0 10,751

860 Richmond Street West 26,671 0 9,203

489 King Street West 26,271 0 6,103

---------------------------------------------------------------------------

Subtotal 85,501 0 26,057

---------------------------------------------------------------------------

Properties for Redevelopment

495 King Street West 11,183 26 14,596

499 King Street West 8,400 10 17,308

---------------------------------------------------------------------------

Subtotal 19,583 36 31,904

---------------------------------------------------------------------------

Total 39,166 36 63,808

---------------------------------------------------------------------------

The acquisition of all but one of the properties in the portfolio is expected to

close in May of 2008, subject to customary conditions. The closing of 860

Richmond Street West is subject to rectification of a minor title issue and is

expected to close somewhat later. Once the acquisitions are closed, the REIT's

portfolio will exceed 5.1 million square feet of GLA with Toronto representing

53% of the total, Montreal 34%, Winnipeg 8%, Quebec City less than 4% and

Kitchener-Waterloo just than 2%.

"183 Bathurst Street and 860 Richmond Street West are located in rapidly

transforming areas of Downtown West, whereas 489, 495 and 499 King Street West

are located right in the midst of our King & Spadina portfolio, making this is a

very strategic acquisition for us," said Michael Emory, President and CEO. "With

nearly 32,000 square feet of land area, 495 and 499 King Street West have

significant redevelopment potential. Because of existing lease commitments,

we'll operate them as rental properties until about 2012, when we expect to put

them into full-scale redevelopment, market conditions permitting."

Redeveloped Properties

183 Bathurst Street is a four-storey, Class I office building located on the

east side of Bathurst Street, just north of Queen Street West. It was renovated

recently and is now 76% leased to tenants consistent in character and quality

with the REIT's tenant base.

860 Richmond Street West is a three-storey, Class I office building located on

the north side of Richmond Street, west of Niagara Street. It was renovated

recently and is now fully leased to tenants consistent in character and quality

with the REIT's tenant base.

489 King Street West is a five-storey, Class I office building located on the

south side of King Street West, just east of the intersection with Brant Street.

It was renovated in the 1990s and is now fully leased to tenants consistent in

character and quality with the REIT's tenant base.

Properties for Redevelopment

495 King Street West is a three-storey, Class I office building located

immediately to the south of 489 King Street West. It was renovated in the 1990s

and is now fully leased to tenants consistent in character and quality with the

REIT's tenant base.

499 King Street West is a single-storey building located immediately to the west

of 489 King Street West. It was renovated recently and is now leased to an

entertainment facility pursuant to a lease that gives the landlord a right of

early termination on March 31, 2012, and at various intervals thereafter.

Acquisition Parameters and Financing

The purchase price for the portfolio represents a capitalization rate of

approximately 6.5%. On closing, the properties comprising the portfolio will be

free and clear of mortgage financing. The REIT will finance the acquisition

initially by drawing down on its line of credit. Following closing, the REIT

intends to place first mortgage financing on the redeveloped properties and

short-term financing on the properties for redevelopment. On completion of this

and other mortgage financings to be undertaken by the REIT in the second

quarter, the REIT will have nothing drawn on its line of credit, a conservative

debt ratio of just over 53% and considerable financing potential on two

unencumbered properties.

Cautionary Statement

This press release may contain forward-looking statements with respect to the

REIT, its operations, strategy, financial performance and condition. These

statements generally can be identified by use of forward looking words such as

"may", "will", "expect", "estimate", "anticipate", intends", "believe" or

"continue" or the negative thereof or similar variations. The actual results and

performance of the REIT discussed herein could differ materially from those

expressed or implied by such statements. Such statements are qualified in their

entirety by the inherent risks and uncertainties surrounding future

expectations, including that the transactions contemplated herein are completed.

Important factors that could cause actual results to differ materially from

expectations include, among other things, general economic and market factors,

competition, changes in government regulations and the factors described under

"Risk Factors" in the Annual Information Form of the REIT which is available at

www.sedar.com. Material assumptions that were made in formulating the

forward-looking statements in this press release are identified above in

connection with the estimate of average annual un-levered yield. These

cautionary statements qualify all forward-looking statements attributable to the

REIT and persons acting on the REIT's behalf. Unless otherwise stated, all

forward-looking statements speak only as of the date of this press release and

the parties have no obligation to update such statements.

"Capitalization rate" is not a measure recognized under Canadian generally

accepted accounting principles ("GAAP") and does not have any standardized

meaning prescribed by GAAP. Capitalization rate is presented in this press

release because management of the REIT believes that this non-GAAP measure is

relevant in interpreting the purchase price of the properties being acquired.

Capitalization rate, as computed by the REIT, may differ from similar

computations as reported by other similar organizations and, accordingly, may

not be comparable to capitalization rate reported by such organizations.

Allied Properties REIT is the leading owner and manager of Class I office

properties in Canada, with portfolio assets in the urban areas of Toronto,

Montreal, Winnipeg, Quebec City and Kitchener. The objectives of the REIT are to

provide stable and growing cash distributions to unitholders and to maximize

unitholder value through effective management and accretive portfolio growth.

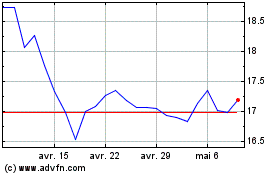

Allied Properties Real E... (TSX:AP.UN)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Allied Properties Real E... (TSX:AP.UN)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024