Allied Properties Real Estate Investment Trust Announces Closing of $125 Million Public Equity Offering

02 Octobre 2009 - 3:30PM

Marketwired Canada

NOT FOR DISTRIBUTION IN THE UNITED STATES

Allied Properties REIT (TSX:AP.UN)announced today that it has closed the

previously announced offering of 7,600,000 units at a price of $16.50 per unit

for gross proceeds of just over $125 million. The units were qualified by a

short form prospectus dated September 25, 2009, and were underwritten by a

syndicate of underwriters led by Scotia Capital Inc. and including RBCDominion

Securities Inc., BMO Nesbitt Burns Inc., CIBC World Markets Inc., Genuity

Capital Markets, National Bank Financial Inc., Canaccord Capital Corporation and

Dundee Securities Corporation.

The REIT intends to use the net proceeds of the offering to repay amounts drawn

on its acquisition line of credit and to fund a portion of the purchase price

for the previously announced acquisition of 151 Front Street West in Toronto,

which is scheduled to close on or before October 28, 2009.

Allied Properties REIT is the leading provider of Class I office space in

Canada, with portfolio assets in the urban areas of Toronto, Montreal, Winnipeg,

Quebec City and Kitchener-Waterloo. Its objectives are to provide stable and

growing cash distributions to unitholders and to maximize unitholder value

through effective management and accretive portfolio growth.

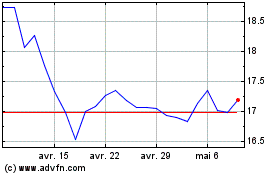

Allied Properties Real E... (TSX:AP.UN)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Allied Properties Real E... (TSX:AP.UN)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024