Allied to Acquire Ownership Interest in 400 West Georgia and Increase Ownership Interest in 19 Duncan

11 Mars 2024 - 10:02PM

Allied Properties Real Estate Investment Trust ("Allied") (TSX:

"AP.UN") today announced that it will acquire an ownership interest

in 400 West Georgia Street in Vancouver (“400 West Georgia”) and

increase its ownership interest in 19 Duncan Street in Toronto (“19

Duncan”).

400 West Georgia is comprised of 345,034 square

feet of office GLA, 5,525 square feet of retail GLA and 163

underground parking stalls. The property is 82% leased to Deloitte,

Apple, Northeastern University, Spaces, RBC, a local café and a

local restaurant, all with a weighted-average lease term of just

over 11 years. The property was designed to a LEED Platinum

standard. Westbank developed and currently owns the property.

Allied provided a $198 million secured mezzanine loan to Westbank

(the “Mezzanine Loan”) in connection with the development. The

property is subject to secured financing in the amount of $250

million.

19 Duncan is comprised of 154,074 square feet of

office GLA, 15,411 square feet of retail GLA, 464

rental-residential units, related common areas and facilities, 25

underground commercial parking stalls and 106 underground

residential parking stalls. The property was designed to a LEED

Gold standard. The office component is fully leased to Thomson

Reuters with a weighted-average lease term of 9.4 years. The

rental-residential component is expected to be leased over the

remainder of 2024. Allied and Westbank currently own the property

in equal shares. The property is subject to construction financing

of up to $295 million.

Allied will convert $130.5 million of the

Mezzanine Loan to equity in exchange for a 90% undivided interest

in 400 West Georgia. The transaction will be based on a total

property value of $395 million. Allied intends to reduce the

secured financing over the course of 2024 and into 2025 by selling

less-strategic properties in Toronto (primarily in response to

unsolicited offers to purchase). Allied will manage the property

from January 1, 2025, onward.

Allied will increase its ownership in 19 Duncan

to a 95% undivided interest by converting the remaining $67.5

million of the Mezzanine Loan to equity and making a cash payment

to Westbank of $36.3 million. The amount payable in cash will be

funded in part with the proceeds from the TELUS Sky reorganization

and in part through the sale of less-strategic assets in Montréal

(primarily in response to unsolicited offers to purchase). The

transaction will be based on a total property value of $525.7

million.

Allied expects to complete the transactions in

relation to 400 West Georgia and 19 Duncan in early April, subject

only to Competition Act approval and customary closing conditions.

The transactions will reduce Westbank’s debt to Allied materially

and afford Allied a large ownership position in two triple-A urban

properties as they near successful completion and full lease-up.

The transactions will put modest and temporary upward pressure on

Allied’s total indebtedness ratio and net debt as a multiple of

Annualized Adjusted EBITDA. Management expects the upward pressure

to abate and the ongoing strengthening of Allied’s debt metrics to

continue in late 2024 and beyond as a result of (i) contemplated

property sales in 2024 and (ii) EBITDA growth on achievement of

full lease-up of the properties, particularly the

rental-residential component of 19 Duncan. The transactions will

also put modest and temporary downward pressure on Allied’s

cashflow per unit. Management expects the downward pressure to

abate in 2025 and beyond as the properties reach full lease-up.

Allied completed the sale of its UDC portfolio

in 2023. In addition to the considerable benefits outlined at the

time, the transaction prompted real estate market participants to

make unsolicited offers to purchase specific properties from

Allied, particularly in Montréal and Toronto. Over the course of

2024 and into 2025, Allied will work toward selling less-strategic

properties in its portfolio at IFRS value for aggregate proceeds of

up to $200 million. The proceeds will be used (i) to fund the

modest incremental allocation of capital associated with the

increase in ownership of 19 Duncan and (ii) to continue the ongoing

strengthening of Allied’s debt-metrics. For Allied, a

less-strategic property is generally one that is smaller in size

and not an integral part of a major concentration or assembly of

distinctive urban workspace in its portfolio. There appears to be

considerable demand for such property in Montréal and Toronto, and

Allied expects to pursue most sales privately rather than through a

public-offering process.

Allied expects to complete the previously

announced reorganization of ownership of TELUS Sky before the end

of the second quarter. “The three transactions (TELUS Sky, 400 West

Georgia and 19 Duncan), along with our contemplated property sales

in Montréal and Toronto, will continue the ongoing upgrade of our

urban workspace portfolio and establish our urban

rental-residential portfolio in a concrete, material and timely

way,” said Michael Emory, Founder & Executive Chair. ”Within a

short period of time, these transactions will continue the ongoing

strengthening of our debt-metrics and propel growth in our cashflow

per unit.”

Cautionary Statements

This press release may contain forward-looking

statements with respect to (i) Allied, (ii) its operations,

strategy, financial performance and condition and (iii) the

expected impact of the transactions contemplated in this press

release. These statements generally can be identified by use of

forward-looking words such as “may”, “will”, “expect”, “estimate”,

“anticipate”, “intends”, “believe” or “continue” or the negative

thereof or similar variations. In particular, this news release

contains forward-looking statements pertaining to a possible

transaction related to Allied’s portfolio.

Such statements are qualified in their entirety

by the inherent risks and uncertainties surrounding future

expectations, including that the transactions contemplated herein

are completed and have the expected impact on funding and earnings.

Important factors that could cause actual results to differ

materially from expectations include, among other things, financing

and interest rates, access to capital, general economic and market

conditions, lease roll-over and other factors described under

“Risks and Uncertainties” in Allied’s Annual MD&A, which is

available at www.sedarplus.ca. These cautionary statements qualify

all forward-looking statements attributable to Allied and persons

acting on Allied’s behalf. Unless otherwise stated, all

forward-looking statements speak only as of the date of this press

release and, except as required by applicable law, Allied has no

obligation to update such statements.

About Allied

Allied is a leading owner-operator of

distinctive urban workspace in Canada’s major cities. Allied’s

mission is to provide knowledge-based organizations with workspace

that is sustainable and conducive to human wellness, creativity,

connectivity and diversity. Allied’s vision is to make a continuous

contribution to cities and culture that elevates and inspires the

humanity in all people.

FOR FURTHER INFORMATION, PLEASE

CONTACT:

Michael EmoryFounder & Executive Chair(416)

977-9002memory@alliedreit.com

Cecilia C. WilliamsPresident & Chief Executive Officer(416)

977-9002cwilliams@alliedreit.com

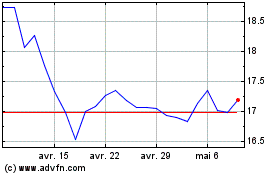

Allied Properties Real E... (TSX:AP.UN)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Allied Properties Real E... (TSX:AP.UN)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024