Allied Properties Real Estate Investment Trust Announces Strong Fourth-Quarter and Year-End Results for 2008

11 Mars 2009 - 2:40AM

Marketwired Canada

Allied Properties REIT (TSX:AP.UN) today announced results for the fourth

quarter and year ended December 31, 2008. The financial results for the fourth

quarter are summarized below and compared to the same quarter in 2007:

(In thousands except for per

unit and % amounts) Q4 2008 Q4 2007 Change % Change

-----------------------------------------------------------------

-----------------------------------------------------------------

Net income 3,296 975 2,321 238.1%

Funds from operations ("FFO") 13,023 10,551 2,472 23.4%

FFO per unit (diluted) $0.42 $0.42 $0.00 0.0%

FFO pay-out ratio 78.7% 74.6% 4.1%

Adjusted FFO ("AFFO") 10,603 9,383 1,220 13.0%

AFFO per unit (diluted) $0.34 $0.37 ($0.03) (8.1%)

AFFO pay-out ratio 96.7% 83.8% 12.9%

-----------------------------------------------------------------

The financial results for 2008 are summarized below and compared to 2007:

(In thousands except for per

unit and % amounts) 2008 2007 Change % Change

--------------------------------------------------------------

--------------------------------------------------------------

Net income 12,512 5,810 6,702 115.4%

FFO 49,818 39,350 10,468 26.6%

FFO per unit (diluted) $1.68 $1.66 $0.02 1.2%

FFO pay-out ratio 77.6% 75.6% 2.0%

AFFO 44,660 35,323 9,337 26.4%

AFFO per unit (diluted) $1.51 $1.49 $0.02 1.3%

AFFO pay-out ratio 86.6% 84.3% 2.3%

--------------------------------------------------------------

"We continued to strengthen our urban-office franchise in 2008," said Michael

Emory, President & CEO. "We expanded our portfolios in Toronto and Montreal,

improved our financial performance measures despite having de-levered our

business and bolstered our balance sheet in a very timely way given the current

economic environment."

Allied completed $152 million in acquisitions in 2008, bringing its portfolio to

81 predominantly Class I office properties with 5.6 million square feet of

leasable area. As in prior years, Allied's portfolio expansion was part of a

focused consolidation strategy that has enabled it to become the leading

provider of Class I office space in each of its target markets.

Allied maintained a high level of leased area through 2008, finishing the year

at 97.3%. Despite de-levering its business over the course of the year, Allied

increased its FFO and AFFO per unit and maintained FFO and AFFO pay-out ratios

well below the average for Canadian REITs.

Allied raised over $120 million in equity in 2008 and secured another $60

million in first-mortgage financing, reducing its debt ratio by year-end to a

conservative 49.4% and leaving it in a strong liquidity position. Aside from $3

million drawn on its $70 million line of credit, Allied had no variable rate

debt at the end of the year. On its mortgage debt, Allied had a weighted-average

interest rate of 5.6%. Finally, Allied had a very moderate mortgage maturity

schedule going forward, with approximately $15 million in mortgages maturing in

2009 (3% of its total mortgage debt), $6 million in 2010 (1%) and $15 million in

2011 (3%).

Allied's Trustees review distribution levels upon receipt of audited financial

statements for each completed fiscal year. Following the most recent review, the

Trustees decided to maintain monthly cash distributions at the current level of

$0.11 per unit ($1.32 per unit annualized). At this distribution level, Allied

expects to maintain conservative FFO and AFFO pay-out ratios, ones that will

remain well below the average for Canadian REITs.

"Although a moderate slowdown in demand for office space in our target markets

is apparent, we expect our property portfolio to continue to perform well in

2009, in large part because of our exceptional market penetration, significantly

lower operating costs and highly sought- after building attributes," said Mr.

Emory. "Our management team is dedicated to remaining within our normal range of

leased area of 96% to 99%."

FFO and AFFO are not financial measures defined by Canadian GAAP. Please see

Allied's MD&A for a description of these measures and their reconciliation to

net income or cash flow from operations, as presented in Allied's consolidated

financial statements for the year ended December 31, 2008. These statements,

together with accompanying notes and MD&A, have been filed with SEDAR,

www.sedar.com, and are also available on Allied's web-site,

www.alliedpropertiesreit.com.

This press release may contain forward-looking statements with respect to

Allied, its operations, strategy, financial performance and condition. These

statements generally can be identified by use of forward looking words such as

"may", "will", "expect", "estimate", "anticipate", intends", "believe" or

"continue" or the negative thereof or similar variations. Allied's actual

results and performance discussed herein could differ materially from those

expressed or implied by such statements. Such statements are qualified in their

entirety by the inherent risks and uncertainties surrounding future

expectations. Important factors that could cause actual results to differ

materially from expectations include, among other things, general economic and

market factors, competition, changes in government regulations and the factors

described under "Risk Factors" in the Allied's Annual Information Form which is

available at www.sedar.com. The cautionary statements qualify all

forward-looking statements attributable to Allied and persons acting on its

behalf. Unless otherwise stated, all forward-looking statements speak only as of

the date of this press release, and Allied has no obligation to update such

statements.

Allied Properties REIT is the leading provider of Class I office space in

Canada, with portfolio assets in the urban areas of Toronto, Montreal, Winnipeg,

Quebec City and Kitchener. Its objectives are to provide stable and growing cash

distributions to unitholders and to maximize unitholder value through effective

management and accretive portfolio growth.

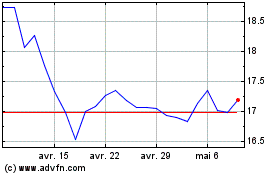

Allied Properties Real E... (TSX:AP.UN)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Allied Properties Real E... (TSX:AP.UN)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024