Allied Properties Real Estate Investment Trust Announces Strong First-Quarter Results

12 Mai 2009 - 10:01PM

Marketwired Canada

Allied Properties REIT (TSX:AP.UN) today announced results for the first quarter

ended March 31, 2009. They are summarized below and compared to the prior

quarter and the same quarter in 2008:

(In thousands

except for per

unit and

% amounts) Q1 2009 Q4 2008 Change %Change Q1 2008 Change %Change

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Net income 3,876 3,296 580 17.6% 2,945 931 31.6%

Net income

per unit (diluted) $ 0.12 $ 0.11 $0.01 9.1% $ 0.11 $ 0.01 9.1%

Funds from

operations ("FFO") 13,929 13,023 906 7.0% 11,834 2,095 17.7%

FFO per

unit (diluted) $ 0.44 $ 0.42 $0.02 4.8% $ 0.42 $ 0.02 4.8%

FFO pay-out

ratio 73.9% 78.7% (4.8%) 75.6% (1.7%)

Adjusted FFO

("AFFO") 12,270 10,603 1,667 15.7% 11,698 572 4.9%

AFFO per

unit (diluted) $ 0.39 $ 0.34 $ 0.05 14.7% $ 0.42 ($0.03) (7.1%)

AFFO pay-out

ratio 83.9% 96.7% (12.8%) 76.5% 7.4%

----------------------------------------------------------------------------

"Our portfolio performed very well in the first quarter," said Michael Emory,

President & CEO. "We expect this to continue over the remainder of the year, in

large part because of our exceptional market penetration, significantly lower

operating costs and highly sought-after building attributes."

Allied maintained a high level of leased area, finishing the quarter at 97.2%.

Despite de-levering its business in 2008, Allied increased its FFO and AFFO per

unit over the prior quarter and maintained FFO and AFFO pay-out ratios well

below the average for Canadian REITs.

Allied finished the quarter in a strong liquidity position, with a conservative

debt ratio of 49.3%. Aside from $13.5 million drawn on its $70 million line of

credit, Allied had no variable rate debt at the end of the quarter. On its

mortgage debt, Allied had a weighted-average interest rate of 5.6% and a very

good interest-coverage ratio. Finally, Allied had $5 million in mortgages

maturing in the remainder of 2009 (1% of its total mortgage debt), $7 million in

2010 (1%) and $15 million in 2011 (3%).

FFO and AFFO are not financial measures defined by Canadian GAAP. Please see

Allied's MD&A for a description of these measures and their reconciliation to

net income or cash flow from operations, as presented in Allied's consolidated

financial statements for the quarter ended March 31, 2009. These statements,

together with accompanying notes and MD&A, have been filed with SEDAR,

www.sedar.com, and are also available on Allied's web-site,

www.alliedpropertiesreit.com.

This press release may contain forward-looking statements with respect to

Allied, its operations, strategy, financial performance and condition. These

statements generally can be identified by use of forward looking words such as

"may", "will", "expect", "estimate", "anticipate", intends", "believe" or

"continue" or the negative thereof or similar variations. Allied's actual

results and performance discussed herein could differ materially from those

expressed or implied by such statements. Such statements are qualified in their

entirety by the inherent risks and uncertainties surrounding future

expectations. Important factors that could cause actual results to differ

materially from expectations include, among other things, general economic and

market factors, competition, changes in government regulations and the factors

described under "Risk Factors" in the Allied's Annual Information Form which is

available at www.sedar.com. The cautionary statements qualify all

forward-looking statements attributable to Allied and persons acting on its

behalf. Unless otherwise stated, all forward-looking statements speak only as of

the date of this press release, and Allied has no obligation to update such

statements.

Allied Properties REIT is the leading provider of Class I office space in

Canada, with portfolio assets in the urban areas of Toronto, Montreal, Winnipeg,

Quebec City and Kitchener. Its objectives are to provide stable and growing cash

distributions to unitholders and to maximize unitholder value through effective

management and accretive portfolio growth.

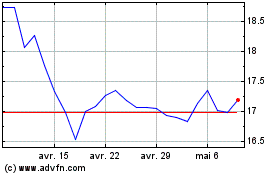

Allied Properties Real E... (TSX:AP.UN)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Allied Properties Real E... (TSX:AP.UN)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024