Allied Properties Real Estate Investment Trust Announces Second-Quarter Results for 2008

07 Août 2008 - 10:53PM

Marketwired Canada

Allied Properties REIT (TSX:AP.UN) today announced results for the second

quarter and the six-month period ended June 30, 2008. On a fully diluted,

per-unit basis, Adjusted Funds From Operations ("AFFO") for the quarter were up

8.2% and for the six-month period 10.5%. The REIT's AFFO pay-out ratio for the

quarter was 86.0% and for the six-month period 81.0%.

The REIT maintained a high level of leased area through the six-month period,

finishing at 97.3%. It also increased same-asset net operating income ("NOI") by

3%, completed $76 million in acquisitions and announced another $76 million in

acquisitions along with a $61 million public offering (all of which closed

recently). The REIT's debt ratio at the end of the period was 52.7%.

"In the first half of the year, we took very deliberate advantage of our

investment and operating expertise, as well as our access to capital," said

Michael Emory, President and CEO. "I believe this is evident in our financial

results and in the continued strength of our balance sheet."

Summary of Financial Results

The financial results for the second quarter are summarized below and

compared to the same quarter in 2007:

(In thousands except for per

unit and % amounts) Q2 2008 Q2 2007 Change % Change

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Distributable Income ("DI") 11,693 10,211 1,482 14.5%

DI per unit (diluted) $0.415 $0.416 ($0.001) (0.2%)

DI pay-out ratio 79.1% 77.6% 1.5%

Funds From Operation ("FFO") 11,512 10,192 1,320 13.0%

FFO per unit (diluted) $0.409 $0.416 ($0.007) (1.7%)

FFO pay-out ratio 80.3% 77.7% 2.6%

AFFO 10,759 8,648 2,111 24.4%

AFFO per unit (diluted) $0.382 $0.353 $0.029 8.2%

AFFO pay-out ratio 86.0% 91.6% (5.6%)

--------------------------------------------------------------------------

The financial results for the six-month period are summarized below

and compared to the same period in 2007:

(In thousands except for per

unit and % amounts) H1 2008 H1 2007 Change % Change

--------------------------------------------------------------------------

--------------------------------------------------------------------------

DI 23,612 17,698 5,914 33.4%

DI per unit (diluted) $0.841 $0.792 $0.049 6.2%

DI pay-out ratio 77.1% 79.3% (2.2%)

FFO 23,346 18,376 4,970 27.0%

FFO per unit (diluted) $0.832 $0.822 $0.010 1.2%

FFO pay-out ratio 77.9% 76.4% 1.5%

AFFO 22,457 16,178 6,279 38.8%

AFFO per unit (diluted) $0.800 $0.724 $0.076 10.5%

AFFO pay-out ratio 81.0% 86.7% (5.7%)

--------------------------------------------------------------------------

Cautionary Statements

DI, FFO, AFFO and NOI are not financial measures defined by Canadian GAAP.

Please see the REIT's MD&A for a description of these measures and their

reconciliation to net income or cash flow from operations, as presented in the

consolidated financial statements of the REIT for the quarter ended June 30,

2008. These statements, together with accompanying notes and MD&A, have been

filed with SEDAR, www.sedar.com, and are also available on the REIT's web-site,

www. alliedpropertiesreit.com.

Allied Properties REIT is the leading owner and manager of Class I office

properties in Canada, with portfolio assets in the urban areas of Toronto,

Montreal, Winnipeg, Quebec City and Kitchener. The objectives of the REIT are to

provide stable and growing cash distributions to unitholders and to maximize

unitholder value through effective management and accretive portfolio growth.

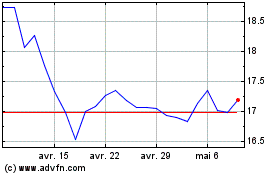

Allied Properties Real E... (TSX:AP.UN)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Allied Properties Real E... (TSX:AP.UN)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024